36 like kind exchange worksheet

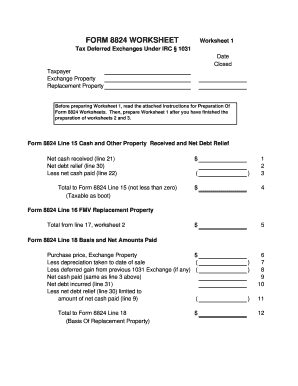

Total from line 17, worksheet 2 $ 5 Form 8824 Line 18 Basis and Net Amounts Paid Purchase price, Exchange Property $ 6 Less depreciation taken to date of sale ( ) 7 Less deferred gain from previous 1031 Exchange (if any) ()8 Net cash paid (same as line 3 above) 9 Net debt incurred (line 31) 10 Less net debt relief (line 30) limited to Like-Kind Exchange. I believe that an asset is characterized as 'given away' by entering a zero sales price. But this will generate a loss, and will conflict with the entries on Form 8824. I filled out 8824 manually with my own adjusted basis calculations which included asset depreciation through the date of sale.

Worksheets and checklists available for free to NATP members include: mid- year tax planning checklist, tax preparer worksheet, per diem rates, like -kind exchange worksheet, NOL allocation, NOL/AMTNOL calculation and carryover, partner's outside basis, standard mileage rates and more.

Like kind exchange worksheet

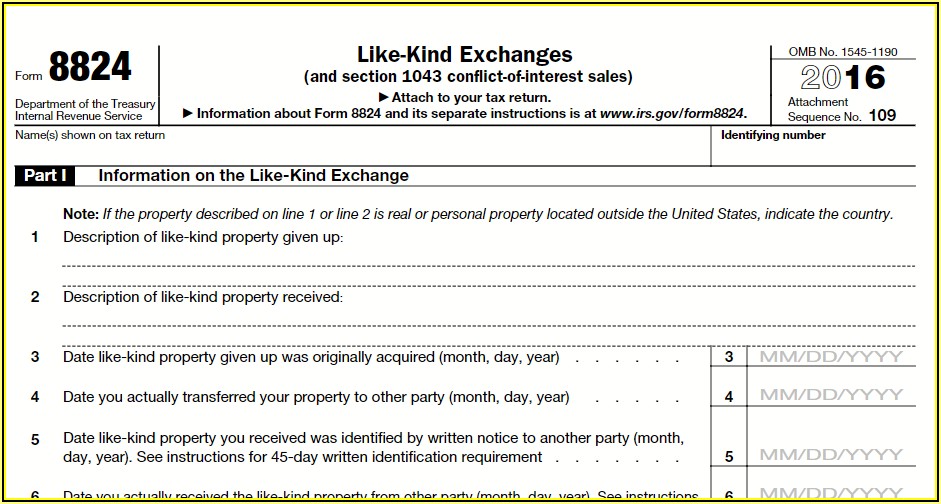

Like Kind Exchange Worksheet and 1031 Exchange Worksheet or References Brettkahr. Download by size: Handphone Tablet Desktop (Original Size) By powering down transmission lines and satellites in advance, power businesses can partially mitigate the effect of voltage spikes brought on by the solar storm. You will most likely discover that, since ... The Exchange is reported on IRS Form 8824, Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy.

