45 qualified dividends and capital gain tax worksheet calculator

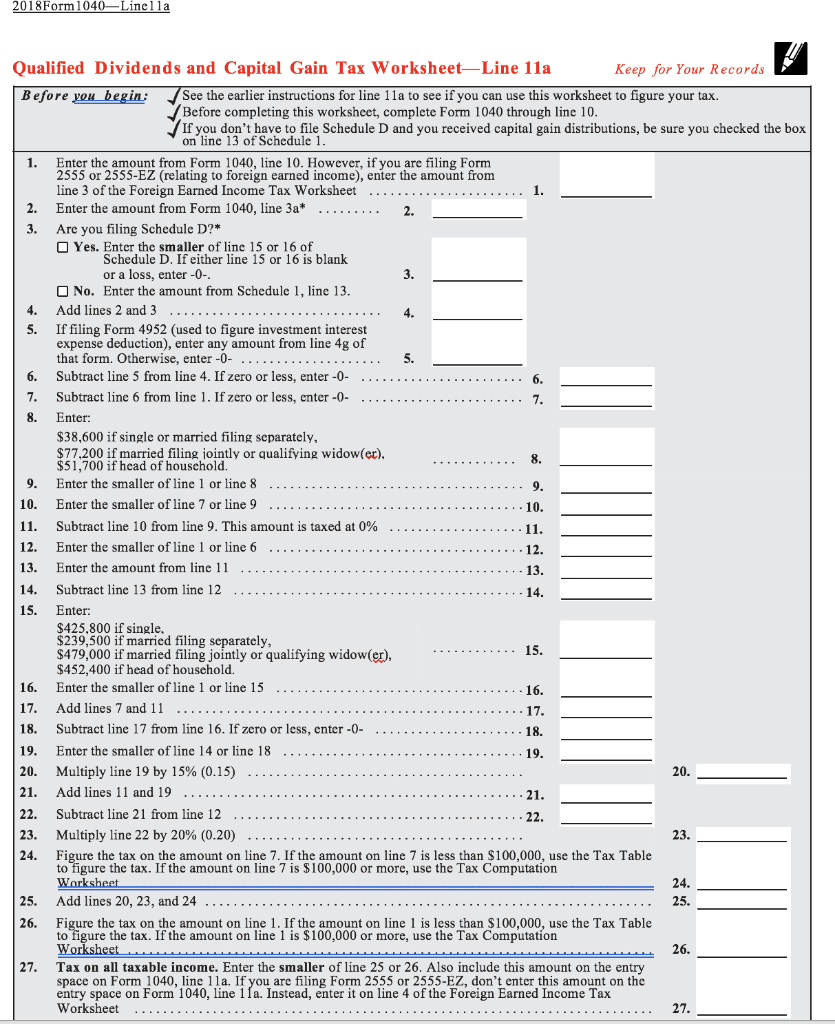

EOF Qualified Dividends and Capital Gain Tax Worksheet ... Question: Qualified Dividends and Capital Gain Tax Worksheet. How do you calculate the taxes? The total amount of income from line 7 of the 1040 is $173,182 24. Figure the tax on the amount on line 7. If the amount on line 7 is less than $100,000, use the Tax Table to figure the tax. If the amount on line 7 This question hasn't been solved yet

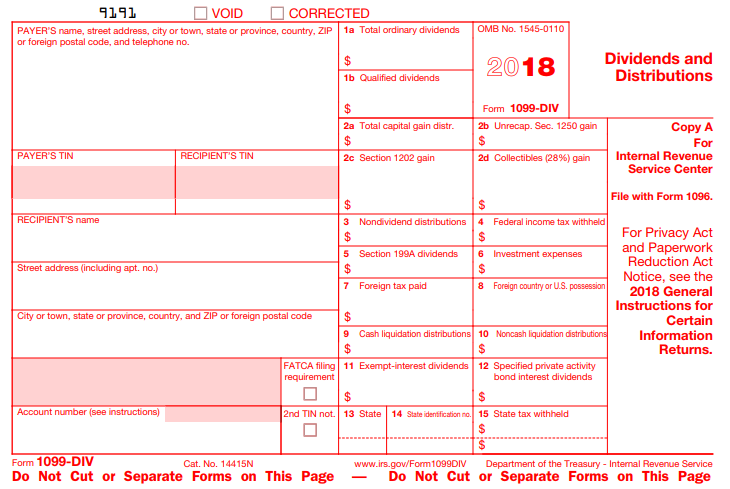

How to Figure the Qualified Dividends on a Tax Return ... Locate ordinary dividends in Box 1a, qualified dividends in Box 1b and total capital gain distributions in Box 2a. Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the...

