38 vanguard retirement expense worksheet

› backdoor-roth-ira-tutorialBackdoor Roth IRA 2021 [Step-by-Step ... - White Coat Investor Dec 04, 2021 · If your income is below a MAGI of $125,000-$140,000 ($198,000-$208,000 Married Filing Jointly), you can contribute directly to a Roth IRA. If you have a retirement plan offered to you at work and your MAGI is below $66,000-$76,000 ($105,000-$125,000 Married Filing Jointly) you can deduct your traditional IRA contributions. Since most readers of ... Home - Friends Talk Money Having this rainy-day fund is important, especially during retirement, because the last thing you want to do is to tap into your retirement nest egg to pay for emergency expenses, especially if making a non-required withdrawal from your IRA or 401(k) plan assists could raise your taxes.

Tools and Calculators Overview | Vanguard Investment analysis (1) Whether your retirement is off in distance, right around the corner, or already here, these tools can lend a hand at any stage of retirement planning. Planning for retirement tools (5) Retirement income calculator. Estimate the potential income you could earn from your investments. Get started. Retirement expense worksheet.

Vanguard retirement expense worksheet

Essay Fountain - Custom Essay Writing Service - 24/7 ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for … 50 Personal Income and Expense Sheet - Ufreeonline fl 150 in e and expense declaration in e for average monthly add up all the in e you received in each category in the last 12 months and divide the total by 12 fl 150 [rev january 1 2019] vanguard retirement expense worksheet when you re finished make a note of your monthly expense estimate and use it in our retirement in e worksheet to help … Vanguard - Create your retirement spending plan Start by estimating what your retirement will cost. If you're the kind of person who makes budgets, create a spreadsheet of your expenses today and how you expect them to change in retirement. Otherwise, you can take a back-of-the-envelope approach: Take what you spend today and multiply it by 85% or 90%.

