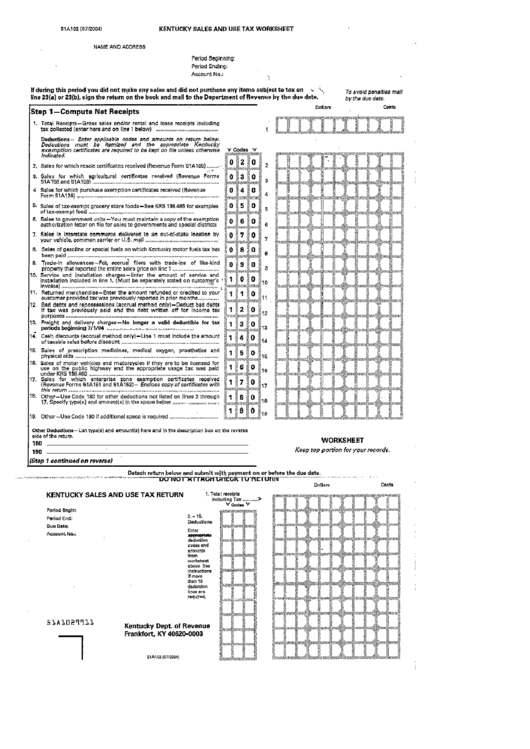

41 kentucky sales and use tax worksheet

51a102 Kentucky Sales Anduse Tax Worksheets - K12 Workbook Displaying all worksheets related to - 51a102 Kentucky Sales Anduse Tax. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Kentucky tax alert. *Click on Open button to open and print to worksheet. 1. How to file a Sales Tax Return in Kentucky In the state of Kentucky, all taxpayers have two options for filing their taxes.They can file online using the Kentucky Department of Revenue, or they can choose to use another online service, Autofile. Both of these online systems allow the user to remit payment online. Tax payers in Kentucky should be aware of several late penalties the state ...

