38 colorado pension and annuity exclusion worksheet

› iowaPrintable Iowa Income Tax Forms for Tax Year 2021 - TaxFormFinder Disability Income Exclusion 41-127: Download / Print: Form - 41-175. 2022 Nonresident Member Composite Agreement: Download / Print: Form 44-019S. 2022 Employee's Withholding en Espanol 44-019S: Download / Print: Form 44-020. 2022 Withholding Certificate for Pension or Annuity: Download / Print: Form IA 6251. 2021 † Iowa Minimum Tax ... › instructions › i1120reiInstructions for Form 1120-REIT (2021) | Internal Revenue Service Use Form 1120-W, Estimated Tax for Corporations, as a worksheet to compute estimated tax. See the Instructions for Form 1120-W. If the REIT overpaid its estimated tax, it may be able to get a quick refund by filing Form 4466, Corporation Application for Quick Refund of Overpayment of Estimated Tax.

Fountain - Custom Essay Writing Service - 24/7 ... Custom Essay Writing Service - 24/7 Professional Care about Your Writing

Colorado pension and annuity exclusion worksheet

Maryland Pension Exclusion - Marylandtaxes.gov If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for Maryland's maximum pension exclusion of $31,100 under the conditions described in Instruction 13 of the Maryland resident tax booklet. If you're eligible, you may be able to subtract some of your taxable pension and retirement annuity income from your federal adjusted gross income. Colorado's Pension and Annuity Subtraction - Jim Saulnier, CFP Considering the Centennial State has a flat income tax of 4.63% these subtractions often translate to substantial tax savings. For instance, if you are over 65 and maxing out the subtraction (you have more than $24,000 of qualifying pension/annuity income) your tax savings is just over $1,100. Additionally, this figure could double if filing ... Instructions for Form 1120-REIT (2021) | Internal Revenue Service COVID-19 employee retention credit. The employee retention credit, enacted by the Coronavirus Aid, Relief, and Economic Security (CARES) Act, and amended by the ARP and other recent legislation, is limited to qualified wages paid before October 1, 2021 (or, in the case of wages paid by an eligible employer which is a recover startup business, before January 1, 2022).