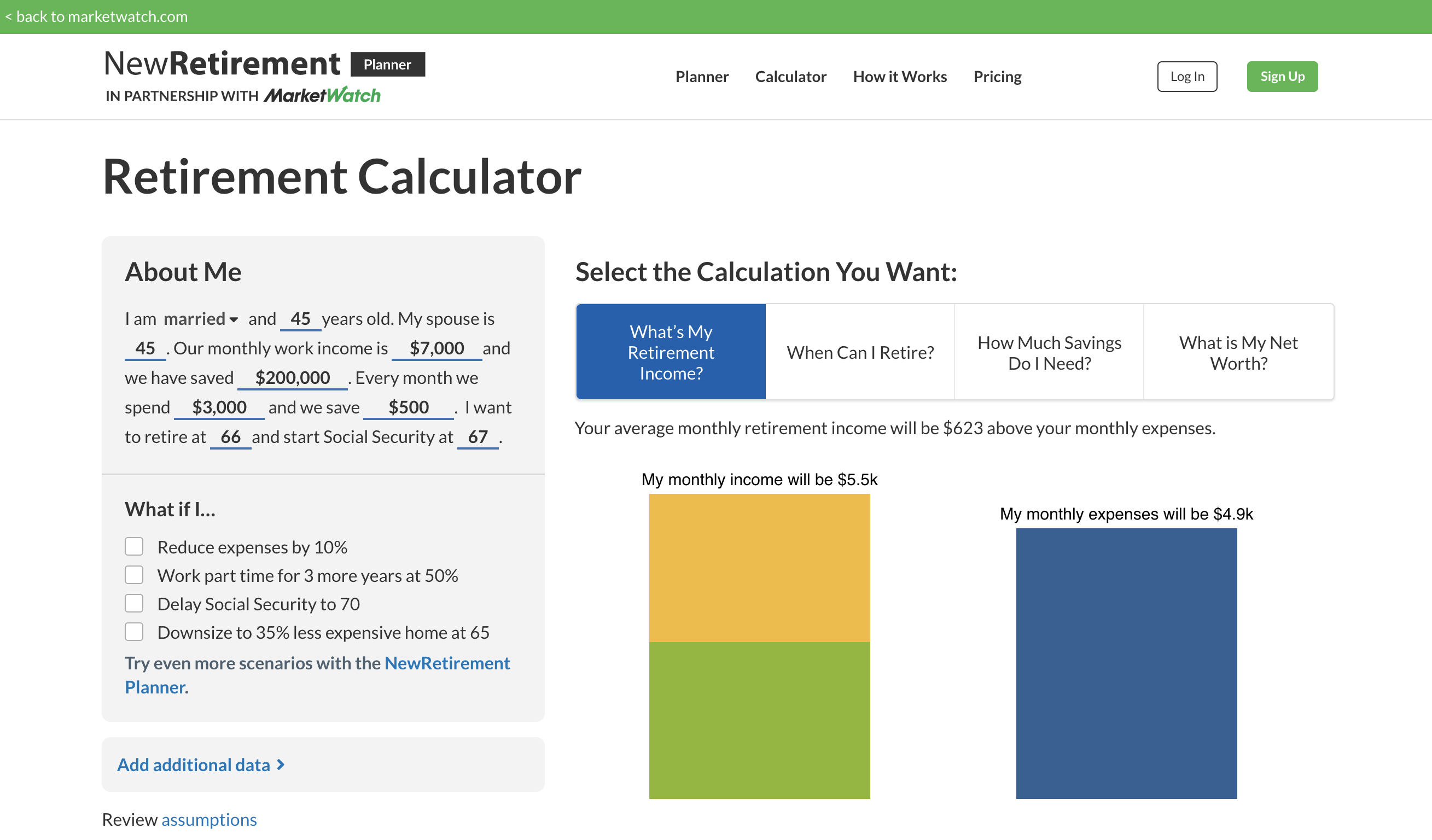

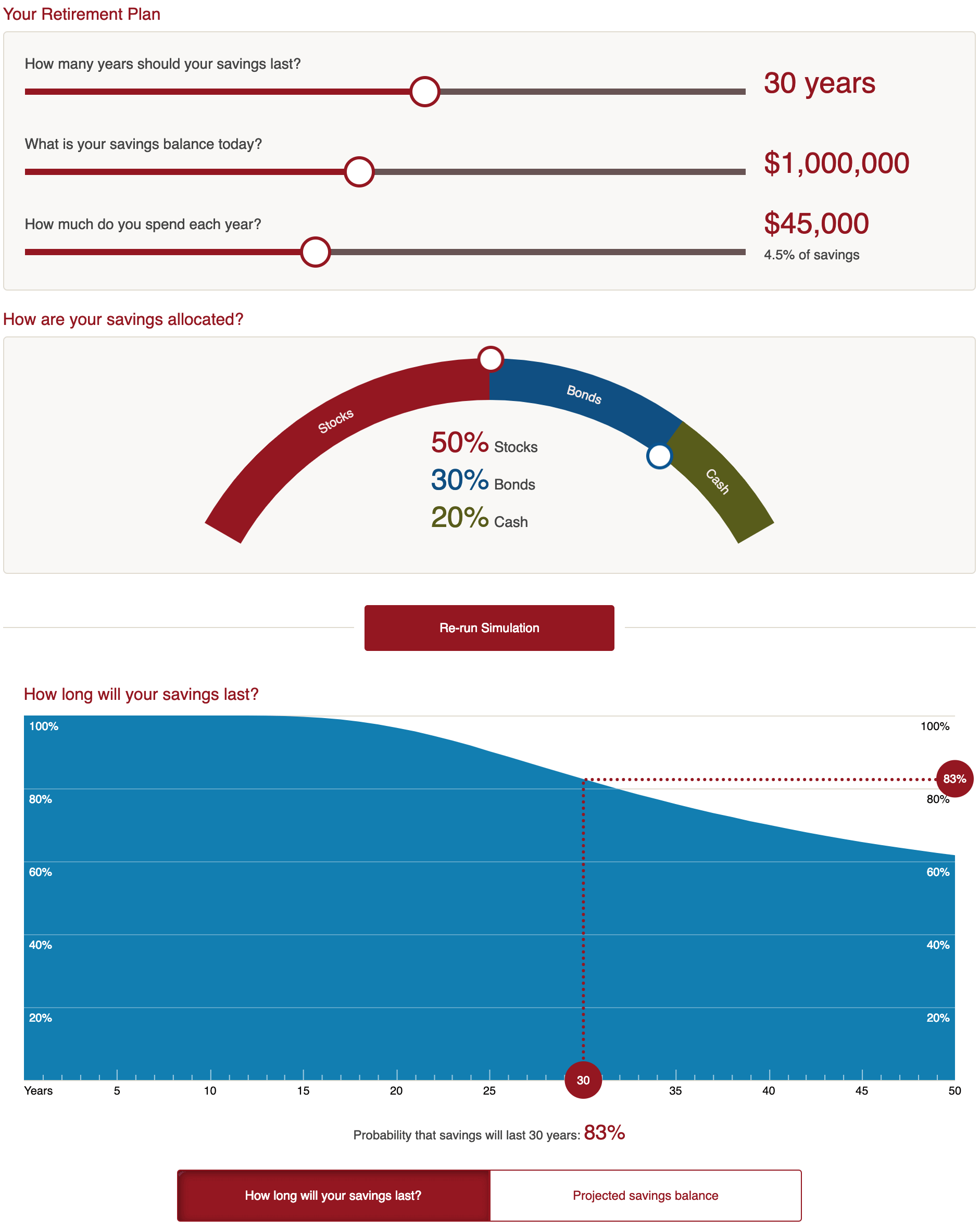

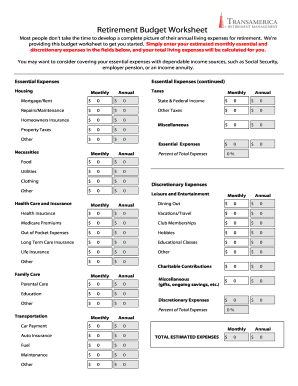

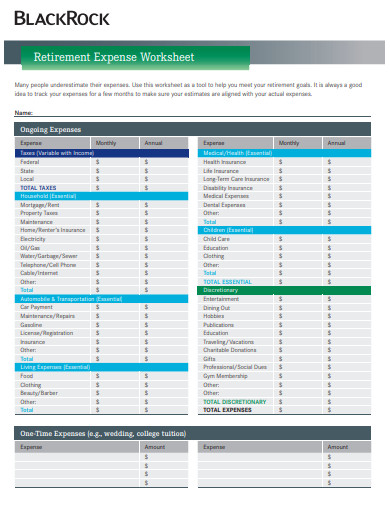

Vanguard retirement expense worksheet. Retirement Nest Egg calculator - Vanguard Previous page. Retirement Nest Egg Calculator. How long will your retirement nest egg last? How much could your investments grow? Answer a few questions to ...How many years should your savings last?: 30 ...How much do you spend each year?: $45,000...What is your savings balance today?: $1,000,0... 11+ Retirement Expense Worksheet Templates in PDF | DOC ... The retirement expense worksheet is to include the expenses planned. And this expenditure is for retirement and afterward. When you have the plan with you then you can make proper expenses later on. There are the plan and the worksheet to write down the expenses in it. Vanguard Retirement Expense Worksheet vs Retirement Budget ... Vanguard Retirement Expense Worksheet vs Retirement Budget Calculator. Retirement Budget Calculator posted a video to playlist.. July 22, 2020 · · PDF Retirement income planning worksheet - Merrill Additional Expenses (including one-time purchases) $ Expected Pay Offs $ After you've documented your expenses in retirement and income sources, your Merrill Lynch Wealth Management Advisor can work with you to create a retirement income plan that seeks to align your portfolio and the income it generates to your individual goals and situation.

