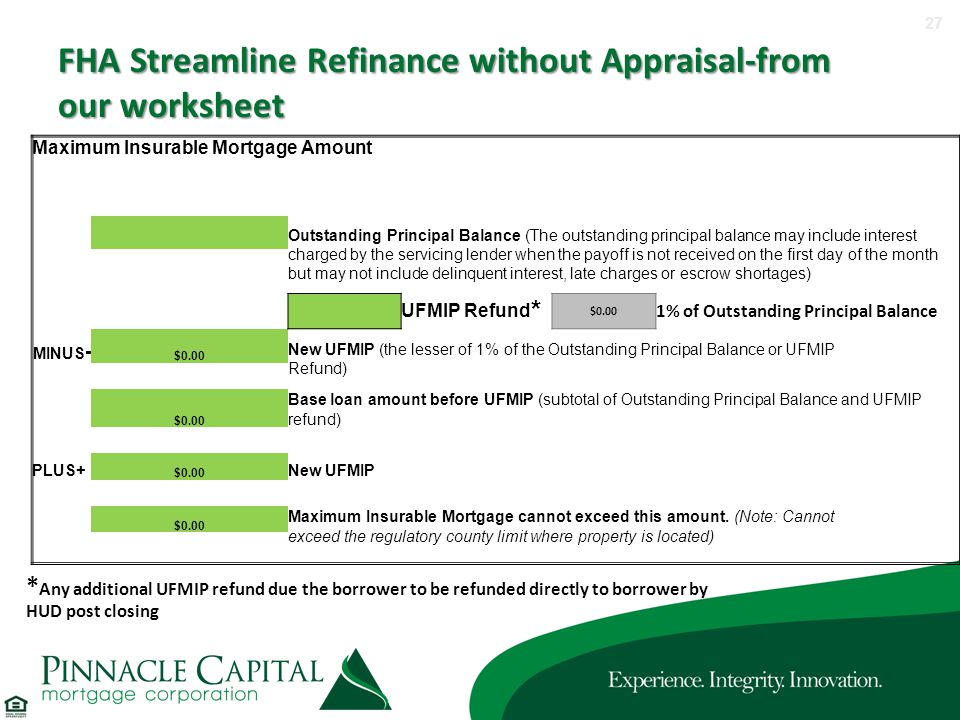

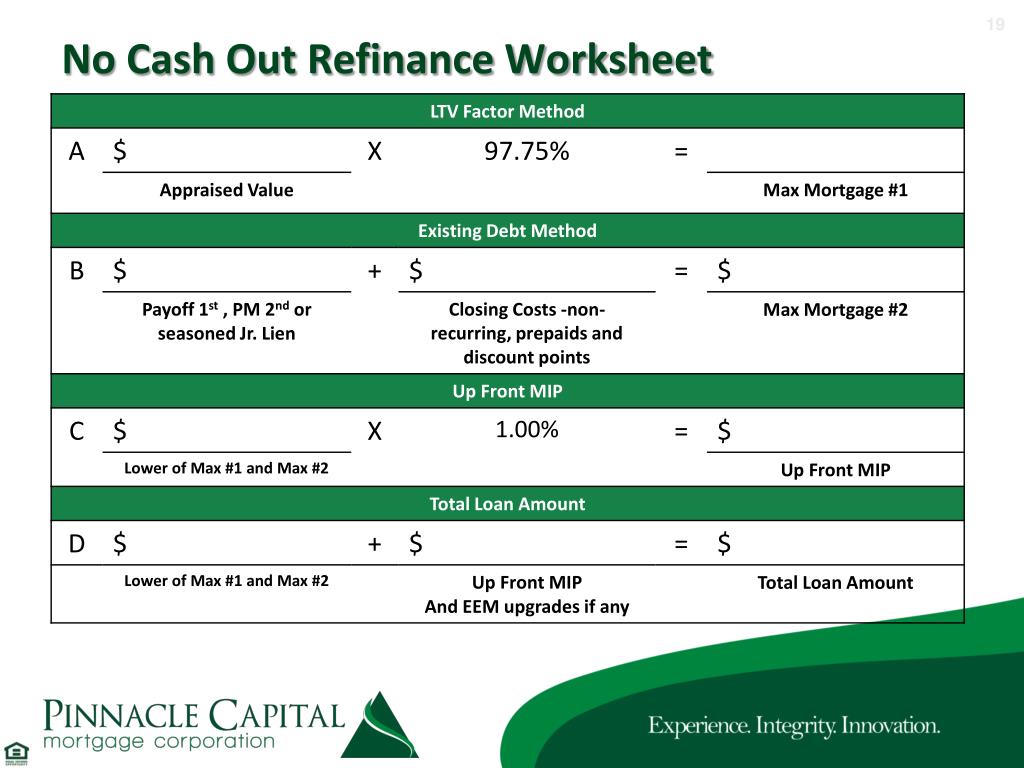

35 fha streamline refinance calculator worksheet

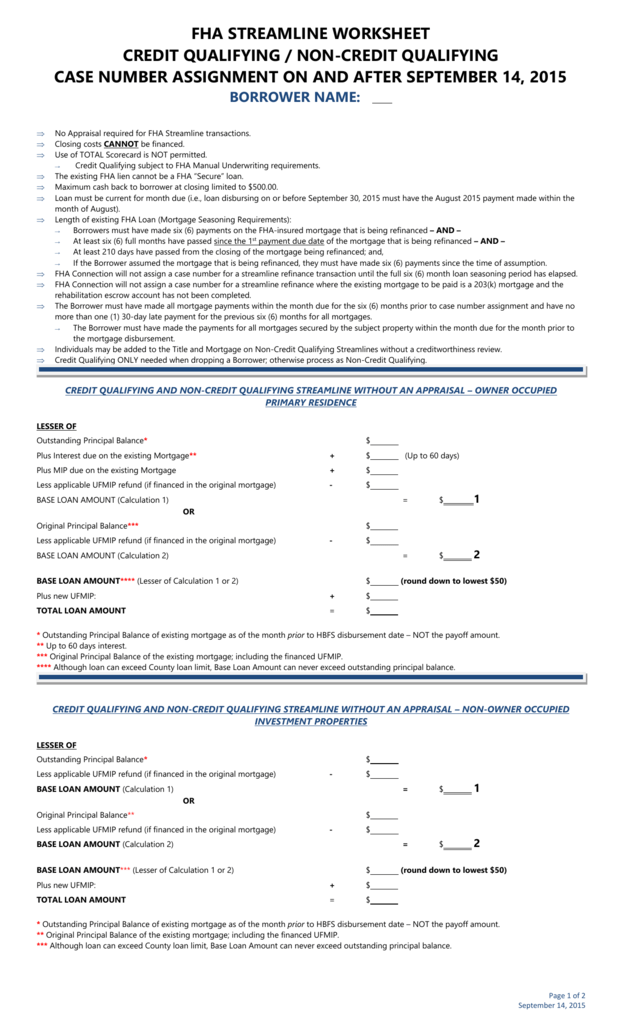

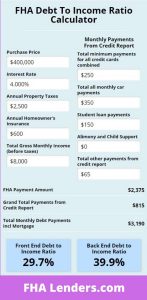

Jul 27, 2021 · There are two types of FHA 203(k) loans: the limited — sometimes referred to as “streamline” — and the standard. Each of these rehab loans also has a 203(k) refinance option for current ... According to FHA guidelines, applicants must have a minimum credit score of 580 to qualify for an FHA cash-out refinance. Most FHA insured lenders, however, set their own limits higher to include a minimum score of 600 - 620, since cash-out refinancing is more carefully approved than even a home purchase.

