42 affordable care act worksheet form

Other Resources | CMS Affordable Care Act Innovation in the Marketplace Newsletters. September 2016 (PDF) October 2016 (PDF) January 2017 (PDF) Consumer Support and Information Consumer Assistance Program Grants. Reports. June 7, 2012 Summary of First Year Consumer Assistance Program Grant Data (PDF) (PDF - 442 KB) Navigators. January 19, 2021 PDF Ichra Worksheet - HealthCare.gov coverage HRA" in this worksheet, but your employer may call it something else. Employers can't offer both a "traditional" job-based coverage and an individual coverage HRA to the same employee. If your employer is offering an individual coverage HRA, you'll get a notice. It'll explain that there are different kinds

1040-US: Affordable Care Act - Form 1095-A, 1095-B, and ... In UltraTax CS, use Screen ACA Cr-2 in the Credits folder to enter information from Form 1095-A or a similar statement. UltraTax/1040 will automatically calculate Form 8962, Premium Tax Credit (PTC). Use Screen ACA Cr to enter any additional information that may be required for Form 8962. Forms 1095-B and 1095-C are optional for 2014.

Affordable care act worksheet form

Affordable Care Act - University of Texas System The 1095-C forms show information about health insurance coverage for you and your family members during each month of the past year. Because of the Affordable Care Act, every person must obtain health insurance or pay a penalty to the IRS, and this form shows your health insurance coverage under UT SELECT. 3. PDF Affordable Care Act Notification Checklist The following health benefit documents should be provided to employees newly eligible for health benefits by the first day the employee is eligible to enroll in coverage (e.g., employee is hired on August 12, the following documents must be provided to employee no later than September 1, the earliest effective date of coverage). Viewpoint Help - Setup - Affordable Care Act Setup Getting Ready for the Affordable Care Act One of the requirements of the Affordable Care Act is that large employers file a Form 1095-C. Viewpoint recommends gathering this information throughout the course of the year, rather than waiting until the Form 1095-C due date. Key data and information required to fill out the 1095-C

