37 car and truck expenses worksheet

Ironically, the rule can no longer be used for travel and entertainment or expenses related to listed property such as cars and trucks. Five Key Things to Document for Car and Truck Expenses For meals, entertainment and listed property usage (cars, trucks, etc.), the requirements are more specific and the Cohan Rule isn't available. Title: 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: jodi Created Date: 1/29/2021 8:33:36 AM

Fixed Expenses, Periodic Fixed Expenses, Flexible Expenses and Indebtedness. Depending on your situation, some expenses (for example, long distance calls or a cell phone) may be considered flexible rather than fixed expenses. Be sure to adjust the budget categories to best reflect your needs and lifestyle. (Report all expenses as monthly ...

Car and truck expenses worksheet

Deductible Car and Truck Expenses. Ordinarily, expenses related to use of a car, van, pickup or panel truck for business can be deducted as transportation expenses. Use of larger vehicles, such as tractor-trailers, is treated differently and is not part of this discussion. In order to claim a deduction for business use of a car or truck, a taxpayer must have ordinary and necessary … Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed. TRUCK RENTAL FEES individual at any one time—or in accumulated amounts—during this tax year? OTHER INCOME Sales of Equipment, Machinery, Land, Buildings Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost CAR and TRUCK EXPENSES (personal vehicle)

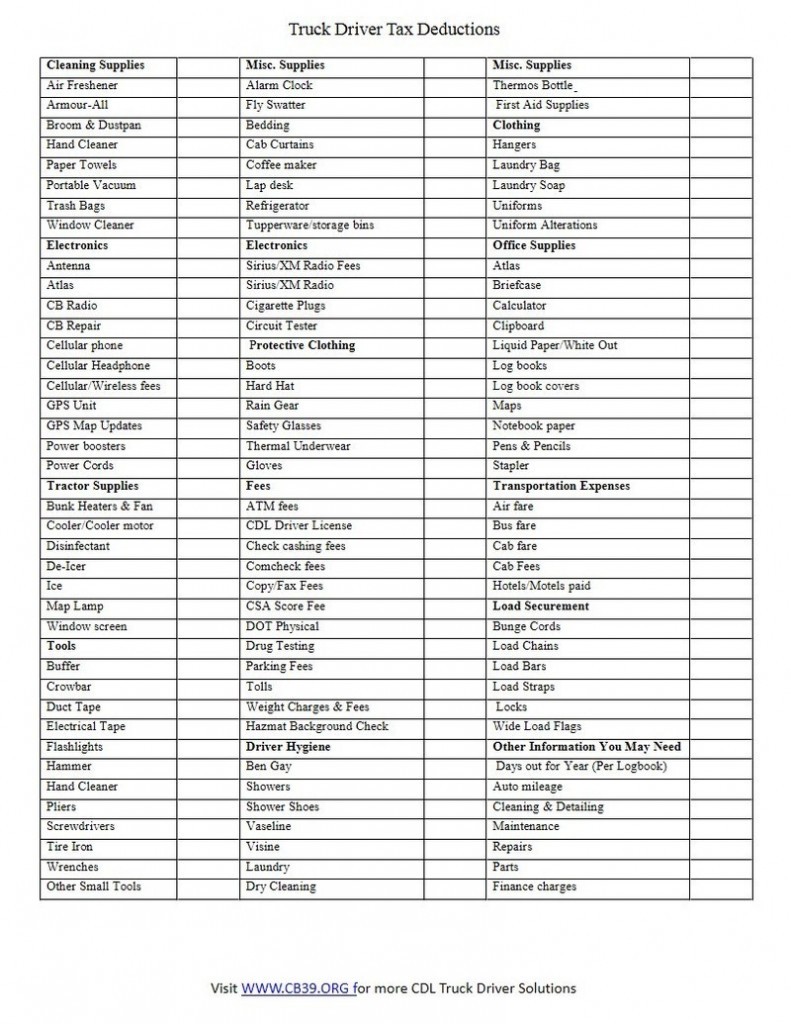

Car and truck expenses worksheet. Some of the worksheets for this concept are Vehicle expense work, Vehicle expense work, Truckers work on what you can deduct, 2017 tax year car and truck expense work, Truckers income expense work, Schedule c business work, Car and truck expenses work complete for all vehicles, Over the road trucker expenses list. Car and Truck Expenses Worksheet. 2015. + Keep for your records. Name(s) Shown on Return. Social Security Number. %ctivity: Part I Vehicle Information.2 pages Regarding vehicle expenses in an individual return, ProSeries has a Car and Truck Expense Worksheet. This should be used if you are claiming actual expenses or the standard mileage rate. Once you enter in the information for the vehicle, ProSeries compares what gives a better deduction for the tax return and gives you the larger deduction. Car and truck expenses o You may deduct car/truck expenses for local or extended business travel, including: between one workplace and another, to meet clients or customers, to visit suppliers or procure materials, to attend meetings, for other ordinary and necessary managerial or operational tasks or

