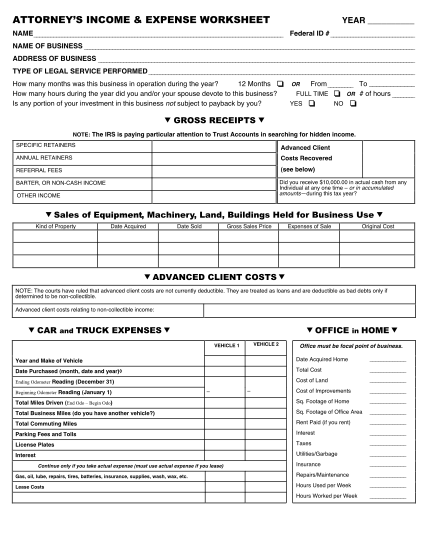

38 business income and expense worksheet

Business Income and Expense Worksheet www.nbs-tax.com nbsinc@nbs-tax.com Norwalk Business Service, Inc. (562) 863-4808 Business or Profession _____ Employer ID ... In conclusion, a business expense spreadsheet helps you to keep track of your business expenses by updating your financial information. Sharing is caring! exceltmp Exceltmp.com is here for your convenience and to save time. It's a source of providing a good range of excel, word, and pdf templates designs and layouts.

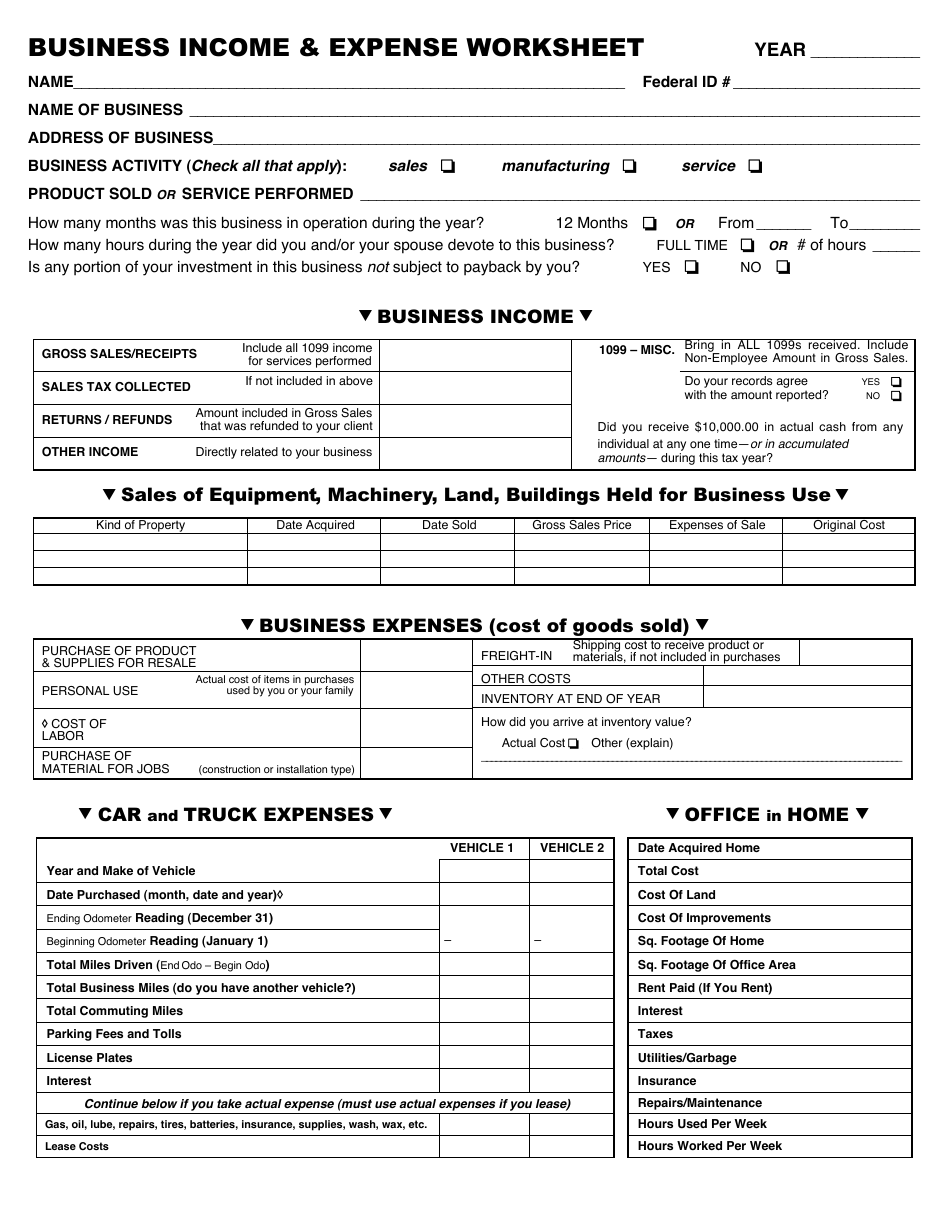

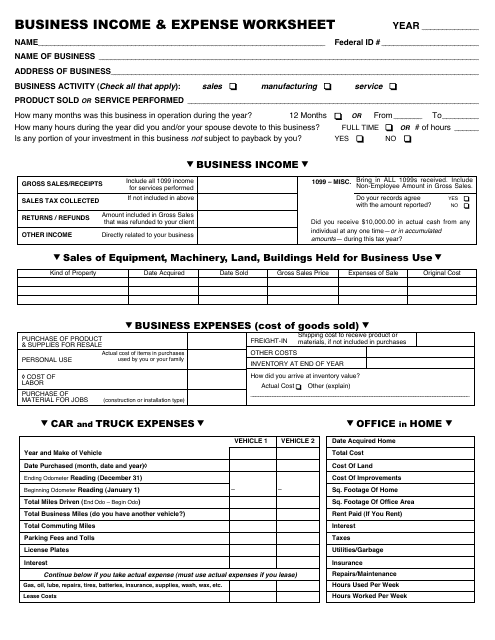

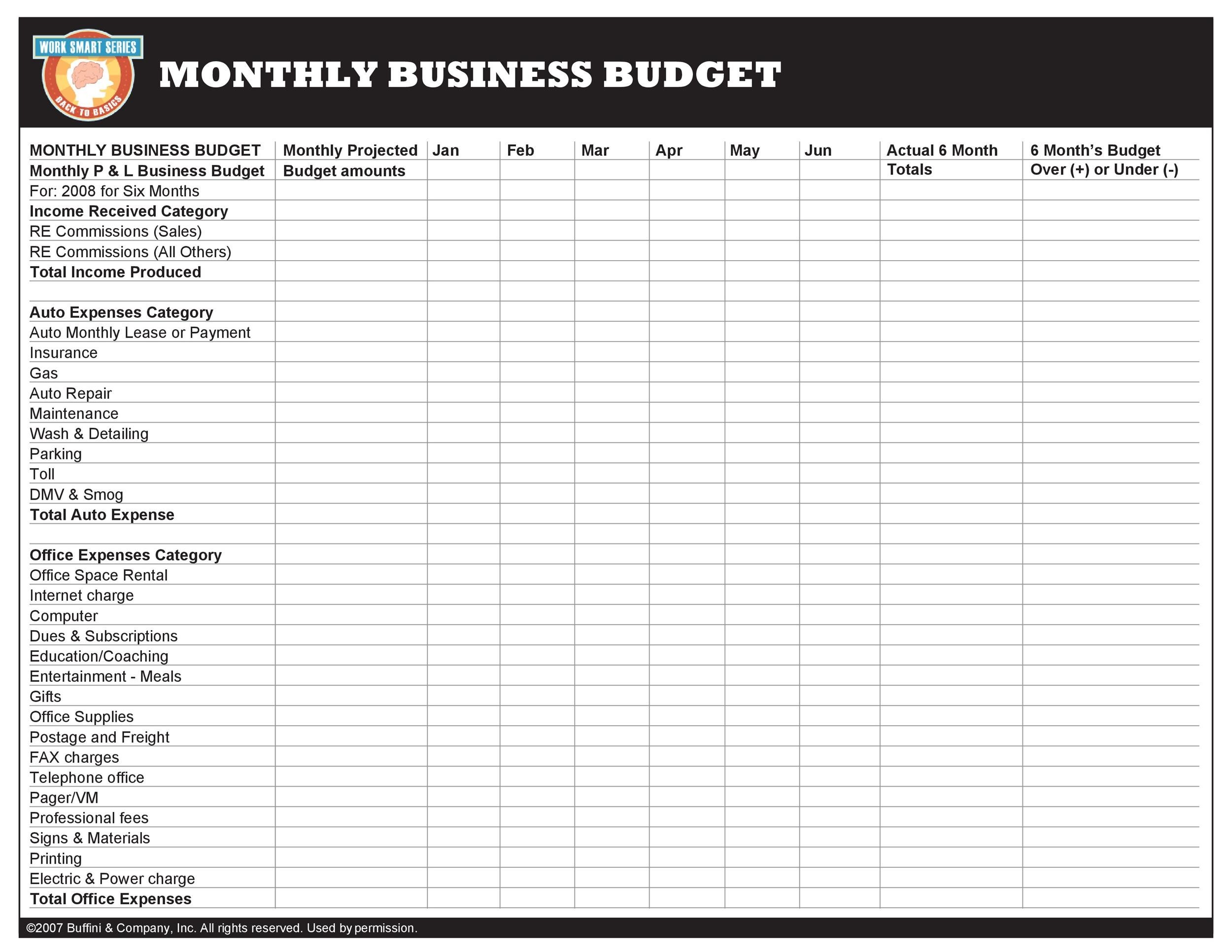

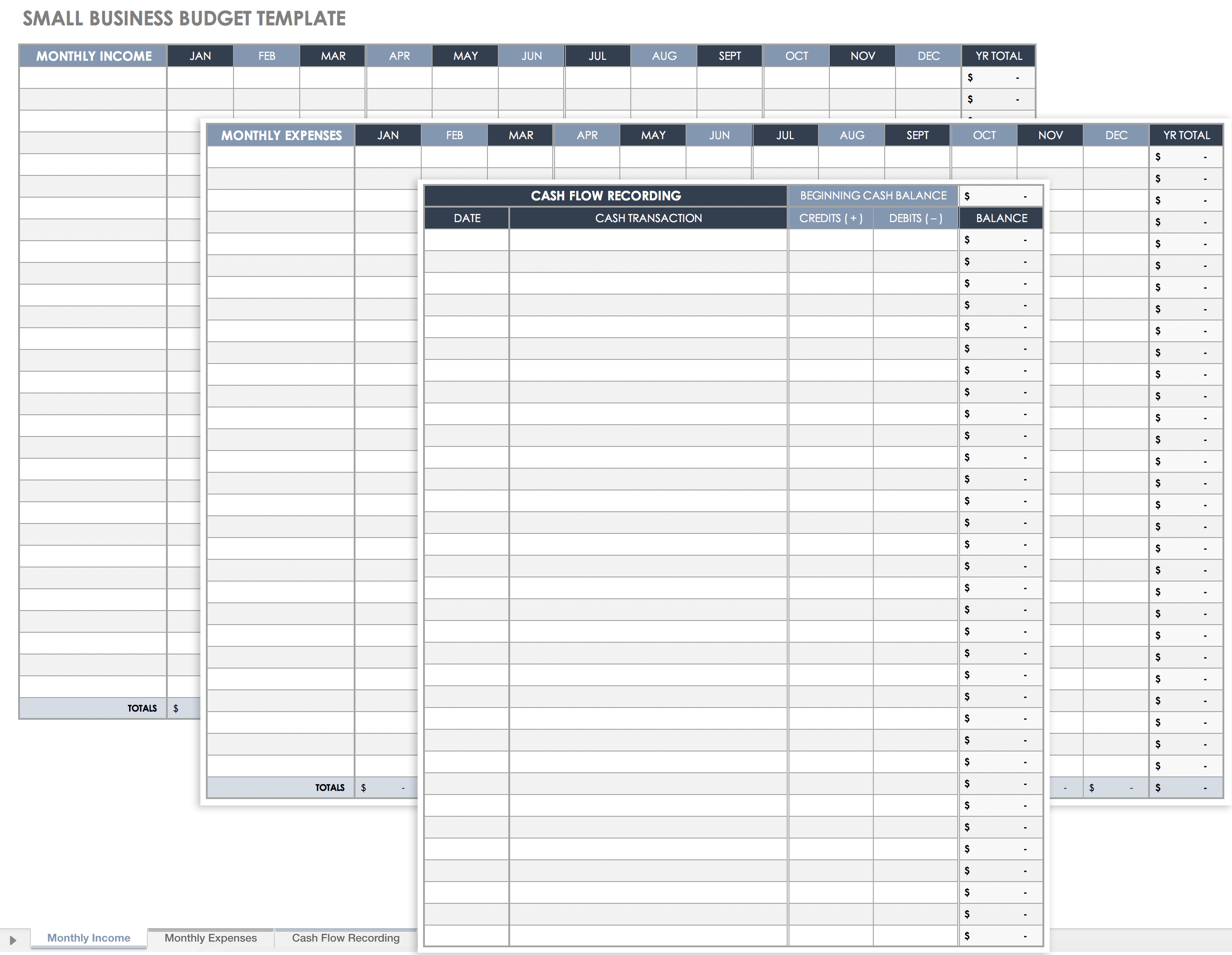

This worksheet is designed to give you a general idea of items you should include in your business budget. Format your expense columns. Expense report template by smartsheet. The second worksheet shown on the right is a multi step income statement that calculates gross profit and operating income.

