39 qualified dividends and capital gain tax worksheet

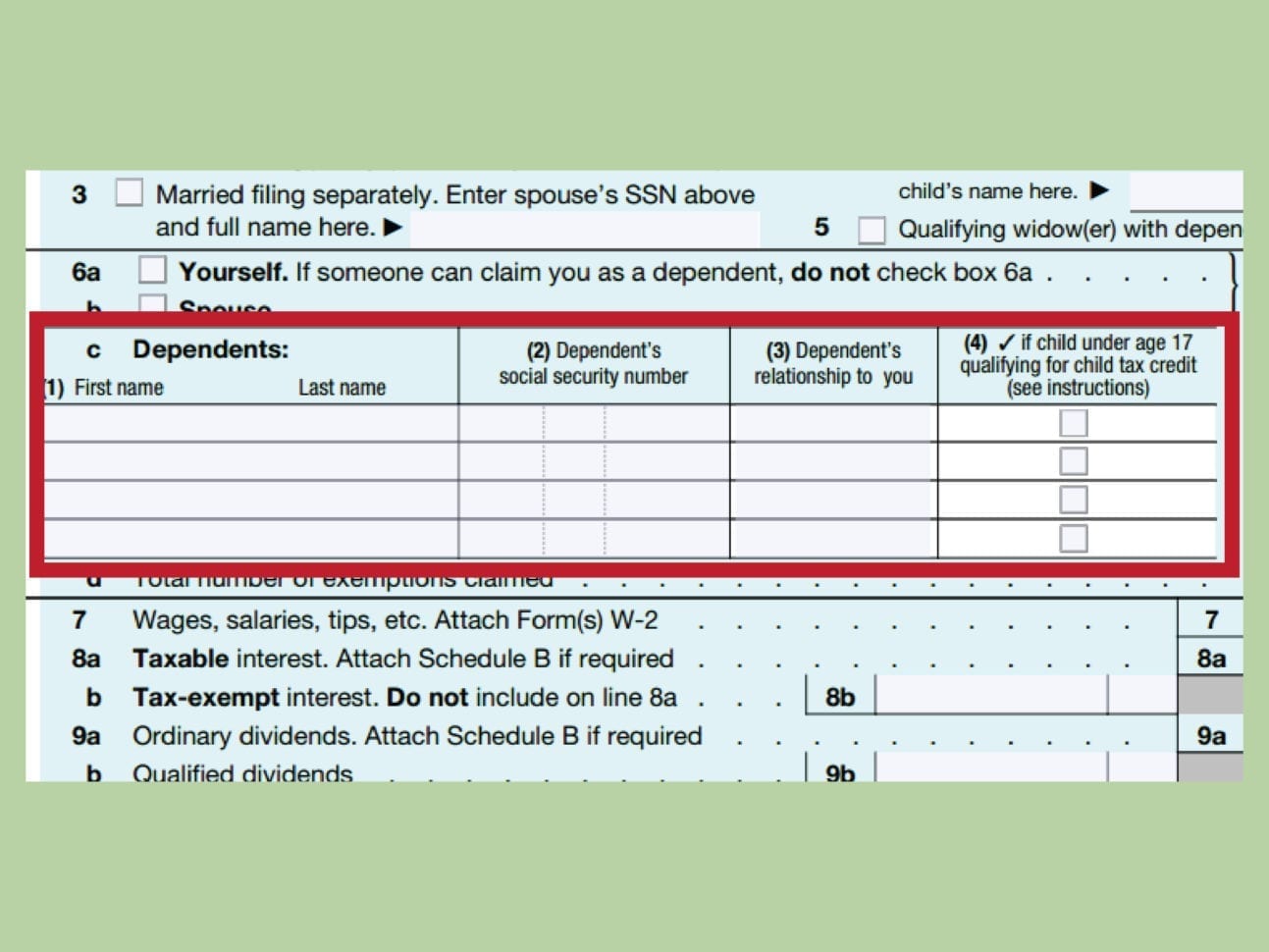

I am struggling to figure out how line 7 (Capital gain or loss) differentiates between short and long term capital gains? Seems to all be lumped together on line 7. And as best I can tell, both the “Qualified Dividends and Capital Gain Tax Worksheet” and the “Tax Computation Worksheet” are both treating the entire amount on line 7 as one. What am I missing?? Some of the worksheets displayed are 2020 form 1041 es, 2020 tax guide, 40 of 117, And losses capital gains, Unsupported calculations and situations in the 2019, 2019 instruction 1040, Tax organizer 2019, Qualified dividends and capital gain tax work 2018.

