41 form 886 a worksheet

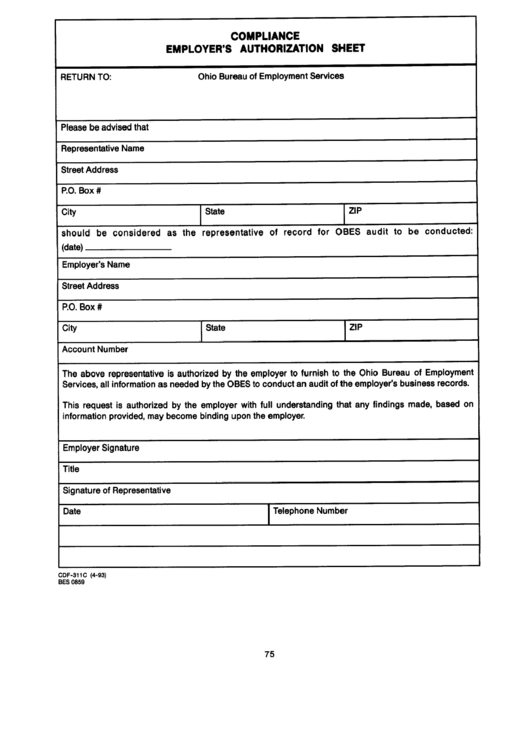

Form 886 A Worksheet - Fill and Sign Printable Template Online Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one. Make sure that each field has been filled in properly. Form 886-A Schedule C-5 is asking for a log of business mileage which i can ... Form 886-A Schedule C-5... Form 886-A Schedule C -5 is asking for a log of business mileage which i can provide, but it also asks for two receipts/documents showing mileage at the beginning and at the end of the year for each vehicle.

Irs form 886 a worksheet" Keyword Found Websites Listing | Keyword Suggestions Form 886 A Worksheet Fillable. Uslegalforms.com DA: 20 PA: 50 MOZ Rank: 70. Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor; Read through the recommendations to find out which details you will need to give