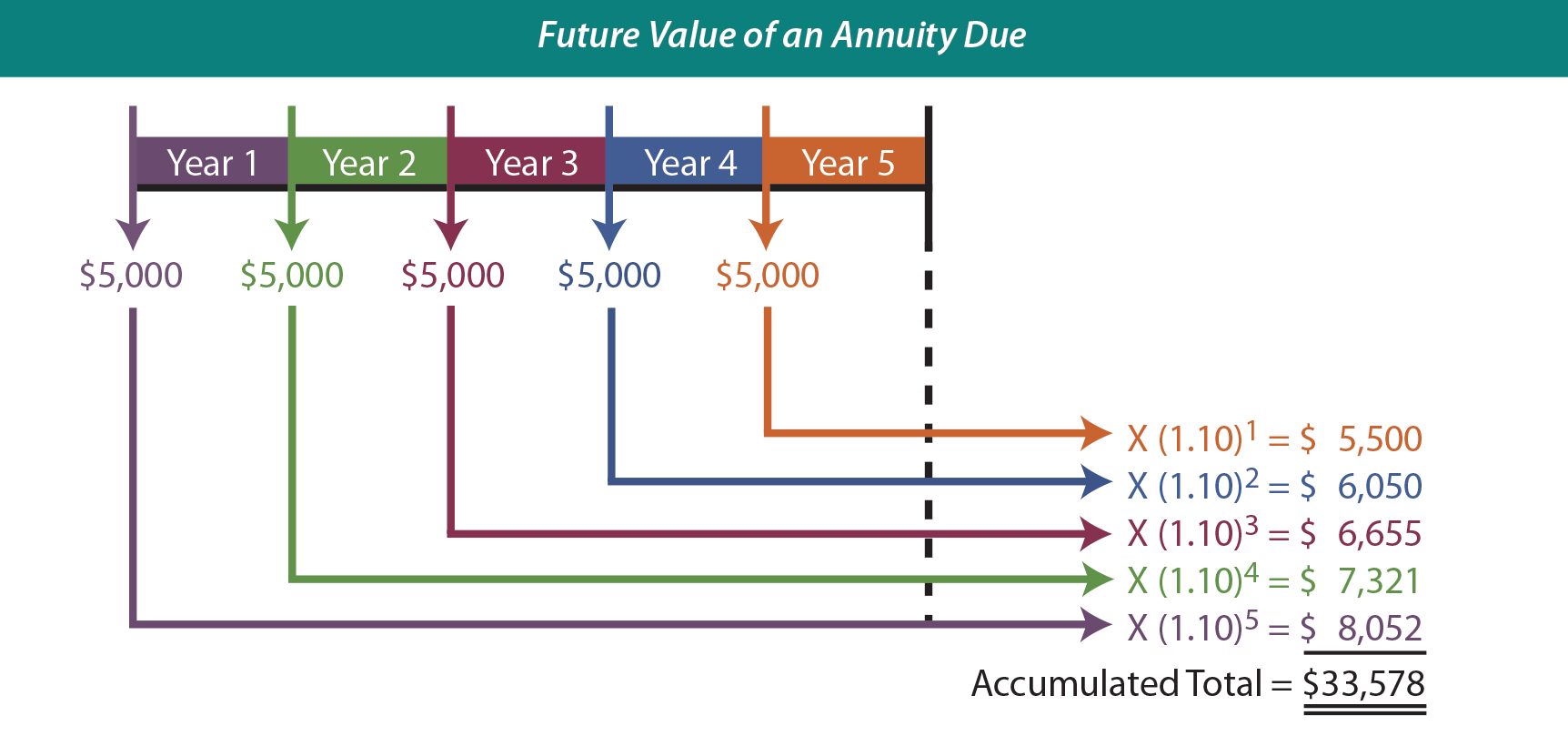

Colorado pension and annuity exclusion worksheet. Do I need to pay capital gains tax if I am retired? Pension income. Fully or partially taxed as ordinary income, depending on whether contributions were tax-deferred. You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401(k)s, 403(b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. Individual Income Tax | Information for Retirees - Colorado Retired Railroad Employees. Federal law exempts railroad retirement benefits from state income taxes. The railroad retirement benefits subtraction is allowed on the Subtractions from Income Schedule ( DR 0104AD) for any railroad retirement benefits reported on Form RRB-1099 or Form RRB-1099-R and included in a taxpayer's federal taxable income. Railroad Retirement Worksheet - Colorado Tax-Aide Resources The Pension Exclusion Worksheet referenced is printed with the CO return immediately following the CO 104. Other input comes from the taxpayer's documents or their entry in TaxSlayer. The taxable amount of Social Security benefits from Form 1040 is used to determine how much of the 1099-SSA and RRB 1099 Tier I amounts are taxable. PDF Colorado enacts several law changes impacting income and ... - Deloitte pension annuity benefits for tax years beginning on or after January 1, 2022, for certain taxpayers who are 65 or older to include all federally taxed social security benefits. • HB 1311 limits deductions for contributions to 529 Plans for tax year s beginning on or after January 1, 2022 to $20,000 per beneficiary

Guide for the Partnership Information Return (T5013 Forms) The absolute value of a number refers to the numerical value of the number without regard to its positive or negative sign. To determine if a partnership exceeds the $2 million threshold, add total worldwide expenses to total worldwide revenues rather than subtract expenses from revenues as you would to determine net income. oakleighaccountants.com.au › do-i-need-to-payDo I need to pay capital gains tax if I am retired? Pension income. Fully or partially taxed as ordinary income, depending on whether contributions were tax-deferred. You have to pay income tax on your pension and on withdrawals from any tax-deferred investments—such as traditional IRAs, 401(k)s, 403(b)s and similar retirement plans, and tax-deferred annuities—in the year you take the money. Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; PlannerSearch - Find a CERTIFIED FINANCIAL PLANNER™ … Oct 05, 2009 · Find financial planning professionals and other resources to help with retirement, investing, credit repair & more. From The Financial Planning Association.