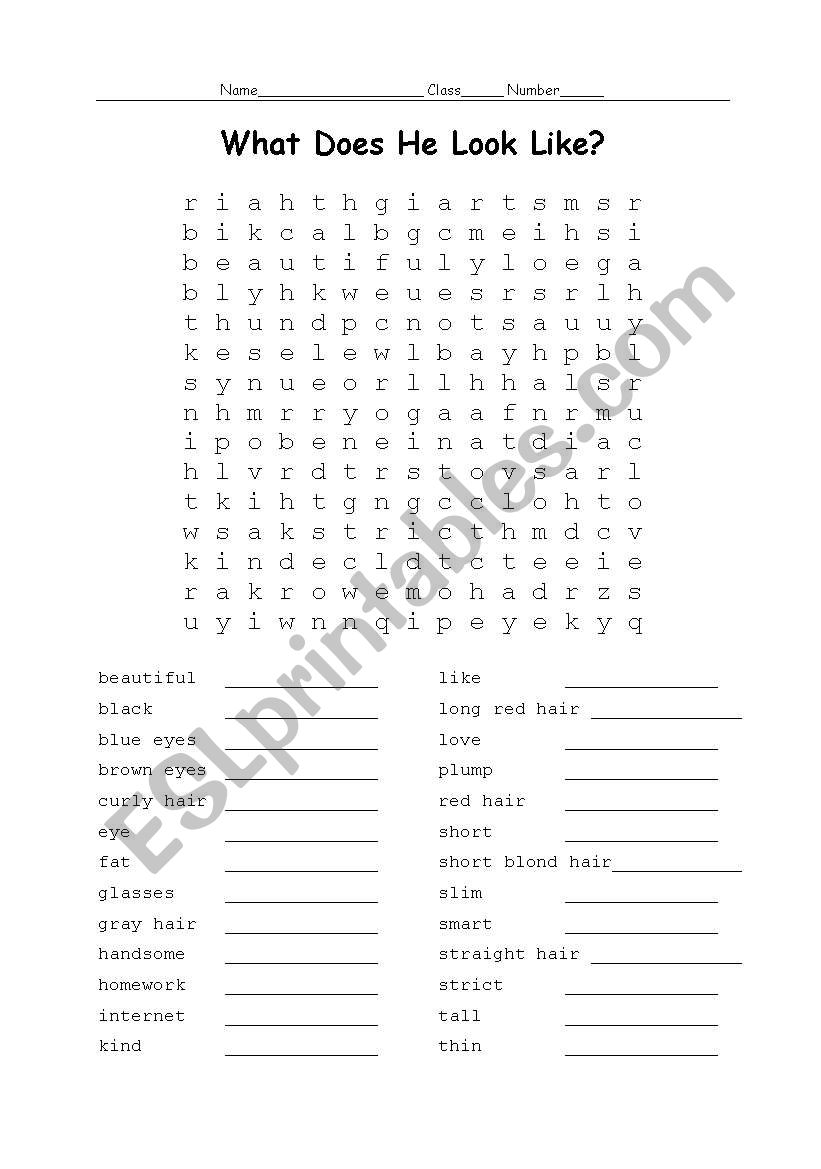

Like kind exchange worksheet. property to another party in a like-kind exchange, you must file Form 8824 with your tax return for that year. Also file Form 8824 for the 2 years following the year of a related party exchange. See the instructions for Line 7, later, for details. Like-Kind Exchanges Generally, if you exchange business or investment real property solely for ... Get Like Kind Exchange Worksheet Images. Vocabulary worksheets on fruits suitable for (very) young learners and beginners/elementary students. All three steps must be completed for the tax return to contain the correct information. Irs Form 8824 Realty Exchange Corporation 1031 Qualified Intermediary from www.1031.us. Download the free like kind exchange worksheet. This 1031 calculator is the same tool our experts use to calculate deferrable taxes when selling a property. Smart 1031 Exchange Investments . We don't think 1031 exchange investing should be so difficult. That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors … FORM 8824 WORKSHEET. Part I of Form 8824 is called “Information on the Like-Kind Exchange” and contains seven lines requesting information about your Exchange. *Line 1. Description of like-kind property given up. Insert a brief description such as “Duplex located at 123 Anywhere Street, City, State, Zip.” If the transaction involved personal property, add …

