39 1040 qualified dividends worksheet

Clarification of Worksheet Line References in the 2020 ... Under " Using the Qualified Dividends and Capital Gain Tax Worksheet for line 15 tax ," number 6 should read, "Complete lines 5 through 25 following the worksheet instructions. Use the child's filing status to complete lines 6, 13, 22, and 24 of the worksheet for Form 1040." The correct line is line 22, not line 23. Fill - Free fillable 2020 QUALIFIED DIVIDENDS and CAPITAL ... Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable.

PDF Note: The draft you are looking for begins on the next ... 22 Do you have qualified dividends on Form 1040, 1040-SR, or 1040-NR, line 3a? Yes. Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR, line 16. No. Complete the rest of Form 1040, 1040-SR, or 1040-NR. Schedule D (Form 1040) 2021

1040 qualified dividends worksheet

1040 (2021) | Internal Revenue Service - IRS tax forms Qualified Dividends. Enter your total qualified dividends on line 3a. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Qualified dividends are eligible for a lower tax rate than other ordinary income. Generally, these dividends are shown in box 1b of Form(s) 1099-DIV. PDF Qualified Dividends and Capital Gain Tax Worksheet -Line ... See the instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040. Enter the amount from Form 1040, line 43 (Form ... 2021 Instructions for Schedule D (2021) | Internal Revenue ... 28% Rate Gain Worksheet—Line 18 Line 19 Instructions for the Unrecaptured Section 1250 Gain Worksheet Lines 1 through 3. Line 4. Step 1. Step 2. Step 3. Unrecaptured Section 1250 Gain Worksheet—Line 19 Line 10. Line 12. Installment sales. Other sales or dispositions of section 1250 property. Line 21 Schedule D Tax Worksheet

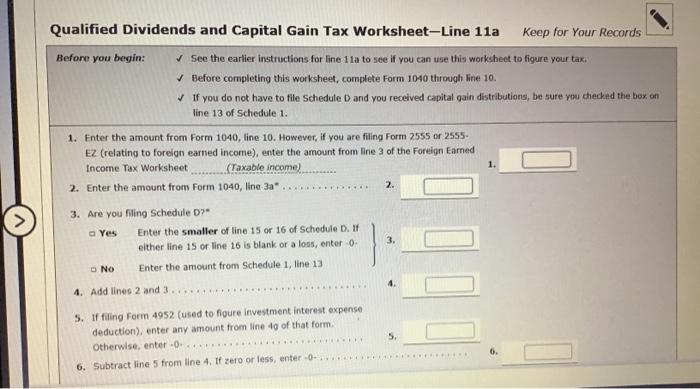

1040 qualified dividends worksheet. Qualified Dividends and Capital Gains Worksheet.pdf ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. Qualified Dividends and Capital Gain Tax Worksheet Form ... Qualified Dividends and Capital Gains Worksheet 2021. Get a fillable 2021 Qualified Dividends and Capital Gains Worksheet template online. Complete and sign it in seconds from your desktop or mobile device, anytime and anywhere. What is a Qualified Dividend Worksheet? - Money Inc IRS introduced the qualified dividend and capital gain tax worksheet as an alternative to Schedule D and added the qualified dividends and new rates to the capital gains worksheet in 2003. The Forms 1040 and 1040A, therefore, help investors to take advantage of lower capital gains rates without having to fill out the Schedule D.

Qualified Dividends And Capital Gain Tax Worksheet Line 12A It Takes 27 Lines In The Irs Qualified Dividends And Capital Gain Tax Worksheet To Work Through The Computations (Form 1040. Qualified dividends and capital gain tax worksheet line 12a. This document is locked as it has been sent for signing. Once completed you can sign your fillable form or send for signing. Complete Lines 21 And 22 Below. PDF Qualified Dividends and Capital Gain Tax Worksheet: An ... for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use … Calculation of tax on Form 1040, line 16 - Thomson Reuters You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a. Qualified dividends, on 1040 Schedule D, worksheet, does ... This worksheet directly compute Qualified Dividends, into lower Tax rate. In 2018, they eliminated the Worksheet below. 2018 Schedule D Tax Worksheet, asks for data, but eliminated link to lower Tax rate for Qualified Divdidends.I have suspicion, how they are handling this issue of Qualified Dividends built into 2018 Schedule D worksheet.

Fill - Free fillable Form 1040 Qualified Dividends and ... Use Fill to complete blank online IRS pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018. The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: Qualified Dividends and Capital Gains Worksheet - t6988 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. Form 1040 line 10 different from line 10 qualified ... Form 1040 line 10 different from line 10 qualified dividend and capital gain worksheet. No it doesn't work that way. 1040 line 10 is always the taxable income. But the tax on it is figured different ways. Even though the full amount shows up as income on the 1040 as income, if you have capital gains or qualified dividends the tax on line 11 is ... Qualified Dividends And Capital Gain Tax Worksheet ... If the tax was calculated on either of these worksheets, you should see "Tax computed on Qualified Dividend Capital Gain WS" as one of the items listed. Go to … Read more 2021 Instruction 1040 … Use the Qualified Dividends and Capital Gain Tax Work- sheet or the Schedule D Tax.

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15.

Qualified Dividends and Capital Gains Worksheet - Page 33 ... Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b.

Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

Qualified Dividends And Capital Gain Tax Worksheet ... The qualified dividends worksheet is found on the back of page 2 in the 1040 instructions booklet just above the schedule 1 form 1040 line 9b amount worksheet. Source: Capital gains tax rates are commonly used to compute qualified dividend taxes.

0 Response to "39 1040 qualified dividends worksheet"

Post a Comment