39 Self Employed Expenses Worksheet

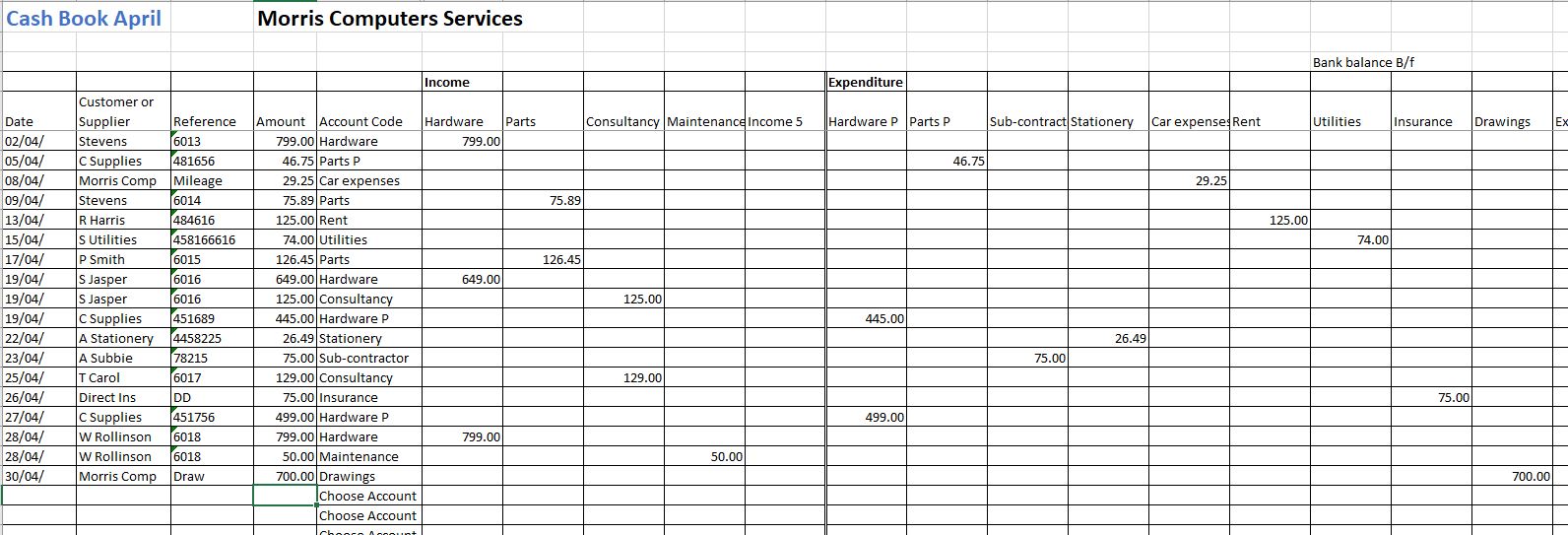

Self-Employed Business Expenses Worksheet and print it out.... Worksheet for Self Employed YTD Income and Expenses 1, WORKSHEET FOR SELF EMPLOYED YEAR -TO-DATE INCOME AND EXPENSES. self-employed business expenses worksheet. The management of the income and the expenses that are to be managed and kept records of in the... Self Employment Expenses Worksheet | TUTORE.ORG - Master of... Self Employment Expenses Worksheet. printable recipes for dinner printable free newspaper template printable hockey puck stickers printable letter worksheets for preschoolers Self Employed Expenses Spreadsheet Using Excel Spreadsheets. Save Image. Home Office Tax Expenses.

LLC Income & Expense Tracking (& the difference from...) - YouTube LLC Income & Expense Tracking (& the difference from being self-employed) [Worksheet #1 V3].

