39 chapter 7 federal income tax worksheet answers

Community Development Block Grant (CDBG) - Mass.gov 02/07/2021 · CDBG Substantial Amendment #3 - Federal CARES Act Update 7/02/2021 . CDBG Substantial Amendment #2 - Federal CARES Act Update 9/11/20. CDBG Substantial Amendment - Federal CARES Act Update 4/30/20. DHCD announced a NOFA on 5/15/20 through CommBuys for State CDBG-CV funds. The NOFA and additional documents are attached below. … 2021 Publication 17 - Internal Revenue Service Dec 16, 2021 — 2021 Tax Computation Worksheet . ... chapters in the primary publication. ... 7. You qualify for the credit for federal tax on.

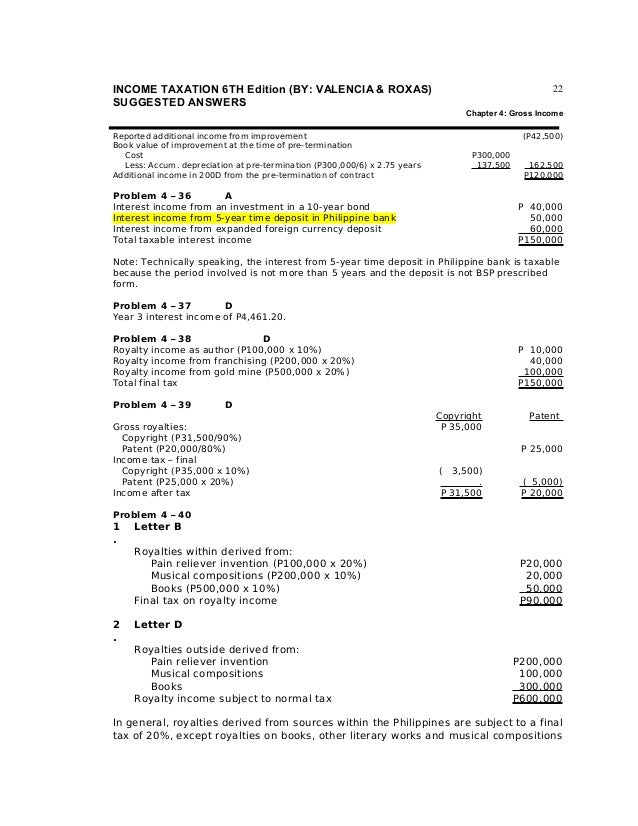

Publication 590-A (2021), Contributions to ... - IRS tax forms Getting answers to your tax questions. ... aid you in the pursuit of graduate or postdoctoral study and included in your gross income under the rules discussed in chapter 1 of Pub. 970, Tax Benefits for Education. Commissions. An amount you receive that is a percentage of profits or sales price is compensation. Self-employment income. If you are self-employed (a sole …