Minnesota Form M1PR Instructions (Homestead Credit Refund and Renter… Homestead Credit Refund and Renter’s Property Tax Refund Instruction Booklet 2021 Property Tax Refund Return (M1PR) Instructions Questions? 2021 Homestead Credit Refund (for Homeowners) and Renter’s Property Tax Refund Forms and Instructions > Form M1PR Homestead Credit Refund (for Homeowners) and Renter’s Property Tax Refund > Schedule … PDF PENSION OR ANNUITY DEDUCTION - leg.colorado.gov PENSION OR ANNUITY D EDUCTION. PENSION OR ANNUITY DEDUCTION . EVALUATION RESULTS. WHAT IS THE TAX EXPENDITURE? The Pension or Annuity Deduction [Section 3922-104(4)(f), C.R.S.] - allows individuals who are at least 55 years of age at the end of the taxable year to deduct "amounts received as pensions or annuities from Guy/uri_nlp_ner_workshop - DAGsHub Contribute to Guy/uri_nlp_ner_workshop by creating an account on DAGsHub. 27 Colorado Pension And Annuity Exclusion Worksheet Colorado pension and annuity exclusion worksheet. How to figure the tax free part of periodic payments under a pension or annuity plan including using a simple worksheet for payments under a qualified plan. ... Colorado pension and annuity exclusion worksheet incorrectly allows premature distribution to be excluded thank you for using proseries ...

Essay Fountain - Custom Essay Writing Service - 24/7 Professional … Custom Essay Writing Service - 24/7 Professional Care about Your Writing

Is my retirement income taxable to Colorado? - Support Colorado allows for a subtraction of pension or annuity income and the amount is based upon the age of the taxpayer. Age 65 or older: you can deduct up to $24,000 or the total amount of your pension, whichever is smaller. At least age 55 but not yet 65: you can subtract up to $20,000 or the total amount of your pension, whichever is smaller.

› createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

PDF Income 25: Pension and Annuity Subtraction - Colorado If you meet certain qualifications, you can subtract some or all of your pension and annuity income on your Colorado individual income tax return (Form 104). You must be at least 55 years of age unless you receive pension and annuity income as a death benefit. You can claim the subtraction only for pension and annuity income that is included in ...

What is the pension and annuity income exclusion on Colorado state tax ... I find a "Pension and Annuity Worksheet" that shows significant taxable social security on 3a and an allowable exclusion for myself and my wife on line 6. But in the Colorado "Pension and Annuity Income" fields, these amounts are not listed. Turbotax entered a pension amount but NOT the taxable social security amount shown on line 6 of the ...

EOF

› minnesota › form-m1prMinnesota Homestead Credit Refund and Renter’s Property Tax ... Homestead Credit Refund and Renter’s Property Tax Refund Instruction Booklet 2021 Property Tax Refund Return (M1PR) Instructions Questions? 2021 Homestead Credit Refund (for Homeowners) and Renter’s Property Tax Refund Forms and Instructions > Form M1PR Homestead Credit Refund (for Homeowners) and Renter’s Property Tax Refund > Schedule M1PR-AI Additions to Income Rev. 12/17/21 We’re ...

Printable Iowa Income Tax Forms for Tax Year 2021 Disability Income Exclusion 41-127: Download / Print: Form - 41-175. 2022 Nonresident Member Composite Agreement: Download / Print: Form 44-019S. 2022 Employee's Withholding en Espanol 44-019S: Download / Print: Form 44-020. 2022 Withholding Certificate for Pension or Annuity: Download / Print: Form IA 6251. 2021 † Iowa Minimum Tax ...

› tax-forms › virginia-form-760Virginia Tax Form 760 Instructions - eSmart Tax 14: Income from Dealer Disposition of Property - Enter the amount that would be reported under the installment method from certain dispositions of property.If, in a prior year, the taxpayer was allowed a subtraction for certain income from dealer dispositions of property made on or after January 1, 2009, in the years following the year of disposition, the taxpayer is required to add back the ...

0 Response to "38 colorado pension and annuity exclusion worksheet"

Post a Comment