38 usda income calculation worksheet

Certification of Compliance Worksheets: 5-Day Schedule ... Lunch Worksheets. Grades K-5. Grades K-8. Grades 6-8. Grades 9-12. 10/17/2013. SFH Section 502 GLP Eligibility Check Worksheet - USDA Example: Current hourly income is $10/hour, and applicant works 40 hours/week. Monthly income would be $10*40*52=$20,800/year. The yearly income of $20,800 divided by 12 months=$1,733/month. Overtime Income. Overtime income is income that is more than the base wages.

DOC Monarch Properties, Inc. - Monarch Properties, Inc. Online ... INCOME & RENT CALCULATION WORKSHEET Property Name: Unit: HOH Last Name: . HUD Section 8 HUD Section 8/236 HUD/USDA(515/Section8) USDA-RD/RA BMIR/Market. Effective Date: Move-in Program Change A/R I/R/Unscheduled Assign RA

Usda income calculation worksheet

XLSX USDA Rural Development 0 0. 0 0. 0 0. 0 0. 0 0. 0 0 0. 0 0. 0 0. 0 0. 0. 0. 0 0. 0 0 0. 0 0. 0 0. 0. 0 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0 0. 0 0 0 0. 365. 365. 365. 0. 0. 0. 0 0. 0 ... PDF Usda Rental Income Worksheet Job Aid USDA RENTAL INCOME WORKSHEET JOB AID Wholesale Lending For calculations to be correct, enter the monthly amount (not the annual amount) for each of these fields. (16-18) 16. Taxes Enter the Property Tax amount for the REO as verified by documentation provided, not the tax return. If the documentation XLS Guaranteed Loan Worksheets - Farm Service Agency * If a payment in Worksheet Three is to be amortized, you can enter the amortization formula in the total column. Annual Cash Oper. Exp. Divided by Gross Income = Operating Ratio The formula is +@PMT(Principal,Interest,Term). For example a $100000 loan amortized over 7 years at 10% would be entered as OTHER Net Income Divided by Total Assets

Usda income calculation worksheet. PDF Tenant Certification Process - Usda • Zero Income - RD's policy is to not accept a tenant certification for an applicant or tenant with zero income unless all income is specifically exempted. • If applicant or tenant states they have no household income, they will need to demonstrate financial capability to meet essential living expenses. PDF Three Types of Income - USDA Rural Development For the Section 502 program,the Worksheet for Computing Income and Maximum Loan Amount Calculator (commonly known as the automated 4‐A) can be found on the program's Forms & Resources site; a link to the site is provided on the slide. PDF INCOME CALCULATION WORKSHEET - DUdiligence.com INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1) Hourly: See Part II, Section 1a, 1b, 1c or 1d (seasonal worker) 2) Weekly: See Part II, Section 2 3) Bi-Weekly: See Part II, Section 3 4) Semi-Monthly: See Part II, Section 4 5) Overtime/Bonuses: See Part II, Section 5a or 5b 6) Commissioned: See Part II, Section 6 PDF Worksheet for Documenting Eligible Household and Repayment ... Calculate and record how the calculation of each income source/type was determined in the space below. 4. Additional Adult Household Member (s) who are not a Party to the Note (Primary Employment from Wages, Salary, Self-Employed, Additional income to Primary Employment, Other Income). Calculate and record how the calculation of each income