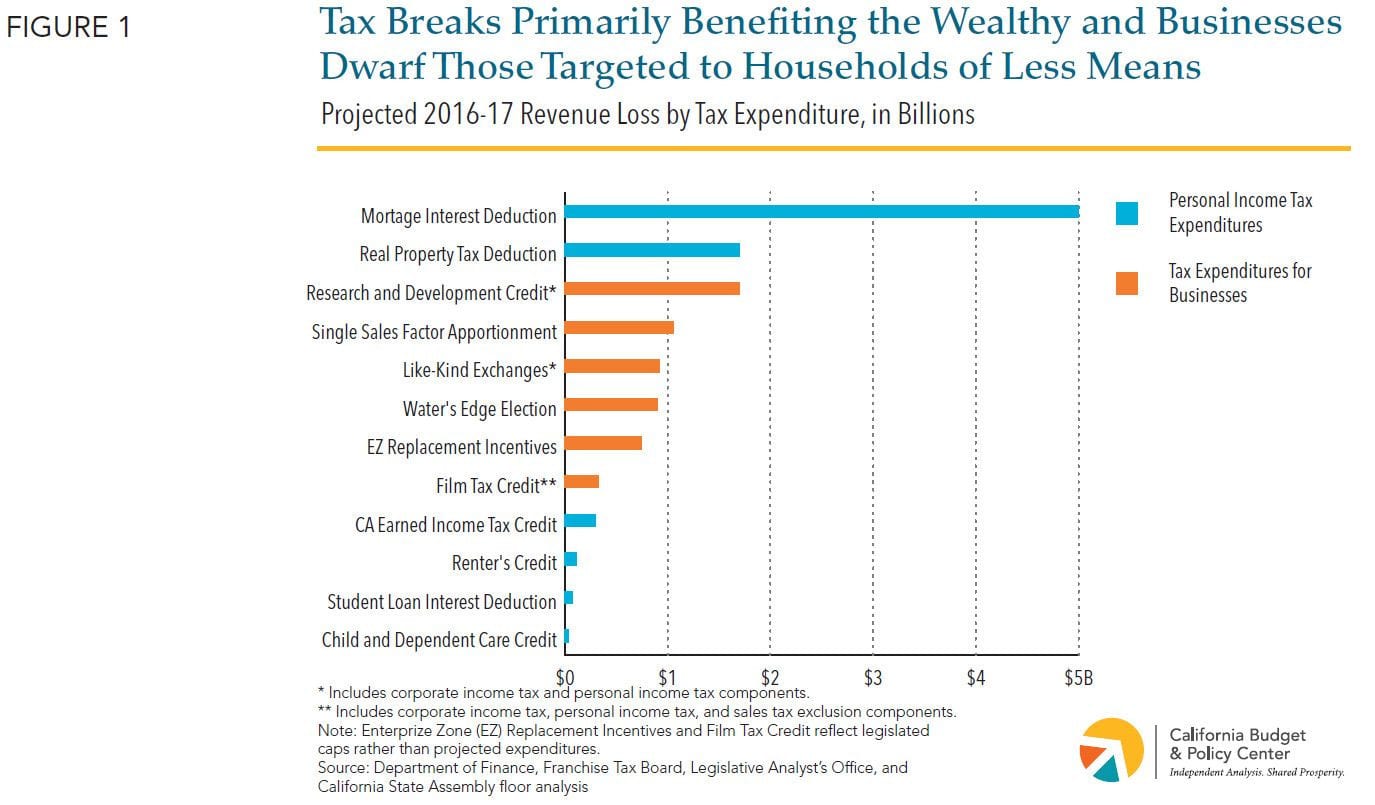

If you've ever completed an exchange, you know how difficult it can be to complete the IRS 8824 Like Kind Exchange form. You may have searched high and low, tried unsuccessfully to use a couple worksheets and even read all the instructions in the IRS publication but still had difficulty figuring out the form and what goes where. Teacher’s Note. In this lesson students will explore a description of the Columbian Exchange written by Charles C. Mann as part of the introduction to his book, 1493: Uncovering the New World Columbus Created.In three excerpts students will examine elements of the Exchange — an overview, a specific biological example of unintended consequences, and finally an … Like-kind exchange, also known as the 1031 exchange, is a transaction or a combination of transactions that prevents the current tax liability under the United States Tax Laws on the sale of an asset because another similar asset is acquired in place of the existing asset. Explanation The IRS considers all "Investment Properties" to be "Like-Kind." Properties do not need to be the same type. For example, raw land can be exchanged for an office building, a warehouse can be exchanged for NNN retail property, or a rental house for a Replacement Property Interest in a 300-unit apartment complex.

Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Qualifying property must be held for use in a trade or business or for investment. WORKSHEET GLOBALISATION Assumpta Bertran I Damià Campeny 1- Read the text and underline the main ideas: Globalisation has been possible for many reasons but the most important are the use of new technologies of communication and information (ICT) because they allow to extend all kind of relationship with people from different continents ... Like-kind exchanges. Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Like-Kind Exchange, later. Photographs of missing children. We constantly effort to reveal a picture with high resolution or with perfect images. Section 1031 Exchange Worksheet And Like Kind Exchange Formula can be valuable inspiration for people who seek a picture according specific topic, you will find it in this website. Finally all pictures we have been displayed in this website will inspire you all.

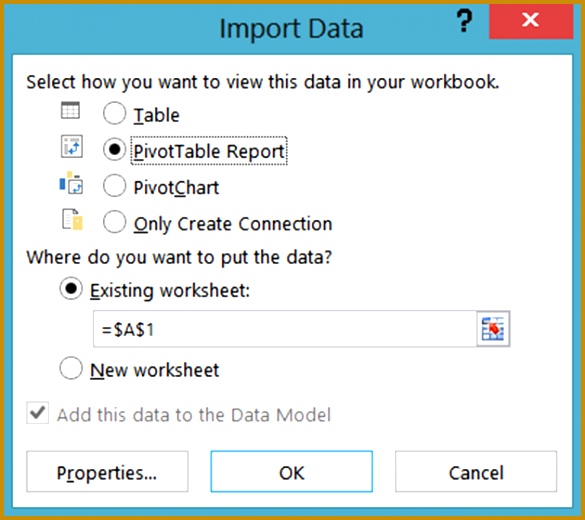

05.08.2012 · If you have a formula like =IF ... cl As Range Dim FirstFound As String Dim sh As Worksheet ' Set Search value SearchString = "ERROR" Application.FindFormat.Clear ' loop through all sheets For Each sh In ActiveWorkbook.Worksheets ' Find first instance on sheet Set cl = sh.Cells.Find(What:=SearchString, _ After:=sh.Cells(1, 1), _ LookIn:=xlValues, _ …

