38 spousal impoverishment income allocation worksheet

22. jul. 2016 ... DHS form 2630 Alternative Care Program Eligibility worksheet for ... The monthly spousal income allocation has increased to $2005 as well as ... July 11, 2021 - Understand Medicaid’s Minimum Monthly Maintenance Needs Allowance (MMMNA), its limits, maximums, shelter costs and how it helps spouses avoid impoverishment.

Separated and legally separated couples continue to be married and therefore may divide assets and allocate income. 8244.1 Spousal Resource Provisions - The ...

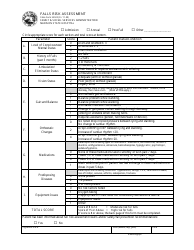

Spousal impoverishment income allocation worksheet

contribute it all to Share of Cost. The well spouse may retain all income in her own name and, if that income is less than $3,260 (the Minimum Monthly Maintenance Needs Allowance, or MMMNA, for 2021), he/she may receive an allocation from the Medi-Cal spouse's income to reach $3,260. Example: John receives a pension of $2,500 per month. Mary ... income-producing assets. Only the community spouse's income is used in this calculation because the community spouse income allocation is not used in a community budget for these enrollees. o In MAXIS, using the ASET function, record all assets as counted or excluded, by owner(s). Record the effective date as June 1, 2016, and the 18.6.1 Spousal Impoverishment Income Allocation Introduction. After the institutionalized person is found eligible, he or she may allocate some of his or her income to the community spouse and dependent family members living with the community spouse. Income that is allocated for the community spouse must actually be given to the community ...

Spousal impoverishment income allocation worksheet. Frequently asked questions about the Division of Assets law in Kansas which allows an at home spouse to divide assets when the other spouse is in a nursing facility. This protects assets for the one still at home and may make the one in the nursing home eligible for Medicaid sooner. Electronic BFA Form 799, Spousal Income Protection, and BFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals, and the associated New Heights-generated Form AE0017, have been revised to include the maximum income standard and the excess shelter deduction increases as released in this SR. 4. okt. 2016 ... In Minnesota, spousal impoverishment protection rules have long been in place for married ... The community spouse income allocation is not. Edit PDFs, Create Forms, Collect Data, Collaborate, Sign, and Fax Documents, and so much more. And you can do it all from anywhere on any device for a fraction of the cost.

Electronic BFA Form 799, Spousal Income Protection, and BFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals, and the associated New Heights-generated Form AE0017, have been revised to include the maximum income standard and the excess shelter deduction increases as released in this SR. Spousal impoverishment figures, pursuant to 42 USC 1396r-5(g); ... BFA Form 799A, Income Computation Worksheet for Allocation of Income for ... Anyone 5 years of age and older is eligible for the COVID-19 vaccine. To find a vaccine provider near you, go to vaccines.gov. View up to date information on Illinois’ Covid-19 vaccine plan and vaccination eligibility from the State of Illinois Coronavirus Response Site · The Governor's ... the release of ACWDLs 90- 01 and 90-03, which relate to property and income, respectively. In California, the SI provisions permit a community spouse to retain the CSRA and the institutionalized spouse may provide a spousal income allocation for the maintenance of the spouse as well as dependent family member allocations.

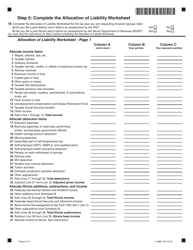

the institutionalized spouse, a calculated amount of the couple's assets is allocated to the community spouse to be used for his own needs. The Medicaid rules that govern the special treatment of a community spouse's income and resource allocation are referred to as spousal impoverishment policy. Protecting and promoting the health and safety of the people of Wisconsin Spousal impoverishment rules include a minimum monthly maintenance needs allowance ( MMMNA) and a community spouse resource allowance ( CSRA) that "protect" a portion of a couple's income and assets (including the home) for the non-applicant spouse. Thereby, preventing the impoverishment of the non-applicant spouse. Understanding Medicaid ... 1. ENTER Maximum Community Spouse Income Allocation $ 2. SUBTRACT Gross Income of Community Spouse - 3. EQUALS Community Spouse Income Allocation = Section B – Dependent Family Member Income Allocation. Name . Name Name 1. ENTER – Maximum Dependent Family Member Income Allocation $ $ $

A copy of the insert page must accompany the Institutionalized. Spouse Budget Worksheet in cases where the spousal share is used to compute the maximum CSRA.

If resources are equal to or less than the standard, the person may be eligible and the person's income must be evaluated. (f) Spousal Impoverishment. Financial ...

