40 qualified dividends and capital gain tax worksheet 2015

2015 Capital Gains Carryover Worksheet - Templates : Resume Sample #27161 2015 Capital Gains Carryover Worksheet. ... tax school december 3 3 21 3 individual in e tax returns irs qualified dividends and capital gains worksheet 2010 qualified dividends and capital gain tax worksheet line 44 2014 tax covers untitled ... PDF 2015 Form 6251 - IRS tax forms 2015 Form 6251 Form 6251 Department of the Treasury Internal Revenue Service (99) Alternative Minimum Tax—Individuals Information about Form 6251 and its separate instructions is at . Attach to Form 1040 or Form 1040NR. OMB No. 1545-0074 2015 Attachment Sequence No. 32 Name(s) shown on Form 1040 or Form 1040NR

How to Dismantle an Ugly IRS Worksheet | Tax Foundation One of these is on most kinds of income, and another of these is on qualified corporate dividends and capital gains. There are seven and three brackets for each of these kinds of income, but the cutoffs for the brackets are based on the combination of both kinds of income.

Qualified dividends and capital gain tax worksheet 2015

qualified dividends and capital gain tax worksheet 2021 In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax. Ordinary dividends are taxed at the usual federal income tax rates, which range from 10% to 37% for tax years 2021 and 2022. 2015 Instructions for Schedule D - Capital Gains and Losses To report a gain or loss from a partnership, S corporation, estate or trust, To report capital gain distributions not reported directly on Form 1040, line 13 (or effectively connected capital gain distributions not reported directly on Form 1040NR, line 14), and To report a capital loss carryover from 2014 to 2015. Additional information. Publication 4681 (2021), Canceled Debts, Foreclosures ... - IRS tax … 31.12.2020 · Because Robert wasn't personally liable for the debt, the abandonment is treated as a sale or exchange of the property in tax year 2021. Robert's amount realized is $185,000 and his adjusted basis in the property is $180,000 (as a result of $20,000 of depreciation deductions on the property). Robert has a $5,000 gain in tax year 2021. (Had ...

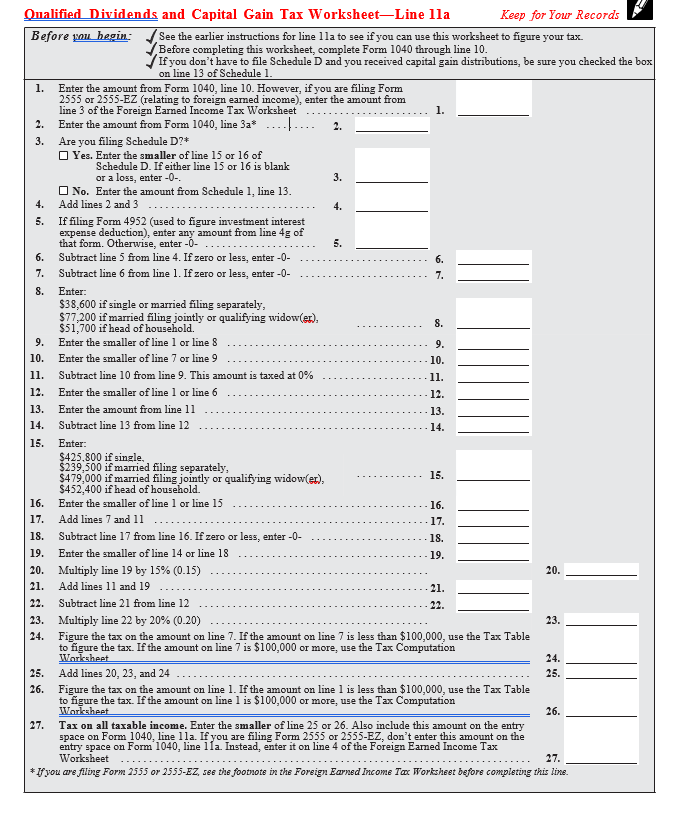

Qualified dividends and capital gain tax worksheet 2015. My 2015 turbotax online does not show "tax calculation worksheet" last updated May 31, 2019 7:38 PM My 2015 turbotax online does not show "tax calculation worksheet" I had qualified dividends and net long capital gains. I wanted to see if TB used worksheet to calculate the tax of capital gains and qualified dividends at the rate of 15% TurboTax Online 0 1 141 Reply 1 Best answer Anita01 New Member J.K. Lasser's Your Income Tax 2016: For Preparing Your 2015 ... J.K. Lasser Institute · 2015 · Business & EconomicsFor Preparing Your 2015 Tax Return J.K. Lasser Institute ... Tax computation on the Qualified Dividends and Capital Gain Tax Worksheet. Dividends Qualified Capital Form Worksheet Gain Tax And [FPRLEZ] Search: Form Qualified Dividends And Capital Gain Tax Worksheet. Capital Gain Dividends. Attach Form(s) W-2 here. Form 1099 will be sent at a later date for all tax reporting. ... Showing 8 worksheets for Qualified Dividends And Capital Gain Tax 2015. In 2014, the trust has $50,000 of dividend income ($30,000 qualified) and $50,000 of realized ... PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. ... complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box ... enter the amount from line 3 of the Foreign Earned Income Tax Worksheet .....1. 2. Enter the amount from Form 1040, line 3a ...

