38 flight attendant tax deductions worksheet

Flight Crew Expense Report and Per Diem Information We need both to prepare your tax returns. Please use this form to detail your flight attendant and pilot tax deductions. Therefore we have created an Overnights Worksheet so you can summarize your schedule. Please download it at- Don t forget about our free online per diem calculator on our website! The Epic Cheat Sheet to Deductions for Self-Employed Rockstars LISTEN TO YOUR TAX PROFESSIONAL (yes, I am yelling that one). Your tax person knows best. Special uniforms you are required to wear (flight attendant outfit or the Hot Dog on a Stick This post has a super helpful worksheet that helps you create your own Deduction Roadmap.

Defining the Per Diem Deduction | EZPERDIEM.COM Per Diem Deduction is not a term that pilots and flight attendants will find in the tax code, yet this term describes a very lucrative tax write-off for pilots and flight attendants. The phrase per diem deduction can also be a bit confusing because it sounds like per diem is being deducted.

Flight attendant tax deductions worksheet

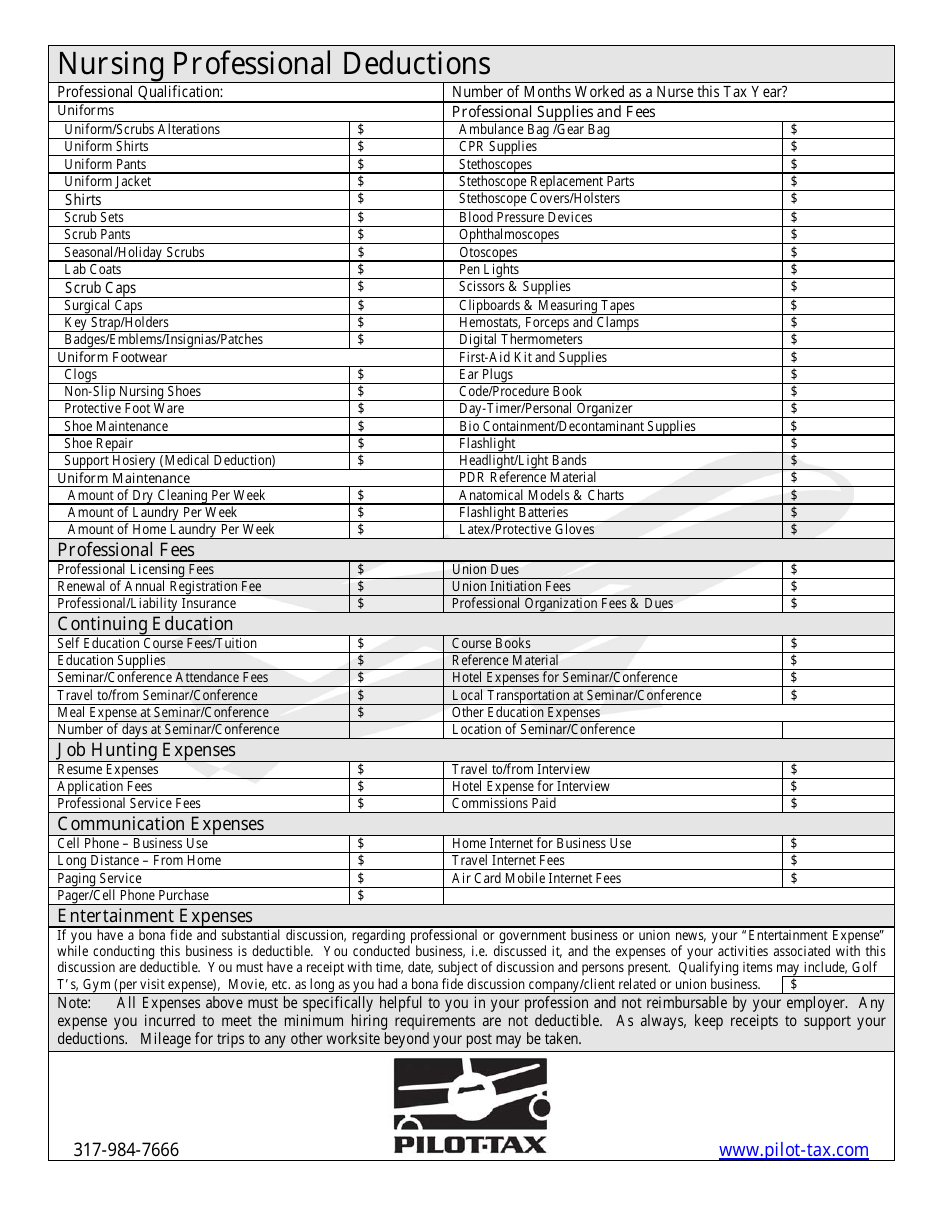

The List: Tax Deductions for In-Flight Staff Cabin crew tax deductions that do not sit within reasonable boundaries for your profession are likely to set off alarm bells at the ATO, who are clamping down strongly on fake or inflated tax deductions. David is a Brisbane based flight attendant who works for a large airline flying out of Brisbane airport. Flight Attendant Professional Deductions - Diamond Financial Flight Attendant Professional Deductions Proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) Do not provide these to Diamond Financial; keep them for your records. All expenses below must be specifically for business use and not reimbursed by employer. Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ...

