36 itemized deductions worksheet 2015

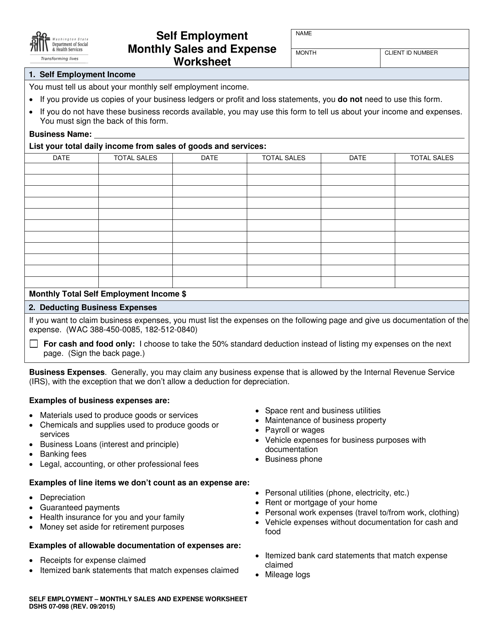

PDF Iowa Department of Revenue 2015 IA 104 This worksheet computes the amount of itemized deductions to enter on line 26 of the IA Schedule A. Step 1 Complete the IA Schedule A, lines 1-25. Step 2 Re-compute the federal Itemized Deduction Worksheet: 1. Enter the sum of lines 3, 8, 13, 17, 18, 24, and 25 from the IA Schedule A .................1. 2. PDF Itemized Deductions - IRS tax forms Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to:

Self-employed health insurance deduction - healthinsurance.org 16/12/2021 · Self-employment and entrepreneurship are a dream for many people, and Obamacare has made that option easier to pursue, thanks to guaranteed-issue coverage, premium subsidies, and Medicaid expansion.For entrepreneurs who don’t have access to a spouse’s group health insurance plan, being self-employed usually means purchasing a policy …