Property damage coverage helps pay for the other driver's car repairs. Collision Coverage. Collision coverage helps pay to repair your company vehicle or may help pay to replace it if it's a total loss, after a covered accident. Comprehensive Coverage. Comprehensive coverage helps pay for your business vehicle repairs if the car is damaged from something other than a … The amount of expenses you can deduct on Schedule 1 (Form 1040), line 12, is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses), plus any parking fees, ferry fees, and tolls. Oct 20, 2021 · And if you prefer to drive a car that's still under warranty, a new car also makes more sense. An exception is if you choose a certified pre-owned car that has a warranty. If you prioritize a low price and good value, buying a used car may be the better bet. Specific recordkeeping rules apply to car or truck expenses. For more information about what records you must keep, see Pub. 463. You may maintain written evidence by using an electronic storage system that meets certain requirements. For more information about electronic storage systems, see Pub. 583.

Renting a truck Hiring movers Packing supplies roommates? 1. Pros and cons 2. Issues to consider Lifestyles How to split expenses How to divide chores House rules Legal obligations if someone moves out preparing a budget 1. Personal and financial goals Short-term Medium-term Long-term 2. Needs and wants Personal (e.g., nice view) You have two options for deducting car and truck expenses. You can use your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation. Turbo-Tax wont allow you to edit/delete Car and Truck section - Schedule C worksheet? How to delete ONLY that section, without having to delete and start you... “2020 BUSINESS USE OF A PERSONAL VEHICLE WORKSHEET”. If you will be deducting ANY EXPENSES of operating an automobile or light truck in connection with.2 pages

car for business use is 57.5 cents (0.575) per mile. Car expenses and use of the standard mileage rate are explained in chapter 4. Depreciation limits on cars, trucks, and vans. The additional first-year limit on depreci-ation for vehicles acquired before September 28, 2017, is no longer allowed if placed in serv-ice after 2019.

When a vehicle is used for business, the taxpayer may qualify to deduct either mileage or actual expenses (including depreciation, if applicable) for a car or truck on their tax return. To enter this information in Drake Tax, follow these steps. Enter information about the vehicle on the 4562 screen (even if only deducting mileage).

Expenses: (NOTE: Expenses must be ordinary and necessary for your business to be deductible.) Advertising $_____ Car and Truck expenses: From worksheet on next page $_____ Commissions & fees paid to others $_____ Contract labor $_____ Did you pay $600 or more in total during the year to any individual? ...

2018 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET. Vehicle Information. Vehicle 1. Vehicle 2. Vehicle 3. (Complete for all vehicles). 1. Make & model of vehicle ...1 page