How to Plan a Retirement Budget (Free Worksheets) Excel | PDF A survey conducted in America showed that most workers estimated that they would require 400,000-500,000 U.S. Dollars to cater for their retirement expenses while the truth is that the expenses will exceed 1,000,000 U.S. Dollars.. A pre-planned budget will show how much you are earning and how much you are spending. › wiki › Tools_and_calculatorsTools and calculators - Bogleheads Jan 31, 2022 · A retirement planner and Social Security calculator are also provided. Portfolio Visualizer, by forum member pvguy. For backtesting, Monte Carlo simulation, tactical asset allocation and optimization, and investment analysis. Fidelity. Fidelity has a comprehensive list of tools and calculators which cover investing and retirement. PDF Budgeting & savings guide - The Vanguard Group Budget worksheet Income Amount Expenses (annually) Amount Annual salary* $55,000 Rent/mortgage $26,000 Quarterly trust distributions $10,000 Car expenses $6,200 Annual gifts $30,000 Insurance $2,200 Credit card $72,000 (entertainment) $38,000 (clothing) Electric/gas bills $2,400 Savings $3,000 Charitable donations $1,600 How to Plan for the Biggest Change in Retirement Expenses It's the Vanguard retirement expenses worksheet, so that's one. You can just Google for other ones. I would say really what it comes down to is listing out all your expenses that you have today,...

