40 business overhead expense worksheet

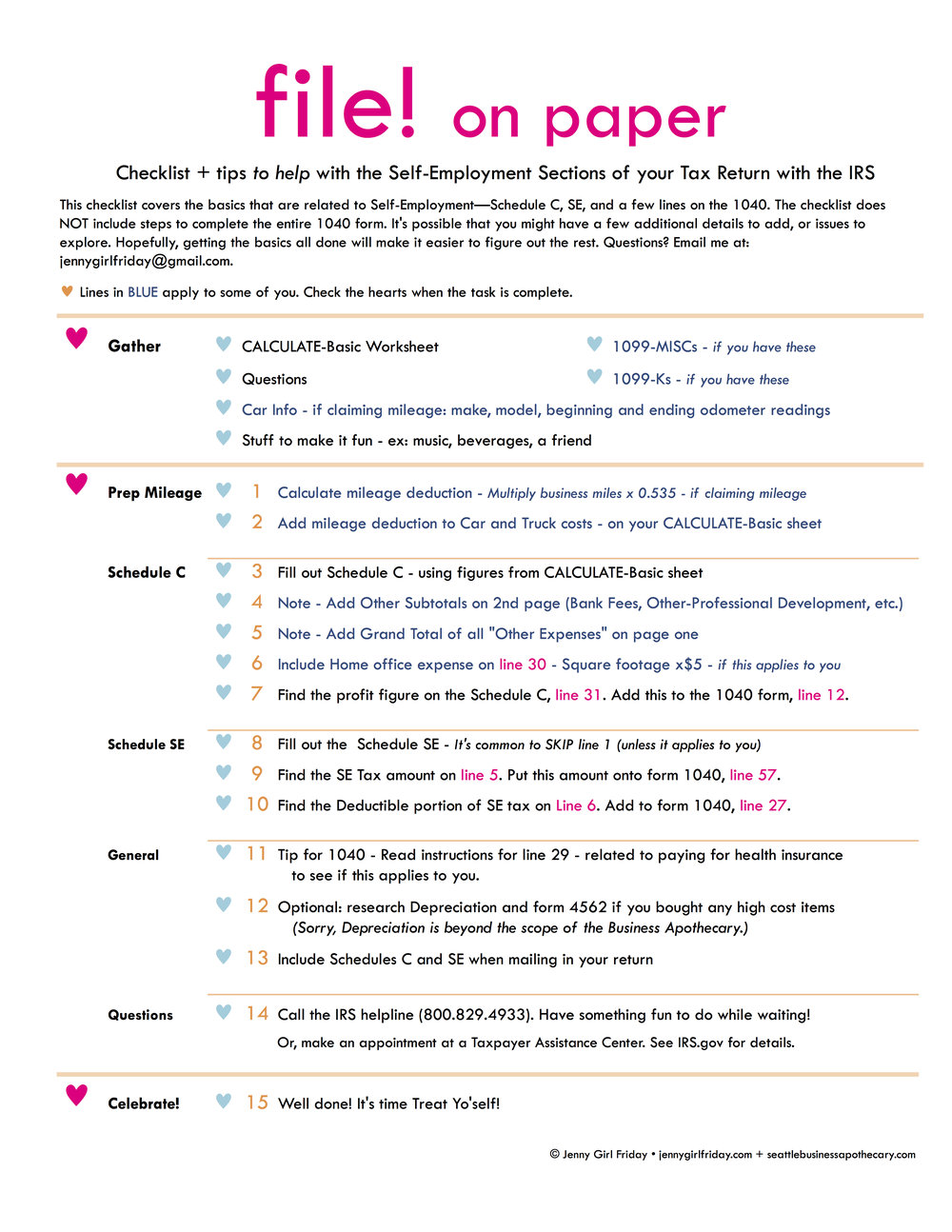

How to Calculate Overhead Costs in 5 Steps - FreshBooks Calculate the Overhead Rate. The overhead rate or the overhead percentage is the amount your business spends on making a product or providing services to its customers. To calculate the overhead rate, divide the indirect costs by the direct costs and multiply by 100. If your overhead rate is 20%, it means the business spends 20% of its revenue ... Business Overhead Calculator | Plan Projections The Excel business overhead budget template, available for download below, helps a business in calculating overhead by entering the amount under the relevant category for each of the five years. Business Overhead Calculator Download The business overhead calculation spreadsheet is available for download in Excel format by following the link below.