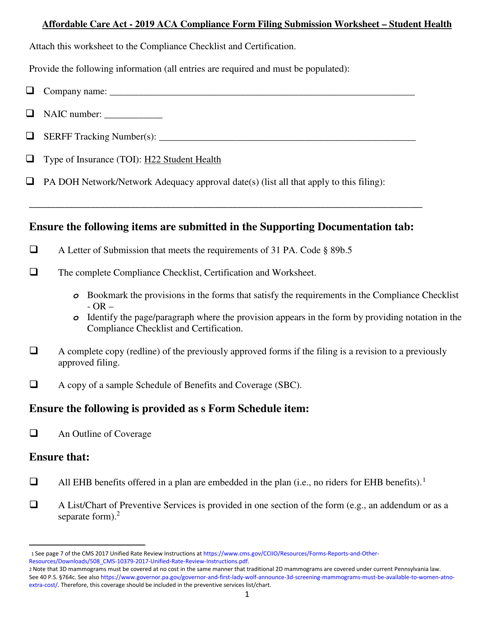

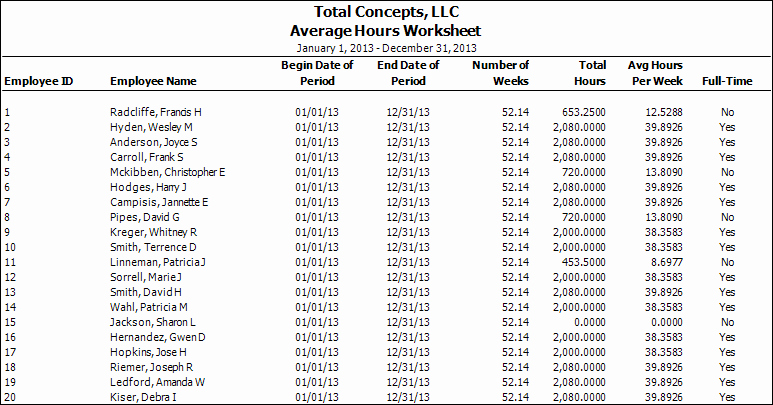

Affordable care act worksheet form. Affordable Care Act - Tax Guide • 1040.com - File Your ... Form 1095-A shows monthly coverage from the Health Insurance Marketplace and qualifies you for the Premium Tax Credit Form 1095-B shows monthly coverage from your healthcare provider Form 1095-C shows monthly coverage from some employer-provided insurance Some taxpayers may receive multiple forms, depending on when and how they were insured. PDF Affordable Care Act - 2022 ACA Compliance Form Filing ... Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet 1 Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): 1. 1040-US: Affordable Care Act - Form 1095-A, 1095-B, and ... In UltraTax CS, use Screen 1095A in the Health Care folder to enter information from Form 1095-A or a similar statement. UltraTax/1040 will automatically calculate Form 8962, Premium Tax Credit (PTC). Use Screen PTC to enter any additional information that may be required for Form 8962. Forms 1095-B and 1095-C are required for 2015. PDF Average Total Number of Employees (ATNE) Worksheet We're providing this worksheet as a tool to help you calculate your ATNE. Please seek the advice of your lawyer or accountant to confirm the accuracy of your employee census. What is ATNE? The Patient Protection and Affordable Care Act (PPACA) defines the number of employees as "the average number of employees

Modified Adjusted Gross Income (MAGI) All of the terms below are directly related to understanding how MAGI applies to the Affordable Care Act and cost assistance. ... Form 8814 and the amount on Form 8814, line 4, is more than $1,050, you must enter certain amounts from that form on Worksheet 1-2. See Form 8814 under Line 2b below. Note. If the amount on line 6 of Worksheet 1-1 ... Affordable Care Act - Oregon VITA & Taxaide Affordable Care Act. Select the appropriate year for associated forms, worksheets, instructions, and tools. Essential Tax Forms for the Affordable Care Act (ACA ... The Affordable Care Act (ACA), also referred to as Obamacare, affects how millions of Americans will prepare their taxes in the new year. The Internal Revenue Service (IRS) has introduced a number of essential tax forms to accommodate the ACA: Form 1095-A, Form 1095-B, Form 1095-C, and Form 8962. TABLE OF CONTENTS The 1095 series for information PDF Affordable Care Act Reporting - Manual - Skyward SKYWARD DOCUMENTATION - AFFORDABLE CARE ACT REPORTING MANUAL Revised: 01/11/17 Page 5 of 102 Version 05.16.10.00.09 The browse will open allowing the additional 2.00 hours to be added to the correct day. ACA Hours can also be added outside this worksheet's specified date range. This is helpful if an employee is late submitting a time sheet.

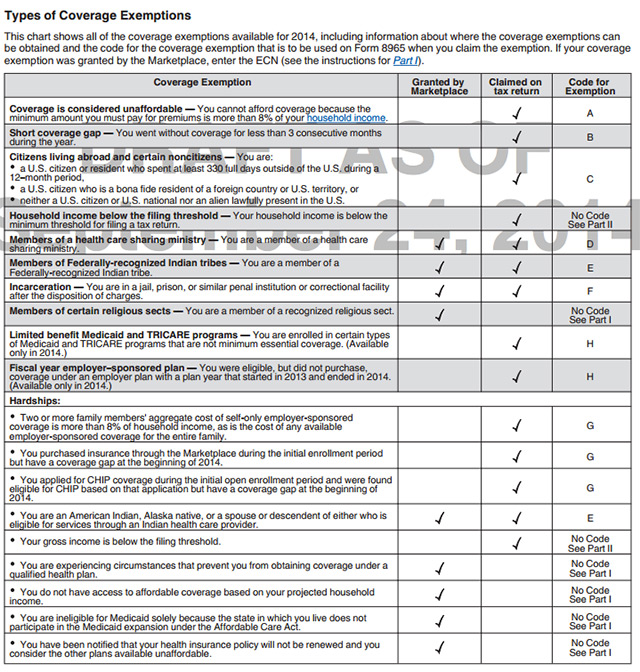

Affordable Care Act Estimator Tools - IRS tax forms To determine the payment when you file your tax return, use the Shared Responsibility Payment Worksheet (Obsolete) in the instructions for Form 8965. Employers The Employer Shared Responsibility Provision Estimator can help employers understand how the provision works and how it may apply. Affordable Care Act | Internal Revenue Service - IRS tax forms The Affordable Care Act contains comprehensive health insurance reforms and includes tax provisions that affect individuals, families, businesses, insurers, tax-exempt organizations and government entities. These tax provisions contain important changes, including how individuals and families file their taxes. PDF OR This worksheet is used to document the agency's reasonable expectations regarding the "full-time" status of a newly hired temporary employee. PLACE A COPY OF THIS COMPLETED FORM IN THE EMPLOYEE FILE 1.AGENCY NAME: 2. EMPLOYEE NAME: 2. DATE OF HIRE: 3. EXPECTED DURATION OF EMPLOYMENT: 4. PDF Types of Coverage Exemptions - IRS tax forms Affordable Care Act. See calculation on the following page. ... except in Connecticut. See the Instructions for Form 8965 to claim the exemption. ... Keep for Your Records Worksheet: Resident of a State That Didn't Expand Medicaid Exemptions (Code G) Taxpayer(s) Household Income (Click on "Summary/Print" in the Menu to see Form 1040) 1 ...

