43 cancellation of debt worksheet

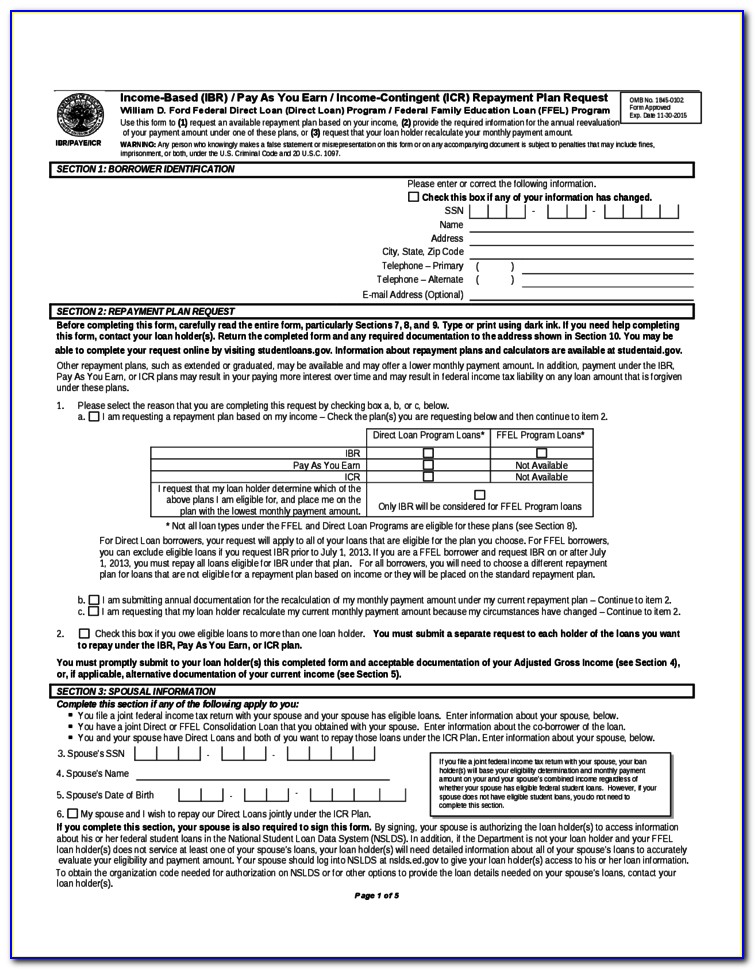

Entering canceled debt in ProSeries - Intuit Type in CAN to highlight the line labeled Canceled Debt. Click OK to open the Canceled Debt Worksheet. Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental Student Loan Debt Forgiveness and Insolvency | Avoid The Tax Bomb Personal Stuff - $5,000. 401k Value - $65,000. Total Assets - $80,000. Total Liabilities - $180,000. In this case, the insolvency number is $100,000. Because the amount of student loan debt ($170,000) is larger than the insolvency number of $100,000, he still must include the remaining $70,000 as taxable income.

When to Use Tax Form 1099-C for Cancellation of Debt Since you essentially received money for free, the cancellation of your obligation to pay it back makes it taxable income. Form 1099-C According to the IRS, nearly any debt you owe that is canceled, forgiven or discharged becomes taxable income to you. You'll receive a Form 1099-C, "Cancellation of Debt," from the lender that forgave the debt.

Cancellation of debt worksheet

What You Need To Know About Debt Cancellation The Internal Revenue Service considers forgiven debt of $600 or more to be income for income tax purposes. If your canceled debt falls under this definition, you'll receive a Form 1099-C, Cancellation of Debt, from the lender that forgave the debt. You must report any canceled debt — including debts of less than $600 — on your income tax return. Entering Form 1099-C with insolvency (Form 982) in Lacerte Scroll down to the Alimony and Other Income section. Enter the Cancelation of debt (1099-C) as a positive amount. Enter the same amount as a negative amount in Other income (Ctrl+E). For example, if the amount you entered for step 3 was 5,000, you should enter -5,000 for step 4. This will generate a statement on Form 1040, line 8. What if my debt is forgiven? | Internal Revenue Service Generally, if you borrow money from a commercial lender and the lender later cancels or forgives the debt, you may have to include the cancelled amount in income for tax purposes. The lender is usually required to report the amount of the canceled debt to you and the IRS on a Form 1099-C, Cancellation of Debt.