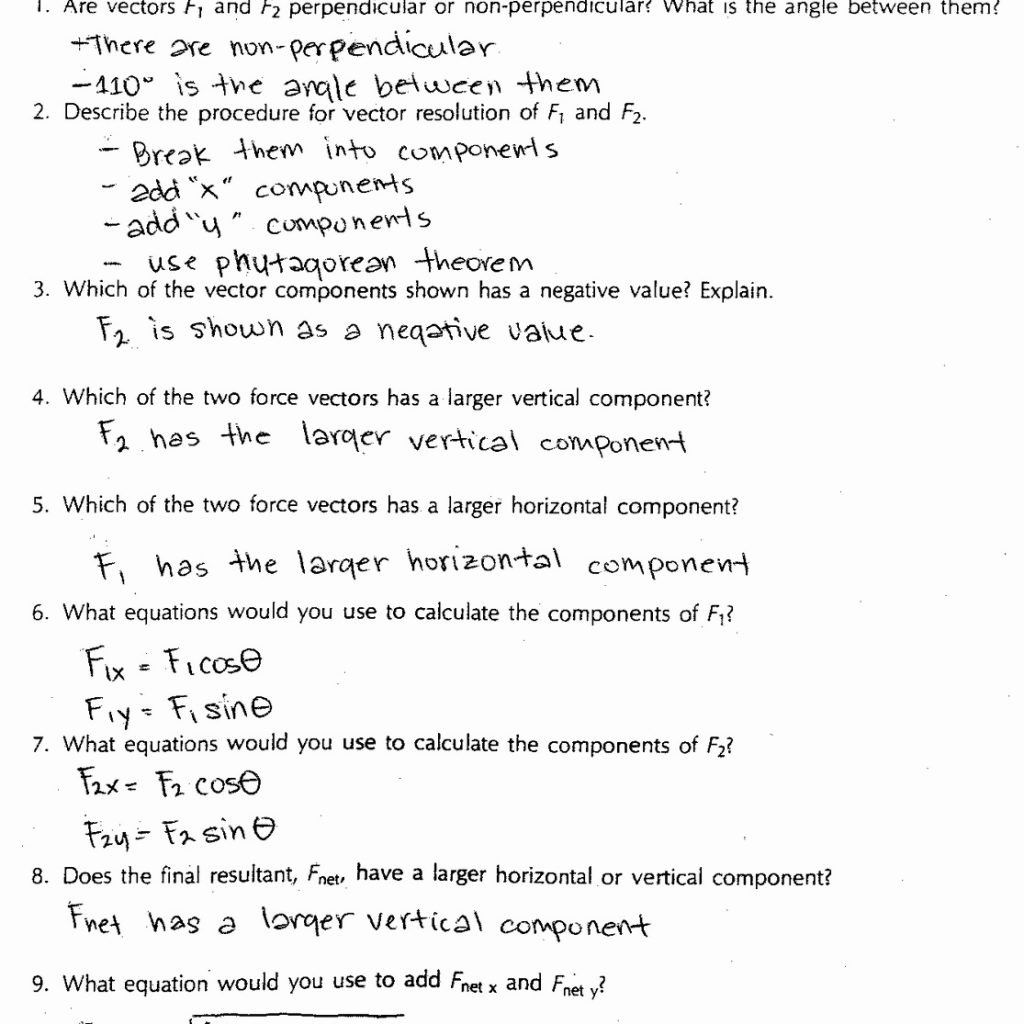

I'm not sure if this is the right subreddit for this or not, but I was directed here. I am in desperate need for some help regarding filling out my Schedule D for my 1040 this year. I'm stuck at Part 3 of Schedule D, line 20. Essentially, I DO have short term gains, and I DO NOT have long term gains. But I also don't have long term losses, I'm literally at neutral $0 for long term. My issue is that, according to instructions, I'm supposed to fill out the "Qualified Dividends and Capital Gains...