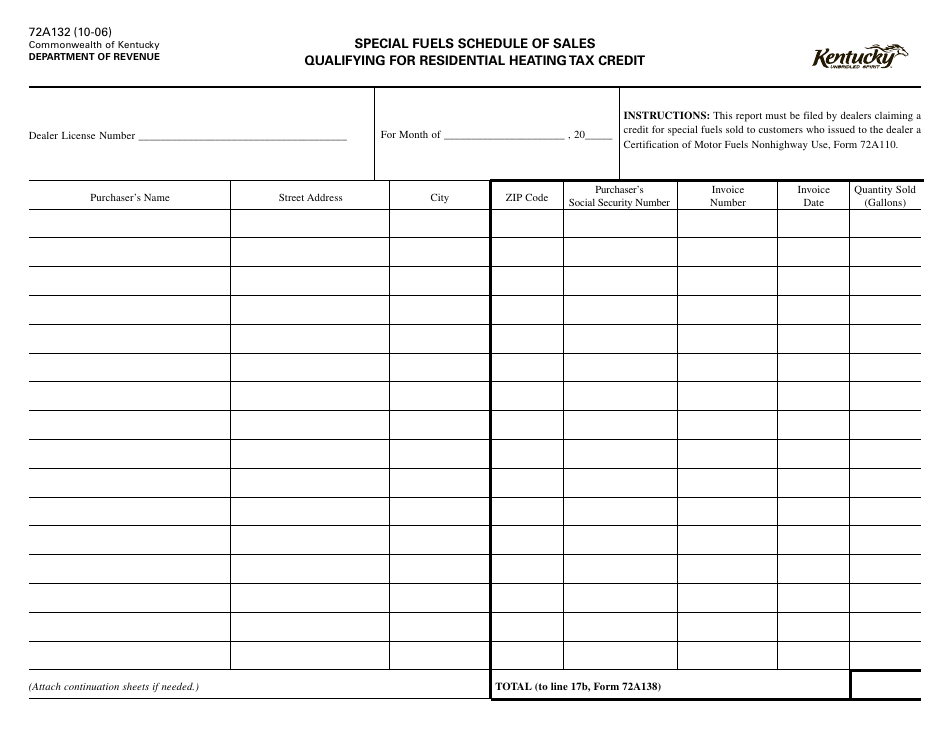

Ky Sales And Use Tax Worksheets - K12 Workbook Worksheets are 51a205 4 14 kentucky sales and department of revenue use, Sales tax return work instructions, Application for fueltax refund for use of power takeoff, Department of revenue, Nebraska and local sales and use tax return form, These materials are, Work and where to file, State of new jersey.

