31 Renting Vs Owning A Home Worksheet Answers

©Family Economics & Financial Education – Revised April 2005 – Housing Unit – Renting vs. Owning a Home – Page 1 Funded by a grant from Take Charge America, Inc. to the Norton School of Family and Consumer Sciences Take Charge America Institute at The University of Arizona Title: Microsoft Word - Renting vs Owning a Home Lesson Plan 1 9 3 Revised March 09 Author: Tiffany Kiramidjian Created Date: 9/21/2009 5:28:37 PM

cars and loanslesson outline www.practicalmoneyskills cars and loans teacher's guide 6-ii presentation slides 6-A costs of owning and operating a motor vehicle 6-B how much can you afford? (the 20-10 rule) 6-C consumer decision making 6-D shopping for a used car 6-E sources of used cars 6-F shopping for a new car 6-G warranties 6-H service contracts 6-I shopping for a car loan

Renting vs owning a home worksheet answers

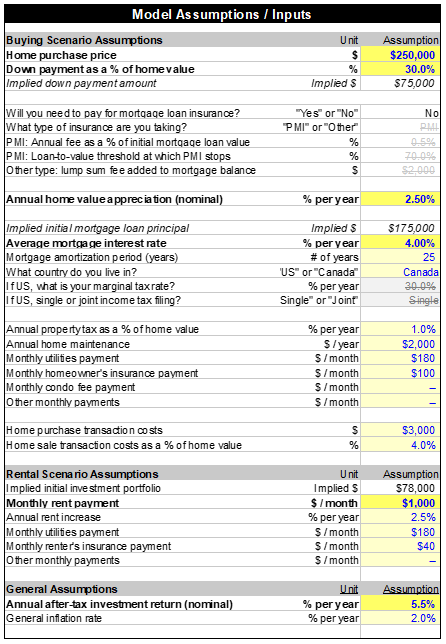

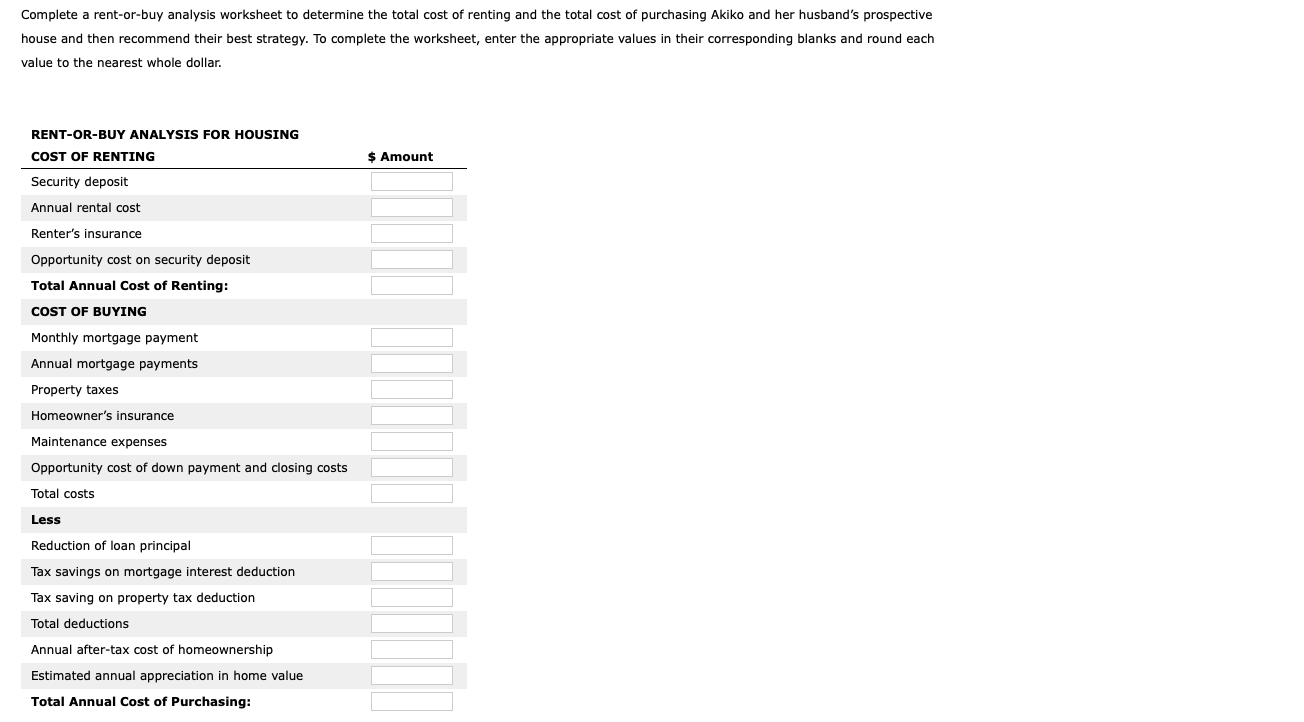

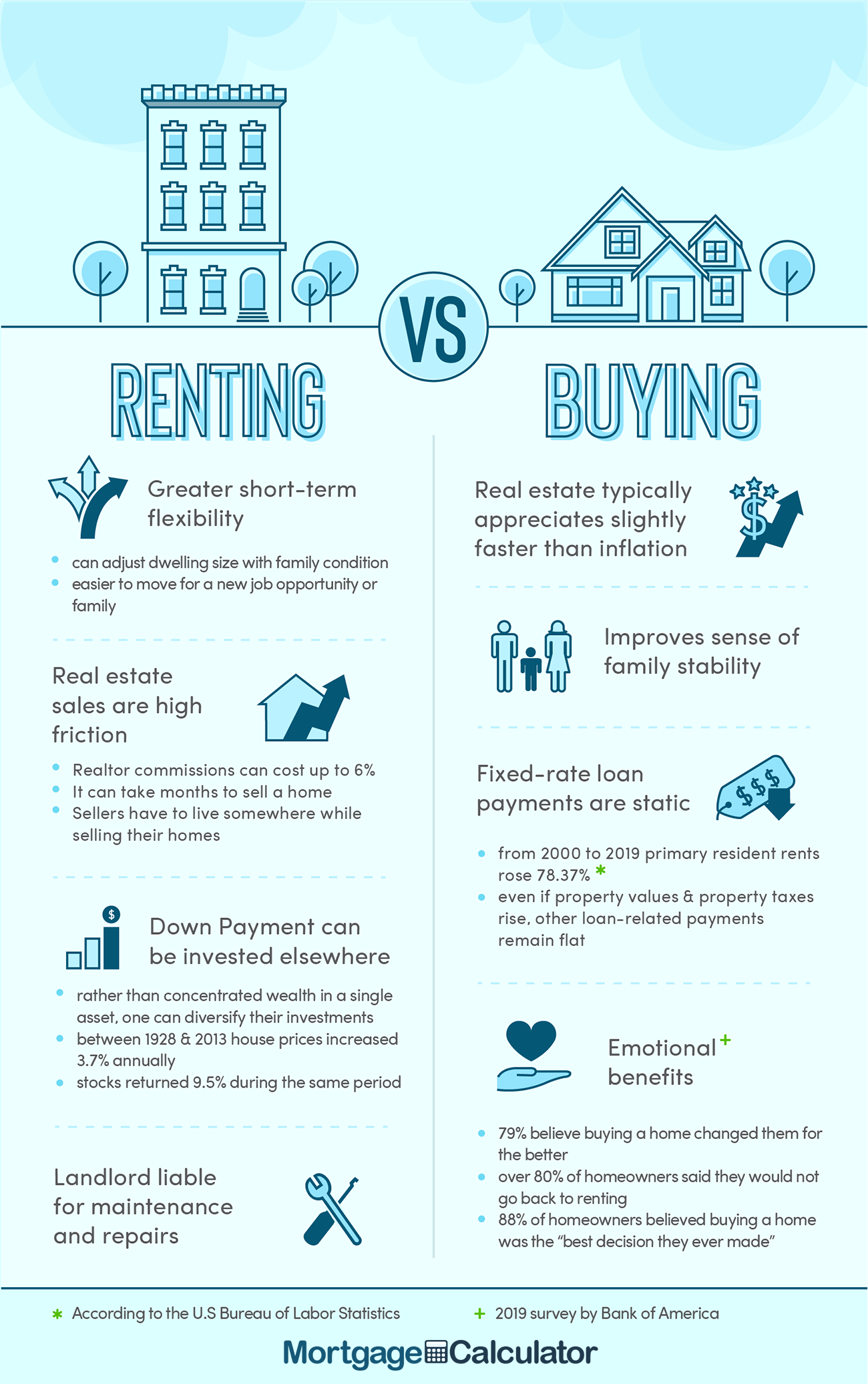

home ownership to be a better match than renting. Renting gives you the ability to easily move around once your lease is up. By contrast, the process of selling a house can be long, stressful and complicated. If you value the freedom to chase educational or career opportunities as they arise, renting beats buying a home. Owning a home means you. The cash inflows to owning a home are any savings or other benefits (rent paid, mortgage interest tax deduction, house price appreciation, etc). We'll assume the home is sold down the line. Costs of Homeownership (Cash outflows) Home purchase price: The amount you are thinking of buying the house for. If they rent, the builder will require monthly rental payments of $1,200 and a security deposit equal to two months of rent. • Since they want to be protected against the possible loss of their possessions, they will purchase a renters' policy of $200 every six months, while a more comprehensive homeowners' policy will cost 0.5% of the home's value per year.