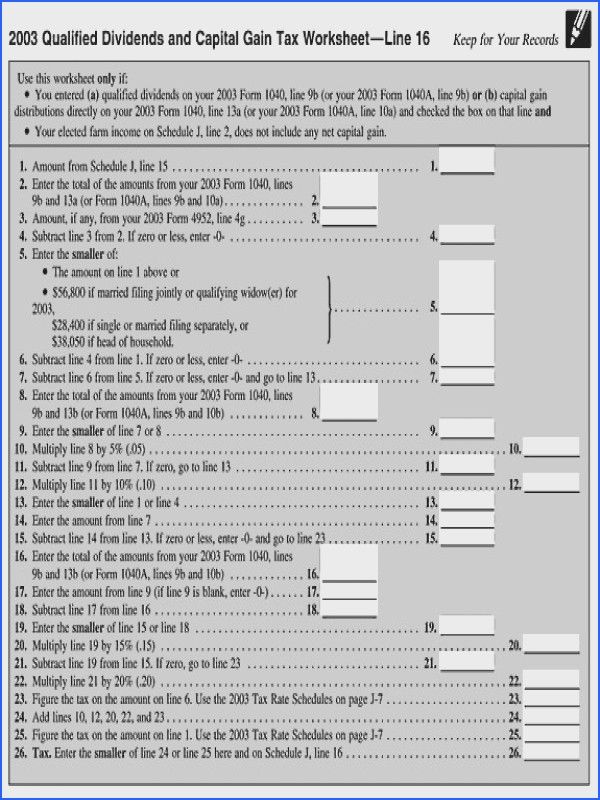

Qualified dividends and capital gain tax worksheet

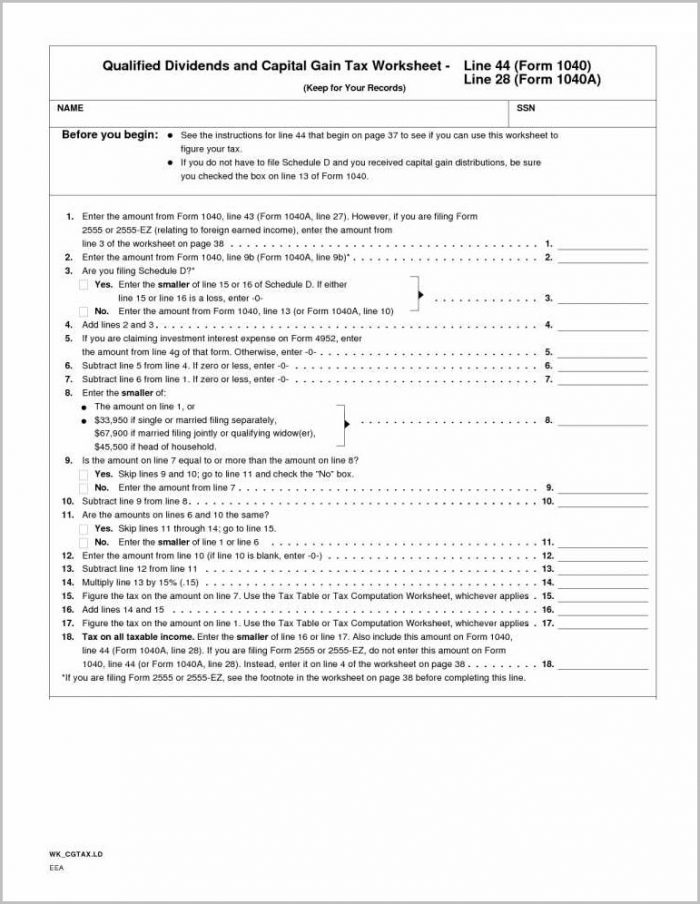

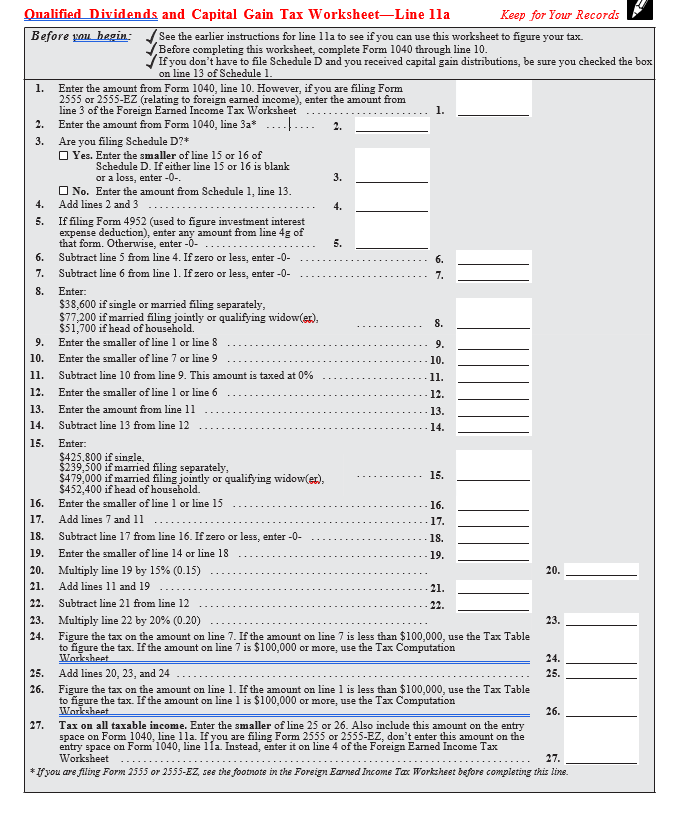

Final Answer. Attached. Qualified Dividends and Capital Gain Tax Worksheet (2018) • See Form 1040 instructions for line 11a to see if you can use this Before completing this worksheet, complete Form 1040 through line 10. • If you do not have to file Schedule D and you received capital gain... Hello! This is my first time preparing my own taxes, as I typically employ a CPA to handle a very complex tax situation (I filed in 13 states last year!) but this year is unusually simple due to the pandemic. I have a mix of long-term and short-term capital gains, and an AGI of 14,245, so by my understanding, my long-term gains should be taxed at 0%. However, I cannot find where I actually subtract that taxable portion from the total tax burden. Am I crazy? I do not find an area on Schedule D,... On Form 1040, line 1 is your salary. Line 3a is qualified dividends. Line 9 adds up your salary, skipping line 3a. Subtract your standard deduction and the new total on line 15 is your taxable income. But then the qualified dividends and capital gain tax worksheet on p31 of the Form 1040 Instructions has you begin with the amount from Form 1040 line 15 and then lines 2 through 4 have you subtract Form 1040 line 3a, even though Form 1040 line 15 never included Form 1040 line 3a. So why does ...