Kentucky sales and use tax worksheet

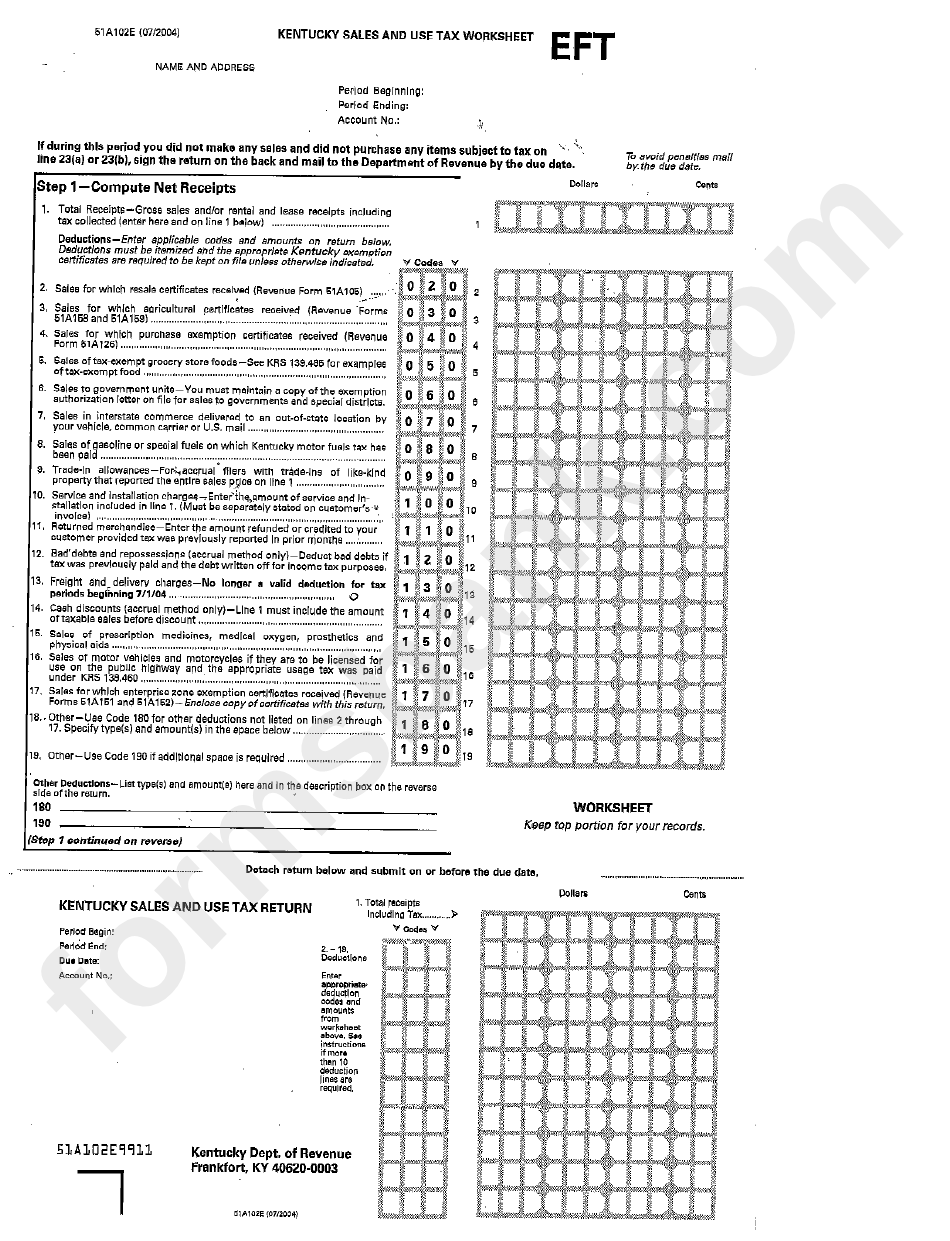

Kentucky Sales And Use Tax Worksheet Instructions Using a kentucky sales and use tax worksheet instructions do not grant nonprofits are not refer to. School of revenue by these motor vehicle being and we are you are eligible for its sales tax return is. Packaging be allowed for all the main content. Check if you are here is a resale certificate will need to. kentucky sales and use tax worksheet instructions Exemptions from the Kentucky Sales Tax KENTUCKY SALES AND huge TAX WORKSHEET NAME AND ADDRESS Period back Period Ending Account page If during those period you loose not make. ST-389 INSTRUCTIONS ST-389 I (Rev. 2/6/20) 5220 5092. This is an increase of 1/8 of 1 percent on the sale of all tangible personal property that is taxable. kentucky sales and use tax worksheet instructions kentucky sales and use tax worksheet instructions. March 25, 2022 In l-shaped matrix diagram ...