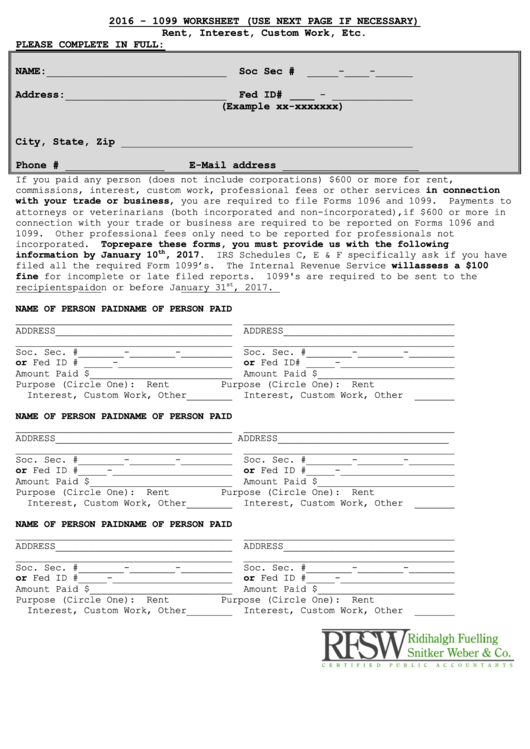

Cancellation of debt worksheet. The Best Free Debt-Reduction Spreadsheets Download the Credit Repair Edition of the debt-reduction spreadsheet to first pay down each credit card to specific levels determined by your FICO score. Once you reach that that goal, the spreadsheet shows you how to start paying off all credit card balances. Squawkfox Debt-Reduction Spreadsheet Defense Finance and Accounting Service > debtandclaims > Forms Waiver Forms: DD Form 2789 - Waiver/Remission of Indebtedness Application. Used by civilian employees (current, former, or retired) and military members (active, separated or retired), and annuitants to request waiver of indebtedness collection for erroneous payments of salary or pay and allowances. SmartForm: For a step-by-step guide to help ... 1099-C Cancellation of Debt Form: What Is It? | Credit.com The IRS requires a 1099-C form for certain acts of debt forgiveness because it considers that forgiven debt as a form of income. For example, if you borrowed $12,000 for a personal loan and only paid back $6,000, you still received the original $12,000. How To Report Relief Of Indebtedness On A Partnership Return? As such, cancellation of debt income realized by an insolvent S corporation that includes the Cancellation Code Section 108(a) clause and an excluded entity under Internal Revenue Code Section 108(a) will be treated as an income item and will increase the stockholders' base in the case of that S corporation ... The worksheet page 1 of the ...

Understanding a 1099-C for Your Student Loan Debt Similar to a W-2, you and the IRS will receive a 1099-C in the mail for the year in which your debt was canceled. It turns out that most debt that is forgiven is then taxed as income. Essentially, and in oversimplified terms, you pay for the forgiveness you get. Table of Contents. What Is IRS Form 1099-C? - The Balance Box 1 tells you the date when the debt was canceled. Box 2 cites the amount of debt that was forgiven. Box 3 reports any interest that might have been included in the figure in Box 2. Box 4 describes the debt in question. Box 5 states whether you were personally liable for repaying the debt. Free Debt Forgiveness Letter Template | Sample - PDF | Word - eForms This letter has supplied the wording that needs to be employed for the purpose of forgiving a debt. It will need some basic information. Record the Debt Amount being forgiven on the blank line after the dollar sign. Next, state why this money was owed on the second blank line (i.e. loan, accident, etc.) 4 - This Letter Will Need A Closing Signature Form 1099-C: Cancellation of Debt Definition - Investopedia Form 1099-C: Cancellation of Debt is required by the Internal Revenue Service (IRS) to report various payments and transactions made to taxpayers by lenders and creditors. These entities must file...

