40 government spending worksheet answers

Study 15 Terms | ECON - Worksheet -... Flashcards | Quizlet ECON - Worksheet - Chapter 14.1 - Government Revenue & Spending - Section 1 - How Taxes Work Terms in this set (15) Tax is a mandatory payment to a government. Revenue is a government income from taxes and other sources. Tax base is a form of wealth - such as income, property, goods, or services - that is subject to taxes. Individual income tax Economics Chapter 10: The Economics of Government Spending Start studying Economics Chapter 10: The Economics of Government Spending. Learn vocabulary, terms, and more with flashcards, games, and other study tools.

5.04 Government Spending Worksheet.docx - Name Government government should spend money. Disagree Disagree T 2. By relying on borrowed money, the government is at risk if people stop lending. F 3. There are negative effects if the government F operates at a surplus. Positive Positive F 4. "Balancing the budget" means the government borrows more money than it spends. Brings in. F 5.

Government spending worksheet answers

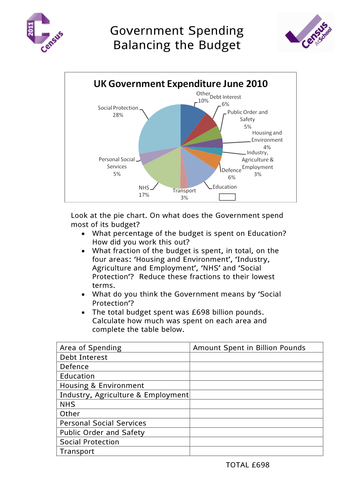

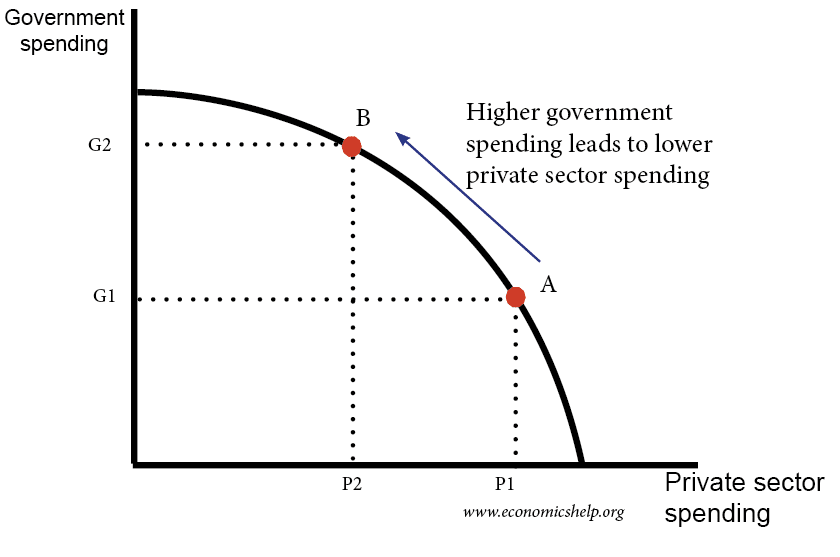

PDF Worksheet Solutions Government Spending - IRS tax forms 1. In what years did the government spend more than it collected? 1950, 1970, 1980, 1990 2. Use a calculator to find out how many times larger revenue was in 2000 than in 1950. about 52 times larger 3. Use a calculator to find out how many times greater spending was in 2000 than in 1950. about 42 times greater 4. PDF Teacher's Guide - ISTE and spending. The budget identifies the amount of revenue that needs to be brought in through taxes, fees, and grants. Like the weather, revenues are forecasted based on planned tax rates, previous year data, and other anticipated funding. The budget also directs the ways in which the county's money will be spent on services and programs. Class 12 Economics Worksheets Download Pdf with Solutions All worksheets and test sheets have been prepared by expert teachers as per the latest Syllabus in Economics Class 12. Students can click on the links below and download all Pdf worksheets for Economics class 12 for free. All latest Kendriya Vidyalaya Class 12 Economics Worksheets with Answers and test papers are given below.

