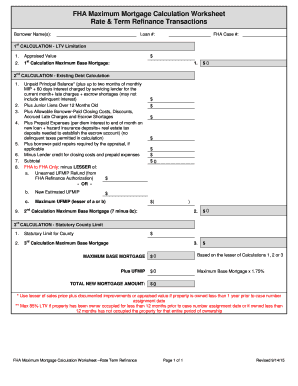

38 fha rate and term refinance worksheet

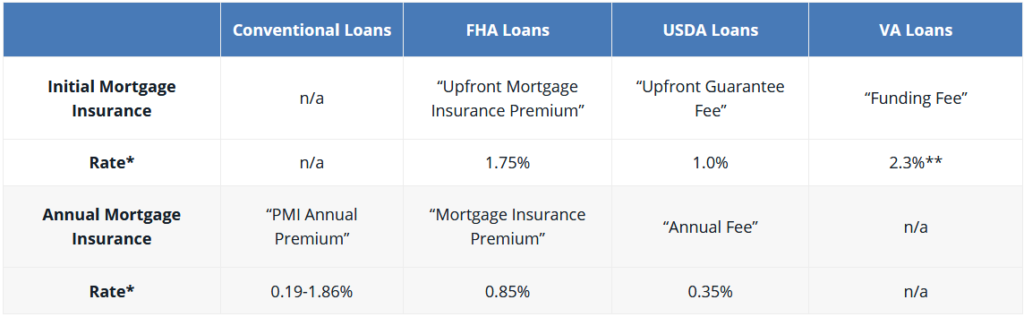

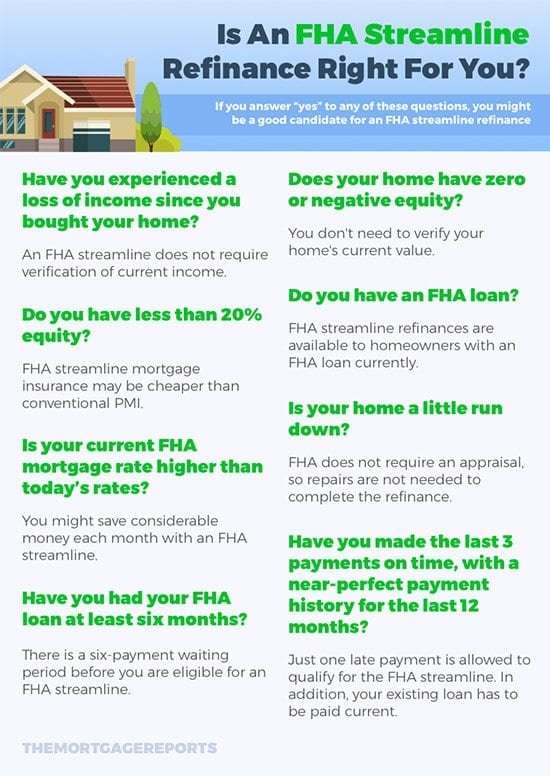

Our current FHA loan is 3.75%. The original loan was $255k, IIRC. We currently owe $230k. We are paying around $250/month in PMI, however, if need be, we have the ability to pay the loan down to 80% and remove the PMI. My parents would loan us some of the money in order to pay down the loan to 80%. We intend to buy a second home as our "long term" home, and keep this as a rental. I don't see that happening unless we refinance our current home to a conventional loan, then get an FHA loan on the... Mutual of Omaha is a Fortune 400 Company with an iconic brand and outstanding customer loyalty. Mutual of Omaha Mortgage is inspired by hometown values and a commitment to being responsible and caring for each other. We exist for the benefit of our customers and employees. Mutual of Omaha Mortgage is a full-service lending company offering both ...