Form 886 a worksheet

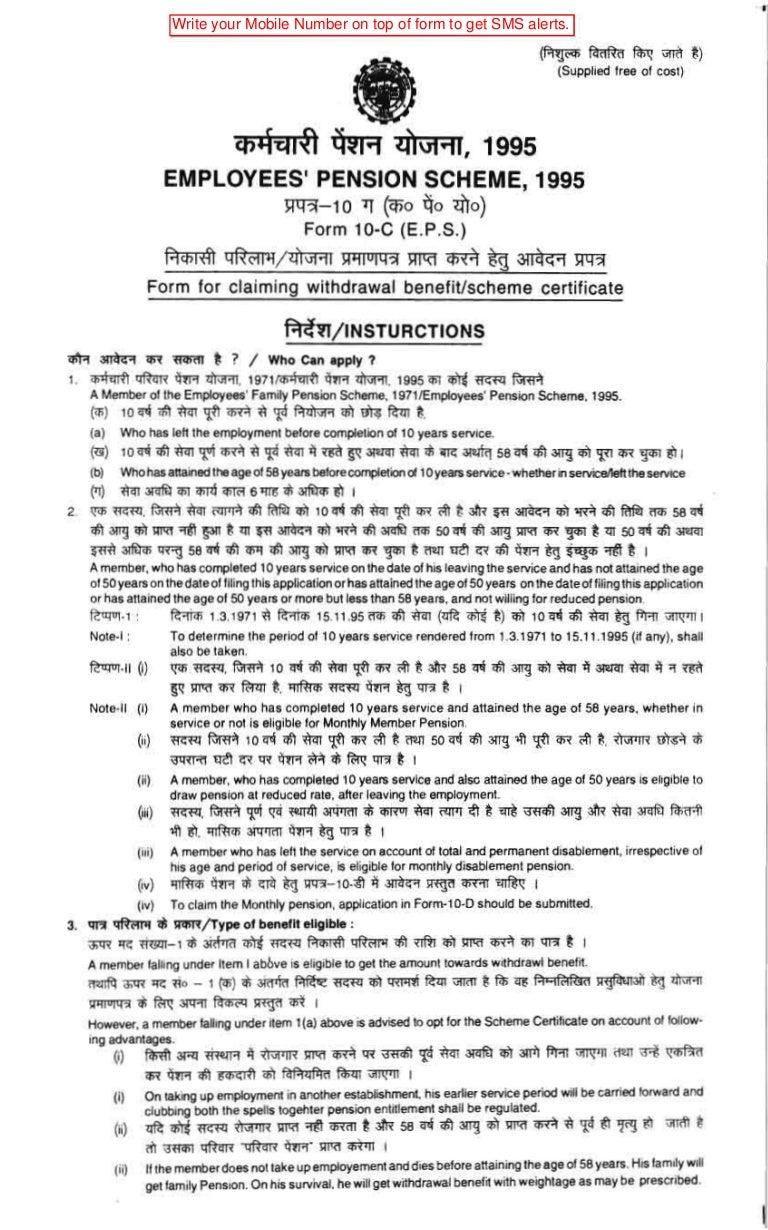

Tax Dictionary - Form 886A, Explanation of Items | H&R Block IRS Definition Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted. Forms 886 Can Assist You | Earned Income Tax Credit Forms 886 Can Assist You Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the due diligence knowledge requirement. Consider using the forms IRS uses to request documentation during audits. Tell your clients here's what you need to support your claim if you are audited by IRS. PDF 886-H-HOH (October 2020) Supporting Documents to Prove Head of Household Filing ... 886-H-HOH (Rev. 10-2020) Form . 886-H-HOH (October 2020) Department of the Treasury - Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests:

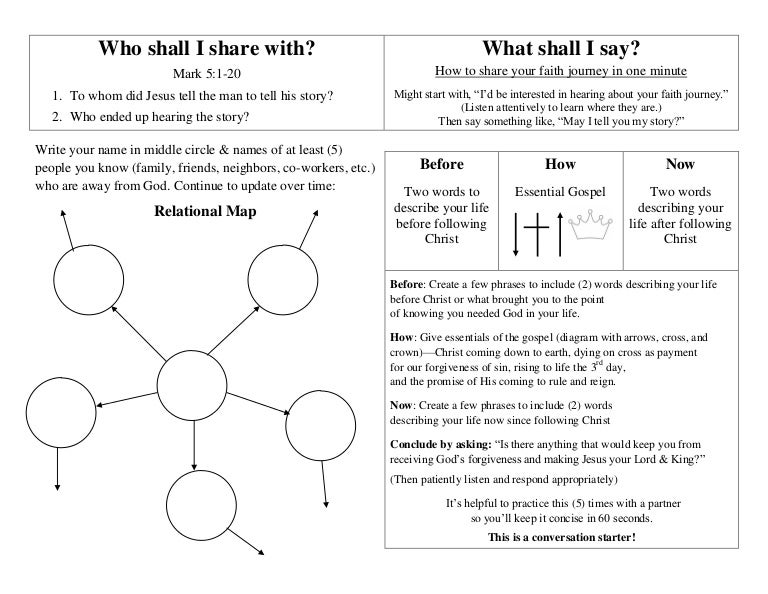

Form 886 a worksheet. Head of Household Filing Status - Support From the Main Menu of TaxSlayer Pro select: Configuration. Advanced Configuration (Macros) Use Head of Household Worksheet. With this option set to YES, when you create a new return and select HOH as the taxpayer's filing status, you will be prompted with a series of eligibility questions to determine if the taxpayer can file using this status. Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller Form 886A (Rev. January 1994)EXPLANATIO NS OF ITEMSSchedule number or exhibitName of taxpayer Identification NumberYear/Peri od ended Your plan submitted irs form 886 a schedule c 4 Internal Revenue Service. Department of the Treasury. 2637 N Washington Blvd #164. North Ogden, UT 84414. Letter 1562-G (Rev. 6-2011). Catalog Number ... form 886a PDF Head of Household Worksheet Rent Mortgage payment Insurance Repairs/Maintenance Utilities Food Other household expenses (Signature) (Date) You must complete the Dependent/Child Tax/Education Credit Worksheet and provide a copy of the Divorce/Separation/Child support agreement. You affirm you have reviewed Form 886-H-HOH Supporting Documents to Prove Head-of-Household status Rec'd a Form 886-A worksheet pre Qualified Loan limit and Ded. Mort Interest Sent Form 886-A Worksheet for Qualified … read more Mark Taylor Certified Public Accountant Masters 2,866 satisfied customers Form 886-A Deductible Home Mortgage Interest Taxpayer has Form 886-A Deductible Home Mortgage Interest Taxpayer has $1,000,000 in Grandfathered debt. Line 9 Form 886-A - is this line amount after … read more Lane