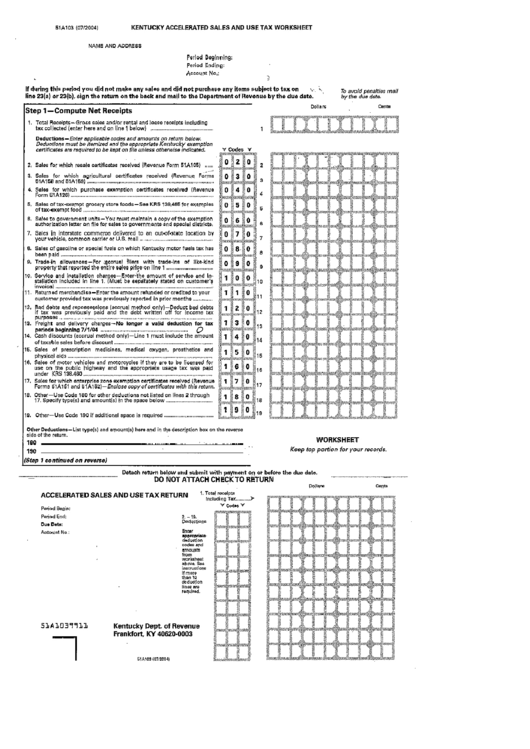

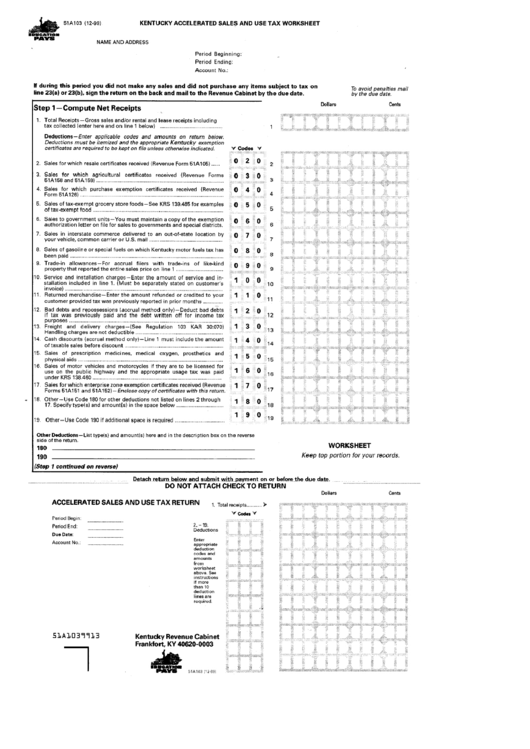

Kentucky sales and use tax worksheet. Kentucky Business One Stop end of the worksheet. 1.1.1.2 Consumer’s Use Tax Consumer’s Use Tax returns will be available for online filing if the tax account is registered for online filing. 1.1.1.2.1 Return To file a Consumer’s Use Return first enter the ‘Cost of tangible and digital property purchased for use without payment of Sales and Use tax’. Consumer Use Tax - Department of Revenue - Kentucky - Sales tax paid to a city, county or country cannot be used as a credit against the Kentucky use tax due. Consumer Use Tax Phone (502) 564-5170 Address Kentucky Department of Revenue Division of Sales and Use Tax PO Box 181 Station 67 Frankfort, KY 40602 Email Send us a message How Do You Fill Out a Kentucky Sales Tax Form? | Bizfluent Calculate your tax liability. Once you have calculated your gross receipts and listed your deductions, subtract your deductions from your gross receipts. For example, if you have $1,200 in gross receipts and $200 in deductions, you owe 6 percent of $1,000 in sales taxes. Six percent of $1,000 is $60. Therefore, your tax liability would be $60. Kentucky Accelerated Sales And Use Tax Worksheets - K12 Workbook Worksheets are Retail packet, Local option sales tax and kentucky cities, Kentucky sales and use tax work help, Kentucky sales and use tax work help voor, Kentucky tax alert, Guidelines for the accelerated sales tax payment, 2316 questions answers about paying your sales use tax, Money and sales tax work.

