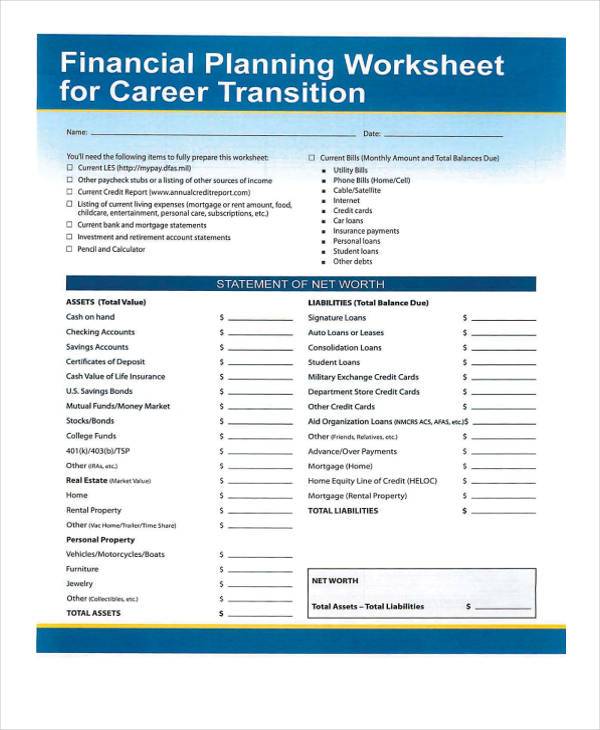

39 financial planning worksheet for career transition

4. Tommy John's Goal Setting Worksheet. Here's a simple and classy-looking, one-page goal setting worksheet that will work great for teenagers! 5. Therapist Aid's Youth Goal Setting Worksheet. These guys offer several pages that can help chunk teen's goals in each area of their lives: Social. Career.

Prior to completing your Individual Transition Plan (ITP), it is important to note that ... TurboTAP Financial Planning Worksheet for Career Transition at:.31 pages