Self employed expenses worksheet

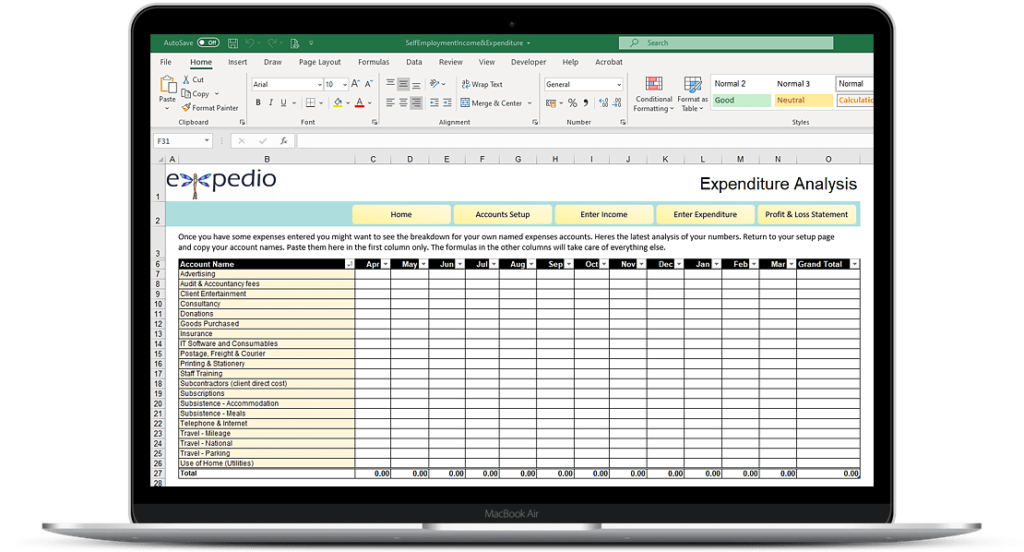

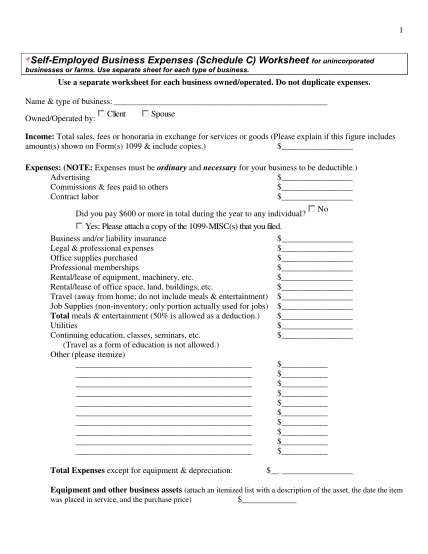

PDF SPECIALTY WORKSHEET for the SELF-EMPLOYED In order to maximi Transportation Expenses. Dues - Professional Socielies. The above expenses are ordinary and necessary in my line of work as a self-employed person. PDF Self-Employed Business Expenses (Schedule C) Worksheet for... Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Business and/or liability insurance Legal & professional expenses Office supplies purchased Professional memberships Rental/lease of equipment, machinery, etc. Self Employed Expense Worksheet - Nidecmege Self Employed Expense Worksheet. Written By Tri Margareta Tuesday, April 23, 2019 Add Comment Edit. A lender may use fannie mae rental income Free Income And Expense Report Template Self Employed Spreadsheet. If you made the deduction on schedule c or made and deducted more than...