Flight attendant tax deductions worksheet. Tax Deductions List for Flight Crew - Page 2 - Airline Pilot Central... The Tax Court has recently ruled on a case that was filed in April of 2010. In that trial, a Flight Attendant for Continental Airlines Watson CPA Group- Airline Pilot Taxes, Flight Attendant Tax Deductions, Flight Crew Tax, Pilot Tax Deductions. PROFESSIONAL DEDUCTIONS - Pilot-Tax If you are a flight attendant and update your resume or fly to an interview, these expenses are deductible. If you do the same for another position outside of the industry, such as a retail position or professional job, these expenses may not be taken as a deduction. List of Flight Attendant Tax Deductions | Sapling The federal government doesn't offer a list of tax deductions specifically for flight attendants. One issue to be aware of is that flight attendant expenses are only deductible if you report them on Schedule A with your other itemized deductions. Home Office Deduction Worksheet (Excel) | Free Tax Tools Our sheet simplifies everything for you so you can be organized for tax season. Our worksheet assumes that you will be filing using the actual expense method because the simplified method bases the size of the home office deduction on the amount of space in your home that you are using as an...

Flight Attendant Tax Guide | PDF | Tax Deduction | Payroll Flight Attendant Tax Guide. Original Title: FlightAttendantTaxGuide.pdf. Thus, in 1990, I started Flightax, Income Tax Returns for Flight Attendants. 6 Computer & Related Expenses This guide has been designed to help you understand the deductions 7 Travel & Safety Items that you have a legal... Small Business Tax Deductions Worksheet (Part 1) Tax deductions can save you money on your tax return but how exactly do they work? When you take a tax deduction, what you're essentially doing is exempting a certain part of your income from taxation. Your actual tax savings will depend on your effective tax rate. Pilot & Flight Crew Tax Preparation | Flight Attendant Tax Returns Flight crew tax preparation including tax returns for pilots and flight attendants. Contact aviation CPA Mark E. Feinsot, CPA today for a free consultation. When you consult a tax preparer that knows the aviation industry like Mark E. Feinsot, CPA, you'll take advantage of all possible deductions and will... Aircrew Taxes Flight Attendant Worksheet Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer Married Pilots – If both you and your spouse fly, use an additional Professional Deduction ...

PDF Work-related daily travel expenses you can claim Flight attendants - claiming work-related expenses. This guide will help you work out what work-related expenses you can claim a tax deduction for and the conditions you must meet before you can claim if you are a flight attendant or cabin crew member. Tax Deductions for Flight Attendants | National Tax & Accounting The most common work-related tax deductions for flight attendants and airline employees are summarised in a basic table below We have a number of clients who are flight attendants and who are in the airline industry and are confident we can optimise your work-related deduction claims… PDF Airline Professional - Tax Deduction Worksheet.xls Tax Deduction Worksheet For. Pilots, Flight Attendants, & Other Airline Personnel. I understand this worksheet provides a way for me to organize my deduction information only. Whether or not an item is listed on this worksheet is not necessarily an indicator of whether or not an item is deductible. 25 examples! What can flight crews write off? Why or why not? Here are 25 examples of flight crew tax deductions that flight crews might or might not be able to deduct from their taxes. Expense example 2: A flight attendant interviews for a job at a different airline. She already works as a flight attendant. Yes. This passes all 4 tests.

Flight Crew Expense Report - Blue Skies Tax Service Blue Skies Tax Service uses a duty day percentage based on your flight schedule to determine the job use portion of these expenses. Therefore, please enter the ANNUAL amounts for Service Charges and Internet Connection. We also discount it a bit for multiple phones, but give you the bulk of the expense...

Tax Deduction List tax deductions itemized cheat sheet deduction worksheet estate business agent spreadsheet realtor agents expense commission title federal advertising excel printable. Flight Attendant Tax Deductions Worksheet - Worksheet List.

PDF Microsoft Word - 2013 Aircrew Taxes Flight Attendant Organizer I have retained Aircrew Taxes to prepare my 2013 Income Tax returns. I hereby verify that the information provided in this Organizer is accurate and complete. Aircrew taxes (770) 884-7565 fax (770) 795-9799 . Flight Attendant Professional Deductions.

Everything You Need to Know About Flight Attendant Tax Deductions Flight Attendant Tax Deductions - Out of Pocket Expenses… Virtually everyone in the corporate world will incur costs associated with their profession. In most cases, those expenses that blur the line between personal and professional tend to fall into the "let's not try this" zone.