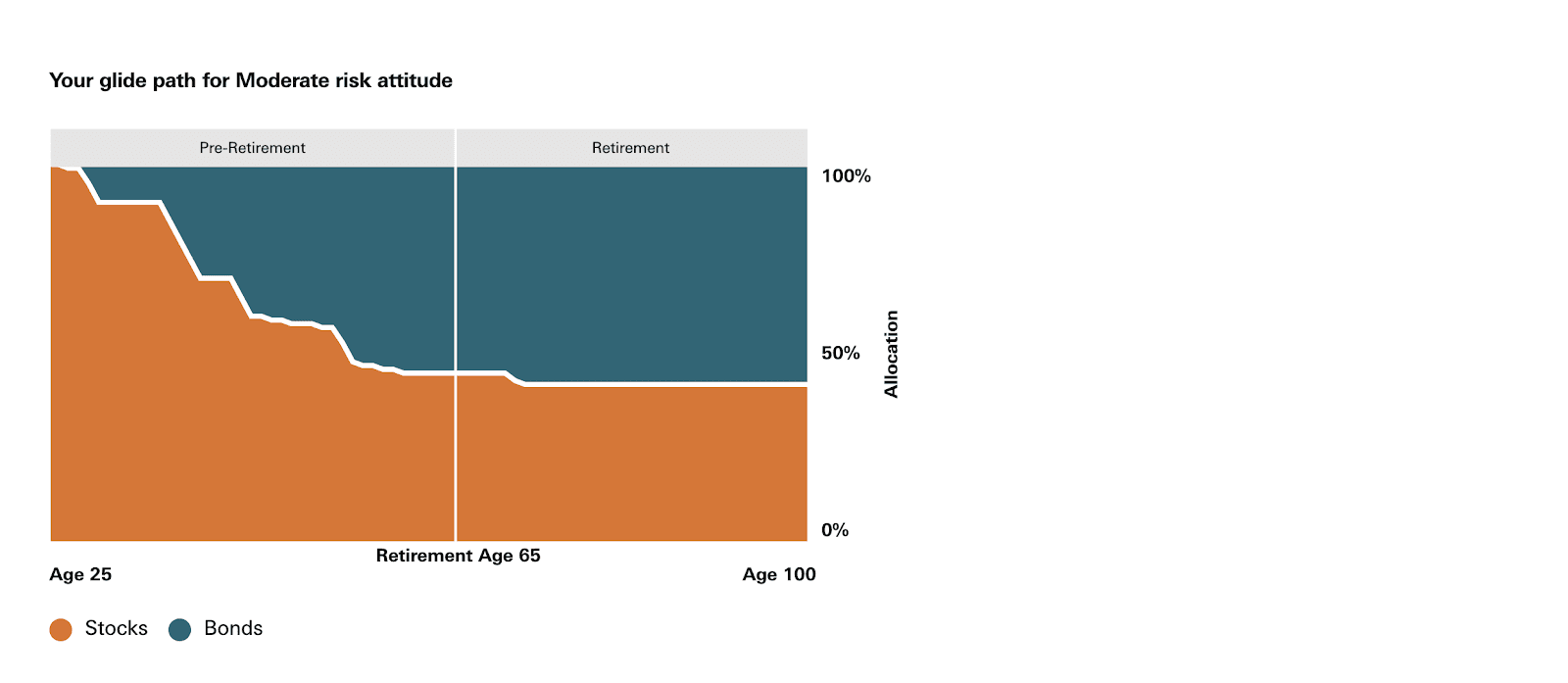

Newsletter Signup - Hollywood.com Newsletter sign up. In subscribing to our newsletter by entering your email address you confirm you are over the age of 18 (or have obtained your parent’s/guardian’s permission to subscribe ... Charles Schwab vs. Vanguard - Which Is the Better Platform ... Vanguard offers free retirement calculators, income and expense worksheets for retirement and education planning, and asset allocation guides. Vanguard makes these available to self-directed investors and wealth management clients. riddleb.it Před 2 dny · Online-Einkauf mit großartigem Angebot im Software Shop. Samsung Tv Calibration App. About Sierra On Credit Stark Enterprises Card Charge . Tegna Inc. Download Ebook Building Science N1 Memorandum And Question Papers 26/11/2021 · Previous Post The last 6 months of Obama Presidency. Vanguard: Helping you reach your investing goals | Vanguard *Vanguard is investor-owned. As an investor-owner, you own the funds that own Vanguard. **For the 10-year period ended December 31, 2021, 7 of 7 Vanguard money market funds, 67 of 86 Vanguard bond funds, 21 of 24 Vanguard balanced funds, and 128 of 183 Vanguard stock funds—for a total of 223 of 300 Vanguard funds—outperformed their Lipper peer group averages.