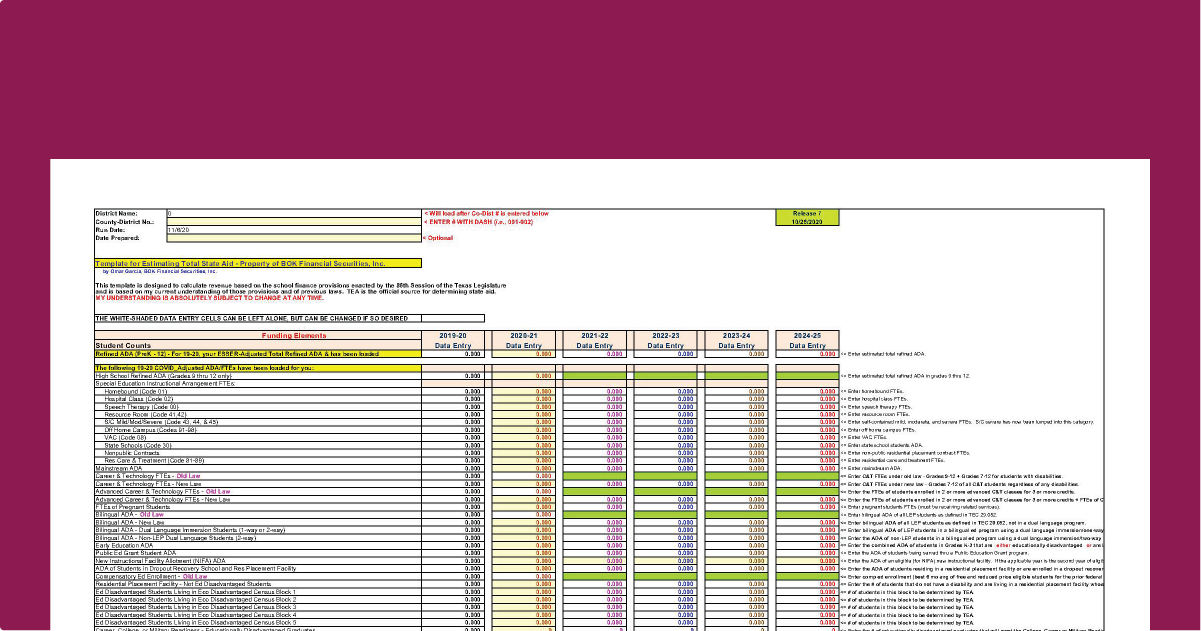

Use the year-end tax planning worksheet below to kickstart the conversation and keep you on track throughout the upcoming tax season. Year-End Tax Planning Worksheet. Raymond James financial advisors do not render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional.

Financial planning worksheet for career transition

Financial Planning Worksheet for Career Transition located on the TAP website because this tool will be updated during the delivery of this module.68 pages

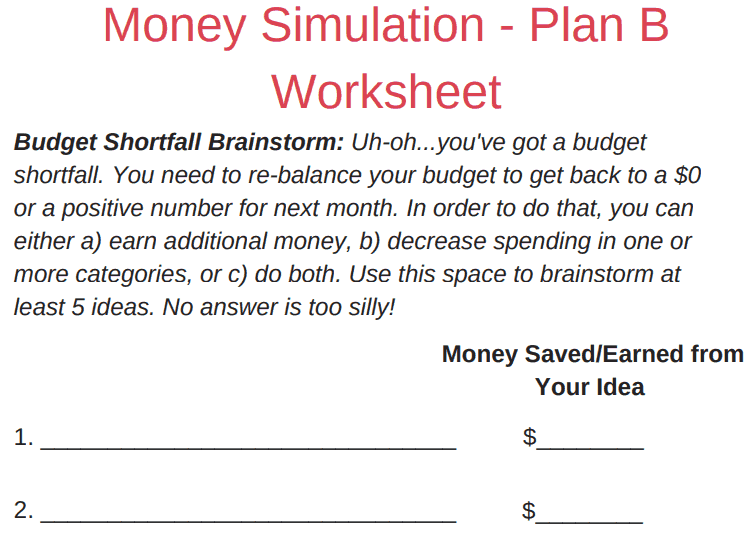

Two-income households make the transition from living on two incomes to one for a variety of reasons. One partner might become pregnant and decide to be a stay-at-home mom, or decide to go back to school so they're too busy to work. Whatever the reason, going from a dual-household income to a solo-income household can be daunting.

Powercat Financial Counseling: Kansas State University created this marriage and money guide to help couples walk through the process of combining finances and building a strong financial foundation. National Foundation for Credit Counseling : If you have significant debt and are looking for a plan to pay it off, this nonprofit provides much ...

Financial planning worksheet for career transition.

Download the College Financial Plan Worksheet; On the Powercat Financial website exists our College Financial Plan worksheet that is linked here. This worksheet will help you answer all the questions asked above so you can determine your total financial aid required to pay for all your expenses, not only tuition and fees.

And they'll pay $10,000 for the planning process, and it takes longer. So it just depends on the situation, but that's the basic range of things. And then on the financial transition process, it's really at least a year and sometimes a second year, and they start at 6,000 and go up per year, depending on, again, the complexity of the situation.

