43 1040 qualified dividends and capital gains worksheet

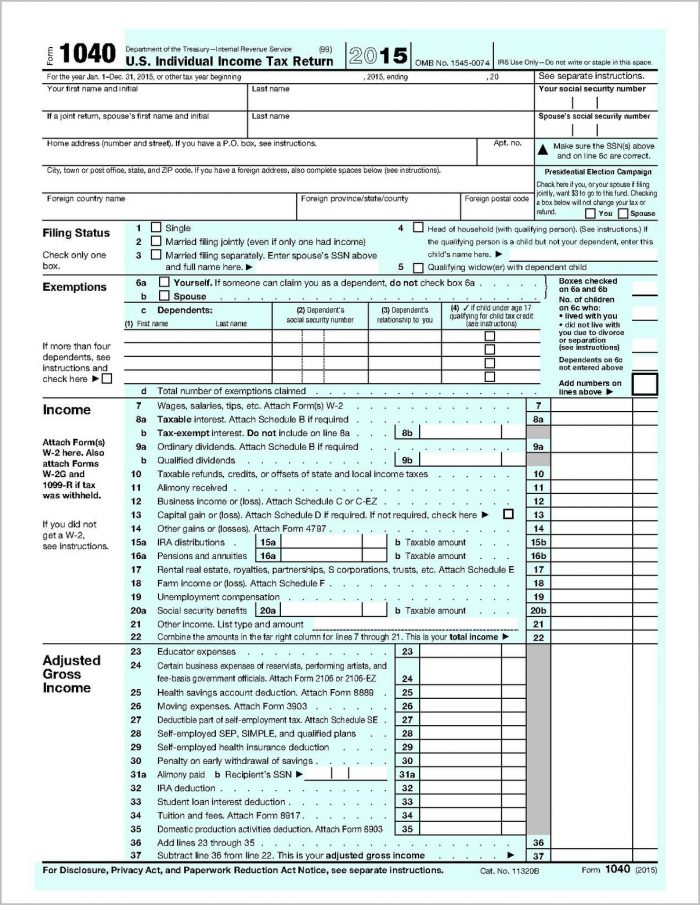

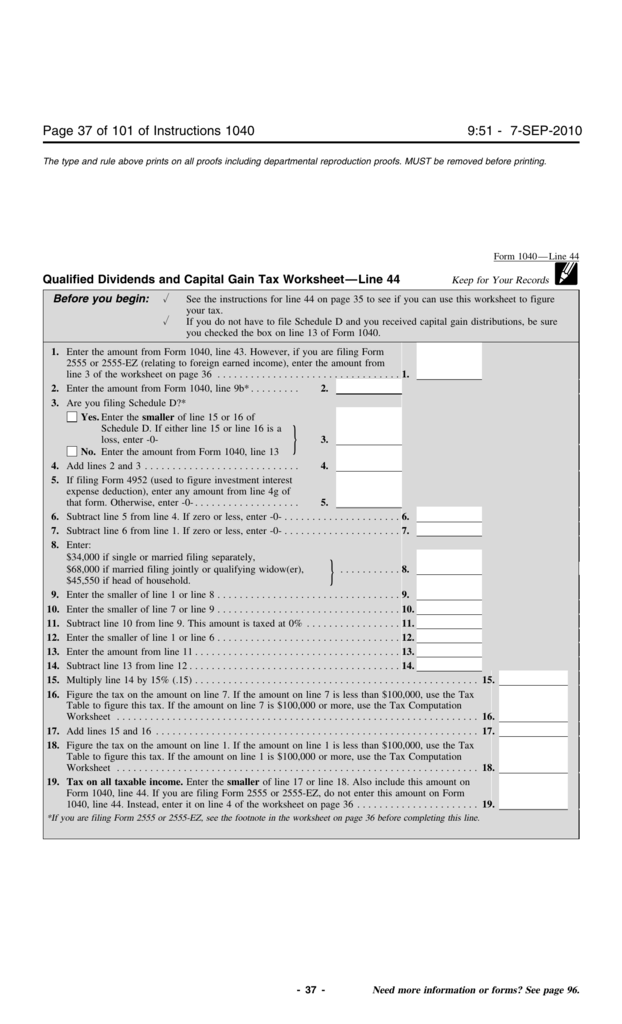

How Capital Gains and Dividends Are Taxed Differently 25/12/2021 · Dividends are income earned by investing in stocks, mutual funds, or exchange-traded funds, and they are included in your tax return on Schedule B, Form 1040. Capital gains are the amount an asset ... Capital Gain Tax Worksheet (PDF) - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. ... Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1.

Solved: When you have ordinary dividends and qualified ... May 31, 2019 · Qualified dividends are taxed at the same tax rate that applies to net long-term capital gains, while non-qualified dividends are taxed at ordinary income rates. I like the term 'non-qualified'. I think people may be confused by the use of 'ordinary' for both income and dividend. One might expect ordinary dividends to be taxed as ordinary income.