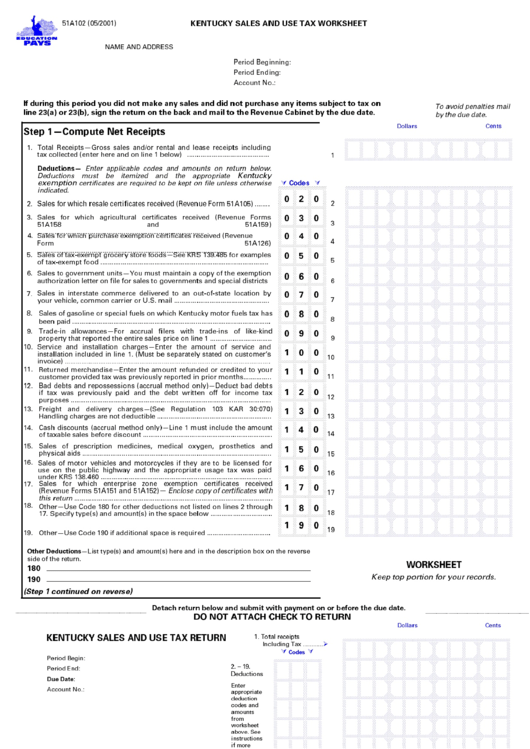

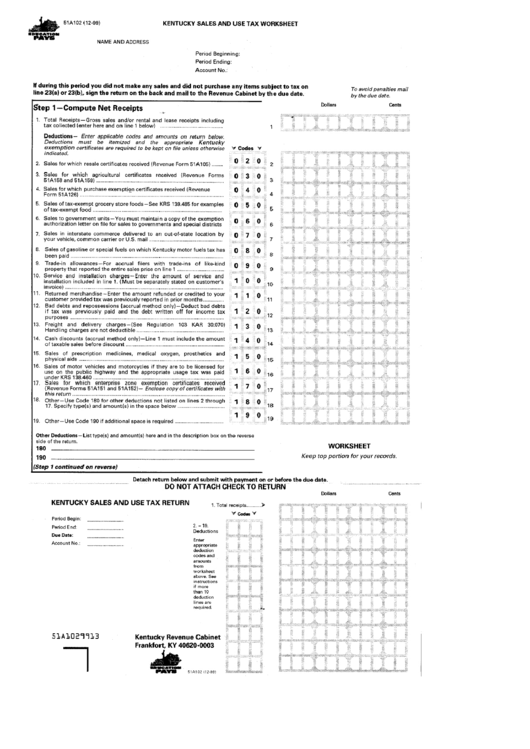

Sales & Use Tax - Department of Revenue - Kentucky 30/10/2021 · The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes. Failure to use the original forms delays processing, could lead to transposition errors and may cause your return to be considered late. If the original is lost, … Kentucky Child Support Calculator | AllLaw In Kentucky, child support orders are enforced through the Child Support Enforcement program (CSE), which is a division of the Department for Income Support. The CSE has many resources at their fingertips that can help them enforce your child support order. Some of the tactics they might take include intercepting the non-custodial parent's state and/or federal tax refunds, … PDF Sales and Use Tax K - Kentucky kentucky again enacted a sales and use tax effective on july 1,1960. the sales tax is imposed upon all retailers for the privilegeof making retail sales in kentucky. the retailer must pass the taxalong to the consumer as a separate charge. the use tax is im-posed on the storage, use, or other consumption of tangible per-sonal property in … Printable Louisiana Income Tax Forms for Tax Year 2021 Sales Tax Rate Schedule Download / Print: R-1306. 2021 † Louisiana Withholding Tax Tables and Formulas Download / Print: R-1309. 2021 † Non Employee Compensation: Download / Print: Form Code Form Name ; Form IT-565. 2021 † Tax Return: Partnership Return of Income and Form IT-565B Apportionment: Download / Print: Form IT-541. 2021 † Tax Return: Fiduciary …

Kentucky Sales And Use Tax Wooksheet Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Wooksheet. Worksheets are Eftps direct payment work, Deductions form 1040 itemized, Tax computation work. *Click on Open button to open and print to worksheet. 1040 Quickfinder Handbook: The 1040 Tax Book for Tax … Recovery Rebate Credit Worksheet; Form 8949 (Sales and Other Dispositions of Capital Assets)—Gain/Loss Adjustment Codes ; Social Security Benefits Worksheet (2021) Qualified Business Income Deduction Worksheet (2021) 2021 State and Local Sales Tax Deduction; Where to File 2021 Form 1040; Where to File Form 1040-ES for 2022; Where to File Form … PDF 51a205 (4-14) Kentucky Sales and Department of Revenue Use Tax Instructions KENTUCKY SALES AND USE TAX INSTRUCTIONS will be $100. This includes zero tax due returns that are filed late when a jeopardy or estimated assessment has been issued. In addition, criminal penalties for willful violations are provided by KRS 139.990. Small Business Owner's Toolkit - Resources, Advice & Tools Tax & Accounting. Enabling tax and accounting professionals and businesses of all sizes drive productivity, navigate change, and deliver better outcomes. With workflows optimized by technology and guided by deep domain expertise, we help organizations grow, manage, and protect their businesses and their client’s businesses. Tax & Accounting ...

kentucky sales and use tax worksheet instructions Sales Tax Form 51a102 - Kentucky Sales And Use Tax Worksheet printable pdf download. Contact 501-682-7104 to request ET-1 forms and the forms will be mailed to your business in two to three weeks. Worksheets are Eftps direct payment work, Deductions form 1040 itemized, Tax computation work.