Business Expense Spreadsheet [100% Free Excel Format] - Excel TMP Jan 29, 2021 · In conclusion, a business expense spreadsheet helps you to keep track of your business expenses by updating your financial information. Sharing is caring! exceltmp Exceltmp.com is here for your convenience and to save time. It's a source of providing a good range of excel, word, and pdf templates designs and layouts.

Business overhead expense worksheet

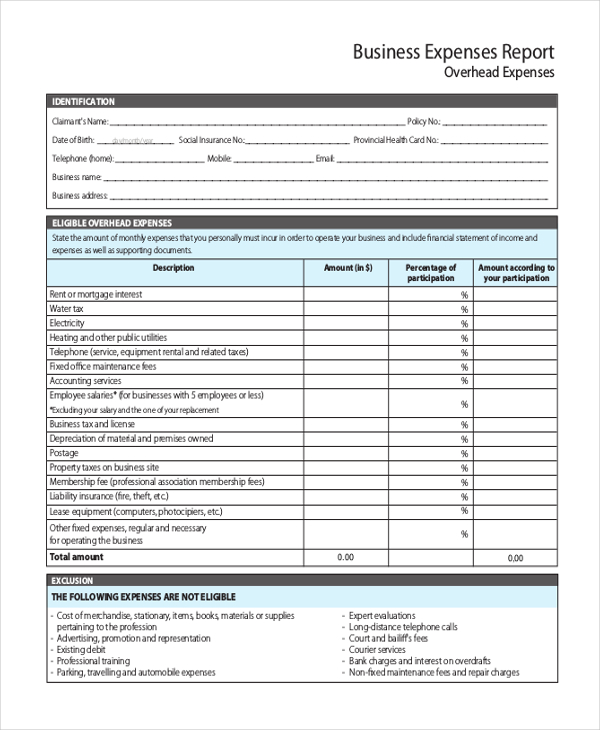

Business Owners Package and Directors and Officers Insurance for CPA firms The AICPA Business Overhead Expense (BOE) Insurance Plan reimburses business owners for existing overhead expenses incurred while they are disabled, keeping the company up and running while the owner recovers. Regular expenses that could be covered under a BOE policy include employee salaries, rent, leases and utilities to name a few. How to Calculate Overhead Ratio (Excel Template) - EDUCBA Then the overhead ratio can be calculated below: - Operating Income = revenue - Cost of Goods Sold - Selling, General & Administrative Expenses - Depreciation Operating Income = Rs 100000 - Rs 25000 - Rs 25000 Operating Income= Rs 50000 Operating Expenses = Salary, General & Administrative Expenses including Depreciation PDF Disability Business Overhead Expense (Boe) Insurance Worksheet To ensure your business continued to operate in that scenario, what ongoing expense obligations would you have even if your disability prevented you from contributing to the organization? Take a few minutes to do the math. A BOE disability insurance policy would reimburse you, the business owner, for these overhead expenses incurred if you ...