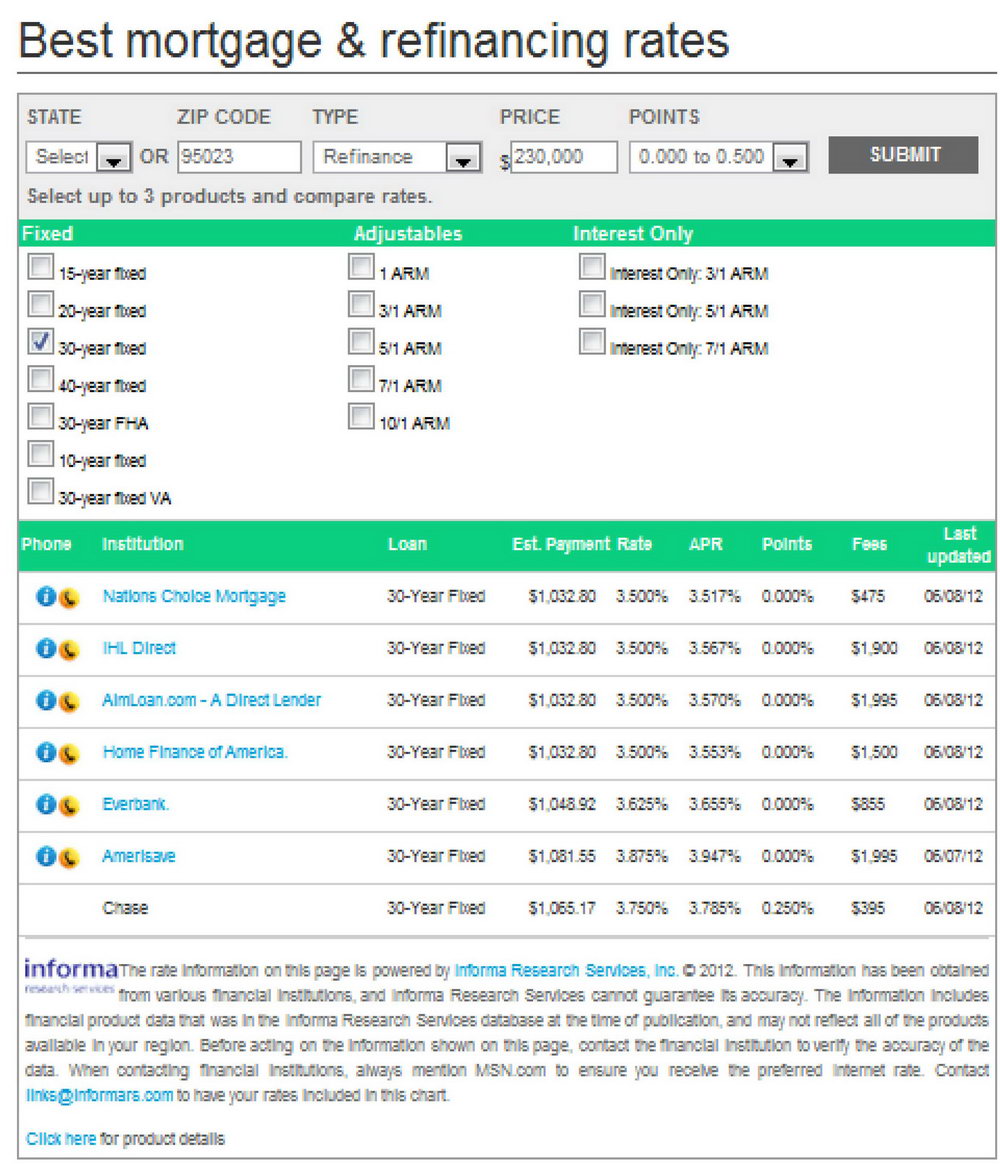

Highly qualified buyer, new construction, conforming loan. I locked at 3.25% on a new construction home a couple months ago thinking it was a good time. Now I can easily get 2.5%. It's too late to unlock/relock elsewhere. I'm going to be refinancing very shortly after settlement. But what I can do is buy my current rate UPWARDS all the way to 4.5% which gives me a closing cost credit of $12,000. That mortgage rate sucks, but I'll only be bound by it for a couple months before I refinance. Wh...