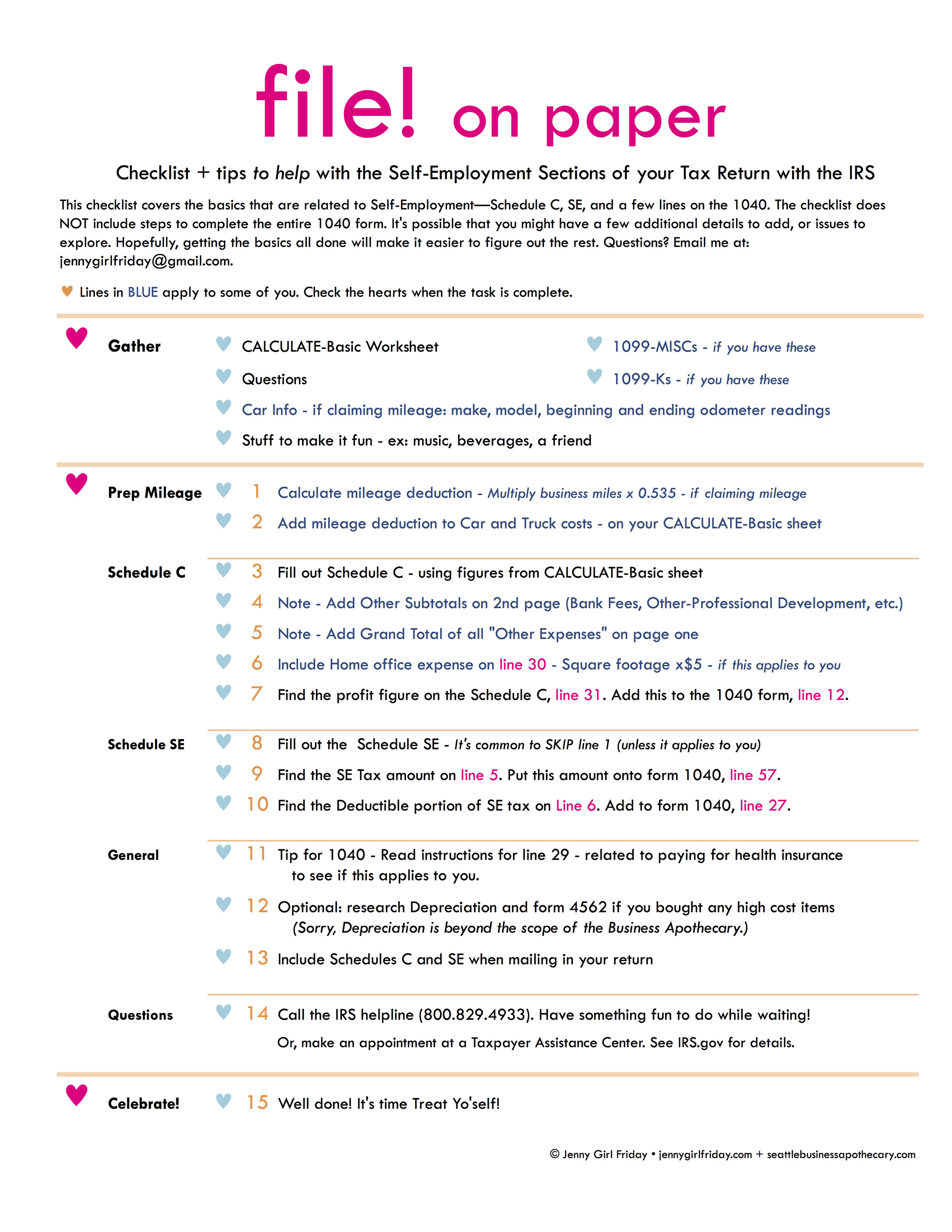

Self employed expenses worksheet. PDF (Schedule C) Self-Employed Business Expenses Worksheet for .. Self employed Health Insurance Deduction. Self-Employed End-of-Year Taxes Intro [Worksheet #3 V1]. Rose Tax & Financial Self Employed Worksheet Therefore, the signNow web application is a must-have for completing and signing self employed business expenses worksheet on the go. Self Employed Expenses Pdf Self Employed Expenses Pdf! study focus room education degrees, courses structure, learning courses. 1 day ago (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Schedule C and expense categories in QuickBooks Self-Employed Learn about Schedule C categories and how to categorize transactions in QuickBooks. If you're self-employed, you use a Schedule C form to report your self-employed income and expenses. It's also known as Form 1040. Tax Deductions for Independent Contractors & Self-Employed in 2022 Independent contractors and many self-employed often work from their home offices. As this is considered a place of business, you could write off a portion of your mortgage interest, rent, real estate or property taxes, security system, and homeowner's land insurance expenses related to a dedicated...