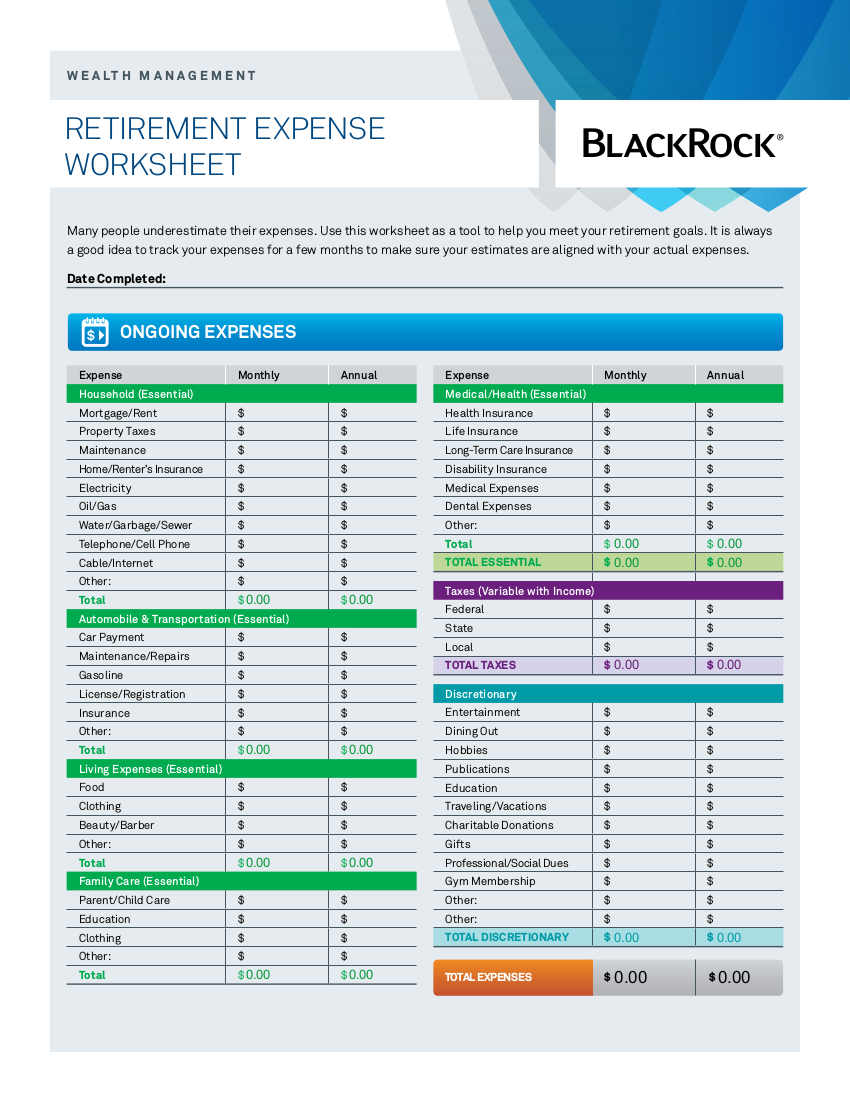

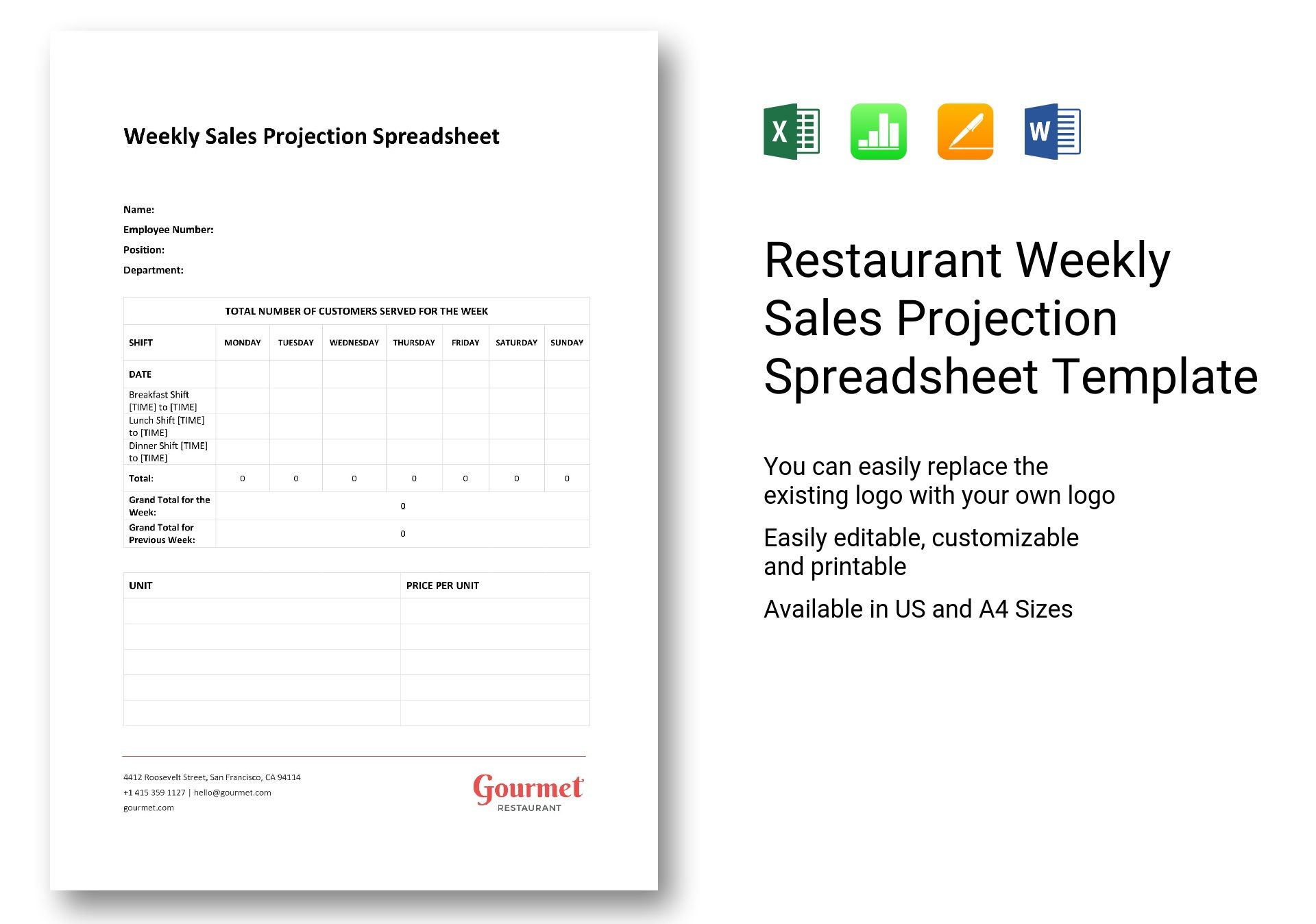

Business overhead expense worksheet. Free Excel spreadsheet for business expenses in 2022 | monday ... Mar 14, 2022 · A spreadsheet for business expenses is a standardized template that tracks and records a company’s expenses. Specifically, it details the “what,” “why,” “who,” and “how” of spending company money, so for example: what was the money spent on? why was it spent? who spent it? and how much was spent? Overhead Expenses Template, Spreadsheet | Small Businesses Monthly Overhead Expenses – 1 Month Worksheet Excel Also known as “fixed” costs, monthly overhead expenses include: rent and utilities, employees and payroll taxes, phone and Internet, vehicles, marketing, professional fees, supplies and materials, bank and credit card charges, travel expenses, and more. XLSX 5-Minute Classes | Free Online Classes For Small Businesses Overhead Expenses - Monthly Estimate your average monthly overhead expenses: Item: - Rent - Utilities - Phone Charges - Salaries - Payroll (taxes, payroll services, etc) - Office Supplies - Postage - Shipping/Courier Services - Licenses and Permits - Legal Fees - Accounting and Professional Services - Membership and Subscription Dues - Business ... Business Operating Expenses Excel Worksheet Use this Business Operating Expenses Excel Worksheet to track your actual and estimated business operating expenses. There are 4 worksheets to help you keep track of your business operating expenses. The first worksheet contains your actual line item expenses. The second worksheet contains your estimated line items expenses

PDF Overhead Worksheet - National Institutes of Health 12. Office Expenses. Supplies Equipment Rental ** (Other) (Other) 13. Automotive. Number of Vehicles Percentage of Personal Use. Rent/Lease ** Gas and Oil. Repairs & Maintenance (Other) 14. Telephone. Basic Service and Equipment Long Distance. ... Overhead Worksheet Created Date: PDF Business Overhead Expense Worksheet - piu.org Petersen nternational nerwriters Business Overhead Expense Worksheet - 03-15-2019 Business Overhead Expense Worksheet 23929 Valencia Boulevard Second Floor, Valencia, CA 