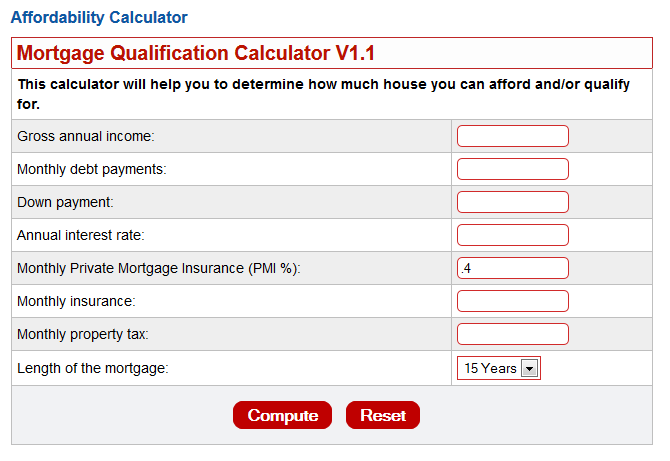

The VA Mortgage Process can be complicated without proper education and tools. Use these calculators to estimate payments and calculate fees.

Fha streamline refinance calculator worksheet

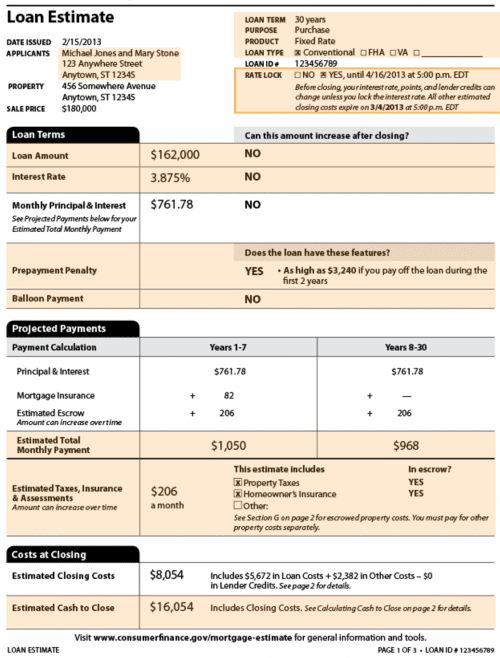

Jan 07, 2022 · Net worth calculator Budget calculator Budget worksheet Savings goal calculator Financial health score calculator Total car cost ... But there are strict requirements for an FHA streamline refinance. Dec 02, 2021 · However, you can cancel private mortgage insurance on a conventional loan as soon as you reach 20% equity. Many homeowners refinance their FHA loan to a conventional loan after they achieve 20% equity for this same reason. Take a cash-out refinance. A cash-out refinance allows you to draw money from your home equity to cover outside expenses ... VA Residual Income Calculator. Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck(s).

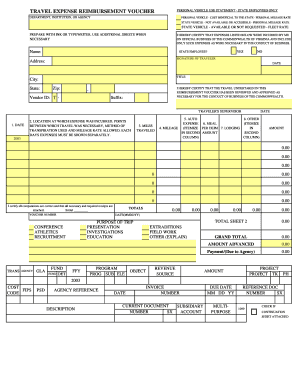

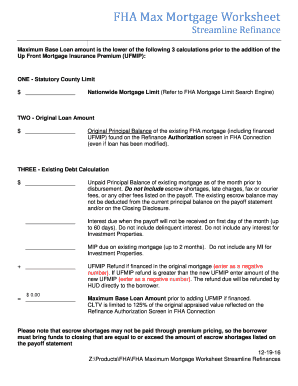

Fha streamline refinance calculator worksheet. Jan 26, 2022 · Refinance Calculator How ... Check out HUD’s Maximum Mortgage Worksheet for more information; Find an FHA 203k consultant if your home improvement costs will exceed approximately $31,000. This ... VA Residual Income Calculator. Residual income is a calculation that estimates the net monthly income after subtracting out the federal, state, local taxes, (proposed) mortgage payment, and all other monthly obligations such as student loans, car payments, credit cards, etc. from the household paycheck(s). Dec 02, 2021 · However, you can cancel private mortgage insurance on a conventional loan as soon as you reach 20% equity. Many homeowners refinance their FHA loan to a conventional loan after they achieve 20% equity for this same reason. Take a cash-out refinance. A cash-out refinance allows you to draw money from your home equity to cover outside expenses ... Jan 07, 2022 · Net worth calculator Budget calculator Budget worksheet Savings goal calculator Financial health score calculator Total car cost ... But there are strict requirements for an FHA streamline refinance.

0 Response to "35 fha streamline refinance calculator worksheet"

Post a Comment