PDF Retirement Worksheet - MetLife 1 Fill in the expected retirement income for yourself and your spouse/partner. 2 Fill in your expected retirement expenses. 3 Subtract expenses from income. If you're like most people, you may have a retirement income gap. 4 Fill in all of your current savings and assets. (Be sure to include any previous workplace retirement plans.)

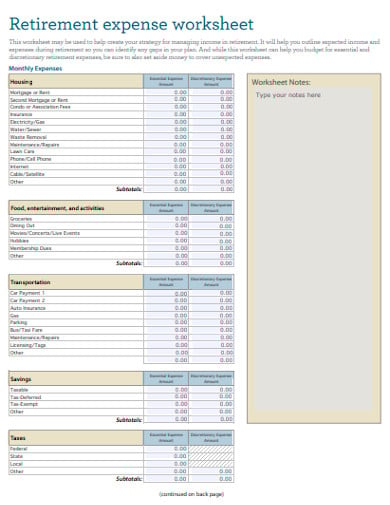

PDF Retirement expense worksheet - Wells Fargo And while this worksheet can help you budget for essential and discretionary retirement expenses, be sure to also set aside money to cover unexpected expenses. Investment products and services are offered through Financial Advisors at Wells Fargo Advisors.

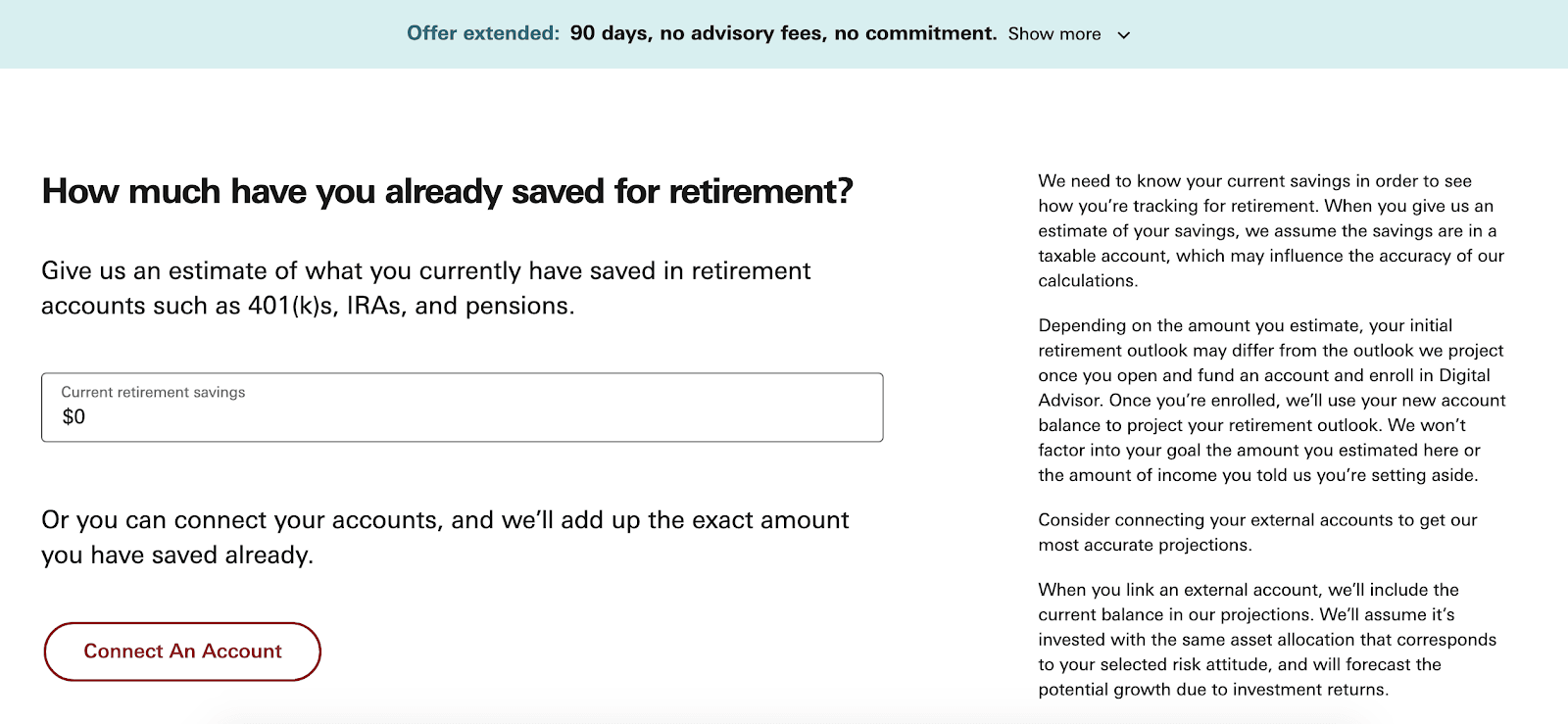

Retirement Expenses Worksheet | Vanguard Worksheet that can help you determine your retirement expenses and create a realistic budget based on your retirement income. ... You'll have important bills and expenses to pay in retirement. Use this interactive worksheet to help you estimate your monthly retirement expenses. ... Vanguard Personal Advisor Services® One-on-one expert advice ...

Login - Vanguard - Retirement Plans Our new website will change the way you think about retirement planning. Try out the new features—and even more are on the way! But if you can't find what you're looking for, our previous site is just a click away.

Use a retirement planning worksheet | Vanguard Use a retirement planning worksheet | Vanguard Figure out your expenses in retirement See what new expenses you might have once you retire—and which ones you can forget about. Potential new costs to consider Health care expenses Once you reach age 65, you qualify for Medicare, the federal health insurance program.

