38 1120s other deductions worksheet

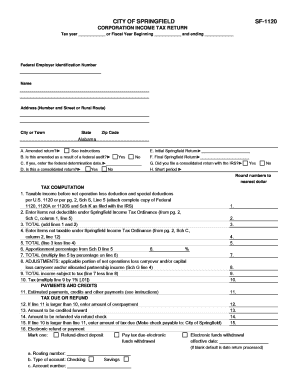

How to File S Corp Taxes & Maximize Deductions | White ... If you are filing as a C Corporation, file form 1120. The 1120S is only for S Corps. This tax form is due to be postmarked by March 15th, but you can file an extension on Form 7004. It's literally one page, 8 lines, and will take about 30 seconds. You see, with an S Corp being a pass-through entity, you pretty much put $0 on every line. 1120 Other Deductions Schedule - Find The Business ... Offer helpful instructions and related details about 1120 Other Deductions Schedule - make it easier for users to find business information than ever. Top Companies. Top Sherwin Williams Neutral Colors Owen Hart Autopsy Christopher Mohler ...

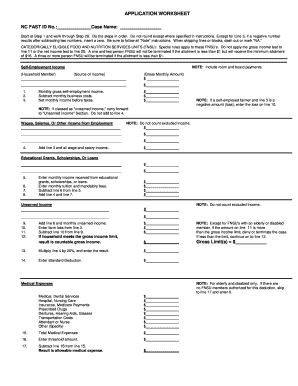

1120 Line 26 Other Deductions Worksheets - Learny Kids Some of the worksheets for this concept are 2019 form 1120, 2020 form 1120 w work, Schedule o 720 17030300 other additions and, Fannie mae cash flow analysis calculator, 2018 ia 1120f general instructions who must file federal, 2018 nonconformity adjustments work, Schedule analysis method sam calculator, Qualified business income deduction.

1120s other deductions worksheet

Irs Form 1120 Other Deductions Statement - Find The ... Some of the worksheets for this concept are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 ... More Info At kiddymath.com ›› PDF Instructions and Worksheets to Schedule K-1 - Aronson LLC Worksheet Instructions for Figuring a Shareholder's Stock and Debt Basis Don't use this worksheet if you have made an election under Regulations section 1.1367-1(g). Part I. Shareholder Stock Basis This worksheet addresses adjustments to stock basis as provided under section 1367. Other code sections might also cause Form 1120 Other Deductions Worksheet - Fill Out and Sign ... Use this step-by-step guide to fill out the Form 1120 other deductions worksheet swiftly and with idEval precision. How to complete the 1120 fillable form online: To start the form, utilize the Fill camp; Sign Online button or tick the preview image of the blank. The advanced tools of the editor will lead you through the editable PDF template.

1120s other deductions worksheet. Schedule K-1 (Form 1120-S) - Health Deduction Worksheet Schedule K-1 (Form 1120-S) - Health Deduction Worksheet. Health Insurance Premiums for a more-than-2% shareholder of a S-Corporation are reported in Box 14 of the individual's Form W-2 Wage and Tax Statement. If you need the amount reported in Box 14 of your W-2 to transfer to Line 16 of Schedule 1 (Form 1040) Additional Income and Adjustments ... Knowledge Base Solution - How do I change Other ... Go to the Income/Deductions > Business worksheet. In Section 7 - Other Depreciation and Amortization. Select Export.; A dialog box will appear. Choose option to "Export this grid to a Spreadsheet with all Data Entered."; A dialog box will appear to Save As. The name of the return and "Depreciation and Amortization (Form 4562)" will appear as the file name. 1120s Other Deductions - Printable Worksheets Some of the worksheets displayed are 2020 instructions for form 1120 s, Forms required attachments, Us 1120s line 19, Arthur dimarsky 32 eric ln staten island ny 10308 646 637, Corporation tax organizer form 1120, Self employment income work s corporation schedule, Instructions and work to schedule k 1, 2018 net profit booklet 11 18. Instructions for Form 1120-S (2021) | Internal Revenue Service If the income, deductions, credits, or other information provided to any shareholder on Schedule K-1 or K-3 is incorrect, file an amended Schedule K-1 or K-3 (Form 1120-S) for that shareholder with the amended Form 1120-S. Also give a copy of the amended Schedule K-1 or K-3 to that shareholder.

1120 Other Deductions Form - 1120 other deductions ... 1120s other deductions worksheet promotiontablecovers. 1120 Other Deductions Form. Here are a number of highest rated 1120 Other Deductions Form pictures upon internet. We identified it from well-behaved source. Its submitted by giving out in the best field. We put up with this nice of 1120 Other Deductions Form graphic could possibly be the ... Why does Form 1120 show a statement for deductions on Line 26? To generate a statement for line 26: Enter deduction type and amounts in the Other (Ctrl+E) field in Screen 20.1, Deductions. The deductions will be listed on the statement Form 1120, Line 26 Other Deductions. 2018 1120s Other Deductions Worksheets - Kiddy Math some of the worksheets for this concept are 2018 form 1120s, 6717 form 1120s 2018 part i shareholders share of, instructions and work to schedule k 1, 1120s income tax return for an s corporation omb no, 2018 il 1120 instructions, basis reporting required for 2018 draft form schedule e, 2018 net profit booklet 11 18, qualified business income … 1120-US: Calculating the Other deductions lines on the S ... The Other deductions line on Page 2 of the Tax Return History Report is the sum of the following amounts on the Form 1120S, Schedule K. Investment interest expense, line 12b. Section 59 (e) (2) expenditures, line 12c. Other deductions, line 12d. Note: The domestic production activity amounts included on Schedule K, line 12d are also included in ...