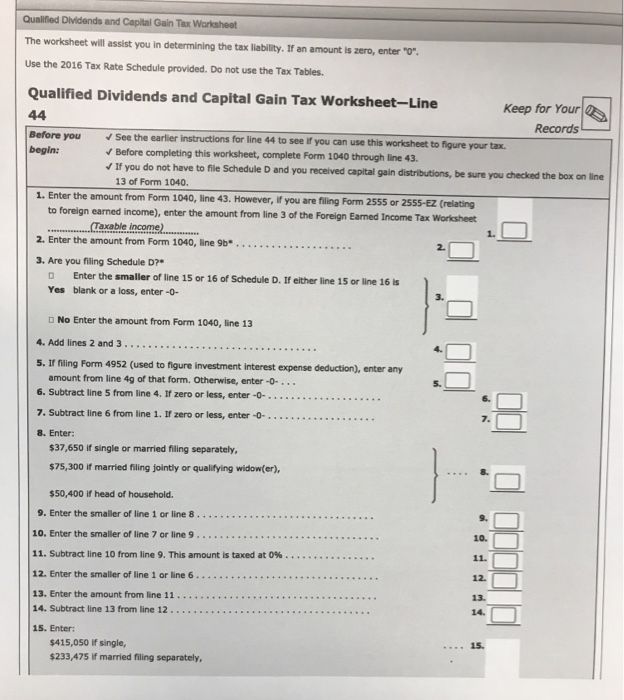

Capital Gain Tax Worksheet - 2015 Form 1040Line 44 Qualified Dividends ... 2015 form 1040—line 44 qualified dividends and capital gain tax worksheet—line 44 keep for your records see the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.before completing this worksheet, complete form 1040 through line 43.if you do not have to file schedule d and you received capital gain … PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040) Line 28 (Form 1040A) 2016 Before you begin: 1. 1. 2. 2. 3. Yes. 3. ... If you do not have to file Schedule D and you received capital gain distributions, be sure ... Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet * If you are filing Form 2555 or 2555 ... Qualified Dividends and Capital Gains Worksheet - StuDocu 6-2 Final Project Two-Schedule B (1040)-2018. 6-2 Final Project Two-Tax Planning Rev1. 6-2 Final Project Two-Schedule 5. ACC 330 Final Project Three Formal Letter to Client. ACC 330 4-2 Final Project ONE Submission. 6-2 Final Project Two Submission-Qualified Dividends and Capital Gains. 4-1 Assignment - Credits. Qualified Dividends and Capital Gains Worksheet - StuDocu Brunner and Suddarth's Textbook of Medical-Surgical Nursing Griechische Grammatik Hide Qualified Dividends and Capital Gains Worksheet ACC-330-R4844 Federal Taxation I 22EW46-2 Final Project Two Submission: Tax Return6-2 Fina... View more University Southern New Hampshire University Course Federal Taxation I (ACC330) Uploaded by Wellington Vondee

1040 US Individual Income Tax Return - eFile.com 65 2015 estimated tax payments and amount applied from 2014 return ... Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions.45 pages Qualified Dividends And Capital Gain Tax Worksheet 2020 Qualified dividends are the portion of your total ordinary dividends subject to the lower capital gains tax rate. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Qualified dividends also have a minimum holding period of the underlying stock. Keep for Your Records. J.K. Lasser's Your Income Tax 2015: For Preparing Your 2014 ... J.K. Lasser Institute · 2014 · Business & EconomicsYou do not have qualified dividends or capital gains or losses to report, so your regular tax liability is figured on the Tax ComputationWorksheet. Free Microsoft Excel-based 1040 form available - Accounting Advisors, Inc. Just in time for tax season, Glenn Reeves of Burlington, Kansas has created a free Microsoft Excel-based version of the 2008 U.S. Individual Tax Return, commonly known as Form 1040. The spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule D - Capital Gains and Losses, along with its worksheet.

US. Individual Income Tax Return Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1 O4ONR, tine 42).14 pages

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

Qualified Dividends and Capital Gains Worksheet.pdf - 2016... 2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line ...

How to Figure the Qualified Dividends on a Tax Return - Zacks Treat qualified dividends (found in box 1b of your 1099-DIV) as ordinary dividends, which are subject to the zero to 15 percent tax rate that applies to capital gains. Subject qualified dividends...

Qualified Dividends and Capital Gain Tax - taxact.com Qualified Dividends and Capital Gain Tax With the passing of the American Taxpayer Relief Act of 2012, certain taxpayers may now see a higher capital gains tax rate than they have in recent years. The new tax rates continue to include the 0% and the 15% rates; however, will also now include a 20% rate.

How Capital Gains and Dividends Are Taxed Differently In the case of qualified dividends, these are taxed the same as long-term capital gains. For 2021 and 2022, individuals in the 10% to 12% tax bracket are still exempt from any tax. Investors who ...

capital_gain_tax_worksheet_1040i - 2015 Form 1040Line 44 Qualified ... View Homework Help - capital_gain_tax_worksheet_1040i from ACCT 4400 at University of North Texas. 2015 Form 1040Line 44 Qualified Dividends and Capital Gain Tax WorksheetLine 44 Keep for Your

Worksheet Tax Dividends Form Qualified Gain Capital And qualified dividends and capital gain tax worksheet 2019 Capital Loss Carryover Worksheet Lines 6 and 14, Schedule D Use this worksheet to gure capital loss carryovers from 2007 to 2008 if 2007 Schedule D, line form 1040 qualified dividends worksheet 2015 Form 1040 Line 44 Qualified Dividends and Capital Gain Tax Worksheet Line 44 Keep for Your.

0 Response to "40 qualified dividends and capital gain tax worksheet 2015"

Post a Comment