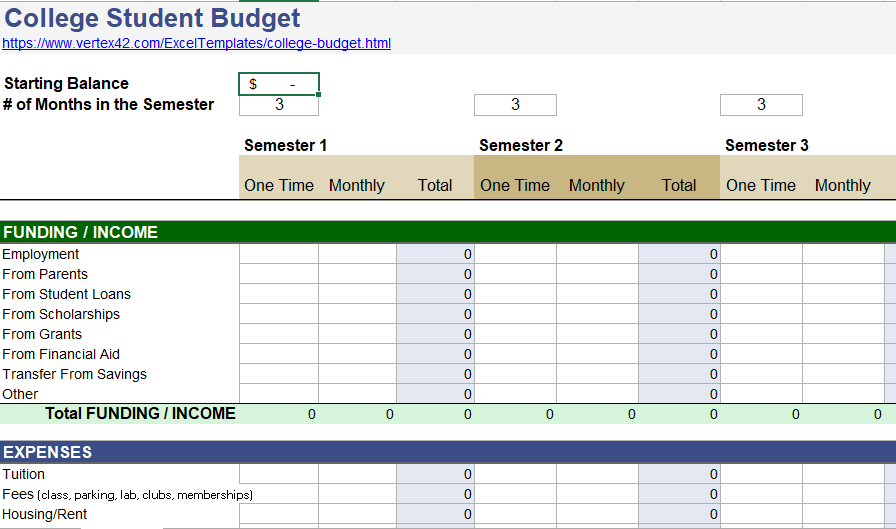

1. Creating a Budget. A budget is simply a plan for how you'll spend your money each month. To make your first budget in college, start by making a list of your fixed expenses, such as rent, tuition, books, car payments, utilities, and food. Next, make a list of your discretionary expenses such as clothing and entertainment.

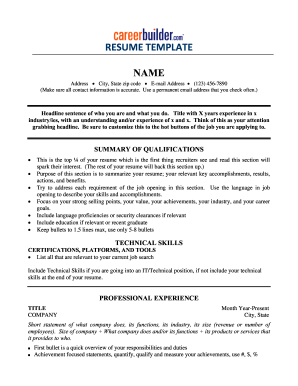

This is a fairly simple worksheet to help you align your military experiences with job skills relevant to the civilian world. If your office is doing things the right way, they will schedule your overview in the morning of the first day, with the financial planning workshop after lunch.

Financial Planning Worksheet for Career Transition 0 Turbotap Financial Planning Worksheet. ✓ Choose online fillable blanks in PDF and add your signature ...

