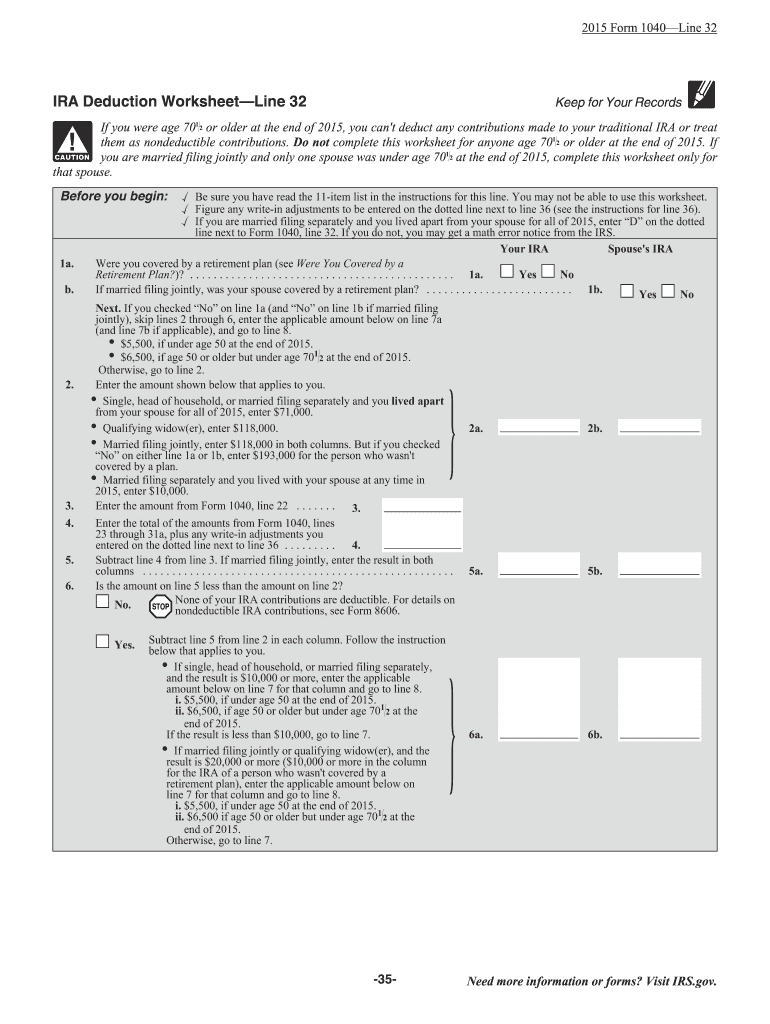

44 ira deduction worksheet 2014

› roth-ira-calculator-2019Calculating Roth IRA: 2021 and 2022 Contribution Limits Jan 29, 2022 · The Roth individual retirement account (Roth IRA) has a contribution limit, which is $6,000 in both 2021 and 2022—or $7,000 if you are age 50 or older. This limit applies across all IRAs. › publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

› ira-limits-contributions-andIRA Limits on Contributions and Income - The Balance Nov 14, 2021 · Your traditional IRA contribution deduction is also limited if you contribute to a workplace retirement account. You can deduct the contribution in full if: You had a MAGI of $66,000 or less in 2021 ($68,000 or less in 2022), and your filing status is single or head of household.

Ira deduction worksheet 2014

How to Recapture Nonrecaptured Net Section 1231 Losses Section 1231 Losses of the Previous Five Years. If you have section 1231 losses in the previous five years that total more than section 1231 gains during those same five years, the excess loss (the unapplied loss) is applied against (subtracted from) the current year's section 1231 gain.. The amount of the loss that is applied against the current year's section 1231 gain is reported as ... social security benefits worksheet 2020 pdf Social Security Benefits Worksheet Worksheet 1 Figuring . Single, Head of Household, Qualifying Widow (er), or Married filing separately and plus any tax-exempt income, plus half of your Social Security benefits exceed $25,000 for singles, $32,000 for marrieds filing jointly, and $0 for marrieds filing separately, the . Do not use staples. 2021 irs social security benefits worksheet 2021 irs social security benefits worksheet. Report at a scam and speak to a recovery consultant for free. Don't let scams get away with fraud. wordle not working on iphone. 2021 irs social security benefits worksheet. Published: June 9, 2022 Categorized as: guichet web pinel ...