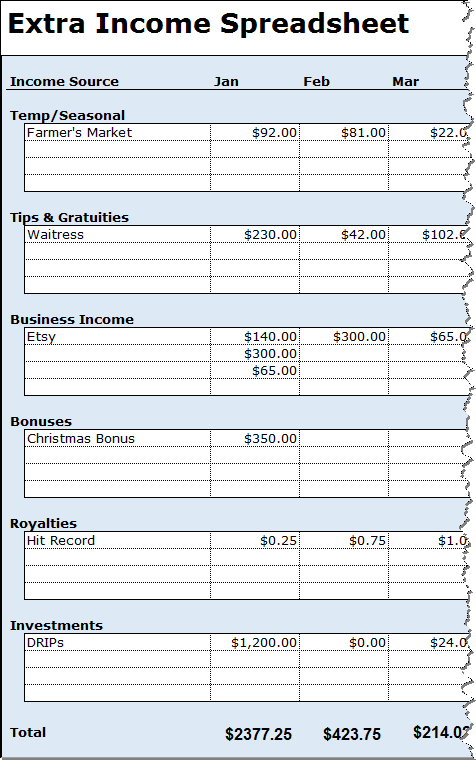

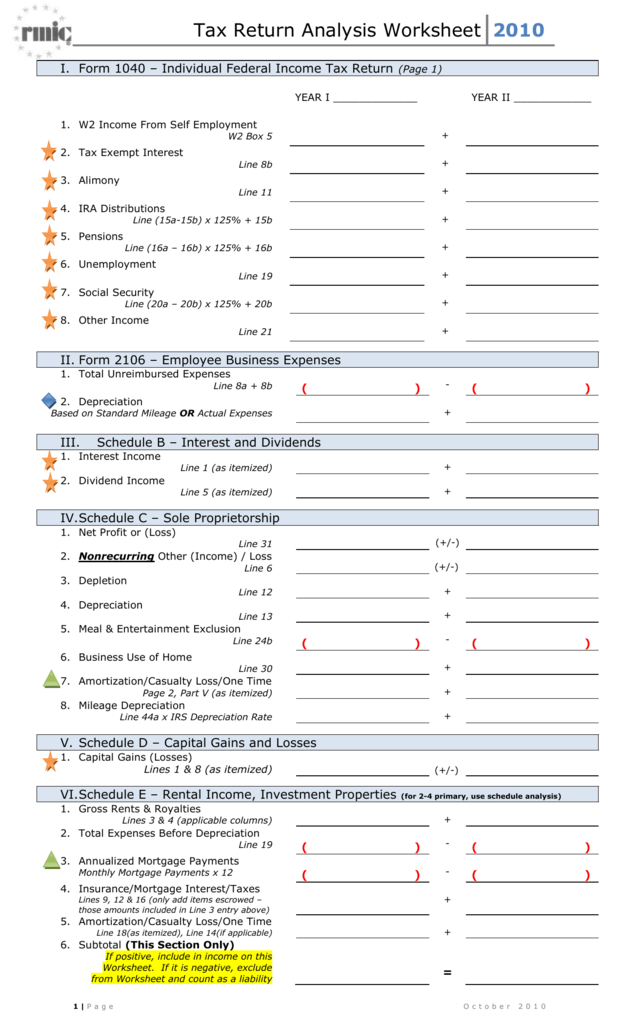

Income and Expense Tracking Worksheet Income and Expense Worksheet. for Excel, Google Sheets, or PDF. This worksheet can be the first step in your journey to control your personal finances. Step 1: Track your Income and Expenses. Step 2: Use that information to create a budget. PDF FNMA_Self-Employed_Income.doc FNMA Self-Employed Income Calculations. EVALUATING PARTNERSHIP TAX RETURNS The Self-Employed Income Analysis (Form 1084A or 1084B) should be used to determine the borrower's share of the partnership's adjusted business income that will be available for qualifying the borrower... 15 Tax Deductions and Benefits for the Self-Employed Self-Employment Tax. Self Employed Contributions Act (SECA). Tax Deductions and Benefits. The self-employment tax refers to the Medicare and Social Security taxes that self-employed people In addition to the office space itself, the expenses that you can deduct for your home office include the... Publication 535 (2020), Business Expenses | Internal Revenue Service Self-Employed Health Insurance Deduction Worksheet. Chronically ill individual. Benefits received. Small Business and Self-Employed (SB/SE) tax center. A-Z index for business. Requirements for filing.