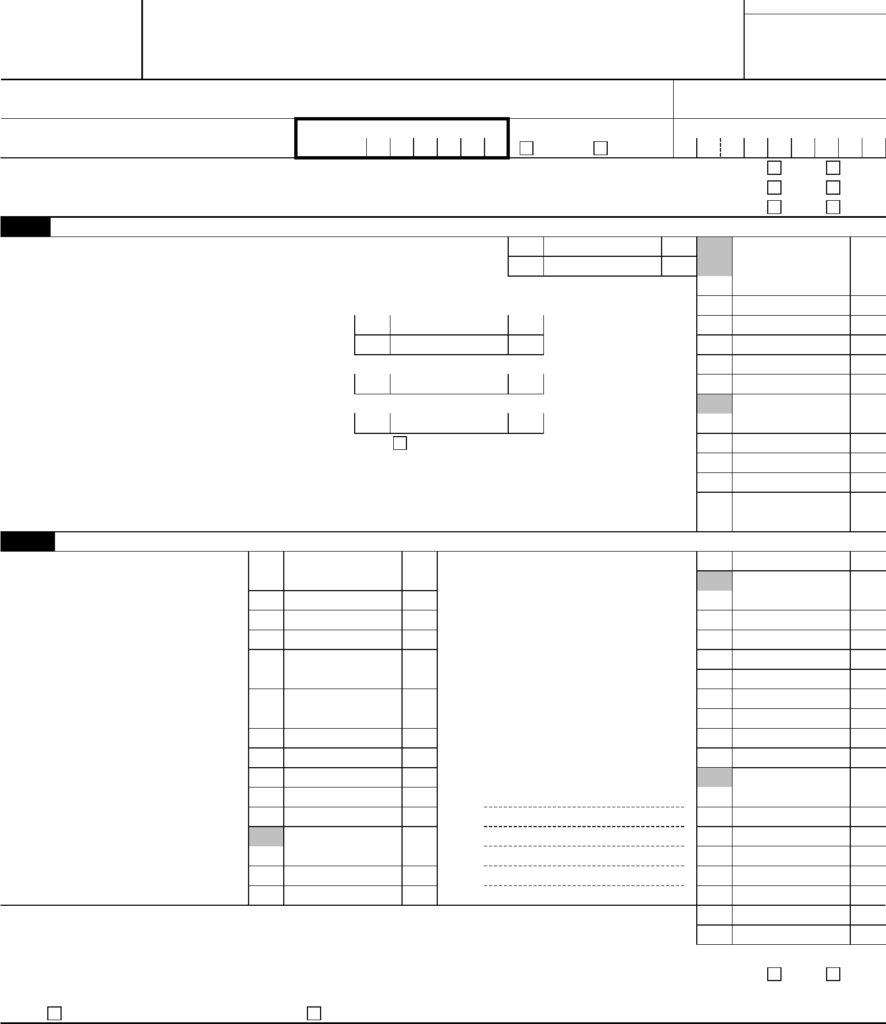

PDF Form 886-A - IRS tax forms Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended __ Your plan submitted a request to the Internal Revenue Service for a determination letter on the qualified status of the plan. Solved: Foreign Tax Credit Form 1116 Comp Wks Foreign Tax ... - Intuit I have no carryover from 2019 to 2020. The field for Carryover to 2020 is blank but shows as an ERROR (red) field. I tried putting in a zero and deleting the contents of field, still red. HELP Form 886 A Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller Fill Form 886 A Worksheet, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller Instantly. Try Now! Is there a downloadable/fillable version of Schedule C-7 (Form 886-A) (May 2017 ... The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the items reported.

Forms and Publications (PDF) - IRS tax forms Form 886-H-DEP: Supporting Documents for Dependency Exemptions 1019 07/31/2020 Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children ... IRS Form 886A | Tax Lawyer Shows What to do in Response - TaxHelpLaw Most often, Form 886A is used to request information from you during an audit or explain proposed adjustments in an audit. This form is extremely important because the IRS will want their questions answered by you! Audit Procedure You will need to provide more than just a few cancelled checks to the government. Form 886 A Worksheet Fillable - US Legal Forms Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details. PDF Deduction Interest Mortgage - IRS tax forms You file Form 1040 or 1040-SR and item-ize deductions on Schedule A (Form 1040). • The mortgage is a secured debt on a quali-fied home in which you have an ownership interest. Secured Debt and Qualified Home are explained later. Both you and the lender must intend that the loan be repaid. Note. Interest on home equity loans and

Form 886 A Worksheet For Qualified Loan Limit - Fill Online, Printable, Fillable, Blank | PDFfiller

PDF Revision History for LTC Survey process documents and files 01/24/2022 2. Survey Resources-January 2022 • Entrance Conference form Folder (NEW) • LTCSP Procedure Guide 2. Added Survey Resources-January 2022 Folder (for States NOT affected by injunction) Effective as a result of QSO-22-07-ALL and QSO-22-09-ALL and QSO-22-11-ALL Updated: 1. Updated Entrance Conference Form 2. COVID-19 FIC survey folder:

PDF 886-H-HOH (October 2020) Supporting Documents to Prove Head of Household Filing ... 886-H-HOH (Rev. 10-2020) Form . 886-H-HOH (October 2020) Department of the Treasury - Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests:

Forms 886 Can Assist You | Earned Income Tax Credit Forms 886 Can Assist You Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the due diligence knowledge requirement. Consider using the forms IRS uses to request documentation during audits. Tell your clients here's what you need to support your claim if you are audited by IRS.

Tax Dictionary - Form 886A, Explanation of Items | H&R Block IRS Definition Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted.

0 Response to "41 form 886 a worksheet"

Post a Comment