Schedule K-1 (Form 1120-S) - Health Deduction Worksheet Schedule K-1 (Form 1120-S) - Health Deduction Worksheet. Health Insurance Premiums for a more than 2% shareholder of a S-Corporation are reported in Box 14 of the individual's Form W-2 Wage and Tax Statement. To get the amount reported in Box 14 to transfer to Line 16 of the individual's Schedule 1 (Form 1040) Additional Income and Adjustments ... 1120 Tax Form: The Different Variations And How To File ... The deductions and tax credits you can enter on Form 1120 are as follows: Line 12. Enter the compensation your officers receive. Line 13. Enter salaries and wages paid to employees. Line 14. Enter repair and maintenance costs, including supplies and labor. Line 15. Enter the total amount of bad debt. 1120s Line 19 Other Deductions 2019 - Printable Worksheets Showing top 8 worksheets in the category - 1120s Line 19 Other Deductions 2019. Some of the worksheets displayed are 1120 s income tax return for an s corporation, 2019 instructions for form 1120 s, Income tax return for an s corporation omb 1545, 2019 ia 1120s income tax return for s corporations, Self employment income work s corporation schedule, 1120s income tax return for an s corporation ... Other Deductions Supporting Details For Form 1120 ... Some of the worksheets for this concept are Us 1120s line 19, Corporate 1120, 1120s income tax return for an s corporation omb no, 2019 form 1120 w work, Instructions for filing 2010 federal form 1065 sample return, Instructions for form 1120s, 6717 form 1120s 2018 part i shareholders share of, California tax forms guide.

Schedule K-1 (Form 1120S) - Deductions - Support By making a separate entry on Line 1 of the K-1 1120-S Edit Screen, it will allow the item to carry to Worksheet 3 of Form 8582 and if the deduction is allowed under the passive loss requirements, it will be reported as a separate line item on Schedule E (Form 1040), line 28, column (f).

U.S. Income Tax Return for an S Corporation - IRS Video Portal attaching Form 2553 to elect to be an S corporation. ... Other deductions (attach statement) . ... b Tax from Schedule D (Form 1120S) .4 pages

PDF US 1120S Line 19 - Other Deductions 2008 Copyright form software only, 2008 Universal Tax Systems, Inc. All rights reserved. USWSA$$1 Accounting Uniforms Tools Temporary help Telephone Supplies

Forms and Instructions (PDF) - IRS tax forms Instructions for Form 1120-S, U.S. Income Tax Return for an S Corporation. Instructions for Schedule K-2 (Form 1120-S) and Schedule K-3 (Form 1120-S) Instructions for Schedule D (Form 1120S), Capital Gains and Losses and Built-In Gains. Instructions for Schedule K-1 (Form 1120-S), Shareholder's Share of Income, Deductions, Credits, etc.

1120s Other Deductions 2020 Worksheets - Kiddy Math some of the worksheets for this concept are 2020 instructions for form 1120 s, corporation tax organizer form 1120, 2020 ia 1120s income tax return for s corporations, 20 purpose of schedule k 1 general instructions, engagement letter for 2020 s, schedule a itemized deductions, fannie mae cash flow analysis calculator, tax work for self employed …

1120s Income Deductions Worksheets - K12 Workbook Displaying all worksheets related to - 1120s Income Deductions. Worksheets are 2018 form 1120s, 6717 form 1120s 2018 part i shareholders share of, Instructions and work to schedule k 1, Instructions for form 1120s, 2016 100s schedule k 1 shareholders instructions for, Us 1120s line 19, Wisconsin department of health services division of, Llc s corp small business work.

Knowledge Base Solution - How do I expense Organizational ... Go to the Income/Deduction > Business worksheet. In section 10 - Other Deductions (1120S) or section 11 - Other Deductions (1120). Line 4 - Other Deductions input Organizational Costs with description "Organizational Costs Expensed Under IRC Sec. 248 (a)" and total amount to be expensed. Step 2: Go to the Income/Deduction > Business worksheet.

Shareholder's Instructions for Schedule K-1 (Form 1120-S) For more information on the treatment of S corporation income, deductions, credits, and other items, see Pub. 535, Business Expenses; Pub. 550,. Investment ...18 pages

solution13.pdf - Drake Support Other income (loss) (see instructions - attach statement). Total income (loss). ... Other deductions (attach statement) ... Tax from Schedule D (Form 1120S).23 pages

Editable form 1120s line 19 other deductions statement - Fill, Print & Download Law Forms in ...

1120-US: Calculating the Other deductions lines on the S ... Repairs and maintenance, line 9. Rents, line 11. Advertising, line 16. Other deductions, line 19. The Other deductions line on Page 2 of the Tax Return History Report is the sum of the following amounts on the Form 1120S, Schedule K. Investment interest expense, line 12b. Section 59 (e) (2) expenditures, line 12c. Other deductions, line 12d.

form 1120 line 26 other deductions worksheet - Fill Online ... PDF editor permits you to help make changes to your Form 1120-A from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently. Video instructions and help with filling out and completing Form 1120 line 26 other deductions worksheet

Forms and Instructions (PDF) - IRS tax forms Instructions for Schedule H (Form 1120-F), Deductions Allocated To Effectively Connected Income Under Regulations Section 1.861-8 2021 12/20/2021 Form 1120-F (Schedule I) Interest Expense Allocation Under Regulations Section 1.882-5 2021 12/16/2021 Inst 1120-F (Schedule I) ...

0 Response to "38 1120s other deductions worksheet"

Post a Comment