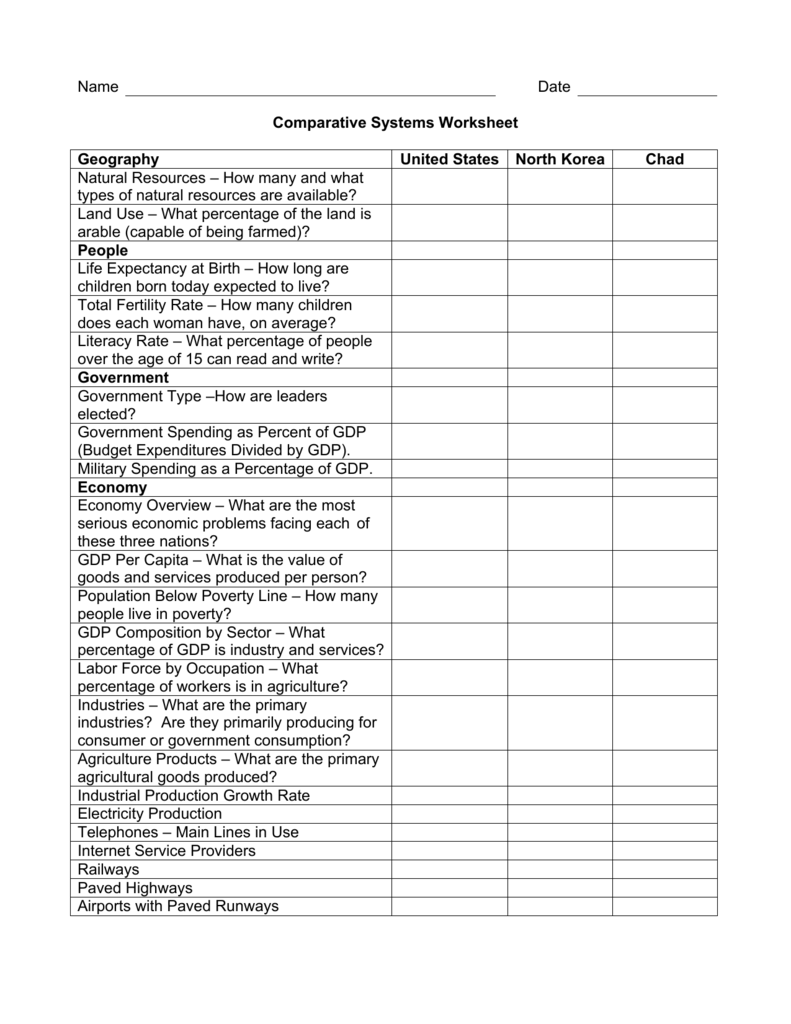

Government spending worksheet answers. PDF Teacher's Guide - Theodore Roosevelt High School Government Spending _____1. People agree about how the government should spend its money. _____2. By relying on borrowed money, the government is at risk if people stop lending. _____3. There are negative effects if the government operates at a surplus. _____4. "Balancing the budget" means the government borrows more money than it spends. _____5. Taxes And Government Spending Worksheets & Teaching Resources | TpT Product DescriptionIncluded is a Power Point and outlined note packet that is used to introduce taxes and government spending, as well as a review of monetary policy, and their influence on the Aggregate Supply and Demand graph to an on-level, honors, or AP level Macroeconomics course. Included are Subjects: Make a Budget - Worksheet | consumer.gov Make a Budget - Worksheet. Use this worksheet to see how much money you spend this month. Also, use the worksheet to plan for next month's budget. File. pdf-1020-make-budget-worksheet_form.pdf (507.72 KB) 5.04 Government Spending Worksheet.docx - Course Hero People generally believe it's good for the government to borrow money. bad t6. When people lend money, they usually charge bad t a fee called interest. f7. The government sells IOUs called cupcakes. securities f f8. The government can meet all its spending needs by collecting taxes. cannot f9.

PDF Answer Key - Federal Reserve Bank of Atlanta Government spending A local library purchases new audio books . 4. Net exports or imports A retailer purchases tennis shoes from a manufacturer in China and sells them . 5. Consumption Mother purchases those tennis shoes from the retailer . Write one more example of each of the four components. 6. Answers will vary Consumption . 7. Answers will ... PDF Worksheet - IRS tax forms Worksheet Government Spending Theme 1: Your Role as a Taxpayer Lesson 1: Why Pay Taxes? ... Use the table below to answer these questions. GOVERNMENT SPENDING Year Revenue, (in billions of dollars) Spending, (in billions of dollars) 1950 $39 $43 1960 $93.50 $92 ... Class 12 Economics Worksheets Download Pdf with Solutions All worksheets and test sheets have been prepared by expert teachers as per the latest Syllabus in Economics Class 12. Students can click on the links below and download all Pdf worksheets for Economics class 12 for free. All latest Kendriya Vidyalaya Class 12 Economics Worksheets with Answers and test papers are given below. PDF Teacher's Guide - ISTE and spending. The budget identifies the amount of revenue that needs to be brought in through taxes, fees, and grants. Like the weather, revenues are forecasted based on planned tax rates, previous year data, and other anticipated funding. The budget also directs the ways in which the county's money will be spent on services and programs.

PDF Worksheet Solutions Government Spending - IRS tax forms 1. In what years did the government spend more than it collected? 1950, 1970, 1980, 1990 2. Use a calculator to find out how many times larger revenue was in 2000 than in 1950. about 52 times larger 3. Use a calculator to find out how many times greater spending was in 2000 than in 1950. about 42 times greater 4.

0 Response to "40 government spending worksheet answers"

Post a Comment