Itemized deductions worksheet 2015

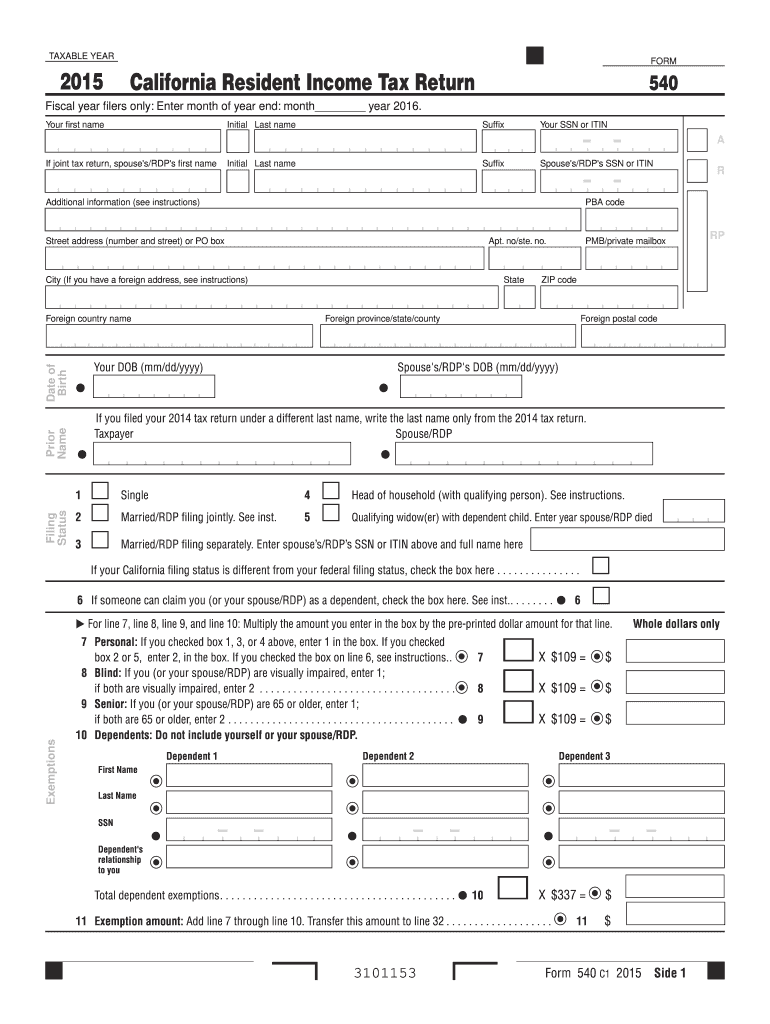

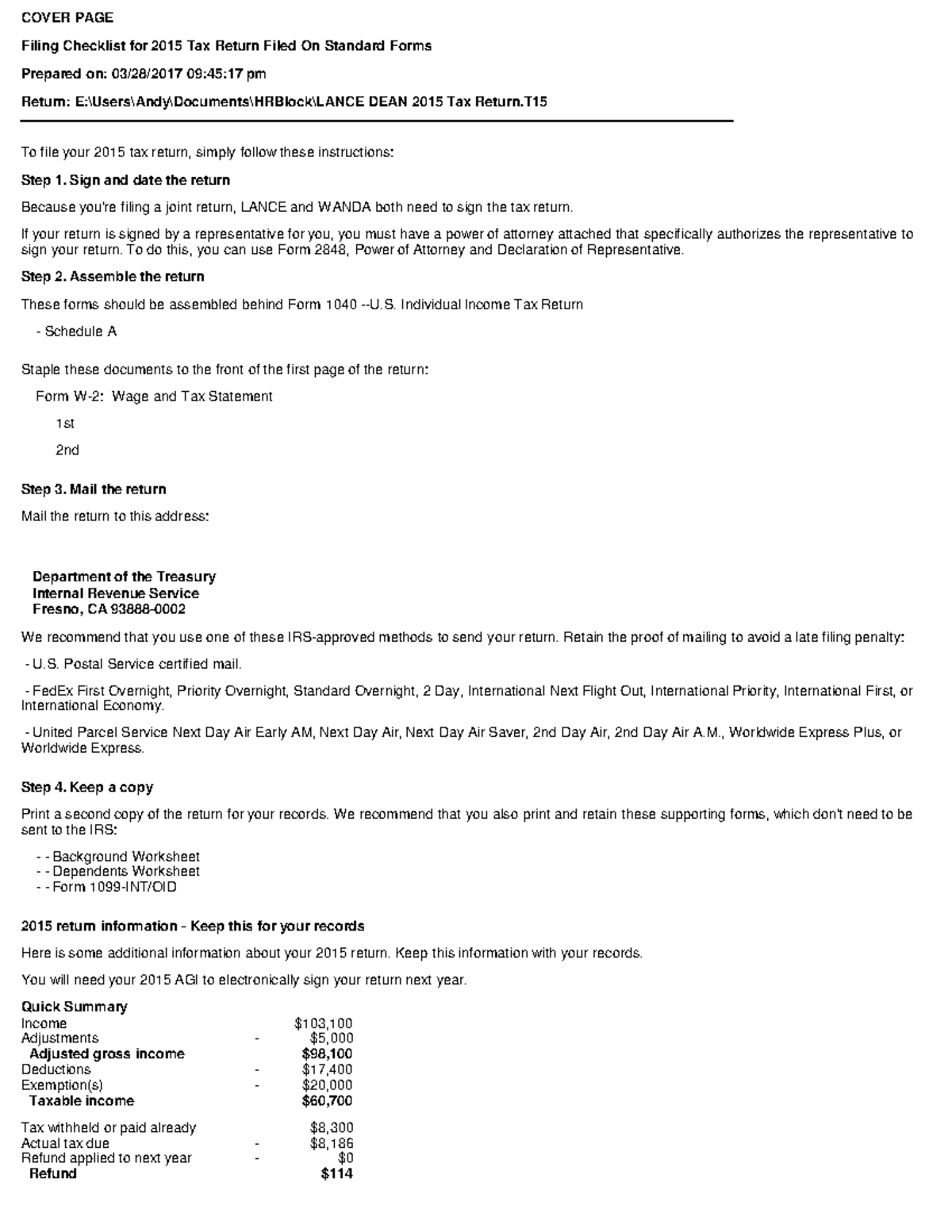

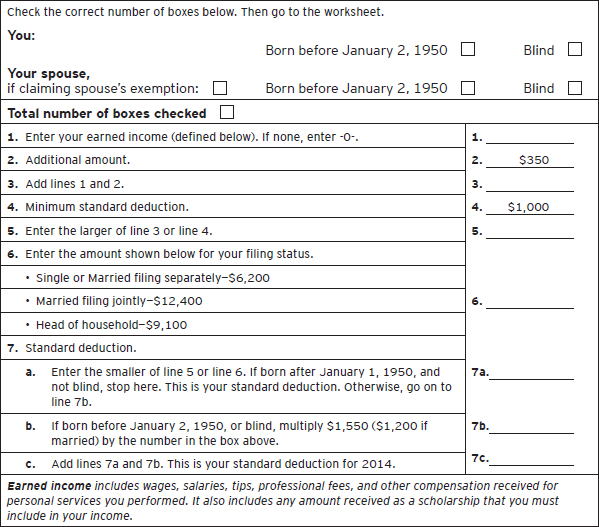

PDF 2015 Itemized Deductions Worksheet 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses. Itemized Deductions Worksheet Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return. PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