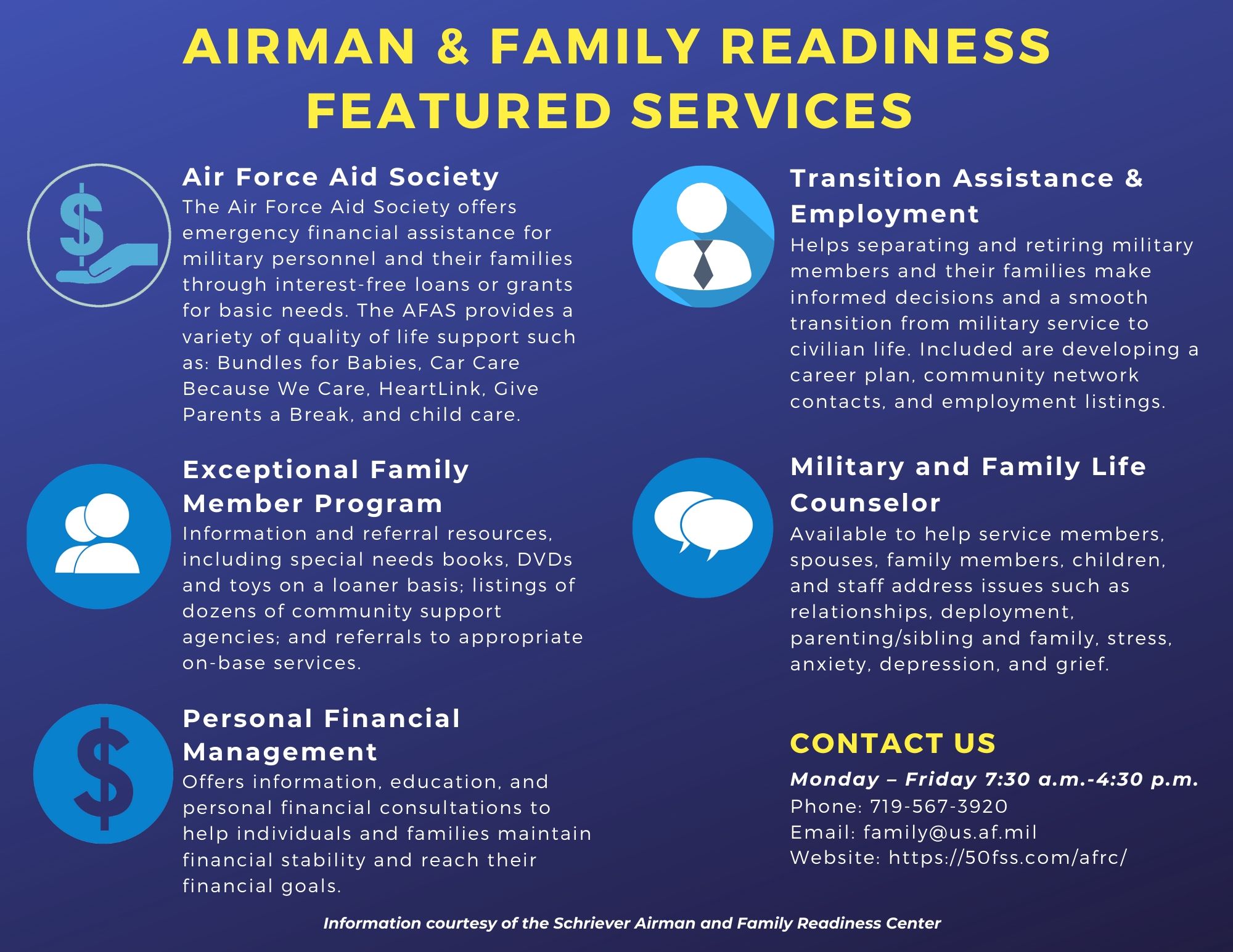

The Transition Readiness Program (TRP) is designed to ease the burden of transitioning Service members and their families by providing classes and resources that will assist with their employment, college, vocational, and entrepreneurial needs. These interactive classes will reduce the stress related to transition by increasing Service members' knowledge, marketability, and confidence as ...

Create a Transition Action Plan . Once you identify your ideal job, your next step is to come up with a plan for how to get it. You'll need to engage with real-world considerations (think: monthly bills, your kids' schools, etc.) to ensure that your dream career is realistic based on your existing responsibilities.

Transition Thursday Webinars: Retirement Planning. Whether you are only a few years away from retirement or just starting your career, now is the time to start thinking about retirement planning. In this webinar, Extension Educator Dave Bau, discusses how to determine retirement expenses, and plan for long-term health.

28. Editor. This occupation is often a great match for former teachers, especially for those with a background in studying and teaching English. After all, much like a good teacher, a good editor needs to be able to recognize and mentor someone else's good ideas and talent. In this case, it's all about writing talent.

Financial Planning Worksheet for Career Transition. STATEMENT OF NET WORTH. ASSETS (Total Value). Cash on hand. $. Checking Accounts. $. Savings Accounts.5 pages

If you don't yet, then your five-year plan can help you define what steps you need to take to make that ultimate goal achievable. 3. Identify your transferable skills. This step is particularly important if you are planning to make a career transition. Look at your current list of experience, knowledge and skills.

Fill Fillable Financial Planning Worksheet, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now!

1: Able. Being able is defined as having considerable skill, proficiency, or intelligence. I guess this one speaks for itself. Everyone you encounter must feel you have sufficient skill to do your job, or you won't have a job to do. Your staff, your patients, and referring doctors must all have confidence in your abilities.

The purpose of the NHLBI Career Transition Award (K22) program is to provide highly qualified postdoctoral fellows and other doctoral-level researchers currently in training in the NHLBI Division of Intramural Research with the opportunity to transition their research programs to extramural institutions as junior investigators. To achieve these objectives, the NHLBI Career Transition Award ...

