45 sec 1031 exchange worksheet

› publications › p550Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. MasterCPE | Online CPE Courses | CPA CPE Online CPE courses - MasterCPE specializes in quality CPE courses, professional CPE courses, online CPE for account and tax professionals.

Excel 1031 Property Exchange - Business Spreadsheets 1031 Property Exchange for Excel is designed for investors, real estate brokers and facilitators allowing to: Balance equities. Evaluate boot given and received. Estimate the realized and recognized gains to calculate the transfer basis. Automatically create sample worksheets of IRS Form 8824. Perform "What if" analysis by changing the input ...

Sec 1031 exchange worksheet

1031 Tax Exchange Rules: What You Need to Know - Investopedia Internal Revenue Service. "Like-Kind Exchanges Under IRC Section 1031." Accessed Nov. 17, 2021. Internal Revenue Service. "Like-Kind Exchanges — Real Estate Tax Tips." Accessed Nov. 17 ... computer science 1.docx - DocShare.tips Add a worksheet labelledCalculations after the DataInput worksheet from Task 4 (but before the four tables from Task 1) that conforms to Appendix 7 of the Study Materials – … Exchanges Under Code Section 1031 - American Bar Association Exchanges Under Code Section 1031 What is a 1031 Exchange? An exchange is a real estate transaction in which a taxpayer sells real estate held for investment or for use in a trade or business and uses the funds to acquire replacement property. A 1031 exchange is governed by Code Section 1031 as well as various IRS Regulations and Rulings.

Sec 1031 exchange worksheet. 1031 Tool Kit - TM 1031 Exchange Phone. 1 877 486 1031. 1031 COMPARISON CALCULATOR. Enter your figures in the fields provided (no commas or dollar signs, for example: 300000 instead of $300,000) and click on "Calculate". 1. Real Estate Investment Software Product Comparison- RealData Software Real Estate Calculator. A potent collection of 16 modules, each with lots of valuable features and options that you would only hope to find in programs costing a great deal more. This is a must-have tool for anyone in real estate or finance. Learn More →. 2020 S Corporation Tax Booklet | FTB.ca.gov 1.1.2015 · On a separate worksheet, using the Form 100S format, complete Form 100S, Side 1 and Side 2, line 1 through line 14, without regard to line 11. If any federal charitable contribution deduction was taken in arriving at the amount entered on Side 1, line 1, enter that amount as an addition on line 7 of the Form 100S formatted worksheet. PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses A. Exchange expenses from sale of Old Property Commissions $_____ Loan fees for seller _____ Title charges _____ ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms taxpayer exchanges for like-kind property of lesser value. This fact sheet, the 21. st in the Tax Gap series, provides additional guidance to taxpayers regarding the rules and regulations governing deferred like-kind exchanges. Who qualifies for the Section 1031 exchange? Owners of investment and business property may qualify for a Section 1031 ... 2019 Limited Liability Company Tax Booklet | California Forms ... 1.1.2015 · 2019 Instructions for Form 568, Limited Liability Company Return of Income. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).. In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code … PDF 2019 Exchange Reporting Guide - 1031 Corp A 1031 exchange must be reported for the tax year in which the exchange was initiated through ... 2018, repealed Section 1031 exchanges of tangible and intangible personal property assets. Reporting State Capital Gain/ Income Tax ; 1031 ; CORP. CORP.com ; 1031 ; CORP; CORP: 1031 ; CORP. CORP.com PDF §1031 BASIS ALLOCATION WORKSHEET - firsttuesday §1031 BASIS ALLOCATION WORKSHEET 100% DATE: _____________, 20______, at _____________________________________________________, California. Items left blank or un checked are not ap pli ca ble. Ref er ences to forms in cludes their equiv a lent.

Achiever Essays - Your favorite homework help service ALL YOUR PAPER NEEDS COVERED 24/7. No matter what kind of academic paper you need, it is simple and affordable to place your order with Achiever Essays. › forms › 20192019 Limited Liability Company Tax Booklet - California Jan 01, 2015 · Schedule K-1 (1065-B) and its instructions – Public Law 114-74, Title XI, sec. 1101(b) repealed the electing large partnership rules for partnership tax years beginning after 2017. As a result, Schedule K-1 (Form 1065-B) and its instructions will be obsolete after 2017. 1031 Exchange with Multiple Properties [Explained A-to-Z] Rules for ... You'll need to deliver the specific addresses of these properties to your 1031 Exchange Accommodator (Qualified Intermediary or QI) with the 45-day Identification Period. Holidays and weekends count so there's no next workday grace period. Finally within the 180-day deadline, closing must be completed on replacement (s). Intuit Professional Tax Preparation Software | Intuit Accountants Intuit Professional Tax Preparation Software | Intuit Accountants

Accounting for 1031 Like-Kind Exchange - BKPR A Section 1031 or like-kind exchange is an income tax concept. It applies when you swap two real estate properties with the same nature or character. Even if the quality or grade of these properties differs, they may still qualify for like-kind exchange treatment. Personal Property Not Qualified for Like-Kind Exchange