PDF Clothing and grooming expenses | flight attendant flight attendant, it pays to learn what you can claim at tax time. You can claim a deduction for travel expenses if you are required to travel overnight to perform your work duties. 'Overnight' can be taken to mean a mandatory rest break after being on duty and before recommencing duty, that is of sufficient...

tax deductions for flight attendants - Personal Tax Specialists If you work as a flight attendant, some of the tax deductions you may be able to claim on your personal tax return are: Meal and Travel. The cost of buying meals when you work overtime, provided you have been paid an allowance by your employer (you can claim for your meals without having to...

Self-Employed Tax Deductions Worksheet (Download FREE) User our free self-employed tax deductions worksheet to record/track all your expenses and cut down your tax bill. The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free.

As a Flight Attendant, covered under transportation workers, what all... Tax reform center. Tax Refund Advance. Deluxe to maximize tax deductions. Premier investment & rental property taxes. Self-employed taxes.

Tax Deductibles For Flight Attendants - Seafarer Tax Refunds - Claim... How do flight attendants claim UK tax refund? If you're a flight attendant and working in different countries, then it's important to know what you can claim back on tax, meaning you It is important to note that there are rules that must be satisfied, so you can claim from these tax deductions.

Tricky tax questions for a flight attendant : personalfinance I am a flight attendant "living" in Florida. However, I work for Delta, and they are based out of Georgia and ATL is my base. Do I have to file a Georgia I get per diem in different states and foreign cities I land in and it comes at different rates, should I go to a professional or file my tax return with turbo tax?

42 airline pilot tax deduction worksheet - Worksheet Was Here Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications...

Tax Deductions for Flight Attendants - Tax Focus... | Tax Focus Flight attendants may also be entitled to general tax deductions that are not work specific, such as investment deductions or car expense deductions. Tax Focus is a Registered Tax Agent and Certified Public Chartered Accountant. With over 20 years of combined tax experience our tax agents are...

About Schedule A (Form 1040), Itemized Deductions | Internal... Coronavirus Tax Relief. Get Your Tax Record. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

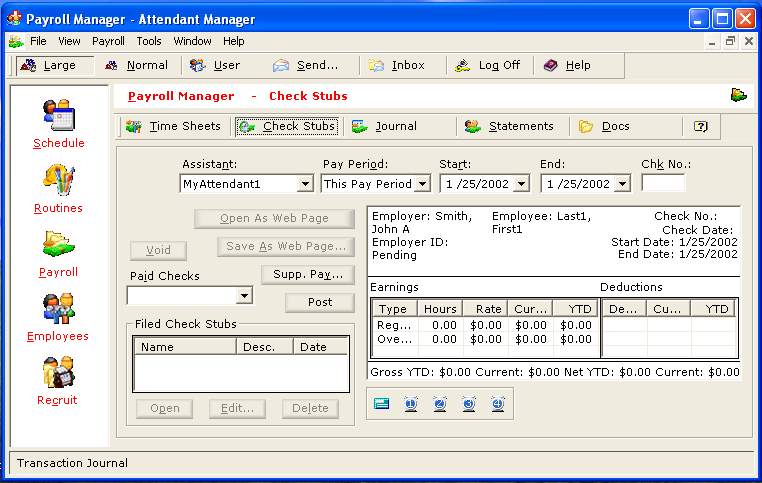

Downloadable, Free Payroll Deductions Worksheet... - Bright Hub The FICA tax deductions are automatically generated by simply typing in the employee's gross salaries, while withholding taxes are based on the Find a free downloadable payroll deductions worksheet in Bright Hub's Media Gallery. We recommend it for small businesses or for those whose...

Flight Crew Expense Report and Per Diem Information There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns. Please use this form to detail your flight attendant and pilot tax deductions.

Flight attendants and cabin crew | Tax Accountant Fees TAX DEDUCTIONS. Work related uniforms, protective clothing and laundry. Laundry: You may claim up to $150 without receipts. Stockings: Many flight attendants buy 50 pairs of stockings @ over $10 a pair = $500 per year. These receipts are hard to keep, especially if purchased with groceries.

Airline Professional - Tax Deduction Worksheet Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ...

Flight Attendant Professional Deductions - Diamond Financial Flight Attendant Professional Deductions Proofs of expenses are required (receipts, credit or debit card statements, paystubs, etc.) Do not provide these to Diamond Financial; keep them for your records. All expenses below must be specifically for business use and not reimbursed by employer.

The List: Tax Deductions for In-Flight Staff Cabin crew tax deductions that do not sit within reasonable boundaries for your profession are likely to set off alarm bells at the ATO, who are clamping down strongly on fake or inflated tax deductions. David is a Brisbane based flight attendant who works for a large airline flying out of Brisbane airport.

0 Response to "38 flight attendant tax deductions worksheet"

Post a Comment