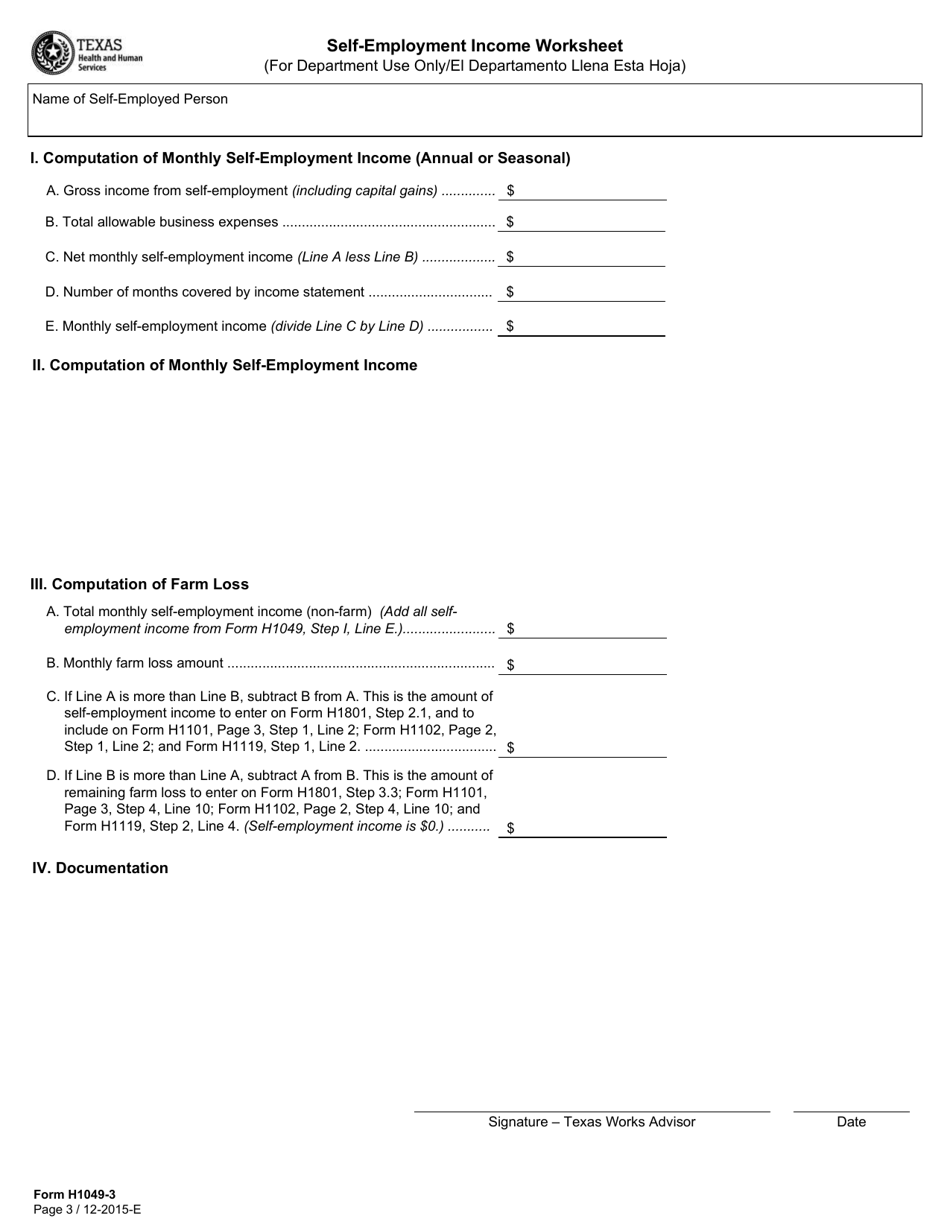

Expenses if you're self-employed - GOV.UK If you're self-employed, your business will have various running costs. You can deduct some of these costs to work out your taxable profit as long as they're allowable expenses. Allowable expenses do not include money taken from your business to pay for private purchases. Self-Employment Income Worksheet For Medicaid Fannie Mae Self Employed Worksheet — db-excel.com. 35 Self Employed Expenses Worksheet - Worksheet Resource Plans. 35 Self Employed Expense Worksheet - Free Worksheet Spreadsheet. Self-Employment Ledger: 40 FREE Templates & Examples. Deductions: employee and self-employed expenses | Quizlet self-employment persons must pay BOTH employer and employee portions of FICA and unemployment taxes. expenses while "away from tax home" at least OVERNIGHT on business. includes transportation, lodging, meals, and miscellaneous expenses. "tax home" generally means... Self Employment Expenses Worksheet - Escolagersonalvesgui Self employment expenses worksheet. My first year of side hustling i did a good job tracking my income but not so much on expenses. Read about 15 tax deductions and benefits that are available to the self employed worker.

Self Employed Taxes For Dummies: A Foolproof Compliance Guide Self-Employed Taxes for 1099 Contractors. As we mentioned above, being self employed or Filing self employed taxes isn't as straightforward as it is for W2 employees. You need to pay close This worksheet can help you with preparing your Schedule C. Other Self Employed Tax Considerations.

Self Employed Business Expenses Worksheet The related expenditure can be. Self employed business expenses worksheet. (schedule c) current year prior year. There is the worksheet that will involve in it This document allows the self employed worker to keep track of their expenses. Then, read across to the rate under column b. Generally, you...

How to Claim Self Employed Expenses - goselfemployed.co How to claim self-employed expenses, where to enter allowable expenses on your self-assessment & a free expenses list for tax time. There are certain self-employed expenses, that even though you may pay for as a result of working for yourself, you cannot claim against your taxes.

5. Self Employment Monthly Sales and Expense Worksheet 4. Self-Employed Business Expenses Worksheet. 5. Self Employment Monthly Sales and Expense Worksheet. 8. Employee Business Expenses Worksheet Template. 9. Small Business Tax Worksheet Sample.