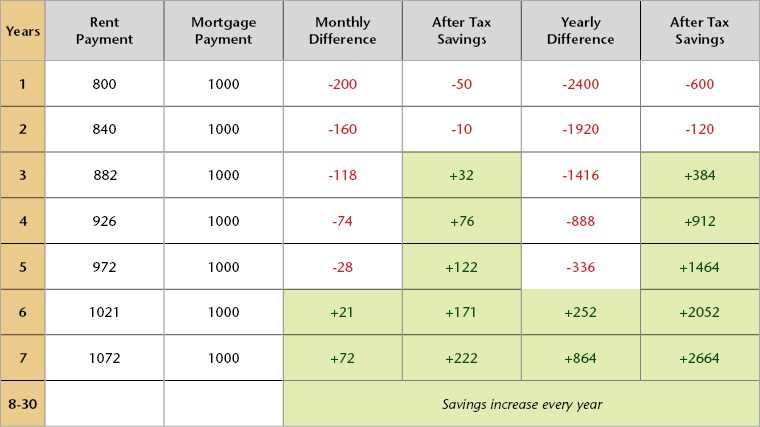

Renting vs owning a home worksheet answers. This rent vs. buy calculator makes the math easy so you can determine the total estimated cost of renting vs. buying. Simply provide the required inputs, compute your totals, and print out a detailed report! As powerful as this renting versus buying calculator is, there are more factors to consider besides just financial cost. Spreadsheet Problem. Use the Ch7_Rent_vs_Own worksheet in the Excel workbook provided on the Web site. Determine the after-tax IRR for owning versus renting in each of the five years with the following changes in the original assumptions in the spreadsheet:. a. The homeowner has a 15 percent marginal tax rate instead of 28 percent. Discuss the answers given by the participants. 6. Hand out the Renting vs. Owning a Home note-taking guide 1.9.3.L1 for participants to complete during the PowerPoint presentation. 7. Give the Renting vs. Owning a Home PowerPoint presentation 1.9.3.G1 to understand the differences between renting and owning a home. The rent-to-own agreement will specify how and when the purchase price is decided. The price could be based on the home's current value—or a predicted one. In some cases, the price becomes official when the buyer and seller sign the contract. In other situations, the purchase price won't be decided until the lease expires.

Renting Is Actually The Smarter Move Sometimes. Bottom line: If you can afford to buy a home where you live and your neighborhood is appreciating, it's almost always a better use of your money than renting. But the assumption that owning a home is always smarter than renting isn't entirely true. This spreadsheet will help you answer the question that many Americans ask, should I keep renting