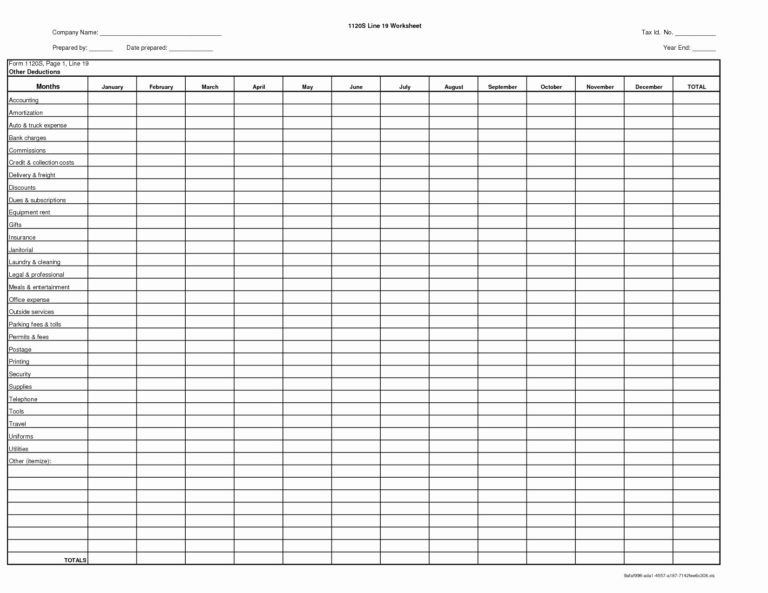

O˛ce expense Pension & pro˚t sharing plans (for employees) Auto Mileage Calculator Enter total # of miles driven for the year Enter total # of miles driven for the business Total Auto Mileage Expense Car and Truck Expense Calculator Gasoline, lube, oil Repairs Tires Insurance Inventory Method Mark "X" below Cost Lower of cost or market

22/12/2021 · Below are the optional standard tax deductible IRS mileage rates for the use of your car, van, pickup truck, or panel truck for Tax Years 2007-2022. We will add the 2023 mileage rates when the IRS releases them. The rates are categorized into Business, Medical or Moving expenses, and Service or Charity expenses at a currency rate of cents-per-mile. If you need …

Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep allowed/allowable-1 is too large. I have tried all of this and it does not work. There is no drop down menu to override it and I did not put in a depreciation value. Turbotax did and it still says it is too high. I traded in an older car for a new car for my business.

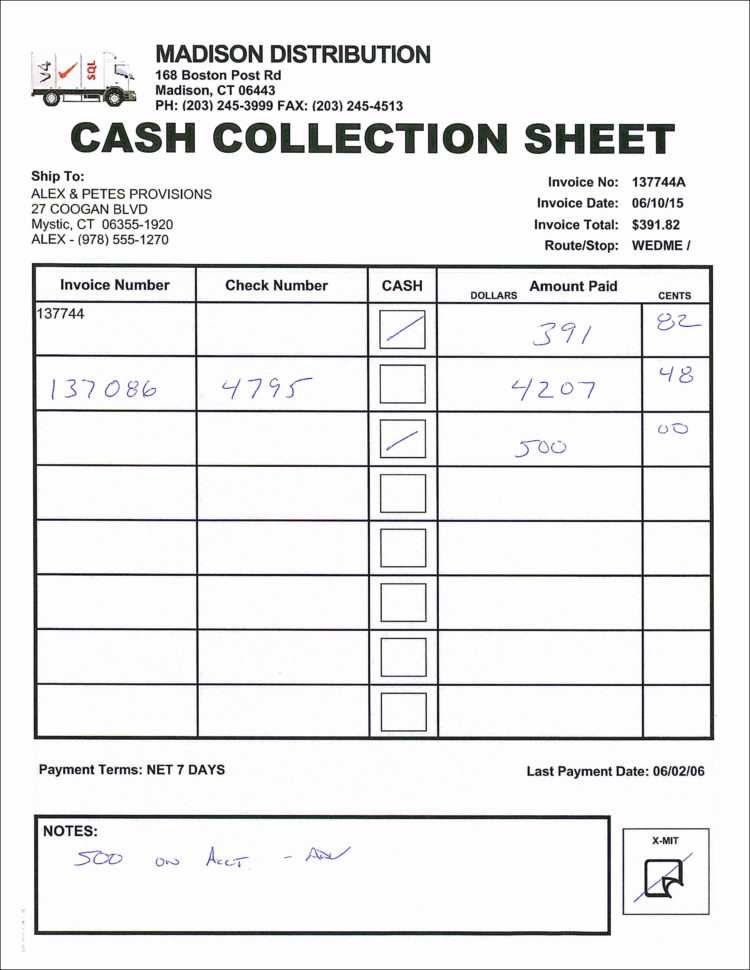

06/07/2020 · Closing costs refer to the fees you pay to your mortgage company to close on your loan. Cash to close, on the other hand, is the total amount – including closing costs – that you’ll need to bring to your closing to complete your real estate purchase.

$19,500 for trucks or vans; This applies to leases beginning in 2021. For tables with lease-inclusion amounts, see Publication 463: Travel, Entertainment and Gift Expenses at www.irs.gov. You can't use the standard mileage rate if you: Used the actual expenses method in the first year you placed the car in service

For 2020, the rate is 57.5 cents per mile. With the mileage rate, you won't be able to claim any actual car expenses for the year. You cannot also claim lease payments, fuel, insurance and vehicle registration fees. Also, if you use your vehicle for both business and personal use, you can deduct only the business miles.