91355 | (800) 345-8816 | Fax (661) 254-0604 | piu@piu.org ... Eligible Monthly Business Expenses 1. Rent 2. Electricity, telephone, heating and water 3. Laundry and maintenance ... Calculating the Overhead Rate: A Step-by-Step Guide The overhead rate is calculated by adding your indirect costs and then dividing them by a specific measurement such as machine hours, sales totals, or labor costs. Direct costs are the costs that ... 37 Handy Business Budget Templates (Excel, Google Sheets) Professional Business Budget Template. Large companies or those who are already well-established can use this more comprehensive template. It offers a sheet for the estimated expenses and a separate sheet to track expenses that accumulate. You can also use it to keep track of expense variances. Small Business Budget Template.

Overhead/Expense Worksheet - Carr's Corner Overhead/Expense Worksheet The following worksheet is for members and business owner to develope good universal business practices. Money expended in the promotion of any business must be recaptured through the sale of your product and its pricing. It offers the following data. Fill in the blanks to get teh cost to run your business for each ... Overhead Expense Template - Small Business Expenses Tracking Excel The business expenses template was designed to be a simple and effective way to easily track your overhead expenses. All expense categories are customizable, giving you the most flexibility. First you simply enter the expense categories you want to use in the orange column A: PDF Business Overhead Expense Worksheet - Truluma Type of Business Normal Monthly Overhead Expense Outlay 1. Rental Real Estate Depreciation, or Business Mortgage Principal (show only one) $ 2. Utilities a. Heat $ b. Power $ c. Water/Sewer $ d. Fixed Telephone/Fax $ 3. Free Small Business Profit and Loss Templates | Smartsheet Monthly Profit and Loss Template. Create a 12-month profit and loss statement that tracks monthly and year-to-date expenses and revenue. After entering your data into the spreadsheet, the template will calculate totals and generate graphs that display gross profit, total expenses, and profit or loss over time.