or buy a home? Buying a home can have financial advantages, but many times these are overstated, and hard to figure out exactly how much these savings are. 46 Termsmitchellcallahan. Business Law - Chapter 9: Renting or Owning a Home. tenant. landlord. lease. lessee. one who rents real property such as an apartment or house. owner of real property who rents it to someone else. contract between a tenant and a landlord (transfers only posse…. The price-to-rent ratio is the ratio of home prices to annualized rent in a given location and is used as a benchmark for estimating whether it is cheaper to rent or own property. more Ground-Rent.

home ownership to be a better match than renting. Renting gives you the ability to easily move around once your lease is up. By contrast, the process of selling a house can be long, stressful and complicated. If you value the freedom to chase educational or career opportunities as they arise, renting beats buying a home. Owning a home means you. the "Rent vs Buy" exercise on the. in a minimum of 100 words the main benefits and drawbacks of renting versus owning a home. Review. Exhibit 7-4 in Ch. 7, p. 225 of. Focus on Personal Finance ... before they will consider approval. Using this information, answer the questions and show your calculations in the table below: Net monthly ... Finance questions and answers; 4. Rent vs. buy home. Use Worksheet 5.2. Denise Green is currently renting an apartment for $725 per month and paying $275 annually for renter's insurance. She just found a small townhouse that she can buy for $185,000. She has enough cash for a $10,000 down payment and $4,000 in closing costs. Owning a home is a financial commitment that requires you to plan ahead and reflect on where your life is headed. Before deciding whether to rent or buy, ask yourself what your budget is and if either choice would require you to stretch your finances.