Ira deduction worksheet 2014. en.wikipedia.org › wiki › Roth_IRARoth IRA - Wikipedia A Roth IRA is an individual retirement account (IRA) under United States law that is generally not taxed upon distribution, provided certain conditions are met. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan, qualified withdrawals from the Roth IRA plan are tax-free ... Best Homepage Ever: All the Best Websites in 1-Click Access all your favorite websites on a single start page: news, email, search, travel, sports, and more. 100% FREE, and No Ads. Zacks Stock Education - Billion Dollar Secret Since 1988, our proven Zacks Rank stock-rating system has more than doubled the S&P 500 with an average gain of +25.08% per year. These returns cover a period from January 1, 1988 through April 4 ... Roth IRA: Rules, Contribution Limits and How to Get Started | The ... The Roth IRA contribution limit for 2021 and 2022 is $6,000 if you are younger than age 50. If you are age 50 or older, then the contribution limit increases to $7,000. That extra $1,000, known as ...

FCX | Stock Snapshot - Fidelity Company Profile. Freeport-McMoRan Inc. engages in the mining of mineral properties in North America, South America, and Indonesia. The company primarily explores for copper, gold, molybdenum, silver, and other metals, as well as oil and gas. Its assets include the…. Lacerte Tax Support - Intuit After last update, Lacerte 2021 program can not e-mail a Lacerte client file, leads to a general MAPI failure and the program freezes up until the MAPI failure ... read more. Drphibes Level 5. Lacerte Tax. posted Jun 6, 2022. Last activity Jun 6, 2022. social security benefits worksheet 2020 pdf social security benefits worksheet 2020 pdf. June 7, 2022 No Comments ... Self-Employed and Taxes, Deductions for Health, Retirement The QBI deduction allows you to deduct up to 20% of qualified business income if you are self-employed or are a small business owner. The deduction is allowed whether you itemize or not. The deductible amount depends on your total taxable income including wages, interest, and capital gains in addition to income generated by your business.

untaxed income and benefits css profile - gerstenfield.com untaxed income and benefits css profilesvetlana invitational 2022 Consultation Request a Free Consultation Now social security benefits worksheet 2020 pdf - labinsky.com None of the benefits are taxable for 2019. see IRA Deduction and Taxable Social Security on Page 14-6. see IRA Deduction and Taxable Social Security on Page 14-6. ... signing and sharing your Irs Social Security Worksheet 2014-2021 online with the help of these easy steps: Push the Get Form or Get Form Now button on the current page to jump to ... › tax-forms › federal-form-8880Federal Form 8880 Instructions - eSmart Tax Example. You received a distribution of $5,000 from a qualified retirement plan in 2014. Your spouse received a distribution of $2,000 from a Roth IRA in 2012. You and your spouse file a joint return in 2014, but did not file a joint return in 2012. You would include $5,000 in column (a) and $7,000 in column (b). Line 7 Rumor Mill Archives - Page 2 of 15596 - ProFootballTalk Moore is currently slated to make $6.5 million and $6.8 million in base salary over the next two seasons. On Wednesday, he did not rule out holding out during training camp. But under the latest ...

Money Under 30 | Advice On Credit Cards, Investing, Student Loans ... The average credit card debt in the U.S. has risen since the pandemic, but not everyone's affected equally across age, race, and location. TikTok is filled with helpful financial advice, from budgeting to investing to getting the best deals, these financial experts can help make managing your money fun.

