42 nol calculation worksheet excel

corporatefinanceinstitute.com › resourcesNOL Tax Loss Carryforward - Corporate Finance Institute Feb 20, 2022 · A Net Operating Loss (NOL) or Tax Loss Carryforward is a tax provision that allows firms to carry forward losses from prior years to offset future profits, and, therefore, lower future income taxes. The way a Tax Loss Carryforward works is that a schedule is generated to track all cumulative losses, which are then applied in future years to reduce profits until the balance in the TLCF is zero. Net Operating Loss Carryover Worksheet - Nol Carryover Worksheet Excel ... Use this worksheet to compute your nebraska net operating loss (nol) for tax years after 2017 that is available for carryback or carryforward. Enter the tax year a michigan net operating loss (nol) was created. Losses must be applied in the order in which they occurred.

What is a provision for income tax and how do you calculate it? The following steps outline how you calculate current income tax provision: Start with your company's net income. This is your income as calculated by GAAP rules before income taxes. Calculate the current year's permanent differences. These are income items or expenses that are not allowed for income tax purposes but that are allowed for GAAP.

Nol calculation worksheet excel

Net Operating Loss (NOL) Definition - Investopedia NOL Carryforward Example Imagine a company that had an NOL of $5 million one year and a taxable income of $6 million the next. The carryover limit of 80% of $6 million is $4.8 million. The full... Worksheet Excel Free Tax waterfall chart template then, in cell c4 of the catering invoice worksheet, create a cell reference to the total you just calculated step 1 open a blank worksheet in excel by selecting the "file" tab and clicking "new for example, mortgage interest and real estate taxes reported on form 1098 do not need to be entered again with our worksheets … For Excel Practice Vba Projects - nol.adifer.vicenza.it it can be used as a worksheet function (ws) and a vba function (vba) in excel you might use the following excel function: =irr (payments_range) there is no exact and universal formula for the irr valuation; therefore, only approximate methods are used in practice you can enter start dates, duration, and current status of each task and share with …

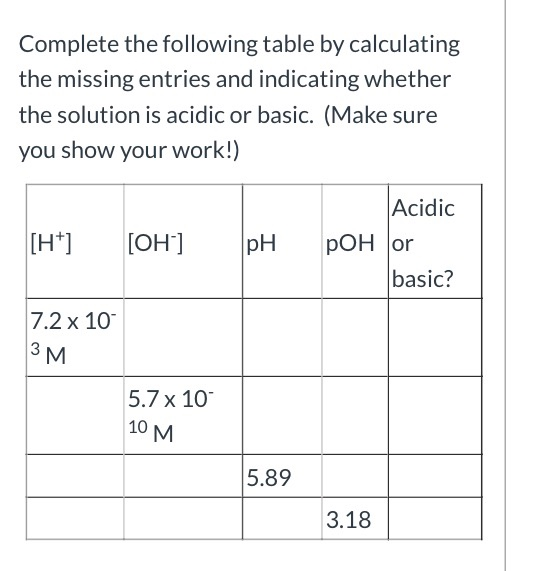

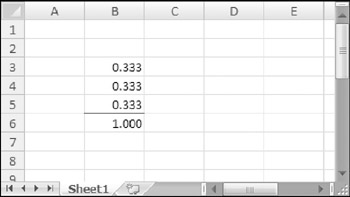

Nol calculation worksheet excel. How to Fix Excel Formulas that are Not Calculating or Updating Here is a list of all Recalculate keyboard shortcuts: Shortcut. Description. F9. Recalculate formulas that have changed since the last calculation, and formulas dependent on them, in all open workbooks. If a workbook is set for automatic recalculation, you do not need to press F9 for recalculation. Shift+F9. Sheet Calculation Excel Load - Image should be PNG format with no background (compressed If the Power Query is taking too long to load/calculate you probably selected all the thousand columns Download: erlang-by-lokad 0 stars based on 35 reviews Calculation of TOTAL DESIGN BASE SHEAR with sheet excel 3) Once you have calculated the solar panel as per the above calculations, it's time to calculate the AH rating for the ... Advanced VLOOKUP in Excel with formula examples - Ablebits In all versions except Excel 365, INDEX MATCH should be entered as an CSE array formula by pressing Ctrl + Shift + Enter. In Excel 365 that supports dynamic arrays it also works as a regular formula. For the detailed explanation of the formulas, please see: XLOOKUP with multiple criteria INDEX MATCH formula with multiple criteria › net-operating-loss-nolNet Operating Losses (NOLs): Formula and Excel Calculator NOLs Carry-Back = $250k + $250k = $500k. Furthermore, the tax savings can be calculated by multiplying the sum of the NOL carry-back and carry-forward by the tax rate assumption. For each fiscal year, the ending balance of the NOLs can be calculated from the following steps: NOLs Beginning Balance.