DFA Forms 799, Spousal Income Protection, and DFA Form 799A, Income Computation Worksheet for Allocation of Income for Institutionalized Individuals, and the associated New Heights-generated Form AE0017, have been updated accordingly. POLICY In accordance with the spousal impoverishment provisions of Section 1924(d)(2)-(4) of the Social Security Act [42 USC 1396r-5(d)(2)-(4)], the maximum ...

July 19, 2021 - Medicaid law provides special protections for the spouses of Medicaid applicants to make sure the spouses have the minimum support needed to continue...

July 13, 2021 - “Spousal Impoverishment Protection” refers to special financial provisions in Medicaid for the Elderly, Blind or Disabled (EBD) law. These provisions affect how we count income and assets for certain married couples receiving or applying for nursing home or community waiver services.

November 19, 2018 - House lawmakers have taken a step toward extending crucial -- but expiring -- financial protections to seniors receiving long-term care in home or

1. jul. 2017 ... For TSOA, the community income rule (add both spouses income together and divide by two) isn't permitted. For married MAC applicants: for the ...

May 01, 2021 · maximum monthly needs allowance of $3,259.50 is used to determine income allocation to the community spouse. 1. If the couple’s total countable monthly income is less than or equal to $3,259.50, then all income could be allocated to the community spouse. 2. If the couple’s total countable monthly income is more than $3,259.50, then the

November 25, 2019 - To financially qualify for Medicaid long-term services and supports (LTSS), an individual must have a low income and limited assets. In response to concerns that these rules could leave a spouse without adequate means of support when a married individual needs LTSS, Congress created the spousal ...

Forms are sorted by those that are strictly for internal purposes and communication and those that are sent outside of the agency. Forms have retained their original form number where applicable. Expand all. Collapse all. Policy Forms List.

Spousal Impoverishment Law / Division of Assets. The Spousal Impoverishment Law, sometimes called Division of Assets, changes the Medicaid eligibility requirement for couples in situations in which only one spouse needs nursing home care. It allows the spouse remaining at home to protect a portion of income and resources.

Spousal Impoverishment Income Allocation and Allowances (Monthly Amounts) Effective July 1, 2021 and January 1, 2021 Community spouse income a llocation The maximum allocation is $ 3,2 59 .50 , or $ 2,903.34 plus an excess shelter allowance , whichever is less . The excess shelter allowance is calculated by adding

May 26, 2021 - This scenario was dubbed “spousal impoverishment” and Congress created rules to prevent it in 1988. Prior to the passage of spousal impoverishment protections, community spouses faced serious financial hardship after spending down their income and assets on nursing home care to get Medicaid ...

SSI and Spousal Impoverishment Standards . SSI Federal Benefit Benefit Rate (FBR) SSI Resource Standard Income Cap Limit (300%) Earned Income Break Even Point Unearned Income Break Even Point Individual 794.00 2,000.00 2,382.00 1,673.00 814.00 Couple 1,191.00 3,000.00 N/A 2,467.00 1,211.00 Substantial ...

Spousal Impoverishment Income Provisions KEESM 8144 & 8244 Spousal Income Determination *Min Income Allowance increased to $1822 eff 5/09 **Max Income Allowance increased to $2739 eff 1/09 Only the institutionalized spouse's income is considered in determining his/her eligibility. Only nonexempt income is considered in determining the allowance.

Feb 01, 2008 · On the Spousal Impoverishment Income Allocation Worksheet (See WKST 07), do the following: 18.6.2 Worksheet 7 Section A -- Community Spouse Income Allocation. Enter on Line 1 the community spouse maximum income allocation. Unless a larger amount is ordered by a fair hearing or court, the maximum allocation is the lesser of: $2,610.00 or

Spousal Impoverishment Income Allocation Worksheet . Assigned Number Title Version Date Publication Type Other Location Language ; F-01306: Spousal Impoverishment Income Allocation Worksheet : July 1, 2014: PDF . None: English : Last Revised: February 7, 2018. Follow us ...

October 20, 2017 - Spousal impoverishment asset protections can reserve up to $120,900 for the at-home spouse. However, the details are more complex. Most states have rules that say that only one-half of the total countable wealth can be allocated to the non-applicant spouse, up to the maximum of $120,900.

September 28, 2020 - Spousal impoverishment rules also allow community spouses of Medicaid LTSS recipients to keep a Minimum Monthly Maintenance Needs Allowance (MMMNA) from their Medicaid spouse’s monthly income.

... federal spousal impoverishment rules prevent the non-applicant spouse from having too little income and resources on which to live.