Business income and expense worksheet

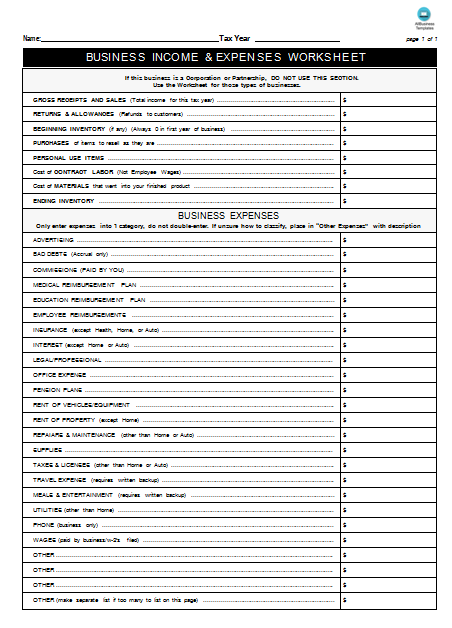

If this business is a Corporation or Partnership, DO NOT USE THIS SECTION. Use the Worksheet for those types of businesses. BUSINESS EXPENSES Only enter expenses into 1 category, do not double-enter. If unsure how to classify, place in "Other Expenses" with description As a business owner, it's important for you to have a system to monitor your financial standing.This includes monitoring expenses, income, budgeting, proper planning, and so on. Using a business expense spreadsheet ensures that your business is financially stable and it can go on operating smoothly. EXPENSES WORKSHEET Expenses Amount Expenses Amount 1. Advertising 21. Other taxes 2. Bad debts (N/A cash benefits) 22. Taxes and Licenses 3. Commissions and fees 23. Travel 4. Employee benefits 24. Meals and entertainment (in full) 5. Health insurance 25. Utilities 6. Other insurance 26. Wages 7. Mortgage interest 27.