Health Care Reform - Affordable Care Act | PSU Human Resources IRS Forms for 2021 Form 1095 for the Affordable Care Act is often called the "W-2 of benefits". You will only receive this form if you are a benefit-eligible employee with the University or had University-sponsored elected coverage at any point in the 2021 calendar year. These forms are similar to your W-2 and while not required to file your 2021 tax return, they may be

Editable provisions of the affordable care act include quizlet - Fill, Print & Download Online ...

Form 8965 - Affordability Worksheet - Support Step One in completing the Affordability Worksheet is to calculate the Affordability Threshold which is 8.16% of Household Income.the tax program will automatically pull into the Household Income calculation all amounts that have been previously entered into the tax return on behalf of the taxpayer and/or spouse.

PDF Affordable Care Act Worksheet - cnccpa.com Affordable Care Act Worksheet Are you required to comply with the Act? How many employees does your Company employ: 200 or more fulltime (FT) employees. (Continue to Step 2. You are required to comply with the Act and must automatically enroll all FT employees in health insurance.)

PDF Affordable Care Act (ACA) Notification Checklist Affordable Care Act (ACA) Notification Checklist . This checklist is intended to document and ensure that departments/agencies are providing the legally required notices to employees for compliance with the ACA. PART I documents the distribution of the legally required Health Insurance Marketplace Coverage Options Notice to newly hired employees.

2019 Pennsylvania Affordable Care Act - Aca Compliance Form Filing Submission Worksheet ...

Health Insurance Care Tax Forms, Instructions & Tools ... Form 8962, Premium Tax Credit (PDF, 110 KB) Form 8962 instructions (PDF, 348 KB) Form 1095-A, Health Insurance Marketplace® Statement This form includes details about the Marketplace insurance you and household members had in 2021. You'll need it to complete Form 8962, Premium Tax Credit.

Form 8965, Health Coverage Exemptions and Instructions There is no Shared Responsibility Form. The amount is derived from the Shared Responsibility Payment Worksheet, found on form 8965 instructions, and is reported on a 1040 Schedule 4. This is the last ACA-related thing you will fill out since it requires knowing information from other forms first. The image below is a draft.

How To Calculate ACA FT and FTE - The ACA Times As part of their annual filing of healthcare coverage information with the IRS, organizations must determine if they are Applicable Large Employers (ALEs) for purposes of the Affordable Care Act (ACA) - that is, whether they have an average of 50 or more full-time (FT) or full-time-equivalent employees (FTE) over the course of a year.

PDF Affordable Care Act - IRS tax forms Affordable Care Act 3-1 Introduction This lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn how to deter-mine if taxpayers are eligible to receive the premium tax credit. A list of terms you may need to know is included at the end of the lesson.

Affordable Care Act | U.S. Department of Labor - DOL Employee Benefits Security Administration. An agency within the U.S. Department of Labor. 200 Constitution Ave NW. Washington, DC 20210. 1-866-4-USA-DOL. 1-866-487-2365. . Federal Government.

PDF Affordable Care Act: 6055 & 6056 Reporting - BASIC • Transmits coverage information to IRS using Form 1094-B • Provides information to insured individuals using Form 1095-B • Includes information on covered dependents Section 6055 of the Affordable Care Act requires health insurers (providers), self-insuring employers and other health coverage providers to provide information to the

Day Nurseries Act for Child care Supervisors - Day Nurseries Act for Child care Supervisors ...

Viewpoint Help - Setup - Affordable Care Act Setup Getting Ready for the Affordable Care Act One of the requirements of the Affordable Care Act is that large employers file a Form 1095-C. Viewpoint recommends gathering this information throughout the course of the year, rather than waiting until the Form 1095-C due date. Key data and information required to fill out the 1095-C

PDF Affordable Care Act Notification Checklist The following health benefit documents should be provided to employees newly eligible for health benefits by the first day the employee is eligible to enroll in coverage (e.g., employee is hired on August 12, the following documents must be provided to employee no later than September 1, the earliest effective date of coverage).

Affordable Care Act - University of Texas System The 1095-C forms show information about health insurance coverage for you and your family members during each month of the past year. Because of the Affordable Care Act, every person must obtain health insurance or pay a penalty to the IRS, and this form shows your health insurance coverage under UT SELECT. 3.

0 Response to "42 affordable care act worksheet form"

Post a Comment