February 23, 2021 - Since 1998, a spouse of a nursing home resident on Medicaid is allowed to keep a reasonable level of income and resources to live on, while still permitting Medicaid payment for the nursing home resident's care. Congress enacted the "spousal impoverishment protections" in 1988 in response to ...

If you need Long-Term Care (LTC) Medi-Cal but you have too much income to qualify for no-share of cost Medi-Cal programs and your spouse does not require Long-Term Care (LTC) Medi-Cal, then you may use "spousal impoverishment protections" to allocate your income to your spouse in order to establish Medi-Cal eligibility without a share of cost.

Signature of Claimant, Date in Spousal Allocation. Community Spouse or Representative _____ _____ I wish to allocate a portion Signature of Claimant or Date of my income to my Authorized Representative Community Spouse. 1. All income received by the Community Spouse has been reported to the

The other night a good friend of mine came into the studio to get some portraits done. We did some really good work and I believe this is the best one.

Spousal Impoverishment Laws. California law allows the community spouse to retain a certain amount of otherwise countable resources available to the couple at the time of application. This is called Community Spouse Resource Allowance (CSRA) and it increases every year according to the Consumer Price Index. The current (2019) CSRA is $126,420.

assets, income and expenses. You will be noti˛ed when the Medicaid case is approved, and how much to pay for your spouse's care. Once the case is open, you will have 90 days to change the ownership of any jointly owned accounts or property. 6. Further questions: If you need additional information regarding the Spousal Impoverishment

18.6.1 Spousal Impoverishment Income Allocation Introduction. After an institutionalized person is found eligible, he or she may allocate some of his or her income to the community spouse and dependent family members living with the community spouse. Income that is allocated for the community spouse must actually be given to the community ...

Fill Spousal Impoverishment Income Allocation Worksheet, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly.

Fill out Spousal Impoverishment Income Allocation Worksheet in several clicks by simply following the instructions listed below: Find the template you need from the library of legal forms. Select the Get form key to open the document and move to editing. Complete all of the necessary boxes (these are yellowish).

These protections apply to persons who are elderly or have disabilities. Medicaid EBD pays for health care and long-term care services for low-income people of ...

spousal impoverishment, the spouse receiving long-term care may have up to $3,000 in countable assets and the community spouse may keep up to half of the couples' countable assets based on federal limits. Also, under spousal impoverishment, the spouse receiving long-term care may be able to give excess income to the community spouse.

Spousal Impoverishment–Maintenance Needs and Resource Standards. Refer to Chart Z-800. Exception: An increase in the spouse’s resource allocation may be granted to generate additional income if the available income is below the spousal allowance. Before a requested increase in the community spouse

The expense of nursing home care — which ranges from $5,000 to $8,000 a month or more — can rapidly deplete the lifetime savings of elderly couples. In 1988, Congress enacted provisions to prevent what has come to be called "spousal impoverishment," leaving the spouse who is still living at home in the community with little or no income or resources.

updated budget steps worksheet for completing Spousal Impoverishment (SI) evaluations for those who request In-Home Support Services (IHSS), Home and Community Based Services (HCBS) applicants and beneficiaries who are HCBS Spouses at annual redetermination or change in circumstance. The updated budget steps worksheet is attached to this letter.

The healthy spouse is called the "community spouse" in Medicaid parlance, and they are entitled to a Community Spouse Resource Allowance. This is half of the assets that are countable up to a limit. In 2021, the limit has been $130,380 in our state, and the minimum allowance is $26,076. Next year, the maximum will be $137,400 and the ...

If the community spouse's total monthly income (as entered in item F) is more than the current spousal monthly maintenance allowance, enter the community spouse's total income (as entered in item F). I. — In spousal impoverishment cases, enter the deduction for dependents as calculated to the right of this item.

18.6.1 Spousal Impoverishment Income Allocation Introduction. After the institutionalized person is found eligible, he or she may allocate some of his or her income to the community spouse and dependent family members living with the community spouse. Income that is allocated for the community spouse must actually be given to the community ...

income-producing assets. Only the community spouse's income is used in this calculation because the community spouse income allocation is not used in a community budget for these enrollees. o In MAXIS, using the ASET function, record all assets as counted or excluded, by owner(s). Record the effective date as June 1, 2016, and the

contribute it all to Share of Cost. The well spouse may retain all income in her own name and, if that income is less than $3,260 (the Minimum Monthly Maintenance Needs Allowance, or MMMNA, for 2021), he/she may receive an allocation from the Medi-Cal spouse's income to reach $3,260. Example: John receives a pension of $2,500 per month. Mary ...

0 Response to "38 spousal impoverishment income allocation worksheet"

Post a Comment