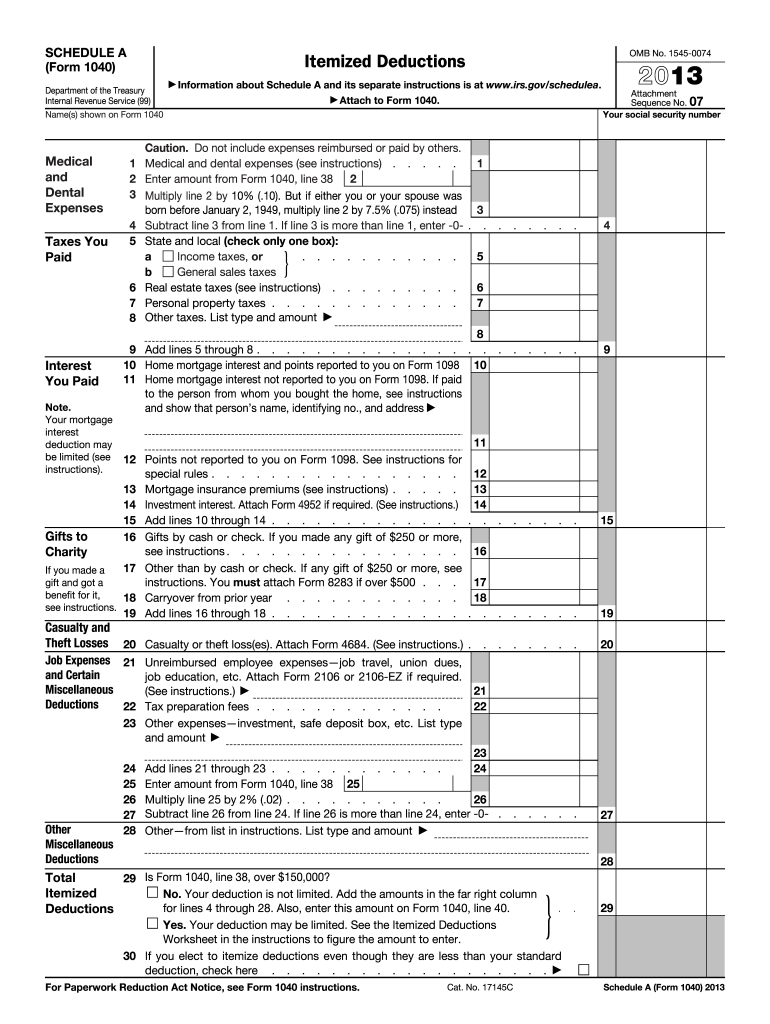

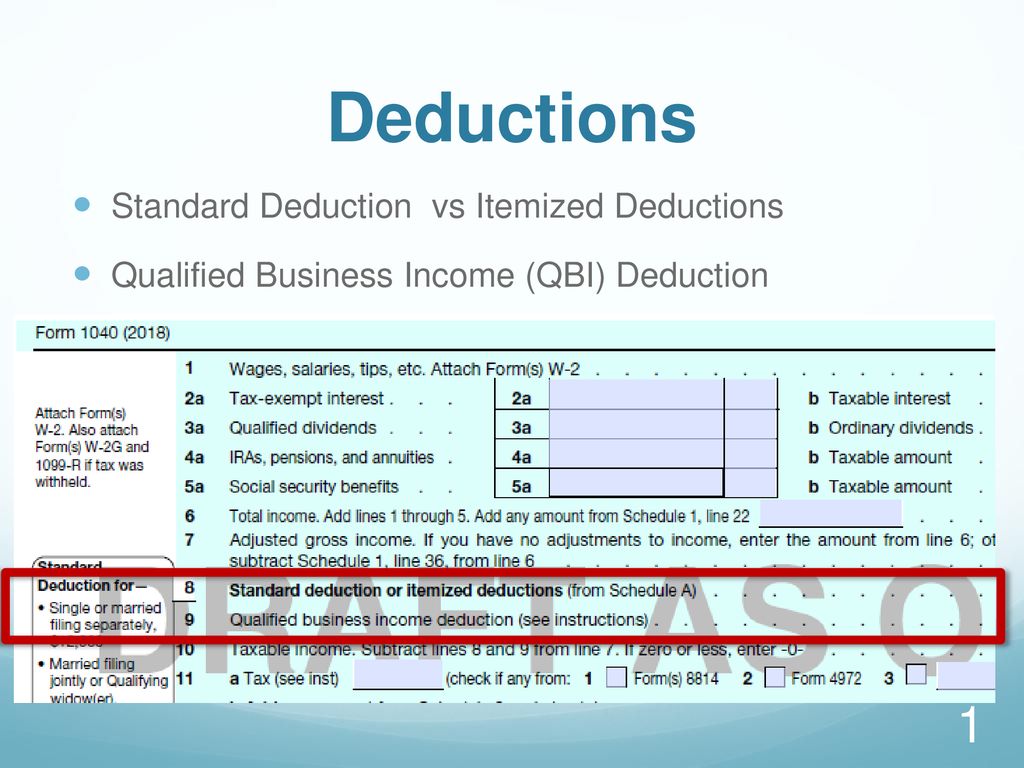

Itemized deductions worksheet 2015. PDF Attach to Form 1040. Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ... PDF Itemized Deductions - IRS tax forms Itemized Deductions: Itemized deductions allow taxpayers to reduce their taxable income based on specific personal expenses. If the total itemized deductions are greater than the standard deduction, it will result in a lower taxable income and lower tax. Standard Deduction: An amount provided by law and based on filing status, age, blindness, and PDF 2015 Publication 536 - IRS tax forms Deductions for contributions to an IRA or a self-employed retirement plan, Health savings account deduction, Archer medical savings account deduc-tion, Most itemized deductions (except for casualty and theft losses, state income tax on trade and business income, and any employee business expenses), and The standard deduction. PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance

How does the deduction for state and local taxes work ... Virtually all who itemized claimed a deduction for state and local taxes paid. High-income households were more likely than low- or moderate-income households to benefit from the SALT deduction. The amount of state and local taxes paid, the probability that taxpayers itemize deductions, and the reduction in federal income taxes for each dollar of state and local taxes … PDF 2021 Schedule A (Form 1040) - IRS tax forms Itemized Deductions . 16. Other—from list in instructions. List type and amount . 2021 Instructions for Schedule A - IRS tax forms 2021 Instructions for Schedule AItemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses, and amounts you paid for certain taxes, interest, … Itemized Deductions Checklist - Affordable Tax Itemized Deductions Checklist Medical Expenses Medical expenses are generally deductible if they exceed 10% of your income or 7.5% of your income if you are over the age of 65. Some common medical expenses: Doctor/Dentist Fees Drug/Alcohol Treatment Cost of Guide Dogs Handicap Access Devices for Disabled Hospital Fees