A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

08.12.2021 · A 1031 exchange, named after Section 1031 of the tax code, can defer capital gains taxes on a sale of investment property by reinvesting in similar property.

When a like-kind exchange is entered on like-kind exchanges worksheet and the "Automatic Sale" feature is used, up to five assets can be sold and new continuation assets are created for all five.

IA 8824 Worksheet Instructions, page 4 . 45-017d(08/03/2020) is a multiasset exchange. An exchange of - computers, vehicles, and cash for computers

Incomplete or Partial Exchange Spanning Two Tax Years 4 . Depreciation of Replacement Property 5 . Personal Property Exchanges after December 31, 2017 6 . Reporting State Capital Gain 6 . Completion of IRS Form 8824 "Like-Kind Exchanges" 6

In a 1031 Exchange, "boot" is anything received by the taxpayer that is not like-kind property. The IRS taxes the value of boot items. You won't find the term "boot" in the Internal Revenue Code.

Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Related Party Exchange Information Part III.

A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset. Open the Asset Entry Worksheet for the asset being traded.

Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ...

If you made more than one like-kind exchange in the same year, (a) you may report each exchange on a separate Form 8824, or (b) you can file only one summary Form 8824 and attach your own statement showing all the information requested on Form 8824 for each exchange. Include your name and tax ID number at the top of each page of the statement.

For me I like to directly speak to the worksheet I want to adress using Sheet("Worksheet"). So if you want to take an information form a particular sheet you can use this: Dim ExampleWorksheet as Worksheet Dim Example as Integer Example = Sheets("ExampleWorksheet").Cells(x,y) So you get rid of messing around with an active or not active worksheets. Share. Improve this …

Stack Exchange network consists of 178 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers.. Visit Stack Exchange

Like Kind Exchange Calculator. If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property. By changing any value in the following form fields ...

Worksheet April 17, 2018. We tried to get some great references about IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example for you. Here it is. It was coming from reputable online resource which we enjoy it. We hope you can find what you need here. We constantly effort to reveal a picture with high resolution or with perfect images.

Mar 23, 2021 · About Form 8824, Like-Kind Exchanges. Use Parts I, II, and III of Form 8824 to report each exchange of business or investment property for property of a like kind. Certain members of the executive branch of the Federal Government and judicial officers of the Federal Government use Part IV to elect to defer gain on conflict-of-interest sales.

Beginning after December 31, 2017, section 1031 like-kind exchange treatment applies only to exchanges of real property held for use in a trade or business or for investment, other than real property held primarily for sale. See Definition of real property, later, for more details. Before the law change, section 1031 also applied to certain exchanges of personal or intangible property.

A like-kind exchange, also known as a Section 1031 exchange, is a way of trading or exchanging assets and, in many cases, deferring gain on the trade (or exchange). "Like-kind" means that the property you trade must be of the same type as the property you receive. Due to changes to Section 1031 exchanges listed in the Tax Cuts and Jobs Act ...

Like kind exchange form templates agreement worksheets worksheet bumdig free for kids qualify example of ftblifornia instructions irs tax federal fantastic 4797 2017 8824 ~ Pladevia www.pladevia.com Post navigation

Analyze Reinvestment - Exchange: The power of a 1031 Exchange is the ability to use dollars otherwise spent in paying taxes. Over the course of a lifetime the benefits of greater cash flow, appreciation and equity buildup can equal many times the actual taxes paid. The above calculations are meant as an estimate and are not guaranteed for accuracy.

The Exchange is reported on IRS Form 8824, Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV.

Like Kind Exchange Worksheet and 1031 Exchange Worksheet or References Brettkahr. Download by size: Handphone Tablet Desktop (Original Size) By powering down transmission lines and satellites in advance, power businesses can partially mitigate the effect of voltage spikes brought on by the solar storm. You will most likely discover that, since ...

0 Response to "36 like kind exchange worksheet"

Post a Comment