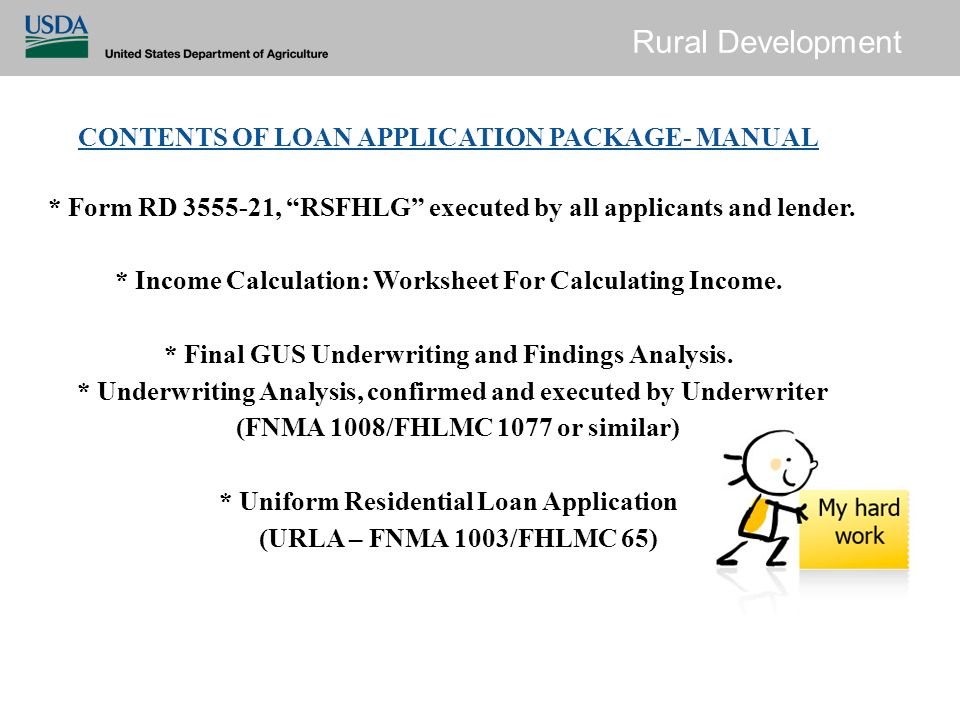

PDF HB-1-3555 CHAPTER 9: INCOME ANALYSIS - USDA Rural Development month timeframe. Form RD 3555-21 Income Calculation Worksheet must state: the income source, the number of months receipt remaining for the ensuing 12- month timeframe, and the total amount to be received. The calculation of annual income should be logical based on the history of income and documentation provided. FNMA Self-Employed Income Calculations - Fill and Sign ... Follow these simple actions to get FNMA Self-Employed Income Calculations prepared for submitting: Get the document you need in our collection of legal templates. Open the document in our online editing tool. Read the recommendations to learn which info you will need to include. Click on the fillable fields and include the required details. PDF CHAPTER 9: INCOME ANALYSIS - USDA Rural Development verifications. Documentation of income calculations should be provided on Attachment 9-B, or the Uniform Transmittal Summary, (FNMA FORM 1008/FREDDIE MAC FORM 1077), or equivalent. Attachment 9-C provides a case study to illustrate how to properly complete the income worksheet. A public website is available to assist in the PDF Guaranteed Rural Housing Origination Stacking Order ... - USDA Income Calculation: Worksheet For Calculating Income - Attachment A FEMA Form 81-93, "Standard Flood Determination Form" Note: Properties located in flood plains will require additional documentation. Confirmation the base flood elevation (BFE) is below lowest habitable floor of subject.

XLSX franklinamerican.com USDA REO Net Rental Income/Loss Calculation Worksheet Equal Housing Lender. Franklin American Mortgage Company, a division of Citizens Bank, N.A. (FAMC), a national banking association, whose address is One Citizens Plaza, Providence, RI 02903. PDF Exh 02-091 Worksheet for Documenting Income Exh 02-091 USDA Worksheet for Calc Income Rev. 5-1-13 MONTHLY REPAYMENT INCOME CALCULATION(Consider stable and dependable income of parties to the note as described in §1980.345(a), 1980.345(b) and 1980.345(c) of RD Instruction 1980‐D). 14. Stable Dependable Monthly Income (Parties to note only). SFH Section 502 GLP Eligibility Check Worksheet - USDA If you are an applicant or an individual interested in learning more about the Single Family Housing Guaranteed Loan Program, please visit our guaranteed housing webpage for further program information and guidance. If you are interested in applying for a guaranteed loan, or have more specific questions not answered by the website, please reach out to any of the program's approved lenders ... PDF Processing USDA Loans in Encompass - Ellie Mae Much of the information on the Income Worksheet is populated from information previously entered on pages 2 and 6 of the Rural Assistance URLA tab. 1 Click an Edit icon to edit the value in a field. 2 In the Annual Income Calculation and Adjusted Income Calculation sections, use the Calculate and Record fields to enter the values and formulas ...

