35 Student Loan Interest Deduction Worksheet 1040a

Have any deductions to claim, such as student loan interest deduction, self-employment tax, educator expenses. Schedule 1 PDF Owe other taxes, such as self-employment tax, household employment taxes, additional tax on IRAs or other qualified retirement plans and tax-favored accounts, AMT, or need to make an excess advance premium tax credit. Instead, for more information, see Pub. 970, and the Student Loan Interest Deduction Worksheet in your Form 1040 or 1040A instructions.US federal income tax law allows, in most situations, for individuals who pay interest on a "qualified student loan" to exclude some or all of their income that was used to pay that interest from their.

But in order to complete that California worksheet, you will first need access to certain information (such as your federal student loan interest deduction amount) from your Form 1040 (or 1040A) federal income tax return. In TurboTax desktop you can view your forms directly.

Student loan interest deduction worksheet 1040a

Student loan interest deduction phase outs. Easier Isn T Better When It Comes To Tax Forms Michele Cagan Cpa Complete the student loan interest deduction worksheet. Student loan interest deduction worksheet 1040a. Subtract line 8 from line 1. You cant claim a student loan interest deduction if your magi is 80000 or more 165000 or more if you. IRA Deduction Worksheet: Line 11 Worksheet: Mortgage Insurance Premiums Deduction Worksheet:. Student Loan Interest:... (Form 1040 or 1040A) Top: The following forms are not supported ~ Tax Year 2020: Form Number Form Name 970: ... Student loan interest tax deductions. According to IRS.gov, you can reduce your income that’s subject to taxes if you’ve paid interest on a qualified student loan and meet several other eligibility requirements, including: 1 The student must be you, your spouse, or your dependent. The student must be enrolled at least half-time in a program leading to a degree, certificate, or other.

Student loan interest deduction worksheet 1040a. 2012 Federal Income Tax Forms Free Printable Form 1040EZ, Form 1040A, Form 1040. Printable 2012 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2012 tax tables, and instructions for easy one page access. For most US individual tax payers, your 2012 federal income tax forms were due on April 15, 2013 for. Figure the deduction using the “Student Loan Interest Deduction Worksheet” in the Form 1040 or Form 1040A instructions. There are many other provisions to the Taxpayer Relief Act.Please consult with your tax advisor to be sure you are eligible for any of these taxpayer benefits. a) Traditional IRA deduction b) Student loan interest deduction c) Tuition and fees deduction d) Domestic production activities deduction e) Foreign earned income exclusion f) Foreign housing exclusion or deduction g) Exclusion of qualified bond interest shown on Form 8815 h) Exclusion of employer-provided adoption benefits shown on Form 8839 Student Loan Interest Deduction Worksheet Form 1040 Line 33 or Form 1040A Line 18 2016 1. Ahead of referring to Student Loan Interest Deduction Worksheet 2016 make sure you know that Schooling is usually all of our answer to a more rewarding the day after tomorrow in addition to learning wont just cease as soon as the university bell.

If you file a Form 2555, Foreign Earned Income, Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa, or if you exclude income from sources inside Puerto Rico, refer to Worksheet 4-1, Student Loan Interest Deduction Worksheet in Publication 970 instead of the worksheet in the Instructions for Form 1040 and Form 1040-SR. Enter the information from Form 1098-E on the Student Loan Interest Deduction Worksheet in ProSeries: Press F6 to bring up Open Forms. Type STU and press Enter. Enter the information from your client's form (s) 1098-E in Part I. Amount you enter in Part I, column (e) will flow to Part II, line 1 for the Computation of the Student Loan Interest. Student Loan Interest Deduction Worksheet Form 1040 Line 33 or Form 1040A Line 18 2016 1. Student loans must furnish this statement to you. Student Loan Interest Deduction Worksheet 2016. You cant claim the deduction if your MAGI is 85000 or more 170000 or more if you file a joint return. Form 1040 2018 Student Loan Interest Deduction Worksheet. Jan 01, 2015 · Use the Student Loan Interest Deduction Worksheet to compute the amount to enter on line 33. For more information, get FTB Pub. 1032. Student Loan Interest Deduction Worksheet. Enter the total amount from Schedule CA (540), line 33, column A. If the amount on line 1 is zero, STOP. You are not allowed a deduction for California