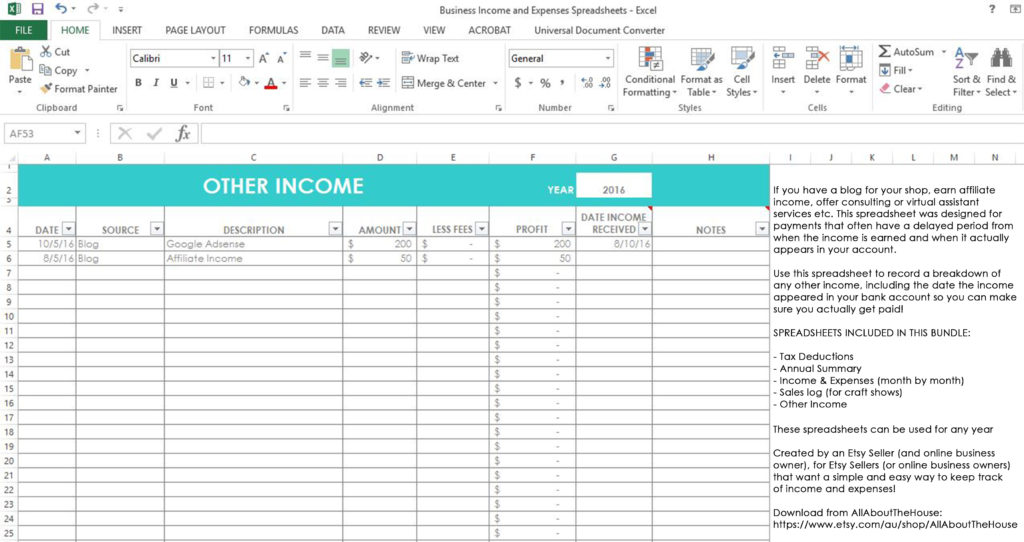

Free expenses spreadsheet for self-employed Get a free self-employed expenses spreadsheet or use Bonsai to track your expenses for free. We've built it to help you get peace of mind and get on with your work. You can also use Bonsai for free to automatically keep track of all your expenses online and be prepared for tax season.

Self employed expenses: what can I claim on tax returns? Self-employed expenses calculator. You need to rely on your tax records when calculating your allowable expenses - the figures will be unique to your business. It's a case of adding up your expenses from your bills and receipts, so it's important that you keep them all, otherwise you might...

PDF Use our SETO (Self-Employed Tax Use this worksheet to record your monthly income and expenses from self-employment. Track gas and vehicle expenses for your budget, but business mileage will be needed for your taxes. Use our SETO (Self-Employed Tax Organizer) to calculate the annual totals (including business mileage)...

IRS Business Expense Categories List [+Free Worksheet] 11. Self-employed health insurance: If you are self-employed, payments made for medical, dental, and qualified long-term care insurance for yourself, your spouse, and your dependents are deductible. The premiums are not deductible on Schedule C like other business expenses, but rather Form 1040...

How to Keep Track of Self-Employed Expenses - Chron.com While deducting business expenses is one of the perks of being self-employed, the Internal Revenue Service places the burden of proving your claimed expenses on you. If you don't have evidence of your claimed expenses, the IRS can disallow your deductions leaving you ...

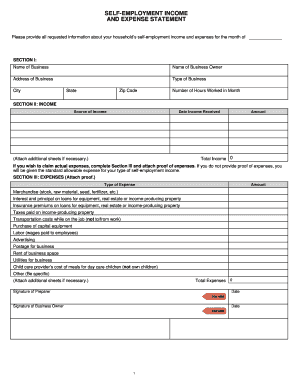

PDF Self Employment Monthly Sales and Expense Worksheet Monthly Total Self Employment Income $. 2. Deducting Business Expenses. If you want to claim business expenses, you must list the expenses on the following page and give us documentation of the expense.

12+ Business Expenses Worksheet in... | Free & Premium Templates self-employed business expenses worksheet. The management of the income and the expenses that are to be managed and kept records of in the Then add on the formulas in the worksheet of the business expenses so that you might keep the record for it. Step 4: Comparing Income to the...

Self Employed Expense Worksheet Excel Details: SELF EMPLOYED INCOME/EXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL I.D. NUMBER Automobile Mileage (Adequate › Get more: Self employed expense sheetShow All. Tax Worksheet for Self-employed, Independent contractors.

Self Employed Expense Worksheet - Nidecmege Self Employed Expense Worksheet. Written By Tri Margareta Tuesday, April 23, 2019 Add Comment Edit. A lender may use fannie mae rental income Free Income And Expense Report Template Self Employed Spreadsheet. If you made the deduction on schedule c or made and deducted more than...

PDF Self-Employed Business Expenses (Schedule C) Worksheet for... Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Business and/or liability insurance Legal & professional expenses Office supplies purchased Professional memberships Rental/lease of equipment, machinery, etc.

PDF SPECIALTY WORKSHEET for the SELF-EMPLOYED In order to maximi Transportation Expenses. Dues - Professional Socielies. The above expenses are ordinary and necessary in my line of work as a self-employed person.

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b7164b3b9866f01727c2_IRS-form-schedule-C.png)

0 Response to "39 Self Employed Expenses Worksheet"

Post a Comment