Usda Income Calculation Worksheet - Fill and Sign ... Be sure the info you fill in Usda Income Calculation Worksheet is updated and accurate. Indicate the date to the template using the Date tool. Click on the Sign tool and make an e-signature. You can use three available options; typing, drawing, or capturing one. Make sure that each and every field has been filled in correctly.

USDA Loan Payment Calculator: Calculate Loan Guarantee ... Income Limits. To obtain a USDA loan, you must fall under the required income limit for moderate income. Moderate income is defined as the greater of 115% of the U.S median family income, 115% of the state-wide and state non-metro median family incomes, or 115/80ths of the area low-income limit.

Eligibility Welcome to the USDA Income and Property Eligibility Site. This site is used to evaluate the likelihood that a potential applicant would be eligible for program assistance. In order to be eligible for many USDA loans, household income must meet certain guidelines. Also, the home to be purchased must be located in an eligible rural area as ...

Announcement 2021-037 - USDA -Implementation of Newly ... The revised 3555-21 is available in GUS (Guaranteed Underwriting System) and in fillable format at the USDA eForms website. The revised 3555-21 has been streamlined by removing the income calculation attachment with the following submission requirements for evidencing the income calculations:

PDF AN Attachment A WORKSHEET FOR DOCUMENTING ELIGIBLE ... - USDA Attachment A Page 2 of 3 Rev 1/2013 Applicant(s): ADJUSTED INCOME CALCULATION (Consider qualifying deductions as described in §1980.348 of RD Instruction 1980-D) 7. Dependent Deduction ($480 for each child under age 18, or full-time student attendi ng school or disabled family member over the age of 18) - #_____ x $480 8. Annual Child Care Expenses (Reasonable expenses for children 12 and under).

PDF Chapter 9: Income Analysis - Usda B. Projecting Annual Income for a 12-Month Period The calculation of annual income is used to determine an applicant's eligibility for the SFHGLP. Income received by the applicant and all adult members of the household is considered in the calculation of annual income. Annual income is the first step in determining program eligible income.

USDA Annual Income Calculation. The worksheet provides space to identify the anticipated income for all adult members of the household. 1. Applicant. Calculate and record how the calculation of each income source/types was determined in the space provided. In the column adjacent insert the annual total income. 2. Co-Applicant

Processing Help Center - NRPS - PRMG Income Calculation Help. The Work Number Employer Locator; Tax Transcript Flow Chart - 2019; Income Calculation Help Videos; Loan Beam; Income Calculation Worksheet Help Guide; Income Calculation Worksheet; Checklists and Guides. Flood Certificate - Order from Borrower Summary Screen; FHA Connection Instructions; HOA CONDO/PUD Best Practices ...

XLS Guaranteed Loan Worksheets - Farm Service Agency * If a payment in Worksheet Three is to be amortized, you can enter the amortization formula in the total column. Annual Cash Oper. Exp. Divided by Gross Income = Operating Ratio The formula is +@PMT(Principal,Interest,Term). For example a $100000 loan amortized over 7 years at 10% would be entered as OTHER Net Income Divided by Total Assets

PDF Usda Rental Income Worksheet Job Aid USDA RENTAL INCOME WORKSHEET JOB AID Wholesale Lending For calculations to be correct, enter the monthly amount (not the annual amount) for each of these fields. (16-18) 16. Taxes Enter the Property Tax amount for the REO as verified by documentation provided, not the tax return. If the documentation

XLSX USDA Rural Development 0 0. 0 0. 0 0. 0 0. 0 0. 0 0 0. 0 0. 0 0. 0 0. 0. 0. 0 0. 0 0 0. 0 0. 0 0. 0. 0 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0. 0 0. 0 0 0 0. 365. 365. 365. 0. 0. 0. 0 0. 0 ...

0 Response to "38 usda income calculation worksheet"

Post a Comment