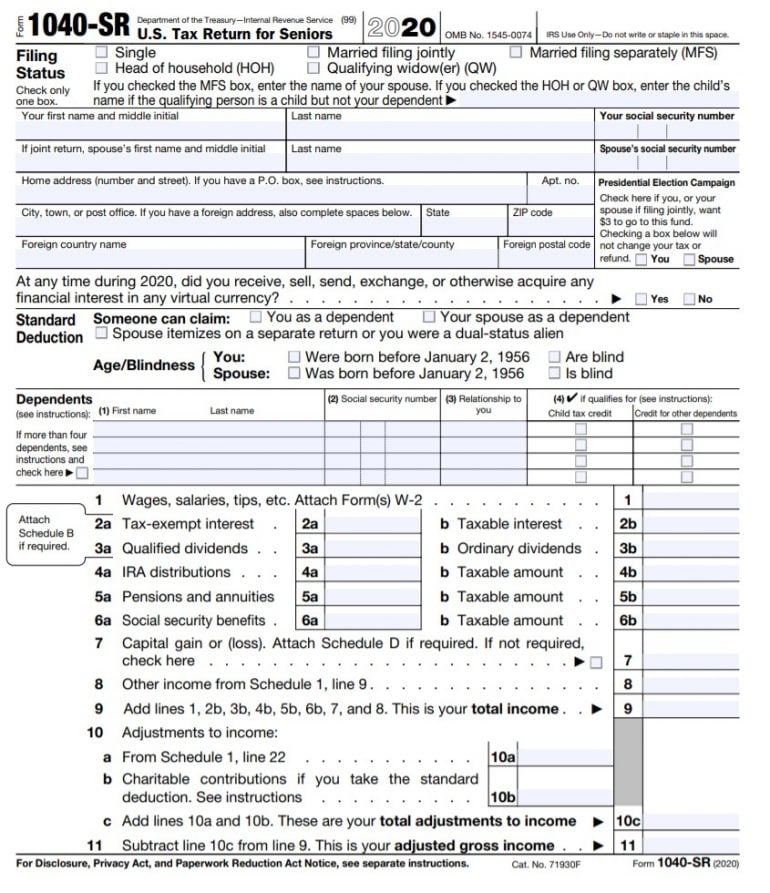

Jan 14, 2021 · Student Loan Interest Deduction Worksheet Form 1040 is generally published in December of each year by the IRS. Form 1040 Instructions are published later in January to include any last minute legislative changes. Apr 12, 2021 · Form 1040 is the main tax form used to file a U.S. individual income tax return. The 1040 shows income, deductions, credits, tax refunds or tax owed to the IRS. Form 1098-E, provided by the bank or governmental agency to which you made loan payments that included $600 or more of interest. You may have deductible interest for which you do not receive a 1098-E. Form 1040, line 33. Calculate using Student Loan Interest Deduction Worksheet found in Form 1040 or 1040A instructions. Student loan interest deduction. • For 2020, the amount of your student loan interest de-duction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can’t claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint return). •

Tax Form 1040 Student Loan Interest. Updated August 20, 2021. Most interest that you pay throughout the year isn’t tax-deductible. However, for some people, there’s a special deduction they can take for paying interest on a student loan when they file the standard federal income tax form 1040. This can reduce your income tax by up to $2,500.

Student loan interest deduction phase outs. Easier Isn T Better When It Comes To Tax Forms Michele Cagan Cpa Complete the student loan interest deduction worksheet. Student loan interest deduction worksheet 1040a. Subtract line 8 from line 1. You cant claim a student loan interest deduction if your magi is 80000 or more 165000 or more if you.

Complete the "Student Loan Interest Deduction Worksheet" in the form's instructions to calculate the amount of your deduction. The amount listed in Box 1 of Form 1098-E is the total interest you paid on your student loan. If you paid interest to more than one lender and received more than one Form 1098-E, enter the total amount from all.

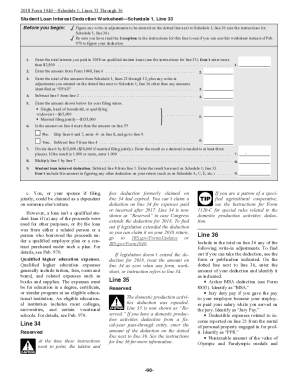

Student Loan Interest Deduction Worksheet—Schedule 1, Line 33. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). Be sure you have read the. Exception in the instructions for this line to see if you can use this worksheet instead of Pub.

The Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions can assist in calculating your deductions. Student Loan Cancellations and Repayment Assistance Loan Cancellation. If a loan you must repay is forgiven or cancelled, you may need to include the amount forgiven in your gross income for tax purposes.

Enter the total interest you paid in 2016 on qualified student loans (see instructions). Do not enter more than $2,500 Enter the amount from Form 1040, line 22 or Form 1040A, line 15 Enter the total of the amounts from Form 1040, lines 23 through 32, plus any write-in adjustments you entered on the dotted line next to line 36 or from Form 1040A.

Student loan interest deduction. For 2020, the amount of your student loan interest deduction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return).

Interest income is below $400 Income or combined incomes below $50,000 1040A Income or combined incomes below $50,000 Capital gain distributions, but no other capital gains or losses Only IRA or student loan adjustments to your income You do NOT itemize deductions 1040 Income or combined incomes over $50,000 Itemized Deductions Self-employment.

Before 2018, you claimed the student loan interest deduction directly on Form 1040. The important tax form you need to help you claim the deduction is the 1098-E, Student Loan Interest Statement. The 1098-E comes from your loan provider. It states in Box 1 how much loan interest you paid during the year.

The student loan interest deduction reduces your taxable income based on how much interest you paid on top of your student loan principal payments. As an example: If you're single and make $40,000 a year, all of it is subject to taxes. But a $2,000 deduction can bring your taxable income down to $38,000.

See the "Student Loan Interest Deduction Worksheet" that accompanies your 1040 or 1040A form, as well as IRS Publication 970, Tax Benefits for Education. Note that this link may not contain information about the newest Tax Cuts and Jobs Act passed in December 2017.

The IRS website and Publication 970, Tax Benefits for Education, have more information on how to deduct your student loan interest. You can also complete the Student Loan Interest Deduction worksheet in the Form 1040 or 1040A instructions.

Generally, you figure the deduction using the Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions. However, if you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from sources within Puerto Rico, you must complete Worksheet 3-1 in this publication.

Questions? We can't give tax advice, but here are some sources for more information on taxes. Visit IRS.gov or call 800-829-1040.; Refer to IRS Pub 970, Tax Benefits for Education, or review the Student Loan Interest Deduction Worksheet in your 1040 or 1040A instructions. Contact your tax advisor.

If a child's only income is interest and dividends (including capital gain distributions and Alaska Permanent Fund dividends), the child was under age 19 at the end of 2020 or was a full-time student under age 24 at the end of 2020, and certain other conditions are met, a parent can elect to include the child's income on the parent's return.

Allowance Worksheet Part II Line 4 Federal adjustments – Health savings account, Moving expenses, Alimony paid, IRA deduction, Student loan interest deduction, Certain business expenses of reservist, performing artist, and fee-basis governmental officials State adjustments – 20% of prior bonus depreciation, 20% of prior section

Form 1098-E will provide you with the amount of interest you paid. The Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions can assist in calculating your deductions. Student Loan Cancellations and Repayment Assistance Loan Cancellation

The Student Loan Interest Deduction Act of 2019 aimed to increase the deduction to $5,000, or $10,000 for married taxpayers filing joint returns, when it was introduced to Congress in June 2019. However, that bill stalled in the House Committee on Ways and Means.