Building your career is one of the surest ways to increase income and make money. When planning for the future, one of the most critical financial decisions is determining your career path. In this lesson, students will be encouraged to consider various topics related to career planning and the financial aspects of employment.

a) client communication methods and frequency b) the approach to investment allocation and selection. c) financial planning services such as, forecasting, retirement planning, estate planning and d) services relating to tax reporting, tax returns and tax strategies. COMPONENT 3 of an advisor's business model includes identifying the processes and presentations for delivery of services and ...

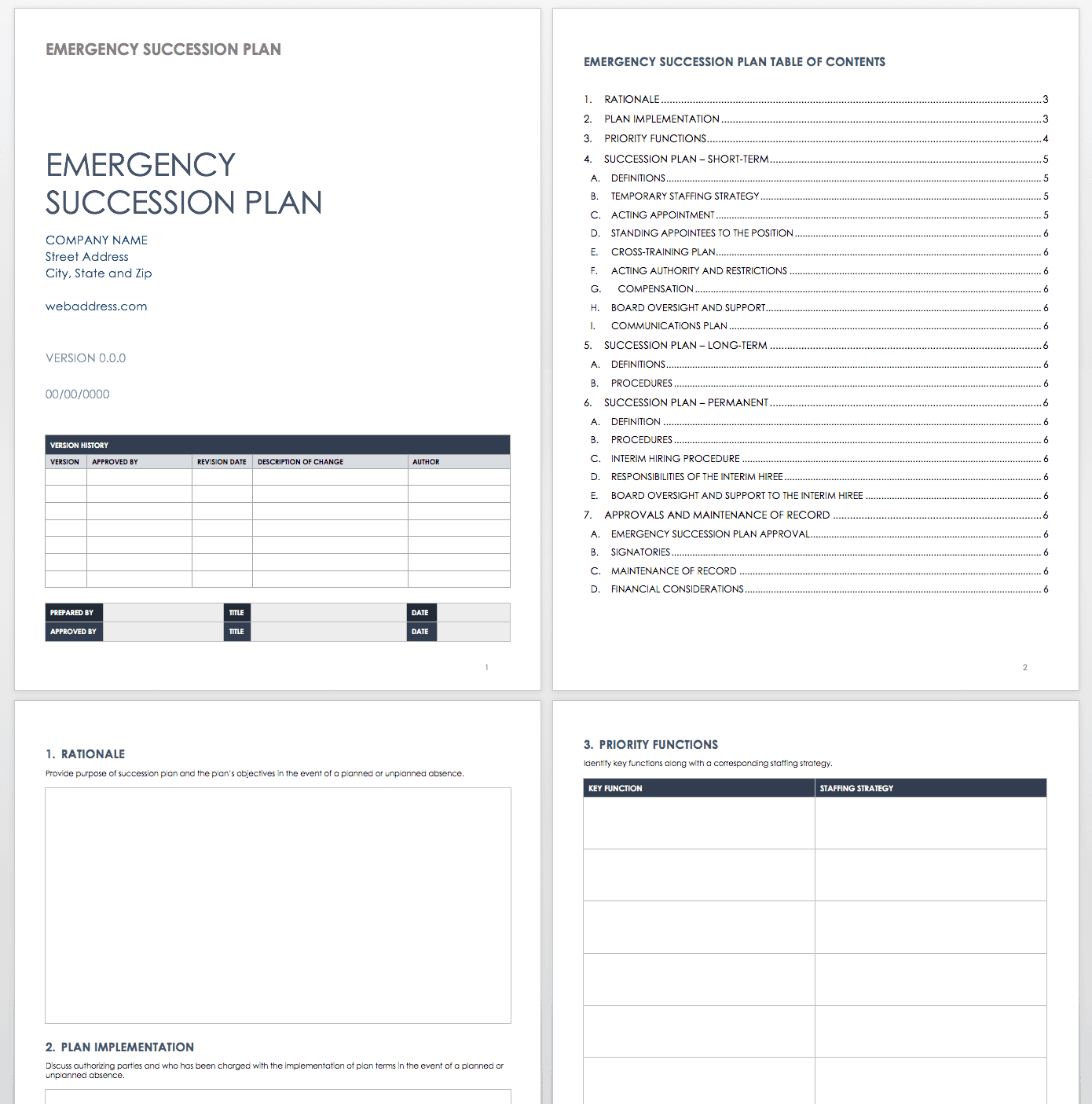

The free download, Potential Successor(s) Evaluation worksheet, from my website should help. My next article will review steps 8 to 18 of the 18-step process that will help financial advisors organize their transition plan in advance of their retirement. These steps occur after choosing a successor when the chosen successor becomes more involved.

Plan Your Finances. Complete the Financial Planning worksheet. This worksheet will be available to students on their student status page in late 2020. It offers you tools for managing your loans, minimizing your debt, and understanding your bottom-line finances. This is not required, but highly encouraged.

Retirement requires a lot of planning and consideration. In addition to finances, you need to think about when and where you'll retire. Experts advise that you may need as much as 80 percent of your pre-retirement income to continue your current standard of living. The exact amount will depend on your individual needs.