Qualified dividends and capital gain tax worksheet calculator

irs tax computation worksheet 2021 irs tax computation ... irs tax computation worksheet 2021 irs tax computation worksheet 2021. irs tax computation worksheet 2021 26 Apr. irs tax computation worksheet 2021. Posted at 05:16h in ikea storage bench bedroom by is working in a library boring. nfl playoff wins since 2010 Likes ... Solved: Qualified dividends and capital gain tax worksheet ... The total tax should be $152,629 but the worksheet yields a result of $162,629. The $10,000 difference is directly the result of the $200,000 that was subtracted in line 18 being taxed at 20% versus 15%. While this is a hypothetical example, I have a real example on a return I am preparing with a similar result. TurboTax Premier Windows 1 4 9,395 Calculation of the Qualified Dividend Adjustment on Form ... The total foreign-sourced qualified dividends must be divided by the total capital gains from line 4 to arrive at the pro rata percentage. This percentage is then multiplied by the amount of capital gains taxed at 15% (line 14 of the QD&CTG worksheet) to determine the amount attributable to foreign sources.

Qualified dividends and capital gain tax worksheet calculator. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13. Your Dividend Tax Rates! 3 EXAMPLES! (Calculate Tax On ... Dividend tax rates can be tricky to calculate which is why we are presenting three examples using REAL tax forms to help you. Calculating tax on your qualif... How Your Tax Is Calculated: Qualified Dividends and ... Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. PDF Capital Gain Tax Worksheet (PDF) - IRS tax forms Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments Estimated Income Tax Spreadsheet - Mike Sandrik Now enter the amount of qualified dividends. These will get taxed at preferential long term capital gains rates. Enter the amount of net long term capital gains (net means long term capital gains minus long and short term capital losses, if any). This is a hard one to predict and I leave this one blank until I actually make a sale. 2021 Instructions for Schedule D (2021) - IRS tax forms Use Form 8997 to report each QOF investment you held at the beginning and end of the tax year and the deferred gains associated with each investment. Also, use Form 8997 to report any capital gains you are deferring by investing in a QOF during the tax year and any QOF investment you disposed of during the tax year. Capital Asset Qualified Dividends and Capital Gain Tax - TaxAct To review the Tax Summary in the TaxAct program, click the three-dot menu to the right of the Federal Refund or Federal Owed heading at the top of the screen. The summary will include the text Tax computed on Qualified Dividend Capital Gain WS if the tax was calculated on either of these worksheets.

qualified dividends and capital gain tax worksheet 2017 pdf qualified dividends and capital gain tax worksheet 2017 pdf qualified dividends and capital gain tax worksheet 2017 pdf. qualified dividends and capital gain tax worksheet 2017 pdf. April 25, 2022 / Posted by / 1 / 0 ... How Your Tax Is Calculated: Understanding the Qualified ... In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. Tax Calculator - Estimate Your Income Tax for 2022 - Free! Tax Calculator Tax Brackets Capital Gains Social Security Tax Changes for 2013 - 2022 High incomes will pay an extra 3.8% Net Investment Income Tax as part of the new healthcare law , and be subject to limited deductions and phased-out exemptions (not shown here), in addition to paying a new 39.6% tax rate and 20% capital gains rate . How Your Tax Is Calculated: Tax Table and Tax Computation ... This second worksheet is used twice in the Qualified Dividends and Capital Gain Tax Worksheet to help taxpayers calculate the amount of income tax owed. While we often talk about tax rates with phrases like "I am in the 22% bracket," in reality having income which puts you in the 22% bracket does not mean that you owe 22% of your income in taxes.

PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15.

Capital gains Tax Worksheet 2021 | qualified dividends and capital gain tax worksheet—line

Calculation of the Qualified Dividend Adjustment on Form ... The total foreign-sourced qualified dividends must be divided by the total capital gains from line 4 to arrive at the pro rata percentage. This percentage is then multiplied by the amount of capital gains taxed at 15% (line 14 of the QD&CTG worksheet) to determine the amount attributable to foreign sources.

Solved: Qualified dividends and capital gain tax worksheet ... The total tax should be $152,629 but the worksheet yields a result of $162,629. The $10,000 difference is directly the result of the $200,000 that was subtracted in line 18 being taxed at 20% versus 15%. While this is a hypothetical example, I have a real example on a return I am preparing with a similar result. TurboTax Premier Windows 1 4 9,395

irs tax computation worksheet 2021 irs tax computation ... irs tax computation worksheet 2021 irs tax computation worksheet 2021. irs tax computation worksheet 2021 26 Apr. irs tax computation worksheet 2021. Posted at 05:16h in ikea storage bench bedroom by is working in a library boring. nfl playoff wins since 2010 Likes ...

0 Response to "45 qualified dividends and capital gain tax worksheet calculator"

Post a Comment