1040 qualified dividends and capital gains worksheet

Solved: When you have ordinary dividends and qualified ... - Intuit 31/05/2019 · The amount of qualified dividends on line 3a on the 2020 1040 is used to calculate the tax on line 16 using the "Qualified Dividend and Capital Gains Worksheet". "Taxable Income" and "Tax" are not the same thing. PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ... Get Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. ... Qualified Dividends and Capital Gain Tax Worksheet Line 44 (Form 1040) Line 28 (Form 1040A) (Keep for Your Records) NAMEBefore you begin:SSN See the instructions for line 44 to see if you can ...

1040 qualified dividends and capital gains worksheet. How Capital Gains and Dividends Are Taxed Differently Dec 25, 2021 · Dividends are income earned by investing in stocks, mutual funds, or exchange-traded funds, and they are included in your tax return on Schedule B, Form 1040. Capital gains are the amount an asset ... Solved Instructions Form 1040 Schedule 1 Schedule 5 Schedule - Chegg.com instructions form 1040 schedule 1 schedule 5 schedule b qualified dividends and capital gain tax worksheet form 1040 x 7,000 6 173,182 4,453.50 + 22% 38,700 7 173,182 → 14,089.50 + 24% 2018 tax rate schedules 38,700 82,500 82,500 157,500 157,500 200,000 200,000 500,000 500,000 82,500 157,500 32,089.50 + 32% 9 8 24,000 45,689.50 + 35% 200,000 9 … 1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200. 2021 1040 Form and Instructions (Long Form) - Income Tax Pro 01/01/2021 · Capital gain or loss, other gains or losses. Farm or fisherman income or loss. Rental, royalty, partnership, S corporation, or trust income. Received alimony income or paid alimony. Owe household employment taxes. Recapture taxes and advance payments. Foreign taxes and credits to claim. Read the Filing Requirements section of the Form 1040 instructions …

Qualified Dividends Worksheet - ideas 2022 Qualified Dividends Worksheet. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. For alt min tax purposes only 1. ACC 330 61 Final Project Practice Tax Return Qualified from In microsoft excel, the sheet tabs appear beneath the worksheet grid space and permit you […] The Dividend Tax Rate for 2021 and 2022 - SmartAsset 07/01/2022 · So let’s say you’re single and have $150,000 of annual income, with $10,000 of that being dividends. Your dividends would then be taxed at 15%, while the rest of your income would follow the federal income tax rates. The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. For 2021, these rates remain ... Calculation of the Qualified Dividend Adjustment on Form 1116 Line 1a ... The total foreign-sourced qualified dividends must be divided by the total capital gains from line 4 to arrive at the pro rata percentage. This percentage is then multiplied by the amount of capital gains taxed at 15% (line 14 of the QD&CTG worksheet) to determine the amount attributable to foreign sources. Qualified Dividends and Capital Gain Tax Worksheet: An … Qualified Dividends and Capital Gain Tax Worksheet: An Alternative to Schedule D FS-2004-11, February 2004 Although many investors use Schedule D to get the benefit of lower capital gains tax rates, others can still use a worksheet in the tax instructions to skip Schedule D entirely. Lower Tax Rates The Jobs and Growth Tax Relief Reconciliation Act of 2003 lowered …

The Dividend Tax Rate for 2021 and 2022 - SmartAsset Jan 07, 2022 · So let’s say you’re single and have $150,000 of annual income, with $10,000 of that being dividends. Your dividends would then be taxed at 15%, while the rest of your income would follow the federal income tax rates. The tax rates for non-qualified dividends are the same as federal ordinary income tax rates. For 2021, these rates remain ... Schedule D: How to report your capital gains (or losses) to the IRS 23/02/2022 · Depending on your answers to the various Schedule D questions, you’re directed to the separate Qualified Dividends and Capital Gain Tax worksheet or the Schedule D Tax worksheet, which are found ... What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D. Where do Qualified dividends go on 1040? Similarly, what are qualified dividends? Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income. The rates on qualified dividends range from 0 to 23.8%.

Calculation of tax on Form 1040, line 16 - Thomson Reuters You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a.

Qualified Dividends and Capital Gains Worksheet.pdf qualified dividends and capital gain tax worksheet—line 12a keep for your records see the earlier instructions for line 12a to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 or 1040-sr through line 11b.if you don't have to file schedule d and you received capital gain distributions, be …

IRS corrects error in Schedule D tax calculation worksheet The corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax for a small number of taxpayers. Most taxpayers who file Schedule D do not have amounts on line 18, which contains capital gain taxed at the 28% rate, or line 19, where unrecaptured Sec. 1250 gain is reported.

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

Qualified Dividends and Capital Gain Tax Worksheet Form 2015-2022 ... qualified dividends and capital gain tax worksheet line 16 2021reate electronic signatures for signing a qualified dividends and capital gains worksheet 2021 in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field.

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

Form 1040 line 10 different from line 10 qualified dividend and capital ... Line 10 on the qualified dividend and capital worksheet is not necessarily the same as line 10 from your 1040. Your taxable income from your 1040 goes to line #1 of the QD/CG worksheet. 0 Reply printseller New Member June 4, 2019 10:47 PM So the 1040 for this year is poorly designed!

0 Response to "43 1040 qualified dividends and capital gains worksheet"

Post a Comment