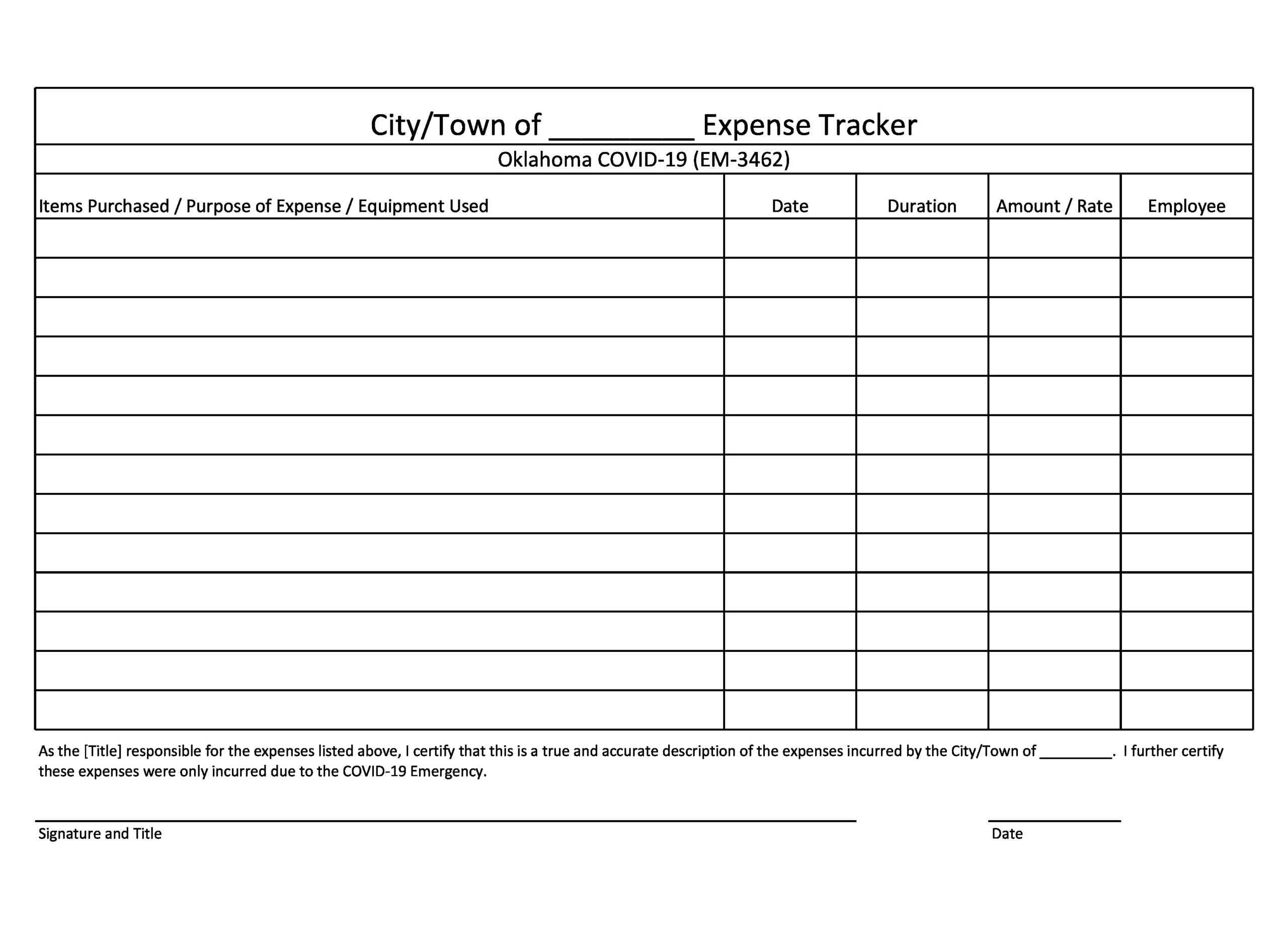

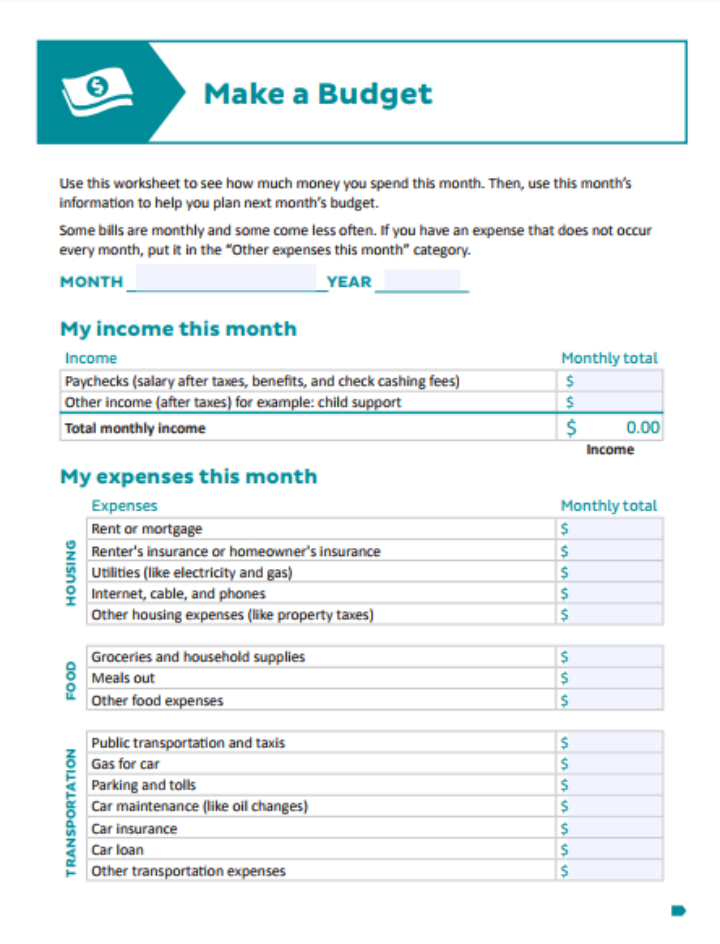

Business income and expense worksheet. An expense tracking template is a worksheet document used to track and organize a person's or a business's finances and help them plan for their monthly or yearly expenses. For personal expense tracking, an expense tracking template records monthly income and household expenses such as clothing, recreation, travel, etc. business income/expense worksheet fill out one sheet for each business - do not combine business name / profession income 1099-misc / self-employment w2 cost of goods sold 1099-misc / self-employment w2 expenses 1099-misc / self-employment w2 other 1099-misc / self-employment w2 business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month policy period. Failure to submit a signed current worksheet will automatically reinstate the Coinsurance Provision for the period going forward. FARM INCOME & EXPENSE WORKSHEET NAME SS # / FEDERAL ID # FARM INCOME SALE OF NON-BREEDING LIVESTOCK AND OTHER SALE OF NON-BREEDING RAISED LIVESTOCK, ... Office supplies/postage (farm business) Farm, farmland, pasture, animals, etc. Pension & profit-sharing plans/maint. fee *REPAIRS ...

Download the business income and expense tracker printable. If you're trying to grow a business or are making any money outside of a regular day jobs you need to stay on top of things. Find a way to track your business income and expenses so you can grow your income, stay on budget, and be ready when it comes time to pay taxes. Business Income and Expense Worksheet.xlsx Author: Cam Created Date: 12/15/2019 8:46:12 PM ... SIMPLIFIED BUSINESS INCOME AND EXTRA EXPENSE WORKSHEET This worksheet is designed to help determine a 12-month business income and extra expense exposure. Business income, in general, pays for net income (or loss) the insured would have earned or incurred, plus continuing normal operating expenses including payroll. of your annual business income basis and add the extra expenses to determine the total business income and extra expense policy limits. For further clarification: $5,000,000 is the 100% business income amount times a six month recovery period equals $2,500,000 (50%). Add $3,000,000