Use a retirement planning worksheet | Vanguard Expenses that might go down in retirement. Many people find that they cut these types of costs once they retire: Gas, clothing, and other work-related costs. Payroll taxes. Income taxes, if your income is lower than when you were working full-time. Certain lifestyle expenses, if you plan to cook more instead of eating out, for example.

Retirement income worksheet | Vanguard Retirement income worksheet | Vanguard Retirement income worksheet As your retirement draws closer, it pays to be prepared. Use this interactive worksheet to estimate your total monthly income in retirement and determine if you're on track to meeting your financial needs. Rest assured, your data won't be saved online. Taxes and expenses

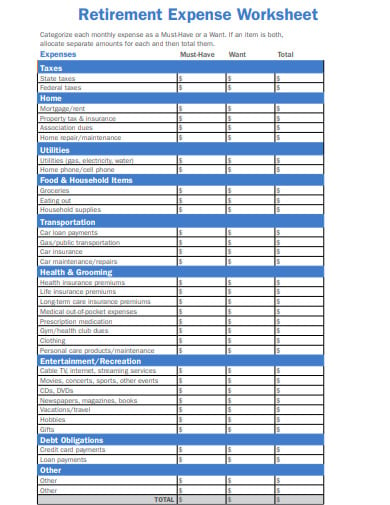

PDF Retirement Expense Worksheet - Capital Advantage Retirement Expense Worksheet Es mate the expenses you have before re rement and those you will have during re rement (if you are currently re red, es mate your current expenses only). Keep in mind that during re rement, some of your expenses may decrease (i.e. dry

› ExcelTemplates › retirementRetirement Calculator - Free Retirement Savings Calculator ... Retirement Calculator - - This calculator estimates the amount of savings you will accumulate and how long it will last during retirement. Retirement Expenses Worksheet - personal.vanguard.com - This worksheet has you estimate your retirement budget by entering housing costs, personal expenses, living expenses, medical expenses ...

Flour Mill Rye [4MH368] Search: Rye Flour Mill. What is Rye Flour Mill. Every flour has its own unique properties. Sourdough Rye using your flour and some crushed organic caraway seeds has lifted my Sourdough Rye to a new level!!

Is It Better to Do Pre-tax Or Roth 401k? - RetireWire 06/11/2020 · The best retirement clients that we’ve done retirement planning for over the years that come to us, they have a very healthy mix of both pre-tax contributions to their 401(k)/IRA rollover and Roth after-tax contributions. A 50/50 mix is absolutely ideal.