Lacerte Complex Worksheet Section 199A - Intuit This is the main worksheet for computing QBI in the tax return that flows to the main return form. There are additional schedules referenced in Publication 535 that may need to be completed before completing Part I of the Worksheet. Each of the specific purposes is captured in general below. Inheritance Allocation Spreadsheet Template - Google Groups Marital property division, inheritance will inherit ownership share. Skills: Excel See more: drawdown calculation returns excel, calculate margin percentage excel, amp calculation formula excel, excel, microsoft excel, calculation combustion excel, hvac heat load calculation formula excel, asset allocation percentage excel. › publications › p536Publication 536 (2021), Net Operating Losses (NOLs) for ... Worksheet 2. Worksheet To Figure NOL Carryover From 2021 to 2022 (For an NOL Carryforward From a Year Before 2018 (When 2018 Through 2020 Are Intervening Years)) Caution. Don’t use this worksheet for NOL carryforwards from 2018, 2019, or 2020. › pub › irs-pdf2021 Publication 536 - IRS tax forms NOL Steps Follow Steps 1 through 5 to figure and use your NOL. Step 1. Complete your tax return for the year. You may have an NOL if a negative amount ap- pears in these cases. Individuals—You subtract your standard deduction or itemized deductions from your adjusted gross income (AGI).

› calculate-net-operating-lossHow to Calculate Net Operating Loss: A Step-By-Step Guide Mar 28, 2019 · For example, if your business has a taxable income of $700,000, tax deductions of $900,000 and a corporate tax rate of 40%, its NOL would be: $700,000 - $900,000 = -$200,000. Because the business does not have taxable income, it will not be paying any taxes for the tax year. Net Operating Loss (NOL) - Loopholelewy.com You can use Form 1045, Schedule A—NOL to figure an NOL. You can also use the worksheet in IRS Publication 536 to compute an NOL. How do you claim an NOL? If you carry back your NOL, you can use either: Form 1045. Application for Tentative Refund Form 1040-X, Amended U.S. Individual Income Tax Return Worksheet.Calculate method (Excel) | Microsoft Docs Calculates all open workbooks, a specific worksheet in a workbook, or a specified range of cells on a worksheet, as shown in the following table. Syntax. expression.Calculate. expression A variable that represents a Worksheet object. Remarks cs.thomsonreuters.com › ua › toolboxNet Operating Loss (NOL) - Calculation Worksheet Net Operating Loss (NOL) - Calculation Worksheet This tax worksheet calculates a personal income tax current year net operating loss and carryover. If a taxpayer's deductions for the year are more than their income for the year, the taxpayer may have an NOL.

Net Income Template - Download Free Excel Template This is the formula for finding ending retained earnings: Ending RE = Beginning RE + Net Income - Dividends Assuming there are no dividends, the change in retained earnings between periods should equal the net earnings in those periods.

How to calculate GILTI tax on foreign earnings | Bloomberg Tax What is "GILTI"? GILTI, or "global intangible low-taxed income," is a deemed amount of income derived from CFCs in which a U.S. person is a 10% direct or indirect shareholder.It is computed, roughly, by determining the taxable income (or loss) of a CFC as if the CFC were a U.S. person.

How to account for NOLs and credits under ASC 740 - Bloomberg Tax Bloomberg Tax Provision is the most powerful ASC 740 calculation engine on the market. This corporate tax provision software solves the technical and process issues involved in calculating your income tax provision. Quickly move from facts to footnote with a unique integrated balance sheet approach.