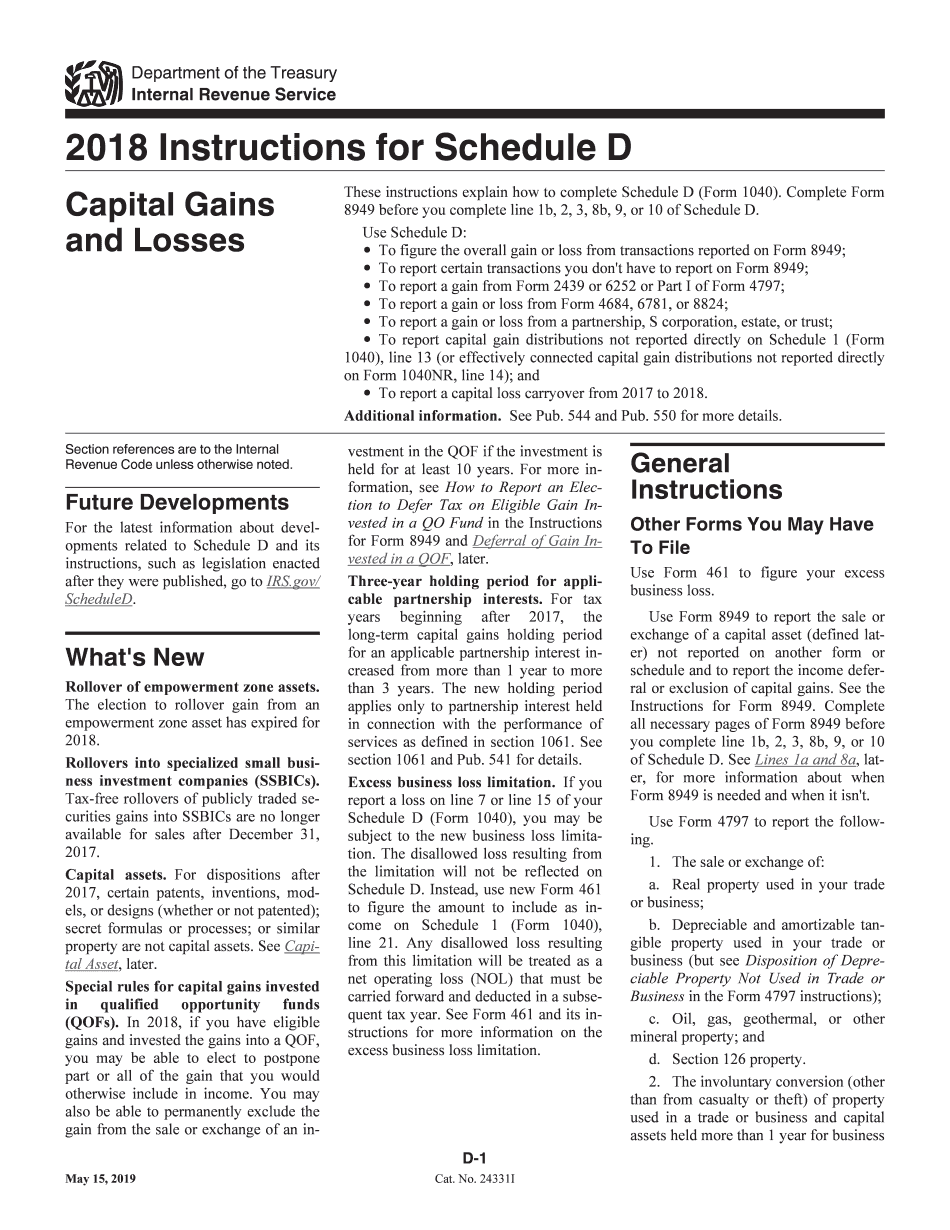

Qualified dividends and capital gain tax worksheet. I am doing these myself, by hand (well, Excel, but not Turbo Tax). Should I just enter the result and not bother showing the worksheet? Is there a proper way to do it? Just print out a little spreadsheet to show the math? Some of them are simple enough to skip, but the Qualified Dividends and Capital Gain Tax Worksheet seems important. American here. You may be aware that we have a stupidly complex tax code, and much of that complexity is pushed onto the taxpayer, who is ultimately responsible for the accuracy of their return. I've been compiling my own tax return without professional help for over 30 years. Most years I use some software to help automate the routine stuff. I'm pretty good at it, for a layperson, but I am **100% confident** that I am missing many opportunities to reduce my tax burden. Every year, I find t... The "Line 44 worksheet" is also called the Qualified Dividends and Capital Gain Tax Worksheet. For the Desktop version you can switch to Forms Mode and open the worksheet to see it. Sep 24, 2021 · For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out. Lines 1-5: Qualified Income & Ordinary Income. Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

Showing top 8 worksheets in the category - Qualified Dividends Capital Gains. Some of the worksheets displayed are 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work an, 2018 form 1041 es, Qualified dividends and capital gain tax work... Worksheet works extremely well for revising individual for assessments, recapitulation Parameters, including the depth of topic, time required for completion, wide variety of skills to remain included and importantly the purpose which is a particular Qualified Dividends And Capital Gain Tax Worksheet... [Google Spreadsheet Link](https://docs.google.com/spreadsheets/d/15hiMJizGN5P9_DDhWEWjgcMOkYSy3ROHf3LZ-ugAAck/edit?usp=sharing) Please COPY the spreadsheet and don't request edit access. Original credit goes to a Bogleheads user TaronM that made the original spreadsheet. I updated his spreadsheet for the Tax Jobs Cuts Act which the original poster wasn't willing to do, which took a lot of work as the annualized income forms changed significantly. I updated his spreadsheet as I'm on SSDI inco... Short-term capital gains tax is a tax on profits from the sale of an asset held for one year or less. The short-term capital gains tax rate equals your ordinary income tax Rather than reinvest dividends in the investment that paid them, rebalance by putting that money into your underperforming investments.