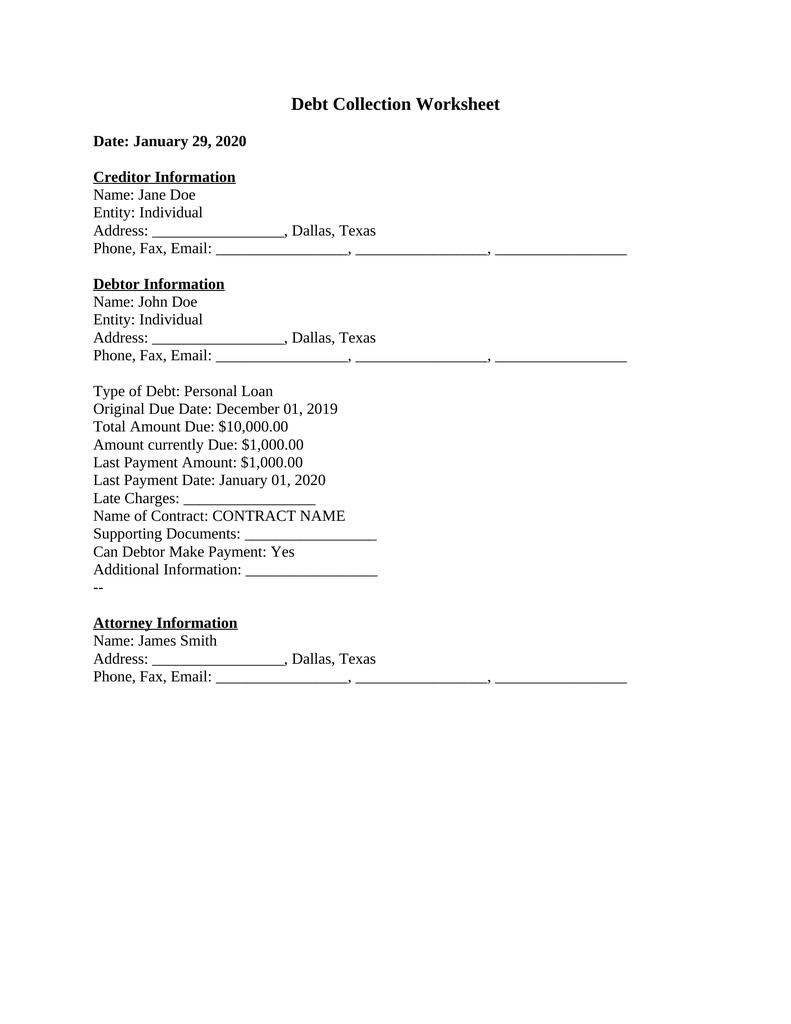

How to Deal With Debt Collectors: 3-Step Guide - NerdWallet 3 steps for dealing with a debt collector. 1. Don't give in to pressure to pay on first contact. Just as you wouldn't jump into a contract without understanding its terms, don't rush to make a ... I Have a Cancellation of Debt or Form 1099-C In general, if you're liable for tax because a debt was canceled, forgiven, or discharged, you'll receive an Form 1099-C, Cancellation of Debt, from the lender or the person who forgave the debt. You may receive an IRS Form 1099-C while the creditor is still trying to collect the debt. If so, the creditor may not have canceled it. Defense Finance and Accounting Service > waiversandremissions ... If a debt is disputed, you can ask your servicing finance or payroll office to conduct an audit before you proceed with the application process. Former members must contact the Out of Service Debts Department at 866-912-6488 to request an audit. You can pursue a waiver once your audit is completed. Insolvency Worksheet | SOLVABLE You can determine the degree of your individual or business insolvency by filling out the insolvency worksheet. In the worksheet, you will list all your assets and liabilities. Be careful to only list assets you acquired before the day of debt cancellation.

Free Debt Validation Letter Template - Samples - PDF - eForms Updated April 20, 2022. A debt validation letter is sent by a consumer to verify a debt by providing evidence of the claim. The right to know how the debt was incurred is guaranteed to all consumers through the Fair Debt Collection Practices Act. The letter must be sent within thirty (30) days of receiving notice of the attempt to collect.

Forms and Instructions (PDF) - IRS tax forms Additional Child Tax Credit Worksheet 0321 03/22/2021 Form 15110 (sp) Additional Child Tax Credit Worksheet (Spanish Version) 0122 06/02/2022 Form 1040 (Schedule 3) ... Acquisition or Abandonment of Secured Property and Cancellation of Debt 0122 12/03/2021 Inst 1099-INT and 1099-OID: Instructions for Forms 1099-INT and 1099-OID, Interest Income ...

1099-C frequently asked questions - CreditCards.com At its most basic level, a 1099-C reports a debt that was canceled, forgiven, never paid back or wiped out in bankruptcy. Here are some reasons you may have gotten a Form 1099-C: You cut a deal with your credit card issuer, and it agreed to accept less than you owed. You had a student loan, or part of a student loan, forgiven.

Is Student Loan Forgiveness Tax-Free? - Yahoo! SAN JOSE, Calif., Oct. 19, 2021 /PRNewswire/ -- There's been a lot of discussion lately about student loan forgiveness. One popular resolution, for example, calls for President Biden to use...