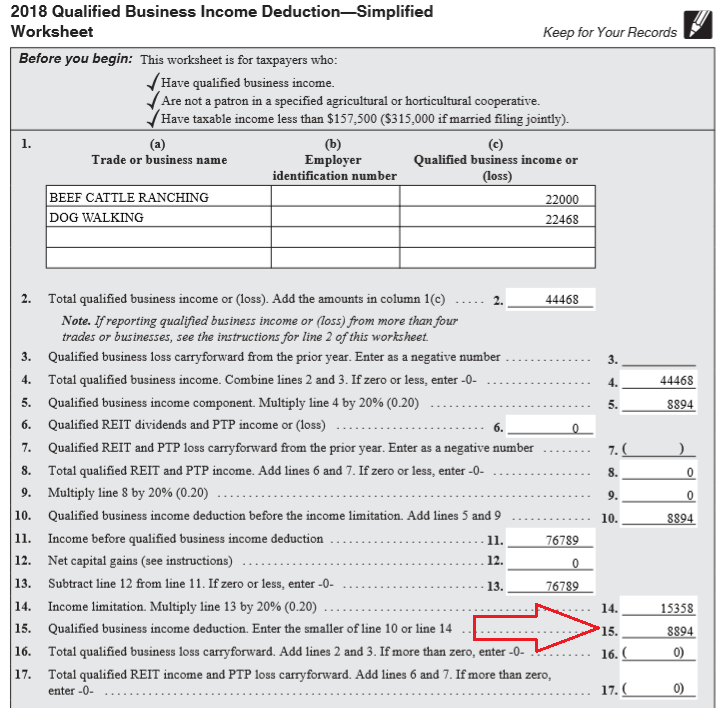

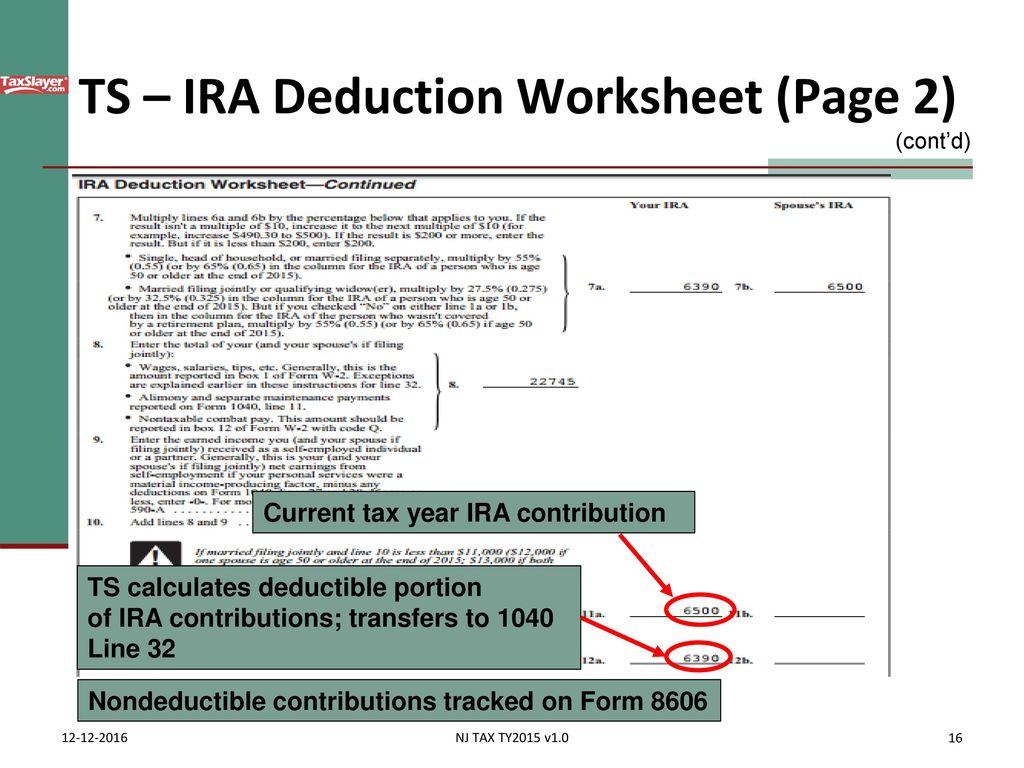

IRA Deduction Worksheet Student Loan Interest Deduction Worksheet How do I determine if the taxpayer has adjustments to income? To identify the adjustments to income that taxpayers can claim, you will need to ask the taxpayers if they had the types of expenses listed on the Adjustments to Income section of Schedule 1. Review the taxpayers'

Instead, for more information, see Pub. 970, and the Student Loan Interest Deduction Worksheet in your Form 1040 or 1040A instructions.US federal income tax law allows, in most situations, for individuals who pay interest on a "qualified student loan" to exclude some or all of their income that was used to pay that interest from their.