PDF Business Overhead Expense Worksheet - Official Site Business Overhead Expense Worksheet (To be sumitted with Application) Firm Name: Business structure: SOLE PROPRIETOR . PARTNERSHIP . CORPORATION . Percentage of Ownership of firm % ELIGIBLE MONTHLY EXPENSES OF THE BUSINESS . Rent or mortgage payments (including principal, interest and taxes) or . Depreciation-if greater than principal payments

Business monthly budget - templates.office.com This Excel spreadsheet budget arrives fully formatted and ready for your numbers. Summarize your largest expenses with a business budget template that compares projected and actual spending, helps you track personnel, and more. Formatted with various typical business categories, this budget is also easily adaptable to your needs.

PDF Business Income & Extra Expense Worksheet Manufacturers business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month policy period. Failure to submit a signed current worksheet will automatically reinstate the Coinsurance Provision for the period going forward.

Business Overhead Expense - CPAI Overhead expenses such as employees' salaries and payroll taxes, rent or mortgage interest payments, charges for utilities such as electricity, telecommunications, heat and water, and business insurance premiums. Coverage amounts available from.$1,000 to $12,000 per month. Duration begins after you have been disabled for 30 continuous days.

All the Best Business Budget Templates | Smartsheet 12-Month Business Budget Template. Download Excel Template. Try Smartsheet Template . For a more detailed view of your company's financials over time, use this business budgeting spreadsheet. Enter your revenue and expense estimations for each month and the entire year.

Business expense budget - templates.office.com Business expense budget Evaluate actual expenses in business against your annual budget plan with this business budget template. It includes charts and graphs of your monthly variances. Business budget templates from Excel calculate your line items, making financial management faster and easier than ever.

How to calculate and track overhead costs for your small business Company A, a consulting company calculates they have $120,000 in monthly overhead costs. They make $800,000 in monthly sales. Company A's overhead percentage would be $120,000 divided by $800,000, which gives you 0.15. Multiply that by 100, and your overhead percentage is 15% of your sales.

Business Overhead Expenses: What They Are and How To Calculate Them Business overhead expenses encompass the ongoing costs of operating a business. They include costs such as: Marketing costs Administrative compensation and benefits Rent & utilities Professional fees Other general company costs such as licenses, dues and subscriptions, administrative vehicles, professional development, etc.

Overhead Expense Worksheet - Kaplan Management Overhead Expense Worksheet . Overhead expense insurance covers the monthly tax-deductible expenses of a business entity. Below find a worksheet sheet that will help you determine your total monthly expenses. Regular lease, rental or mortgage payment on business premises $ _____ Rental, mortgage or realty taxes _____ ...

Business Expenses Template, Overhead Expenses Tracking About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators ...

Overhead Expense Insurance - Principal Financial Group Overhead Expense (OE) insurance reimburses a business owner for business expenses incurred during an owner's disability. Covered expenses are those that are deductible for federal income tax purposes, such as replacement salaries, utilities, phone bills, and lease payments.

PDF Disability Business Overhead Expense (Boe) Insurance Worksheet To ensure your business continued to operate in that scenario, what ongoing expense obligations would you have even if your disability prevented you from contributing to the organization? Take a few minutes to do the math. A BOE disability insurance policy would reimburse you, the business owner, for these overhead expenses incurred if you ...

How to Calculate Overhead Ratio (Excel Template) - EDUCBA Then the overhead ratio can be calculated below: - Operating Income = revenue - Cost of Goods Sold - Selling, General & Administrative Expenses - Depreciation Operating Income = Rs 100000 - Rs 25000 - Rs 25000 Operating Income= Rs 50000 Operating Expenses = Salary, General & Administrative Expenses including Depreciation

Business Owners Package and Directors and Officers Insurance for CPA firms The AICPA Business Overhead Expense (BOE) Insurance Plan reimburses business owners for existing overhead expenses incurred while they are disabled, keeping the company up and running while the owner recovers. Regular expenses that could be covered under a BOE policy include employee salaries, rent, leases and utilities to name a few.

0 Response to "40 business overhead expense worksheet"

Post a Comment