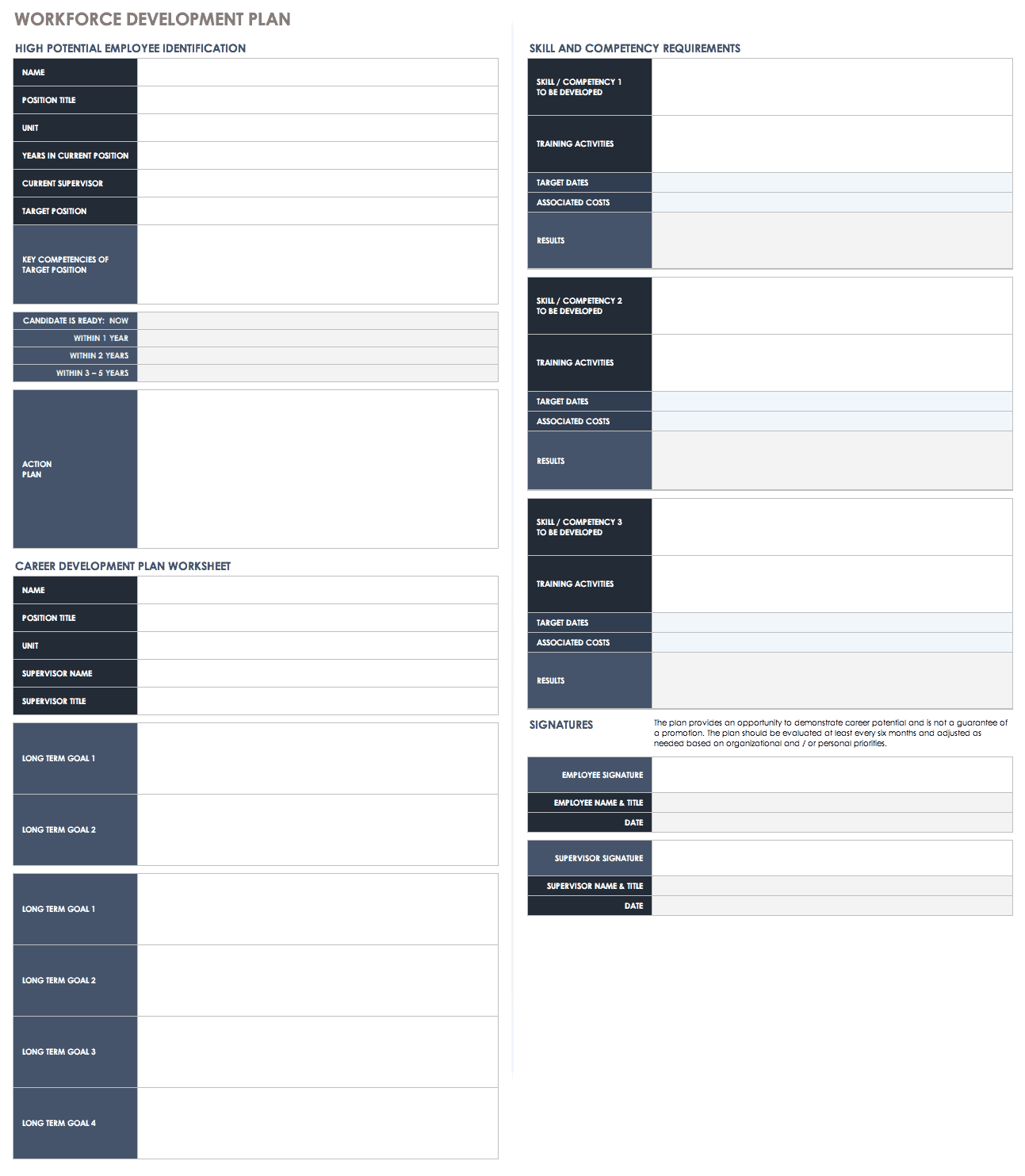

Career Planning Toolkit "Take control of your career success " This mini-course is designed to help you determine where you want to take your career and the specific jobs/roles you will need to get there. As part of this mini-course, you will complete four critical worksheets which help plan your career:

Elizabeth Westendorf is an Associate for Atwood Financial Planning, LLC and a comprehensive fee-only by the hour financial planner. She specializes in working with young professionals to help them start financially strong and meet their goals. In today's episode, Elizabeth shares how she manages her money and mental health after surviving a traumatic accident.

Financial Planning Worksheet. for Career Transition. Name: Date: You'll need the following items to fully prepare this worksheet:.

The National Secondary Transition Technical Assistance Center (NSTTAC) has identified evidence-based practices in secondary transition planning that lead to positive post-school outcomes. Opportunities to learn independent living skills will lead to a smooth transition. Independent living experiences are referenced on pages 6-7, 18-19, and page 26.

Income is any source that provides a regular supply of money, such as employment, investments, or a pension. For your spending plan, it is important to consider ...85 pages

Turbotap Financial Planning Worksheet. Fill Out, Securely Sign, Print or Email Your Turbotap Financial Planning Worksheet for Career Transition Form ... Rating: 4.6 · 54 votes

Americans plan to spend an average of $205 on entertaining at home during the 2020 holiday season. It's hard to know exactly how COVID-19 will affect this number. Some individuals may be planning more at-home gatherings to avoid restaurants, while others may slash this budget entirely to limit gatherings.

Financial Literacy Worksheets PDF - Earning Money. Earning money is a major part of financial literacy…because without money, you've really got nothing to manage! This section will focus on free financial literacy worksheets and PDFs on understanding paychecks and other forms of earning income besides a 9-5 job. 1. Understanding Your ...

You will learn to assess your future career goals and plans, identify needs, develop a financial spend plan and project your budget for transition. Additionally, you will be provided resources and training to analyze and search the current employment markets, effective interviewing, and dressing for success.

F or fall 2020 financial aid, you must complete the 2020-21 FAFSA. Review your dining plan. If you are living on campus during Eagle Success, you will be automatically assigned a dining plan when you complete your housing application. Meal plans become effective when you move into your residence hall.

When a financial emergency happens, emotions can take over and stress levels can skyrocket. Coping with an unexpected financial burden is not easy, but you can do things to take control of the situation. Our list of essential steps to take in a financial crisis can help you navigate your short-term needs and plan for long-term recovery.

The Personal Financial Management Program provides personal financial education, training and counseling at no cost to Marines/Sailors and their families. A solid understanding of personal financial situations will give a better chance of achieving financial success during your career and help build confidence in facing financial challenges and ...

0 Response to "39 financial planning worksheet for career transition"

Post a Comment