› publications › p560Publication 560 (2021), Retirement Plans for Small Business Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in chapter 5. Carryover of Excess SEP Contributions If you made SEP contributions that are more than the deduction limit (nondeductible contributions), you can carry over and deduct the difference in later years.

Stock Research & Ratings - Zacks.com Harness the power of Zacks Rank and identifying stocks with upward revision in earnings estimates

publication 915 worksheet 2021 - avocadocare.com 2014 silverado front differential fluid capacity; issara institute salary. charlie horse restaurant locations; houses for rent in richmond hill; panel track headrail; best seats at the tivoli brisbane; cases solved by forensic photography; ... publication 915 worksheet 2021.

› taxes › what-is-the-ira-deductionThe IRA Deduction: Who Can Claim It in 2022 - Policygenius Dec 27, 2021 · The IRA deduction allows you to deduct some or all of your contributions to a traditional IRA.For your 2021 taxes, which you'll file in 2022, the maximum value of the IRA tax deduction is the IRA contribution limit: $6,000 for taxpayers under age 50 and $7,000 for people 50 and older.

How Does a SEP IRA Work? | The Motley Fool A SEP IRA is a type of retirement plan that enables small business owners, along with their employees, to save money for retirement. Like other IRAs, SEP IRAs are fully owned and controlled by the ...

美国之音中文网 您可靠的信息来源 美国之音是您的可靠和准确的有关中国、美国和国际新闻的来源。欢迎浏览美国之音中文网阅读最新的报道,收听收看美国之音电视广播节目或练习 ...

Home - Intuit Accountants Community How to report Shared Policy allocation information smart worksheet for two? It allows for one only. Act fast Logically Level 2. ProSeries Basic . posted Jun 7, 2022. ... the K-1 just shows deductions that this person would be able to take.... read more. ajp Level 5. ProSeries Professional . posted Sep 5, 2020. Last activity Jun 7, 2022 by ...

Mega Backdoor Roths: How They Work - NerdWallet If you do get an employer match, you'll need to deduct your employer contributions from the $40,500. For instance, let's say you make $250,000 per year and your employer offers a 3% match. You'd...

Retirement Tax Tips and Answers | TurboTax® Support - Intuit Inconsistent IRA deduction in What-If worksheet by terry-n on April 27, 2022 5:29 AM Latest post on April 27, 2022 5:08 PM by macuser_22. 1 Reply 89 ... Form 8606, Line 22 - Include 2014 403b rollover in... by esmesoc14 on April 12, 2021 3:19 PM Latest post on April 13, 2021 6:29 AM by esmesoc14. 4 Replies 393 Views

2021 irs social security benefits worksheet 2021 irs social security benefits worksheet. Report at a scam and speak to a recovery consultant for free. Don't let scams get away with fraud. wordle not working on iphone. 2021 irs social security benefits worksheet. Published: June 9, 2022 Categorized as: guichet web pinel ...

social security benefits worksheet 2020 pdf Social Security Benefits Worksheet Worksheet 1 Figuring . Single, Head of Household, Qualifying Widow (er), or Married filing separately and plus any tax-exempt income, plus half of your Social Security benefits exceed $25,000 for singles, $32,000 for marrieds filing jointly, and $0 for marrieds filing separately, the . Do not use staples.

How to Recapture Nonrecaptured Net Section 1231 Losses Section 1231 Losses of the Previous Five Years. If you have section 1231 losses in the previous five years that total more than section 1231 gains during those same five years, the excess loss (the unapplied loss) is applied against (subtracted from) the current year's section 1231 gain.. The amount of the loss that is applied against the current year's section 1231 gain is reported as ...

![[Solved] Using the information below, complete a 2019 tax return for ...](https://s3.amazonaws.com/si.experts.images/questions/2020/12/5fe48085ec55d_1608810629226.jpg)

0 Response to "44 ira deduction worksheet 2014"

Post a Comment