Vanguard - Retirement Expense Worksheet Size up your spending. Rethink your living situation. Retirement Expense Worksheet. How much do you have to spend? Is there a shortfall? Consider income annuities. Taking Social Security benefits.

PDF How to use Monthly budget worksheet this worksheet ... of the worksheet, plug those subtotals into the simple equation and you'll find out what your monthly income—after expenses—could be! Transfer Subtotal A and Subtotal B to their spaces on the next page. Essential Budget Items (A) Household Expenses Mortgage/Rent $ Utilities/Telephone $ Gas/Oil/Water $ General Maintenance $

Bankrate: Guiding you through life's financial journey Use Bankrate.com's free tools, expert analysis, and award-winning content to make smarter financial decisions. Explore personal finance topics including credit cards, investments, identity ...

Retirement calculators and spending - Bogleheads Click on a "Vary Expense" link to set up a spending stage. Other approaches to setting up stages are also possible. ↑ Access to Financial Engines is free through many company retirement plans. Vanguard investors with at least $50,000 also have free access. Others may need to purchase access.

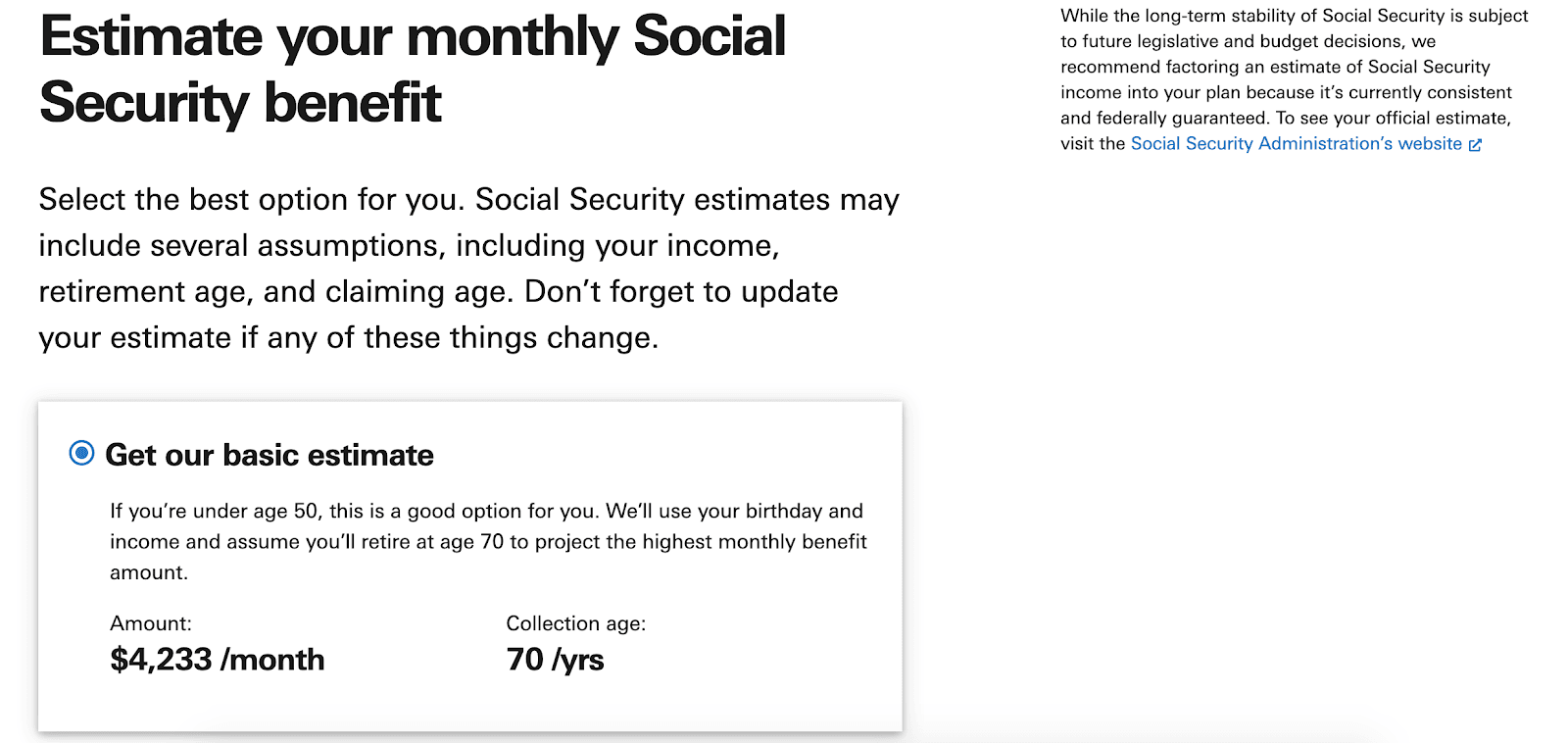

PDF Build your Social Security strategy - The Vanguard Group retirement? Use our retirement expenses worksheet Calculate your annual retirement surplus or gap: E F E F C B A D - Enter the higher number = Your retirement savings plus your annual income = could provide this much income each year: Annual Social Security bene˜ts Multiply your monthly estimates by 12. Age 62 You Spouse Full retirement age ...

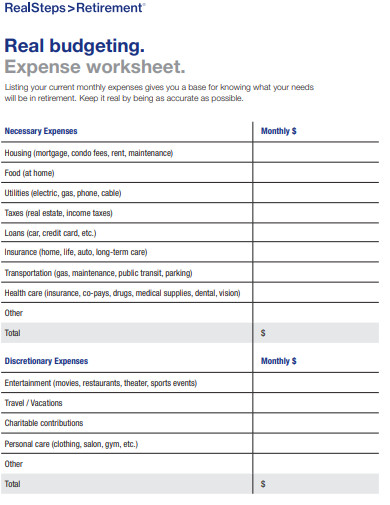

Map out your retirement budget - Principal This worksheet (PDF) helps you examine for income sources and detailed expenses more closely. Before you start plotting your budget in detail, know that for most people, different types of retirement income cover different expenses. A typical retirement budget may look like this: Build your budget.

Bogleheads Investing Advice and Info Bogleheads® is the title adopted by many of the investing enthusiasts who participate in this site. The term is intended to honor Vanguard founder and investor advocate John Bogle.. The Bogleheads® emphasize starting early, living below one's means, regular saving, broad diversification, simplicity, and sticking to one's investment plan regardless of market conditions.