Chapter 7 federal income tax worksheet answers

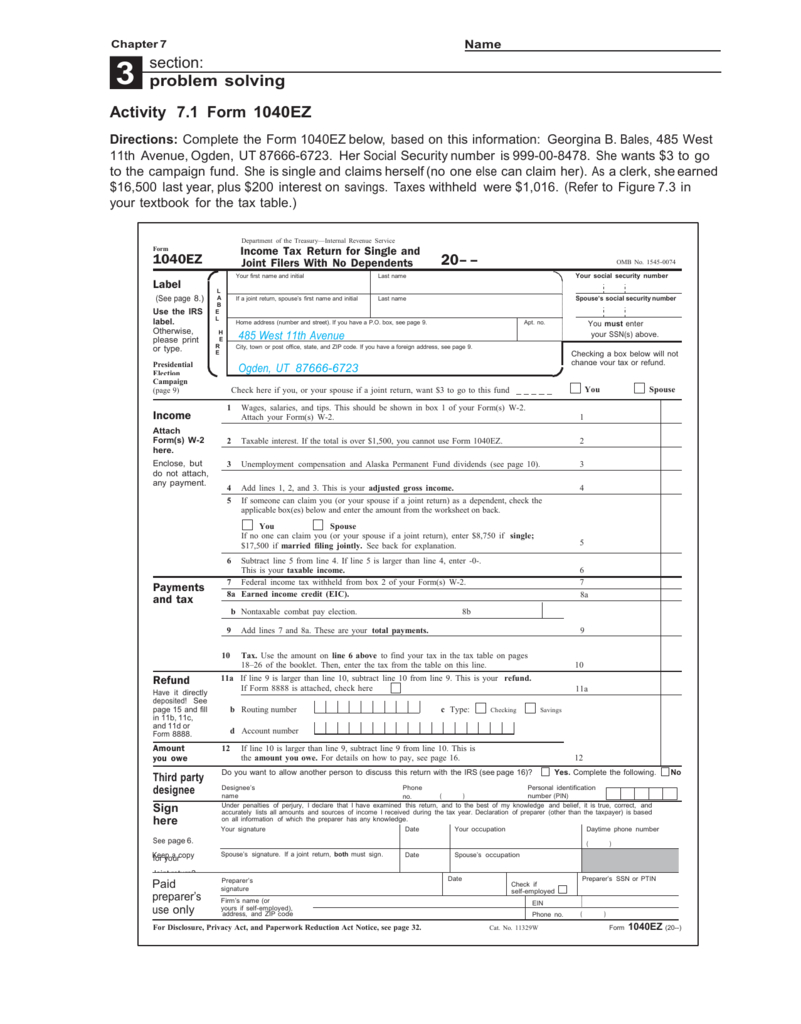

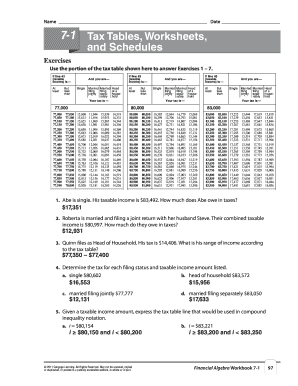

Income Taxes - Henry County Schools Mar 15, 2011 — Compute federal income taxes using a tax table and tax schedules. Tax Tables, Worksheets, and Schedules. 7-1. The hardest thing in the world ...56 pages Your Federal Income Tax for Individuals 1995 · Income tax( For use in preparing 1995 tax returns ) You may claim the earned income credit if you ... If you do not have a qualifying child skip 6 and answer 7. Cengage Brain Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.

Chapter 7 federal income tax worksheet answers. Your Federal Income Tax for Individuals United States. Internal Revenue Service · 1994 · Income taxState and Local Income Tax Refund Worksheet - Line 10 Forms 1099 - DIV 1 . ... Frank's share of dividends on stock owned by his partnership $ 80 7 . State of Oregon: Businesses - Corporate Activity Tax FAQ The Corporate Activity Tax (CAT) is an annual tax, established in 2019, and applicable to tax years beginning on or after January 1, 2020. The CAT is imposed on taxpayers for the privilege of doing business in this state. The CAT is not a transactional tax, such as a retail sales tax, nor is it an income tax. Tax Guide for Small Business - Page 36 - Google Books Result 1966 · Small businessPayment of the entire 1975 estimated tax liability , or any balance due ... Page 36 Chapter 7 Amounts withheld from your salary for Federal income tax are ... Publication 505 (2022), Tax Withholding and Estimated Tax ... Use Worksheet 1-2 if you are a dependent for 2022 and, for 2021, you had a refund of all federal income tax withheld because of no tax liability. Worksheet 1-3 Projected Tax for 2022: Project the taxable income you will have for 2022 and figure the amount of tax you will have to pay on that income. Worksheet 1-4 Tax Computation Worksheets for 2022

2019 Fiduciary Income 541 Tax Booklet | FTB.ca.gov 01/01/2015 · The fiduciary must file Form 541 for the estate of an individual involved in bankruptcy proceedings under Chapter 7, 11, or 12 of Title 11 of the United States (U.S.) Code if the estate has one of the following: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $1,000; An … Pennsylvania Form 40 Instruction Booklet (Income Tax ... Income Tax Return Instruction Booklet (PA-40) 2021 Pennsylvania Personal Income Tax Return Instructions (PA-40 IN) 21 2021 INSTRUCTIONS BOOKLET NO FORMS INCLUDED PA-40 IN 06-21 TAX RATE The state income tax rate for 2021 is 3.07 percent (0.0307). 2021 TAX RETURN FILING DUE DATE To remain consistent with the federal tax due date, the due date … Essay Fountain - Custom Essay Writing Service - 24/7 ... With this guarantee feel comfortable to message us or chat with our online agents who are available 24hours a day and 7 days a week be it on a weekend or on a holiday. We offer 24/7 essay help for busy students. As a busy student, you might end up forgetting some of the assignments assigned to you until a night or a day before they are due. This might be very … Cengage Brain Nous voudrions effectuer une description ici mais le site que vous consultez ne nous en laisse pas la possibilité.

Your Federal Income Tax for Individuals 1995 · Income tax( For use in preparing 1995 tax returns ) You may claim the earned income credit if you ... If you do not have a qualifying child skip 6 and answer 7. Income Taxes - Henry County Schools Mar 15, 2011 — Compute federal income taxes using a tax table and tax schedules. Tax Tables, Worksheets, and Schedules. 7-1. The hardest thing in the world ...56 pages

Publication 17 (2013), Your Federal Income Tax | Reading worksheets, Worksheets, Worksheets free

income analysis worksheet - Edit, Fill, Print & Download Best Online Forms in Word & PDF | cash ...

0 Response to "39 chapter 7 federal income tax worksheet answers"

Post a Comment