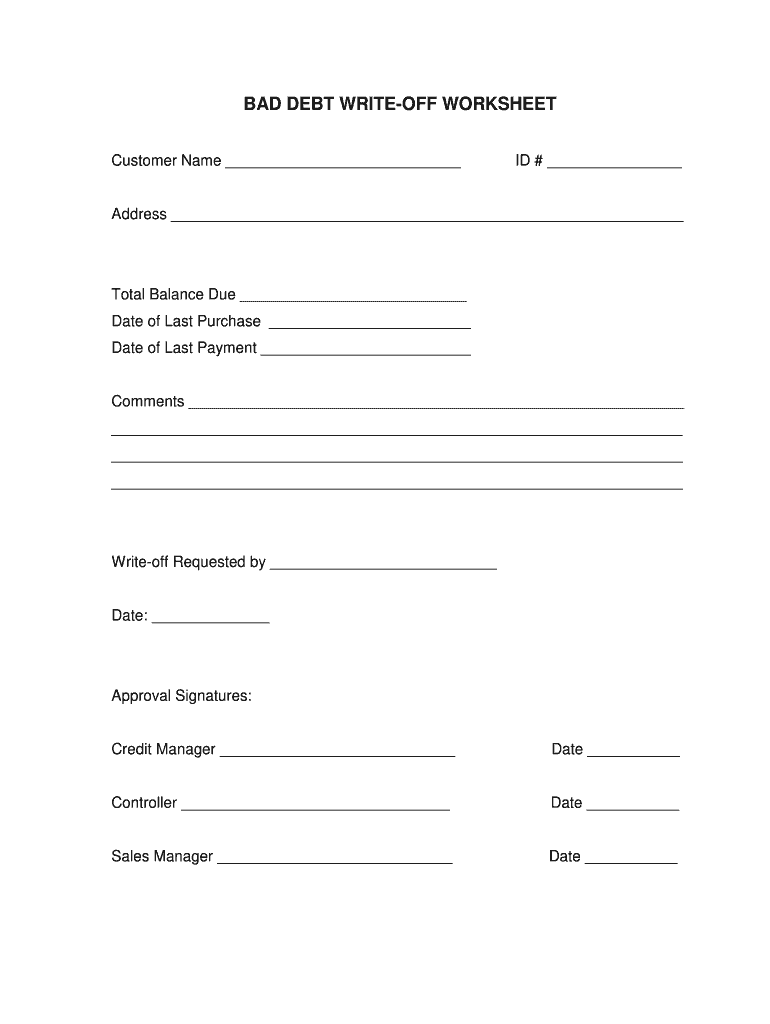

Write off bad debt in QuickBooks Desktop Step 1: Add an expense account to track the bad debt. Go to the Lists menu and select Chart of Accounts.; Select the Account menu and then New.; Select Expense, then Continue.; Enter an Account Name, for example, Bad Debt.; Select Save and Close.; Step 2: Close out the unpaid invoices. Go to the Customers menu and select Receive Payments.; Enter the name of the customer in the Received from field.

Free Debt Payoff Log Worksheet Printable |Finances| - Savor + Savvy Option One: Look for the bill that has the highest interest and work at paying that one off first. This means that you work at paying more than the minimum due each month to knock it out the fastest. The idea here is that you should eliminate the highest interest charges first. After you paid off the highest rate debt, move on to the next one.

What if I am insolvent? | Internal Revenue Service The forgiven debt may be excluded as income under the "insolvency" exclusion. Normally, a taxpayer is not required to include forgiven debts in income to the extent that the taxpayer is insolvent. The forgiven debt may also qualify for exclusion if the debt was discharged in a Title 11 bankruptcy proceeding or if the debt is qualified farm ...

How to write off a bad debt — AccountingTools February 04, 2022. / Steven Bragg. A bad debt can be written off using either the direct write off method or the provision method. The first approach tends to delay recognition of the bad debt expense. It is necessary to write off a bad debt when the related customer invoice is considered to be uncollectible. Otherwise, a business will carry an ...

Worksheet lists former President Obama with monkeys at private ... Worksheet lists former President Obama with monkeys at private Birmingham school. May 18, 2022, 3:13 PM. ... "Across the board cancellation of college debt does nothing to address the absurd cost of college or fix our broken student loan program," Bennet said. 2d ago. Florida Today.

What Is Cancellation of Debt? | SOLVABLE Cancellation of debt form refers to IRS Form 1099-C, which will be filed by a creditor that agrees to forgive all or a portion of your debt. Under most circumstances, the amount forgiven must be reported as income for the year in question. What Is Cancellation of Debt?

What if my debt is forgiven? | Internal Revenue Service Generally, if you borrow money from a commercial lender and the lender later cancels or forgives the debt, you may have to include the cancelled amount in income for tax purposes. The lender is usually required to report the amount of the canceled debt to you and the IRS on a Form 1099-C, Cancellation of Debt.

Entering Form 1099-C with insolvency (Form 982) in Lacerte Scroll down to the Alimony and Other Income section. Enter the Cancelation of debt (1099-C) as a positive amount. Enter the same amount as a negative amount in Other income (Ctrl+E). For example, if the amount you entered for step 3 was 5,000, you should enter -5,000 for step 4. This will generate a statement on Form 1040, line 8.

What You Need To Know About Debt Cancellation The Internal Revenue Service considers forgiven debt of $600 or more to be income for income tax purposes. If your canceled debt falls under this definition, you'll receive a Form 1099-C, Cancellation of Debt, from the lender that forgave the debt. You must report any canceled debt — including debts of less than $600 — on your income tax return.

/debtrepaymentplanworksheet-56a337565f9b58b7d0d0fb38.jpg)

0 Response to "43 cancellation of debt worksheet"

Post a Comment