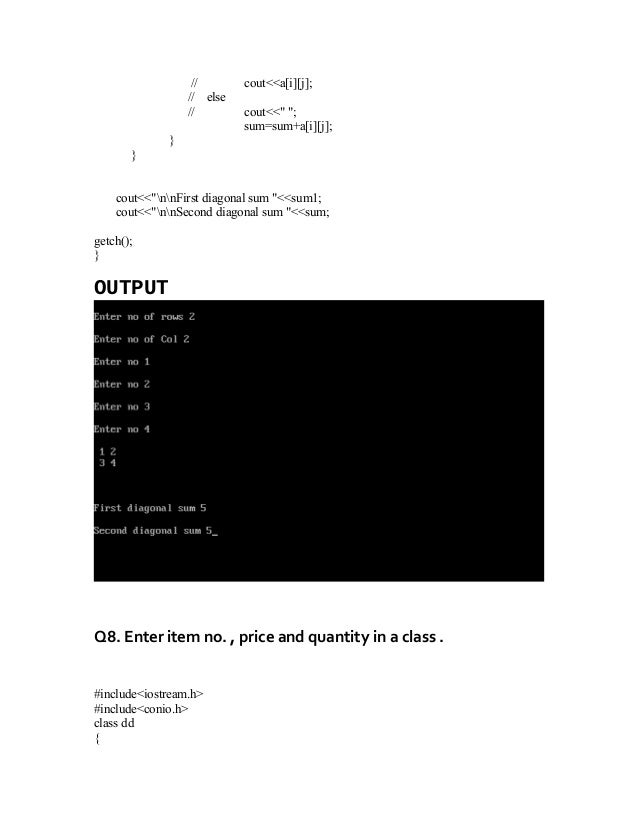

docshare.tips › computer-science-1docx_58b409bfb6dcomputer science 1.docx - DocShare.tips theDataInput worksheet. Hint: Cost Price (AT) x Exchange Rate (AT to AU) · If the Exchange Rate Type isLC then the Cost Price (AU) is calculated by multiplying the Cost Price (LC) by the Exchange Rate (LC to AU) cell on theDataInput worksheet. Hint: Cost Price (LC) x Exchange Rate (LC to AU)

Publication 550 (2021), Investment Income and Expenses Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Capital gains tax in the United States - Wikipedia In the United States of America, individuals and corporations pay U.S. federal income tax on the net total of all their capital gains.The tax rate depends on both the investor's tax bracket and the amount of time the investment was held. Short-term capital gains are taxed at the investor's ordinary income tax rate and are defined as investments held for a year or less before being sold.

Library of 1031 Exchange Forms Visit our library of important 1031 exchange forms. The pros at Equity Advantage have provided everything you need in easily downloadable PDF files. 800-735-1031 info@1031exchange.com

› code › t12c006Code of Laws - Title 12 - Chapter 6 - South Carolina Income ... SECTION 12-6-1110. Modifications of gross, adjusted gross, and taxable income calculated under Internal Revenue Code. For South Carolina income tax purposes, gross income, adjusted gross income, and taxable income as calculated under the Internal Revenue Code are modified as provided in this article and subject to allocation and apportionment as provided in Article 17 of this chapter.

How To Record A 1031 Exchange Your replacement property is recorded as a credit to the account, which decreases that balance. Using the same piece of land valued at $200,000, you do a 1031 like-kind exchange for another piece of land valued at $175,000. Your loss or credit on the exchange is $25,000.

› issues › 2020The built-in gains tax Dec 01, 2020 · A tax-deferred, like-kind exchange of an asset does not trigger the built-in gain inherent in that asset, except to the extent of boot received in the exchange. Rather, the unrecognized built-in gain and the unexpired portion of the recognition period transfers to the asset received in the exchange (Sec. 1374(d)(8); Regs. Sec. 1. 1374-8).

Instructions for Form 8824 (2021) | Internal Revenue Service Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. ... and partly for business or investment, you will need to use two separate Forms 8824 as worksheets. Use one worksheet ...

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 The following example is used throughout this workbook, and a completed Worksheet using this example is included. EXAMPLE: To show the use of the Worksheet, we will use the following example of an exchange transaction. In this example, the exchanger will buy down in value and receive excess exchange escrow funds. 1. Basis.

› publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... Under this type of exchange, the person receiving your property may be required to place funds in an escrow account or trust. If certain rules are met, these funds won’t be considered a payment until you have the right to receive the funds or, if earlier, the end of the exchange period. See Regulations section 1.1031(k)-1(j)(2) for these rules.

PDF WorkSheets & Forms - 1031 Exchange Experts WorkSheet #2 - Calculation of Exchange Expenses HUD-1 Line # A. Exchange expenses from sale of Old Property Commissions $_____ 700 ... Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21

0 Response to "45 sec 1031 exchange worksheet"

Post a Comment