Retirement Budget Worksheet RETIREMENT BUDGET WORKSHEET For year ending: 1STEP ONE: EXPENSES (MONTHLY) During Retirement ESSENTIAL EXPENSES Housing Utilities Food Health Care Family Care Transportation Personal Tithe/Charitable Savings Taxes Other Essential Total Essential Expenses NON-ESSENTIAL EXPENSES Recreational and Entertainment

7 Best Free Retirement Planning Spreadsheets for 2022 Note: Vanguard provides an easy tool if you simply want to calculate your retirement expenses. Retirement Planning Spreadsheet for Google Sheets The flexible and easy-to-use Retirement Planner spreadsheet estimates the value of your savings and investments into the future. Experiment with growth rate scenarios and project outcomes in real-time.

Vanguard - See what you spend - Vanguard - Retirement Plans If you chronically spend more than you earn, try to cut out some frivolous expenses. A luxury item like a new TV is not necessarily a need on the same level as, say, a car repair or a doctor's bill. Prioritize your expenses in this order: Short-term needs (repairs and maintenance). Long-term needs (retirement and education).

Vanguard - Create your retirement spending plan Start by estimating what your retirement will cost. If you're the kind of person who makes budgets, create a spreadsheet of your expenses today and how you expect them to change in retirement. Otherwise, you can take a back-of-the-envelope approach: Take what you spend today and multiply it by 85% or 90%.

50 Personal Income and Expense Sheet - Ufreeonline fl 150 in e and expense declaration in e for average monthly add up all the in e you received in each category in the last 12 months and divide the total by 12 fl 150 [rev january 1 2019] vanguard retirement expense worksheet when you re finished make a note of your monthly expense estimate and use it in our retirement in e worksheet to help …

Essay Fountain - Custom Essay Writing Service - 24/7 ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for …

/BalanceSheet-tablet-no-hands-659322eb6e4745fd98086a6354ebf9c4.png)

/Review_INV_vanguard-9976a70869cd4e0386976794f2b670f4.png)

0 Response to "38 vanguard retirement expense worksheet"

Post a Comment