Hi folks, Short version: I can't find where in Form 6251, part III that the value of ISOs (line 2i in Part I) are factored in. Without that, my AMT basically goes away -- which is nice, but I'm sure not something the IRS would be happy about. ​ I have an ouch-worthy AMT hit this year for exercising (and holding) ISOs, and I have a very small qualified dividend -- like $50. Everything else on my return is pretty basic -- standard deduction and no other credits. Here's where I'm g... Fill Qualified Dividends And Capital Gain Tax Worksheet Instructions, download blank or editable online. 2016 Qualified Dividends and Capital Gain Tax WorksheetLine44 See Form 1040 instructions for line 44 to see if you can use this worksheet to figure your tax. Qualified dividends capital gains worksheet line 44. The corrected worksheet results in a lower regular tax for most taxpayers and a higher regular tax Tools or tax ros e a qualified dividends and capital gain tax worksheet (2019) •form 1040 instructions for line 12a to see if the taxpayer can use... Irs Tax putation Worksheet from Qualified Dividends And Capital Gain Tax Worksheet , source: homeschooldressage.com. qualified dividends california tax, qualified dividends magi, qualified dividends meaning, qualified dividends worksheet line 44, qualified dividends historical tax rates

Line 37 reads: >Enter the amount from **line 6 of the Qualified Dividends and Capital Gain Tax Worksheet** in the instructions for Form 1040, line 44 > or the amount from **line 13 of the Schedule D Tax Worksheet** in the instructions for Schedule D (Form 1040), > whichever applies The instructions don't seem to tell me which one applies. The two amounts are not at all the same (maybe I messed up and they should be?). The instructions clarify that none of the three statements apply ...

Oct 13, 2021 · When it comes time to calculate your capital gains tax liability, you'll add together all of the numbers in the gain/loss column of your worksheet. That allows you to offset your gains with your losses and reduce your total taxable amount. If your losses outnumber your gains, you can offset all of your gains, as well as up to $3,000 of your ...

Get qualified dividends and capital gain tax worksheet 2021 signed right from your smartphone using these six tips: Type signnow.com in your phone’s browser and log in to your account. If you don’t have an account yet, register. Search for the document you need to electronically sign on your device and upload it.