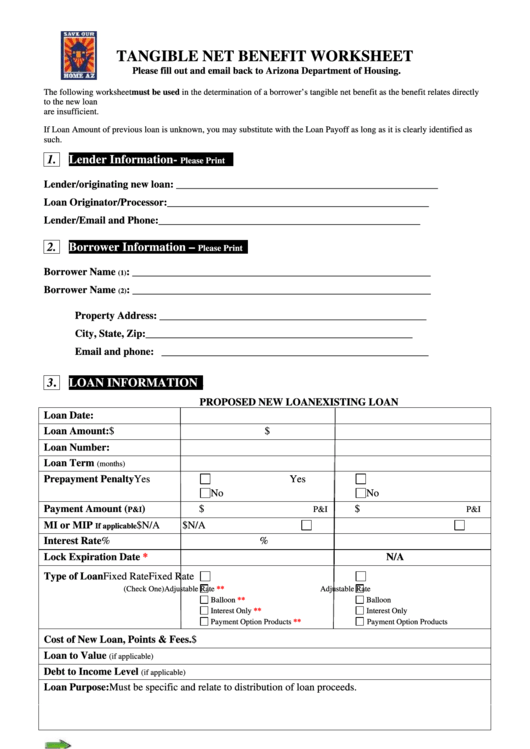

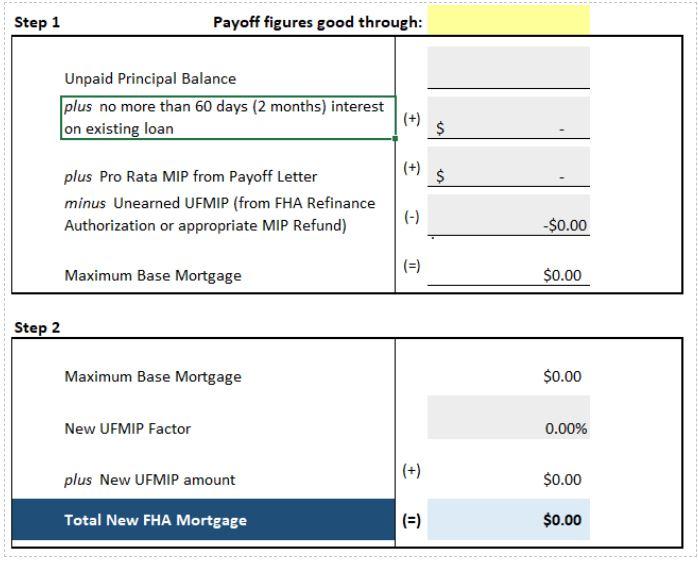

Fha rate and term refinance worksheet

Hi all, First time homeowner here. I bought my house on 2017 for $245k at 4.75% (30yr conv). Luckily, in my area (Florida) house prices have gone through the roof so my house is now estimated to be $330k - 350k (need a proper appraisal to make sure of course). Remaining balance on the mortgage is currently $219k. Can I even do a cash out refinance for an amount larger than the original loan? Does it make sense to do so, or should I just aim to lower my monthly payments? Just looking for some c... Hello PFC, I bought my first house in 2019. When I purchased the house, I was given a 5 year fixed rate of 3.19 percent by a mortgage broker and my wife and I took it. After we signed on, I looked around a bit more and found out that the rate was on the higher side and that it's more like 1.9 percent. Is there any way we can fix this? Much thanks in advance! Spouse of U.K. citizen and we’re looking on relocating back there in the next few years. We’d like to eventually buy, but are used to the concept of a fixed 30-year mortgage rate in the U.S. and are trying to figure out how 2 to 5 year terms work and if they are as much of pain as they sound. Any insight is appreciated!

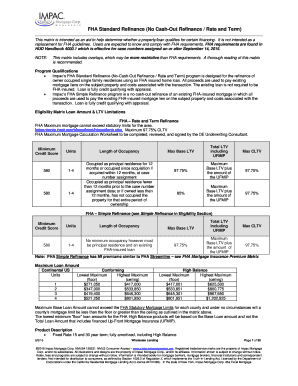

Fha rate and term refinance worksheet. Quick question, when doing a FHA Streamline Refinance loan. Are we allowed to also change the term. For example from 20 years left to 30 years with the refinance. Current Situation: My family and I have been in our house for just over 10 years. We bought it in Dec. of 2006 for just under 157k. About 7 years ago, I refinanced to get a lower fixed rate of 4.875% and lower our monthly payments. I have never been late on or missed a payment and my current credit score is in the 800's. As far as how much we owe now, it is just under 130k. I do not know the current market value of my house. Question: Saturday, I got a letter in the mail from my current ... My rate will not be dropping, but because of property values I will likely be able to drop the mortgage protection insurance or decrease it significantly. And then I'll be in a conventional loan. I'm wondering if this is the time to do it in order to drop the PMI while rates are low and home values are high. Or would it make sense to lock in a lower rate through an FHA streamline? Hello all, I have a decent SFR rental portfolio in Florida. I am curious as to what rates and terms people are getting and in Florida specifically. Interested in actual approved and/or recently closed loans. Would love to hear details such as: -interest rate -LTV (how much of current appraisal would they lend) -term in years -did you escrow taxes and insurance -time from app to closing -was property owned in personal name or LLC (or other entity) -any documentation required to prove rental in...