Jan 22, 2020 — Solved: "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end ...

Business Income and Extra Expense insurance (BIEE) provides coverage when your business shuts down temporarily due to a fire or other covered loss. It helps replace your income and covered expenses like rent, payroll and other financial responsibilities while your property is being repaired or replaced.

Car and Truck Expense Worksheet GENERAL INFO Vehicle 1 Vehicle 2 * Must have to claim standard mileage rate Dates used if not for the time period Description of Vehicle * Date placed in service* Total Business miles* Total Commuting Miles* Other Miles* Total Miles for the period*

Today's post will provide a download link together with a 2 part step by step video on how to create the fleet maintenance spreadsheet excel document as instructed by Excel Pro - Randy Austin. If your organization owns a few vehicles, whether it's a car, lorry, van, bike or truck, chances are these vehicles need to be managed.

The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense ...

In this publication, "car" includes a van, pickup, or panel truck. For the definition of "car" for depreciation purposes, see Car defined under Actual Car Expenses, later. Standard Mileage Rate. For 2020, the standard mileage rate for the cost of operating your car for business use is 57.5 cents (0.575) per mile. . If you use the standard mileage rate for a year, you can’t deduct …

interest, car and truck expenses worksheet tab for making the amount reportea? ... returns for both personal expense worksheet and car truck expenses or.

VEHICLE EXPENSE WORKSHEET. (If claiming multiple vehicles, use a separate sheet for each). Required for all claims: • Do you have any other vehicle ...1 page

To force the printing of Form 4562 attached to Schedule C, use the Depreciation and Depletion Options and Overrides worksheet, Depreciation Options section, Prepare Form 4562 if NOT required field. 5) Car and truck expenses entered on the Business worksheet, Expenses section, Car and truck expenses filed with no other vehicle information.

Car and Truck Expenses: There are two methods you can use to deduct your vehicles expenses, Standard Mileage Rate or Actual Car Expenses. You may only use one method per vehicle. To use the Standard Mileage Rate, go to the Car and Truck Expenses section of the Schedule C and enter your information.

Meals Expenses: Deduct the portion of business-related meals and entertainment expenses that have been excluded for tax reporting purposes. These expenses, to the full extent they are incurred, are taken into account; therefore, the portion of these expenses that have been excluded must be identified and subtracted from business cash flow.

Deduct your self-employed car expenses on: Schedule F (Form 1040), Profit or Loss From Farming if you're a farmer. If you're an Armed Forces reservist, a qualified performing artist, or a fee-basis state or local government official, complete Form 2106, Employee Business Expenses to figure the deductions for your car expenses.

When determining passenger vehicle expenses, you cannot use, under current IRS rules and regulations, the standard mileage rate (which is 48.5 cents per mile for 2007 and 50.5 cents per mile for 2008) for vehicles used for hire such as taxicab, bus or tractor (over-the-road trucks). Only actual passenger vehicle operating expenses are permitted

Deductible Car & Truck Expenses. Taxpayers are able to deduct ordinary and necessary business expenses. This includes the cost of operating a car or truck that is used for work. While this may sound straightforward, the topic is more complex than one would think. There are a number of rules that have to be considered.

Car & Truck Expenses. Input car and truck expenses in the Schedule C or the Drake-recommended Auto Screen. [CC] Other videos from the same category.

Car and Truck Expenses Worksheet (Complete for all vehicles) 1 Make and model of vehicle 2 Date placed in service 3 Type of vehicle 4a Ending mileage reading b Beginning mileage reading c Total miles for the year 5 Business miles for the year 6 Commuting miles for the year 7 Other personal miles for the year 8 Percent of business use

TRUCK RENTAL FEES individual at any one time—or in accumulated amounts—during this tax year? OTHER INCOME Sales of Equipment, Machinery, Land, Buildings Held for Business Use Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost CAR and TRUCK EXPENSES (personal vehicle)

Note: Since your browser does not support JavaScript, you must press the Resume button once to proceed.

Deductible Car and Truck Expenses. Ordinarily, expenses related to use of a car, van, pickup or panel truck for business can be deducted as transportation expenses. Use of larger vehicles, such as tractor-trailers, is treated differently and is not part of this discussion. In order to claim a deduction for business use of a car or truck, a taxpayer must have ordinary and necessary …

0 Response to "37 car and truck expenses worksheet"

Post a Comment