If they rent, the builder will require monthly rental payments of $1,200 and a security deposit equal to two months of rent. • Since they want to be protected against the possible loss of their possessions, they will purchase a renters' policy of $200 every six months, while a more comprehensive homeowners' policy will cost 0.5% of the home's value per year.

Homeowners Insurance Q&;A. Homeowners insurance is one of the broadest types of risk coverage you can buy. In general, it covers the roof over your head, the shirt on your back and yes, even the kitchen sink! Homeowners insurance also protects you, your family members and your pets, if someone else is hurt at your home or away from it.

List 3 advantages of owning List 3 disadvantages of owning 1. 1. 2. 2. 3. 3. Total Points Earned 30 Total Points Possible Percentage List 3 costs of renting 1. 2. 3. OWNING Home Ownership— Equity— Collateral— What is the recommended purchase price an individual should pay for a home? What percentage of the purchase price is a down payment.

Personal Finance: Renting vs. Owning Go to Everfi and complete the Renting vs. Owning Module. During or after completing the module, answer the following questions. This short answer worksheet is worth up to 10 points and the module is worth up to 10 points. Total Possible Points is 20. PLEASE WRITE LEGIBLY OR TYPE YOUR

Math 154: Project 3 - Buying vs. Renting (Chapter 9) Objective: In this project you will create an Excel Workbook consisting of two worksheets. You will then use it to perform various financial calculations and answer the questions below. Specifically, it will be used to examine whether it is better to buy a home or rent, depending on things such as income, property and income taxes.

In this project students figure their purchasing power, select a house that they would like to buy, and investigate the total costs involved in purchasing that home. Students will also compare and contrast the advantages and disadvantages of a 15 vs. 30 year mortgage and renting vs. owning. This ass...

The cash inflows to owning a home are any savings or other benefits (rent paid, mortgage interest tax deduction, house price appreciation, etc). We'll assume the home is sold down the line. Costs of Homeownership (Cash outflows) Home purchase price: The amount you are thinking of buying the house for.

ID: 2487009 Language: English School subject: English as a Second Language (ESL) Grade/level: adults Age: 18+ Main content: Vocab activity Other contents: Add to my workbooks (0) Download file pdf Embed in my website or blog Add to Google Classroom

Your home will most likely increase in value over time depending on the market and how well you take care of it. What you buy for $200,000 today could sell for $260,000 down the road. You have tax advantages. Many of the costs of owning a home—like property taxes—are tax deductible. And if you're paying off a mortgage, you'll get to.

Rent is the act of paying a landlord for the right of use on a residential property. The primary cost of renting a home is the monthly rental fee. Other costs include the security deposit, application fee, and possibly, insurance. A rental home is typically considered a temporary residence.

Renting vs. buying a home is a big decision, and there are pros and cons to each option. In recent years, a higher percentage of U.S. households were renting than at any point since 1965.

View Homework Help - Rent-vs.-Buy-Worksheet-_-Peter-Lazaroff.pdf from ART 1010 at Southwest Tennessee Community College. Rent vs. Buy Worksheet Rent or Buy? Whether a home purchase makes sense

For home buying, the Rent vs. Buy Calculator considers one-time costs — closing costs and the down payment — and ongoing expenses, like property taxes, an HOA fee, home insurance, and private.

This lesson will provide students with information on buying a home and where and how to begin the process. After comparing the differences between renting and buying, students will be introduced to a five-step process for home buying. This framework provides an overview for the activities involved with selecting and purchasing a home.

and lease them to people who prefer renting instead of owning. Because condo owners share common areas, each unit owner shares the cost of. Ask your teacher to review your answers before continuing with this lesson. Student Module 10.1 7... at -home Mom , and Omar works for a computer software company. They want to find a larger place to ...

5. Give each student the home classified section of the newspaper. 6. Students each choose 3 ads for homes for sale/rent. 7. Students role play with a partner. Referring to her/his worksheet, Partner A uses her/his questions from Step 4 and pretends to be buying or renting a house. Partner B uses the home

0 Response to "31 Renting Vs Owning A Home Worksheet Answers"

Post a Comment