Hi everyone, ​ I don't have experience refinancing so I wanted to ask the community for their advice on whether or not to refinance out of my FHA mortgage. I own a 2 family home where both units are rented out. Posted below are rental and mortgage details: ​ I originally purchased the house exactly 3 years ago for $380K with 3.5% down FHA mortgage. I'm 30 years old and plan to hold onto the property into retirement. I try to make 1 extra payment a year so that I can pay... I'm sure this will get down voted to hell, but I still think it will benefit many if we know what institution to choose once the time comes to refi. I live in Houston TX and I came across this piece of information [https://www.aei.org/nowcast-10-metros-most-threatened-by-high-numbers-of-fha-delinquencies-may-2021/](https://www.aei.org/nowcast-10-metros-most-threatened-by-high-numbers-of-fha-delinquencies-may-2021/)while browsing about delinquent mortgages in my area. Losing your house is terrible, no questions about it. But, with these numbers of "serious delinquent" loans, what can people do? Can banks in Texas just go ahead and foreclo... Does it make sense to Refi? I tried some refi calculators but couldn't find one for this situation Current FHA loan with lifetime PMI: current loan balance $351,950 current interest rate 2.25% P&I payment $1,392 MIP: $236/month ​ New Conventional Loan: loan balance $355,000 interest rate 2.75% P&I payment $1449 no PMI ​ closing cost are estimated at $3380 and would be rolled into the loan balance as reflected above. hoping to get an appraisal waiver whi...

I have a 30 yr fixed mortgage, can I refinance it again to be a new 30 yr loan at the same interest? or am I required to have a reason to refinance it? (basically I would get escrow refunded to me, a new escrow would be funded and paid in closing, and I would skip a month of mortgage payments). my new monthly payment would be about the same. Principal $358,400 Interest rate: 3.5% Loan origination 12/2016 MIP: $252.04 Current P+I monthly pmt: $1,715 I obtained a quote from a local CU that can refinance and remove mortgage insurance, however rates are a bit higher Proposed Interest rate: 3.75% Same principal amount, no cash out Closing costs $4,800 New monthly P+I: $1,708 What’s a ballpark for my break even in this scenario? I’ll be saving about $260/mo in monthly payment but my interest rate will be higher and resetting the loan ... I’ve currently had my FHA loan for 1.5 years. My current interest rate is 4%. I have a silent second loan for $10k at 0% interest that will need to be paid off at the time of refi/sale. We aren’t planning on living here for more than 5 more years. However, if we can lower our interest rate and drop our PMI payment and make that $10k back within the next 2-3 years, I think it would be worth it. We currently have more than 20% equity in our home based on current value estimates, so with a lower ... have almost $100,000 in private student loans with my monthly payment being almost $1400. It’s insane. Currently I’ve been working on refinancing and recently got approved for SoFi and a couple others for a 10 year term reducing my payment to $900-$970. My current term is 8 years left but I still save money on the life of the loan because my interest is almost cut in half from 6% to somewhere between 3.2-4.5%. My question is would it be wise to instead choose a 15 year term for now which would ...

The value of my home has gone up pretty high since I purchased it and I really want to get rid of this insurance. I'm basically paying $200 a month for nothing. Some things I read if I get a new appraisal for my home and if it goes up a certain amount I can refinance it out. Something else I read said you literally can't do anything unless you pay 20% off of the total premium. I also heard that I could potentially refinance and do a 15-year mortgage And don't need to do the appraisal or have ...

Spouse of U.K. citizen and we’re looking on relocating back there in the next few years. We’d like to eventually buy, but are used to the concept of a fixed 30-year mortgage rate in the U.S. and are trying to figure out how 2 to 5 year terms work and if they are as much of pain as they sound. Any insight is appreciated!

Hello PFC, I bought my first house in 2019. When I purchased the house, I was given a 5 year fixed rate of 3.19 percent by a mortgage broker and my wife and I took it. After we signed on, I looked around a bit more and found out that the rate was on the higher side and that it's more like 1.9 percent. Is there any way we can fix this? Much thanks in advance!

Hi all, First time homeowner here. I bought my house on 2017 for $245k at 4.75% (30yr conv). Luckily, in my area (Florida) house prices have gone through the roof so my house is now estimated to be $330k - 350k (need a proper appraisal to make sure of course). Remaining balance on the mortgage is currently $219k. Can I even do a cash out refinance for an amount larger than the original loan? Does it make sense to do so, or should I just aim to lower my monthly payments? Just looking for some c...

0 Response to "38 fha rate and term refinance worksheet"

Post a Comment