See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1.

2018 Form 1040—Line 11a. Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

Pub 929 says: ​ If line 14 includes any net capital gain or qualified dividends, use the Qualified Dividends and Capital Gain Tax Worksheet to figure this tax. For details, see the instructions for Form 8615, line 15. However, if the child has 28% rate gain or unrecaptured section 1250 gain, use the Schedule D Tax Worksheet. Use the Schedule D Tax Worksheet (in the Schedule D instructions) to figure the line 15 tax if the child has \*\*unrecaptured section 1250 gain\*\* or \*\*28...

I made one sale of stock in 2016. It's on a 1099-B, not "Ordinary". (I also had some distributions on 1099-DIV). Line 13 instructions say >Exception 2. You must file Schedule D. Schedule D Line 20 says >Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). Don't complete lines 21 and 22 below. (So nothing goes into Line 13. Schedule D instructions, weirdly, skips Line 20). The wo...

I sold some stock last year, resulting in both short and long term capital gains. When I go through the Qualified Dividends and Capital Gain Tax Worksheet, I noticed it's using the same 15% tax rate against the short term gains. I entered in the total (short + long) gains on line 13 of the 1040 - was I supposed to separate short term gains out somewhere else? Should I just manually do 15% against long term and 20% against short term to get the right taxes owed? I feel like I've followed all ...

Qualified dividends and capital-gain tax worksheet is a helpful tool when calculating the tax that a company pays on their shares of stock. This article provides you with an overview of the Qualified Dividends Tax Worksheet and how it can be used to your advantage.

I started filing my taxes through TaxAct.com but since you can view your 1040 I thought about filling out the paper form myself. While copying over the amounts I found a discrepancy with the amount for my tax owed (1040 Line 44) between the TaxAct.com 1040 and the amount listed in the [2015 Tax Table](https://www.irs.gov/pub/irs-pdf/i1040tt.pdf). My taxable income was the same between me filling out the form myself and TaxAct.com at $61,982. From the tax table on irs.gov (linked above) the tax ...

Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Feb 02, 2021 · Qualified dividends and capital gain tax worksheet 2020.

You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. Non-dividend distributions can reduce your cost basis in the stock by the amount of the distribution.

Tools or Tax ros ea Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. • Before completing this worksheet, complete Form 1040 through line 15.

[This article](http://www.forbes.com/sites/laurashin/2015/03/30/how-this-couple-retired-in-their-30s-to-travel-the-world/) is a few weeks old, but due to saving and investing, this couple retired in their mid 30s with a million dollars and live off the dividends. The part that caught my eye was this section *I do a pretty active tax management of those assets, so in 2013 and 2014, we paid $0 tax while also converting about $20,000 a year to our Roth IRA to make that money tax-free forever* The...

Aug 10, 2021 · Qualified Dividends vs. Ordinary Dividends Qualified Dividends. To be qualified, a dividend must be paid by a U.S. company or a foreign company that trades in the U.S. or has a tax treaty with the ...

I calculate my taxes-due with the Tax Computation Worksheet, then I do it again with the Qualified Dividends and Capital Gain Tax Worksheet, then I calculate it AGAIN with the AMT and add a little. But in the end, any capital gains will still be at 15%, right? Also -- does getting those capital gains affect how AMT hits me at all? In other words, does when and how I sell stock (it's all long-term) make any difference in the tax bracket or de facto tax bracket I end up in? Like how bunching ...

These files are related to Qualified Dividends And Capital Gain Tax Worksheet Instructions Fill Online, Printable, Fillable, Blank. Just preview or download the desired file.

I hope this is a simple question. I've been preparing my taxes myself while checking against turbo-tax and credit karma. Credit Karma has decided to calculated Tax (line 44 of 1040) using the "Qualified Dividends and Capital Gain Tax worksheet". However I don't believe I meet the criteria to use this worksheet. 1) I am required to file schedule D, and lines 15 & 16 are not more than 0. >Qualified Dividends and Capital Gain Tax Worksheet. >Use the Qualified Dividends and Capital G...

I am in the midst of doing my taxes, and have been using TaxAct. However, I keep hitting a snag with Form 1116. I believe the software is wrong in how its determining Line 18, but, after contacting them, TaxAct is insistent their calculation is correct. Relevant background: I take the Foreign Earned Income Exclusion, but I make more than the FEIE limit. I am trying to take a credit on the foreign tax paid on the remaining, unexcluded foreign earned wages. I also sold a significant amount of inv...