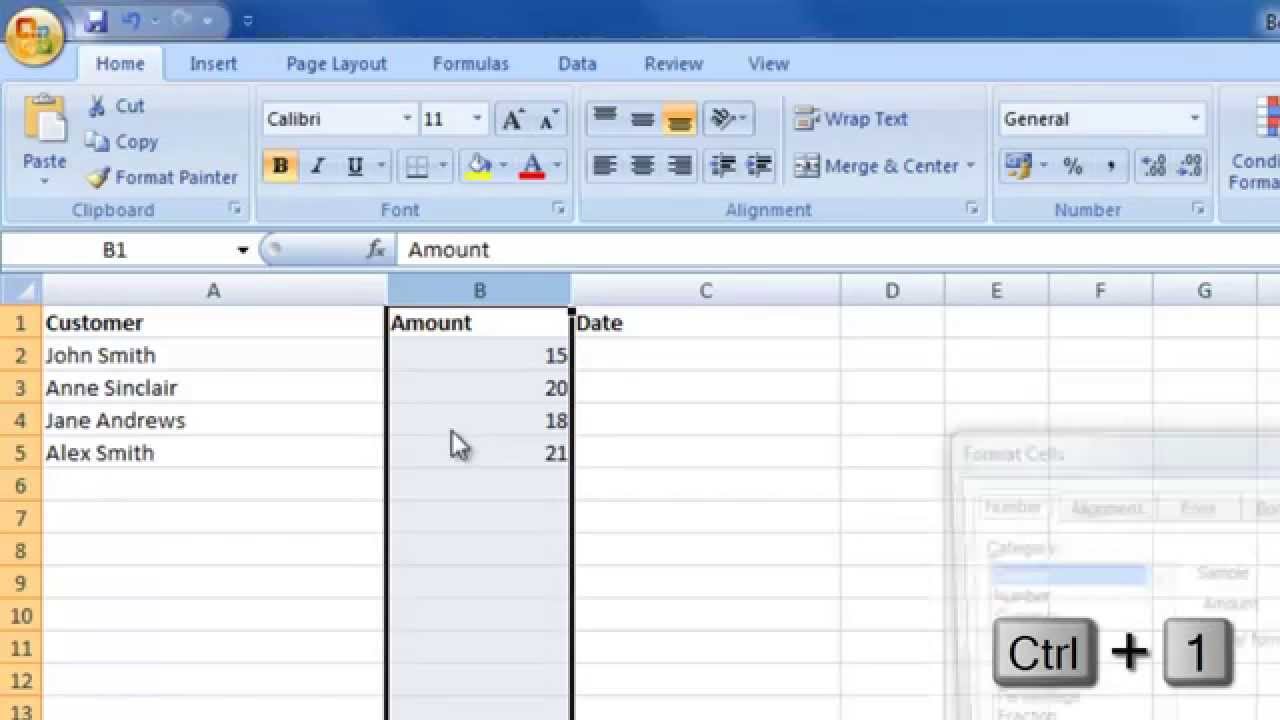

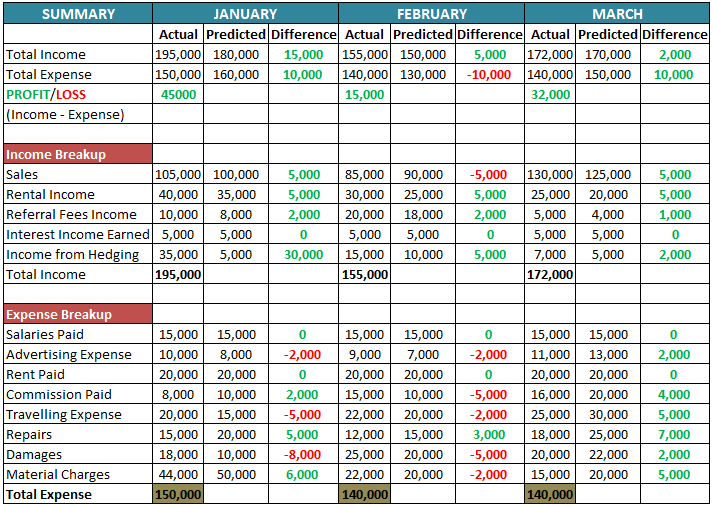

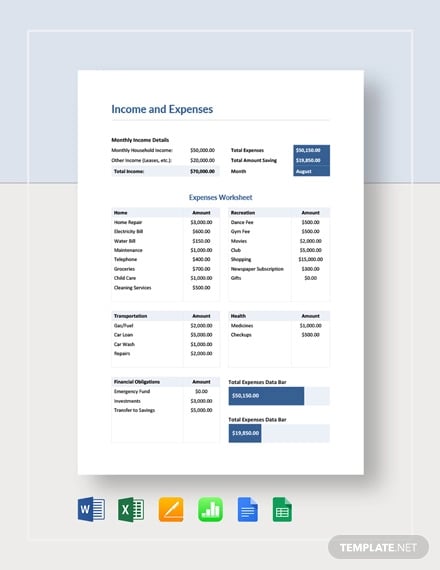

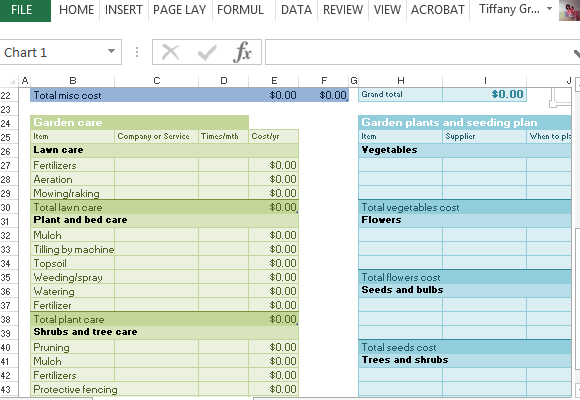

Monthly business income and expense worksheet excel. Consequently the income and expense template excel is an excellent tool to get an idea of how the firm is doing financially in a professional framework. So income and expense template is very important if you are you want to set up your funds significantly. The image below shows an example of ... You can include both your income and expense spreadsheets in the same workbook. Doing this gives you the option to create a third sheet later on which allows you to calculate the balance sheet using the date from the income and expense sheets. Your new workbook should contain three sample worksheets by default. Business Income and Expense Summary . Income and Cost of Goods Sold. Gross receipts or sales. Returns and allowances. Total Income. Inventory Purchases minus cost of items withdrawn for personal use. ... This worksheet was created to give you a manual method of tracking your business income. The following worksheet lays out the income statement line items you can use to set up a basic business budget. Depending on your business, you may include additional types of income or expenses. This worksheet is designed to give you a general idea of items you should include in your business budget . An Excel Spreadsheet works well for this task.

Mileage Expense = (Business use ONLY- attach Auto Expense Worksheet) ***This document is a summary for tax preparation purposes. It was prepared using MY business records of income and expenses. I attest that it is true, correct and complete.*** Signature Date Spouses Signature (only If business is jointly owned) Date GROSS RECEIPTS / SALES $

10+ Income & Expense Worksheet Examples [ Business, Rental, Monthly ] Trying to keep track of your income and expenses is a must if you want to spend your finances effectively. And, as chance will have it, there is a slew of mobile apps and services designed to make this task even more manageable.