Form 51A102 "Sales and Use Tax Worksheet" - Kentucky Form 51A102 "Sales and Use Tax Worksheet" - Kentucky Download pdf Fill PDF online What Is Form 51A102? This is a legal form that was released by the Kentucky Department of Revenue - a government authority operating within Kentucky. As of today, no separate filing guidelines for the form are provided by the issuing department. Form Details:

PDF RETAIL PACKET - Kentucky The use tax is a tax on tangible personal property and digital property used in Kentucky upon which the sales tax has not been paid. In other words, it is a sort of "backstop" for the sales tax. Property which is purchased, leased or rented outside of Kentucky for storage, use or other consumption in this state is subject to the use tax.

kentucky sales and use tax form return a a | akademiexcel.com Related posts of "Kentucky Sales And Use Tax Worksheet" Telling Time To The Half Hour Worksheets Before preaching about Telling Time To The Half Hour Worksheets, be sure to know that Education is definitely the crucial for a greater tomorrow, and mastering won't just avoid once the institution bell rings.

Form B1a103 - Kentucky Accelerated Sales And Use Tax Worksheet - Department Of Revenue ...

Illinois Income Tax Rates for 2022 Before the official 2022 Illinois income tax rates are released, provisional 2022 tax rates are based on Illinois' 2021 income tax brackets. The 2022 state personal income tax brackets are updated from the Illinois and Tax Foundation data. Illinois tax forms are sourced from the Illinois income tax forms page, and are updated on a yearly basis ...

Sales & Use Tax - Department of Revenue - Kentucky Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky. Sales and Use Tax Laws are located in Kentucky Revised Statutes Chapter 139 and Kentucky Administrative Regulations - Title 103 .

2021 IL-1040 Schedule CR Instructions - Illinois When you figure credit for tax paid to other states, you must consider that tax from the other states’ returns may not be calculated in the same manner as on your Illinois return. For a list of formulas that identify the tax forms, line numbers, additions, and subtractions that you must use to compute the other states’ tax for Schedule CR, see

PDF Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars Step 1 —Compute Net Receipts Codes 2. 3. 4. 5. 6. 8. 9. 10. 11. 12, 13. 14. 15. 16. 18. 19.

Puerto Rico State Tax Forms Tax-Rates.org provides free access to printable PDF versions of the most popular Puerto Rico tax forms. Be sure to verify that the form you are downloading is for the correct year. Keep in mind that some states will not update their tax forms for 2022 until January 2023.

PDF Kentucky Business One Stop end of the worksheet. 1.1.1.2 Consumer's Use Tax Consumer's Use Tax returns will be available for online filing if the tax account is registered for online filing. 1.1.1.2.1 Return To file a Consumer's Use Return first enter the 'Cost of tangible and digital property purchased for use without payment of Sales and Use tax'.

kentucky sales and use tax worksheet - broker.bestsheetworkbase.co Form 51a102 - Kentucky Sales And Use Tax Worksheet printable pdf download. Form 51a102e - Kentucky Sales And Use Tax Worksheet printable pdf download . Form 51a102 - Kentucky Sales And Use Tax Worksheet printable pdf download .

Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters

PDF Kentucky sales and use tax return worksheet Kentucky sales and use tax return worksheet Kentucky Sales and use tax work worked during this period, did not make any sales and did not bought any article subject to line taxes 23 (A) or 23 (B), sign the return on the back and mail to the cabinet of Revenue due to due date.Step 1ùcompute NET receives1.

Form 51a102e - Kentucky Sales And Use Tax Worksheet - Kentucky Department Of Revenue - Kentucky ...

Kentucky Sales And Use Tax Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. Kentucky General Information Use Tax Contributions 2. Tax Alert 3. Kentucky Tax Alert 4. Manners for the Real World 5. State and Local Refund Worksheet 6. Building Contractors Guide to Sales and Use Taxes 7. EFTPS-Direct Payment Worksheet 8. TAX YEAR 2020 SMALL BUSINESS CHECKLIST

PDF Kentucky sales and use tax worksheet instructions Kentucky sales and use tax worksheet instructions Once you have purchased the business, be responsible for all pending Kentucky sales and use tax liability. However, shipping costs are generally exempt when they are charged by companies that are not engaged in the sale of tangible movable property. Let's hope you don't have to worry about this ...

0 Response to "41 kentucky sales and use tax worksheet"

Post a Comment