I am in desperate need for some help regarding filling out my Schedule D for my 1040 this year. I'm stuck at Part 3 of Schedule D, line 20. Essentially, I DO have short term gains, and I DO NOT have long term gains. But I also don't have long term losses, I'm literally at neutral $0 for long term. My issue is that, according to instructions, I'm supposed to fill out the "Qualified Dividends and Capital Gains Tax Worksheet". I found that worksheet and filled it out. Except that since I have no ...

2016 Federal Tax. Qualified Dividends and Capital Gain Tax Worksheet. Before you begin: Before you begin: See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to...

From the Capital Prize Gold Mine in Georgetown, Colorado on a snowy day, looking towards Devil's Gate Bridge.

Below are some of the general changes on the federal level this year for those who are planning: Change in tax rates. The highest tax rate for 2013 is 39.6%. For details, see the 2013 Tax Computation Worksheet or the 2013 Tax Rate Schedules, later. Tax rate on net capital gain and qualified dividends. The maximum tax rate of 15% on net capital gain and qualified dividends has increased to 20% for some taxpayers. The Qualified Dividends and Capital Gain Tax Worksheet in the line 44 instruction...

Qualified dividends and capital gain tax worksheet form 1040 instructions page 40. Before completing this worksheet complete form 1040 thro...

Both dividend income and capital gains are sources of profit for a shareholder and will create possible tax liabilities for investors. In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends.

Hello - I am considered a US resident for US Tax Purposes and I am new to filing US individual tax returns. It appears my TFSA investments in Canada result in PFIC filing requirements and other non-registered mutual fund investments. Per reviewing the 2020 Form 8621, and if were to elect these PFICs as QEF, what is the benefit of making an Election B to defer tax until termination of the QEF? I intend to return to Canada. Given that PFIC income is taxed at the highest marginal rate (37% for 202...

Trying to file my federal taxes. 1040 Line 6 is for Capital Gains which I have, so I'm doing Schedule D. Schedule D line 20 says I should use the Qualified Dividends and Capital Gain Tax Worksheet. So I go to that worksheet and it wants me to enter my amount from 1040 Line 11b which I havent gotten to yet because I dont know what to enter in Line 6. Can anyone help please?