42 itemized deduction worksheet 2015 - Worksheet Was Here The Standard Mileage Rate for operating expenses of a vehicle for medical reasons is 23 cents per mile. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. The amounts will be reported on the Schedule KPI KS or KF you received from the entity. 42 itemized deductions worksheet 2015 - Worksheet Information Itemized deductions worksheet 2015. 2015 Instructions for Schedule A (Form 1040) - Internal ... Jan 11, 2016 — In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you ... IT-203-D - Tax.ny.gov Itemized Deduction Schedule. IT-203-D. Submit this form with Form IT-203. Publication 529 (12/2020), Miscellaneous Deductions ... Miscellaneous itemized deductions are those deductions that would have been subject to the 2%-of-adjusted-gross-income (AGI) limitation. You can still claim certain expenses as itemized deductions on Schedule A (Form 1040), Schedule A (1040-NR), or as an adjustment to income on Form 1040 or 1040-SR. This publication covers the following topics. PDF 2015 737 Worksheet -- California RDP Adjustments Worksheet ... There are other itemized deductions that are also subject to the 2% limitation rule and some itemized deductions are subject to an overall limitation rule . Get federal Publication 17, Your Federal Income Tax, Part Five, Standard Deduction and Itemized Deductions . ... 2015 737 Worksheet -- California RDP Adjustments Worksheet Recalculated ...

IRS Federal Standard Tax Deductions For 2021 and 2022 17/01/2022 · IRS Standard Tax Deductions 2021, 2022. by Annie Spratt. These standard deductions will be applied by tax year for your IRS and state return(s) respectively. As a result of the latest tax reform, the standard deductions have increased significantly, however many other deductions got discontinued as a result of the same tax reform. If all this reading is not for …

PDF Deductions (Form 1040) Itemized - IRS tax forms 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

PDF Itemized Deduction Worksheet TAX YEAR - Maceyko Tax Itemized Deduction Worksheet Medical Expenses. Must exceed 7.5% of income to be a benefit. Include cost for dependents-do not include any expenses that were reimbursed by insurance Dentists $ Hospitals $ Doctors $ Insurance $ Equipment $ Prescriptions $ Eyeglasses $ Other $ Medical Miles _____

PDF Schedule A - Itemized Deductions - IRS tax forms Schedule A - Itemized Deductions (continued) Select for mortgage interest reported on Form 1098. Enter amount from Form 1098F, box 1 (and box 2, if applicable). See Tab EXT, Legislative Extenders for Private Mortgage Insurance (if extended) Note: The deduction for home equity debt is dis-allowed as a mortgage interest deduction unless

Oklahoma Tax Rates, Standard Deductions, and Forms. Other Standard Deductions by State: Compare State Standard Deduction Amounts IRS Standard Deduction: Federal Standard Deductions Oklahoma Income Tax Forms. Oklahoma State Income Tax Forms for Tax Year 2021 (Jan. 1 - Dec. 31, 2021) can be e-Filed in conjunction with a IRS Income Tax Return.

Prior Year Products - IRS tax forms

pdfFiller - Fill Online, Printable, Fillable, Blank Itemized Donation List Printable is not the form you're looking for? Search for another form here. Search. Comments and Help with salvation army donations. In addition, no liability or responsibility is accepted for the information on this worksheet. We make no warranty that the value used will match the value recorded on a tax return. The reader is solely responsible for …

About Schedule A (Form 1040), Itemized Deductions ... About Schedule A (Form 1040), Itemized Deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

PDF 2015 Instructions for Form 6251 - IRS tax forms AMT tax brackets. For 2015, the 26% tax rate applies to the first $185,400 ($92,700 if married filing separately) of taxable excess (the amount on line 30). This change is reflected in lines 31, 42, and 63. Limit on itemized deductions. You cannot deduct all of your itemized deductions for regular tax purposes if your adjusted gross income is more

PDF 2015 SCHEDULE CA (540) California Adjustments - Residents Schedule CA (540) 2015 Side 1 TAXABLE YEAR 2015 California Adjustments — Residents SCHEDULE CA (540) Important: Attach this schedule behind Form 540, Side 5 as a supporting California schedule. Name(s) as shown on tax return. SSN or ITIN. Part I. Income Adjustment Schedule Section A - Income. A

Itemized Deductions Worksheet Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return.

PDF 2015 Itemized Deductions Worksheet 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses.

0 Response to "36 itemized deductions worksheet 2015"

Post a Comment