Business income and expense worksheet template. Available in a4 us letter sizes. This worksheet is designed to give you a general idea of items you should include in your business budget. Expense report template by smartsheet. Accounting sheets for small business templates are very useful tools. For detailed instructions see the blog article ...

OTHER INCOME Directly related to your business individual at any one time—or in accumulated amounts— during this tax year? Sales of Equipment, Machinery, Land, Buildings Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost BUSINESS EXPENSES (cost of goods sold)

Description. This version was created specifically for printing and completing by hand. This worksheet can be the first step in your journey to control your personal finances. Step 1: Track your Income and Expenses. Step 2: Use that information to create a budget. Step 3: Continue tracking to help you stick to your budget.

EXPENSES WORKSHEET Expenses Amount Expenses Amount 1. Advertising 21. Other taxes 2. Bad debts (N/A cash benefits) 22. Taxes and Licenses 3. Commissions and fees 23. Travel 4. Employee benefits 24. Meals and entertainment (in full) 5. Health insurance 25. Utilities 6. Other insurance 26. Wages 7. Mortgage interest 27.

As a business owner, it's important for you to have a system to monitor your financial standing.This includes monitoring expenses, income, budgeting, proper planning, and so on. Using a business expense spreadsheet ensures that your business is financially stable and it can go on operating smoothly.

If this business is a Corporation or Partnership, DO NOT USE THIS SECTION. Use the Worksheet for those types of businesses. BUSINESS EXPENSES Only enter expenses into 1 category, do not double-enter. If unsure how to classify, place in "Other Expenses" with description

0 Response to "38 business income and expense worksheet"

Post a Comment