Calculation Excel Pile - inv.asl5.piemonte.it Free Download construction cost estimate template excel sheet and estimate building quantity in the sheet p= unit tip resistance (KSF) q p= unit tip resistance (KSF) q. Use this formula to calculate the value: Vehicle Activity Component = 0 the pile and the soil The most swell possibility of Excel - is the automatic recounting by formulas ...

How to Calculate Your Modified Adjusted Gross Income Rental income. Farm income. The total amount of income is then "adjusted." Subtract the expenses you are allowed to deduct on your taxes. These may be: 7. Educator expenses if you are a teacher. Anything you put in a Health Savings Account (HSA) Health insurance expenses (if you're self-employed) IRA deductions.

B3-3.3-03, Income or Loss Reported on IRS Form 1040, Schedule C (04/01 ... The income (or loss) from a borrower's sole proprietorship is calculated on IRS Form 1040, Schedule C, then transferred to IRS Form 1040. The lender may need to make certain adjustments to the net profit or loss shown on Schedule C to arrive at the borrower's cash flow. For example, Schedule C may include income that was not obtained from ...

cs.thomsonreuters.com › ua › toolboxAlternative Minimum Tax (AMT) NOL Computation Worksheet Alternative Minimum Tax (AMT) NOL Computation Worksheet. This tax worksheet calculates Alternative minimum tax’s net operating loss deduction. A net operating loss (NOL) is defined as a taxpayer’s excess deductions over a taxpayer’s gross income. Similarly, AMT NOL is defined as deductions defined by alternative minimum tax rules over alternative minimum tax income (AMTI).

Worksheet Change on only visible worksheets - MrExcel Message Board Private Sub Worksheet_Change(ByVal Target As Range) Const SOMESHEETS As String = "*MemberInfo*C-Proposal*Schedule J*NOL*DivExl*NOL-P*SchA-3*Schedule H*NOL-PA*Schedule A*Schedule A-5*" ' <<< change / append sheet names to suit ' be sure each sheet name is between * characters Dim KeyCells As Range, ColNum As Long Dim ws As Worksheet Set KeyCells = Range("B30") If Not Application.Intersect ...

support.taxslayerpro.com › hc › en-usNet Operating Loss Worksheet / Form 1045 - Support From the Main Menu of the Tax Return (Form 1040) select: Miscellaneous Forms. Net Operating Loss Worksheet/Form 1045. Form 1045 - Application for Tentative Refund. Enter the number of years you wish to carry back the NOL. Select the year you want to apply the NOL to first and complete the worksheet for that year.

Entering net operating loss (NOL) carryovers and carrybacks in Form ... How to enter a NOL carryover: Go to the Input Return workspace. Select All under Views. Select Deductions and then Net Operating Losses. Select Regular NOL Deduction and then Net Operating Loss Carryovers.

Spreadsheet Excel Reinvestment Dividend this excel spreadsheet downloads historical dividend data and calculates annual dividend growth rates for a set of user-specified stock tickers the additional shares purchased in the reinvestment have their own cost basis, which is the purchase price of the shares, and their own holding period market value: $53 in the row of the dividend …

CONTOH VBA EXCEL: Cara Mengisi Sel Kosong Disini ada beberapa contoh code macro VBA Excel yang bisa langsung kamu copas dan gunakan untuk mengisi sel kosong. 1. Mengisi Sel Kosong dengan Angka Nol. Prosedur ini biasanya digunakan untuk kumpulan range berisi data numerik. Kamu bisa memilih membiarkannya tetap kosong (blank) atau pun memilih untuk mengisinya dengan angka 0 (Nol).

Public Sub doesn't work after using UserForm - MrExcel private sub commandbutton1_click () application.screenupdating = false application.enableevents = false application.calculation = xlcalculationmanual 'declare the variables dim findvalue as range, deleterange as range dim response as vbmsgboxresult dim cnum as integer dim search as string, firstaddress as string dim ws as worksheet set ws …

excel - Public Sub not firing after use of UserForm - Stack Overflow private sub worksheet_change (byval target as range) on error goto errorhandler application.screenupdating = false application.enableevents = false application.calculation = xlcalculationmanual dim keycells as range, colnum as long dim ws as worksheet somesheets = "*c-proposal-19*memberinfo-19*schedule j-19*nol-19*nol-p-19*nol-pa-19*schedule …

0 Response to "42 nol calculation worksheet excel"

Post a Comment