Copy of Student Loan Interest Deduction Worksheet, page 36 of the 2013 IRS 1040 Instructions. Copy of Student Loan Interest Deduction Worksheet, page 32 of the 2013 1040A instructions. Tuition and Fees. Copy of last filed IRS Form 1040 with this adjustment listed on line 34. Copy of last filed IRS Form 1040A with this adjustment listed on line 19

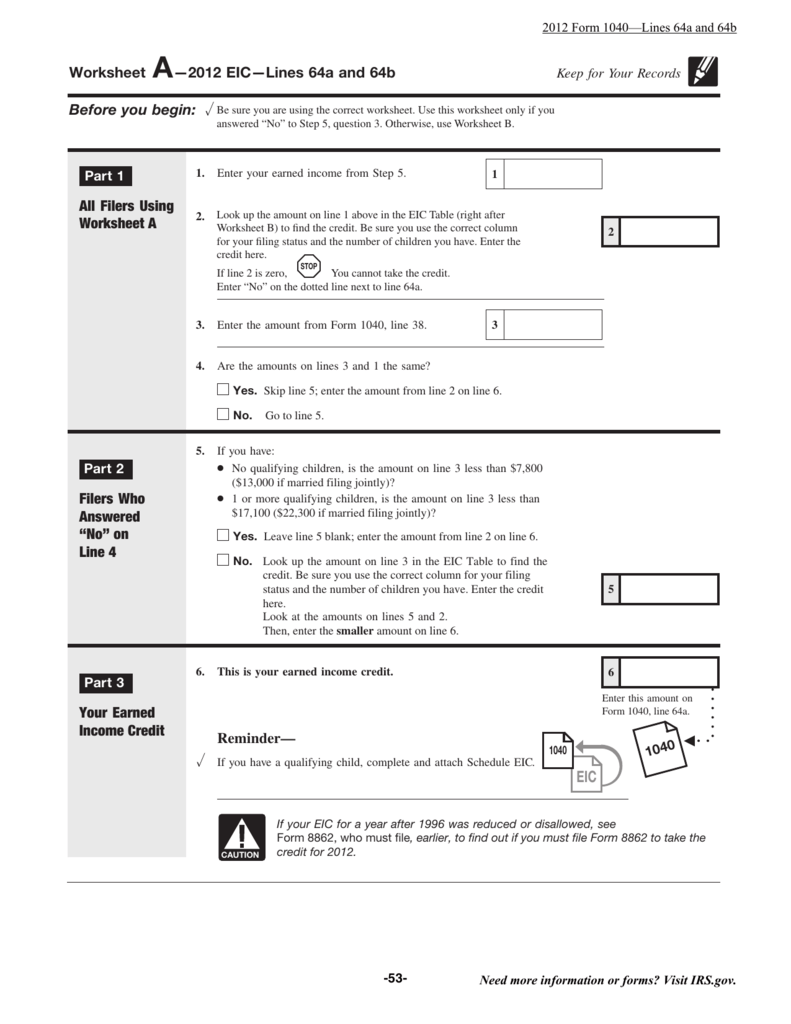

You won't claim any adjustments to income (deduction for IRA contributions, a student loan interest deduction, etc.). You won't claim any credits other than the Earned Income Tax Credit. Form 1040A. If you're one of the 80% of Americans who earn less than $100,000 per

Student loan interest tax deductions. According to IRS.gov, you can reduce your income that’s subject to taxes if you’ve paid interest on a qualified student loan and meet several other eligibility requirements, including: 1 The student must be you, your spouse, or your dependent. The student must be enrolled at least half-time in a program leading to a degree, certificate, or other.

The max deduction is $2,500 for your 2020 tax return. This max is per return, not per taxpayer, even if both spouses on a joint return qualify for the deduction. The student loan interest amount goes on our Student Loan Adjustment screen. When you enter the interest amount, we’ll figure the deduction for you automatically.

Pub. 970 also explains the student loan interest deduction. Before the worksheet can be completed, the taxpayer must know his or her total income for the year, reported on line 22 of Form 1040 (line 15, Form 1040A). Then the income is reduced for certain deductions in lines 23-32 on Form 1040 (lines 16 and 17 on Form 1040A).

IRA Deduction Worksheet: Line 11 Worksheet: Mortgage Insurance Premiums Deduction Worksheet:. Student Loan Interest:... (Form 1040 or 1040A) Top: The following forms are not supported ~ Tax Year 2020: Form Number Form Name 970: ...

0 Response to "35 Student Loan Interest Deduction Worksheet 1040a"

Post a Comment