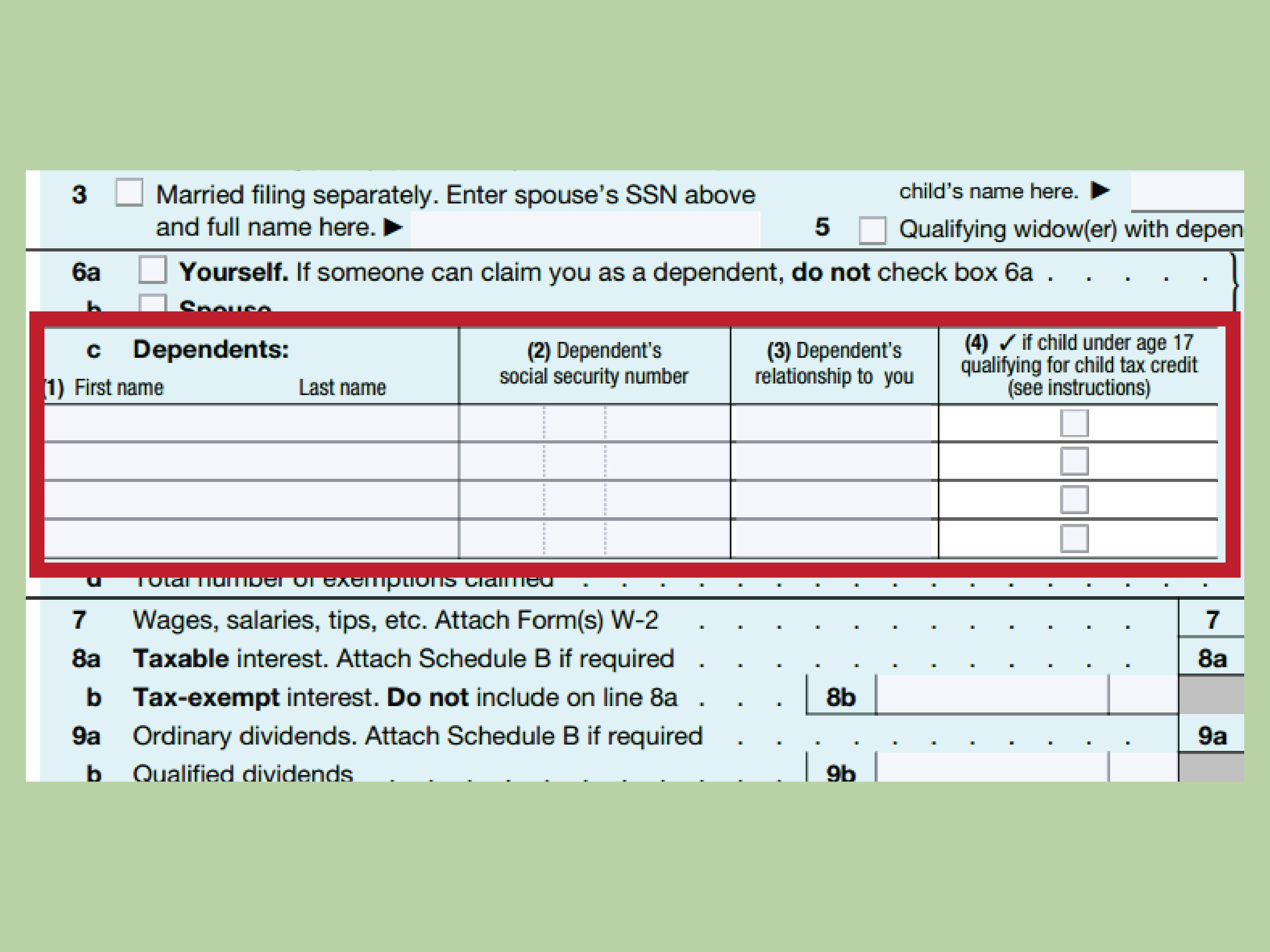

Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount.

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below: Feel all the benefits of completing and submitting documents on the internet. Using our platform filling in Qualified Dividends And Capital Gain Tax...

May 21, 2021 · Qualified dividends are similar to ordinary dividends but are subject to the same 0%,15% or 20% rates that apply to long-term capital gains. Your qualified dividends will appear in box 1b of Form ...

Something that has been bothering me for a while now is how LTCGs work on form 1040. So from what I understand, you calculate your net CG/CL on Schedule D and report that total on line 13 of your 1040. Then you compute the tax on your LTCG on the 'Qualified Dividends and Capital Gain Tax Worksheet' and that gets reported on line 44. But LTCGs are still included in your Taxable Income. You have to take them out so they're not taxed twice along side ordinary taxable income, right? Like, I get th...

2016 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax.

Tagged: capital gain, qualified dividend. This topic has 4 replies, 3 voices, and was last updated 11 months, 3 weeks ago by kaneohe. [Using 2020 preliminary forms & data] I completed the "Qualified Dividends and Capital Gain Tax Worksheet" and saw that I had only $20,126 on line 9 which I think...

Oct 03, 2021 · 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) This document is locked as it has been sent for signing. You have successfully completed this document. Other parties need to complete fields in the document. You will recieve an email notification when the document has been completed by all parties.

Capital gains rates by income level. 7. Sample for qualified dividends and capital gain tax worksheet. Qualified Dividends Capital Gains Worksheet Results. Understanding Div Numbers Seeking Alpha. Schedule Capital Gains Losses Definition.

...Gain Tax Worksheet—Line 44 Before you begin: u u Keep for Your Records See the instructions for line 44 on page 35 to see if you can use this worksheet to figure If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Form 1040.

A qualified dividend is taxed at the capital gains tax rate, while ordinary dividends are taxed at standard federal income tax rates. Qualified dividends must meet special requirements put in place by the IRS. The maximum tax rate for qualified dividends is 20...

I keep finding contradicting leads through the directions of the 1040, 1040-SD, and the Qualified dividends and Capital Gain Tax Worksheet. For 1040, there is line 6 to report capital gain or (loss), but no line for distributions. this led me to fill out Schedule D. 1040-SD line 13 asks for Capital gain distributions, while in the directions explains that capital gain distributions are listed as ordinary dividends in my 1099-DIV. Once reaching line 20, and lines 18 and 19 being blank, I'm guid...

Qualified dividends, as defined by the United States Internal Revenue Code, are ordinary dividends that meet specific criteria to be taxed at the lower long-term capital gains tax rate rather than at higher tax rate for an individual's ordinary income.The rates on qualified dividends range from 0 to 23.8%. The category of qualified dividend (as opposed to an ordinary …

Hi All, I recently saw a post asking about dividend stocks and the response was that a Total Market portfolio gave a higher yield. I'd like to point out an attribute of dividend income I was unaware of that may benefit others. When I began working, 1980, I opened an IRA and contributed when I could. When employers started offering 401Ks I took advantage of that. I've never had children and have a simple lifestyle, so I usually had other investment monies available . Over the years I ended...

/Howarecapitalgainsanddividendstaxeddifferently2-aa1e45473ab6480185b77281959dee5c.png)

0 Response to "39 qualified dividends and capital gain tax worksheet"

Post a Comment