31 Pastor's Housing Allowance Worksheet

that the allowance 1) represents compensation for ministerial services, 2) is used to pay housing expenses, and 3) does not exceed the fair rental value of the home (furnished, plus utilities). The clergy housing allowance is subject to self-employment taxes, and most clergy pay these quarterly using IRS Form 1040 ES. Housing Expense Estimated. Information for Retired Ministers Regarding Housing Allowance 08-19 Page. 2. of . 4. I\9814896.5. The minister's housing allowance designation is only an . estimate. of his or her expected housing expenses for the year. Housing allowance exclusion — This is the amount a retired minister legally canexclude from income taxes and is limited to.

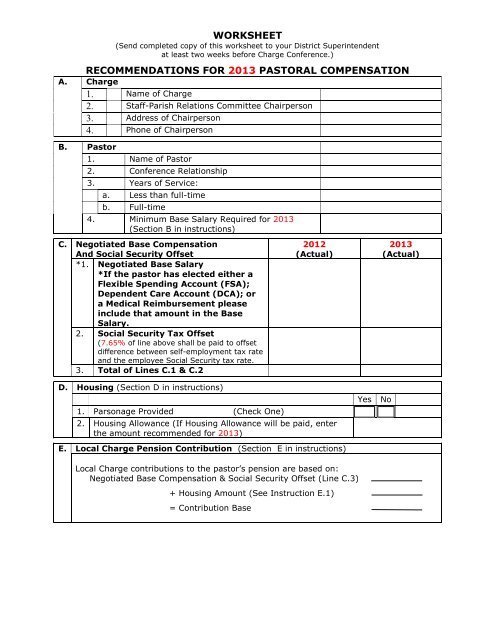

rostered minister to actually realize the full benefit of 7.65%. Total Compensation The sum of the baseline compensation and all adjustments including an adjustment for Social Security and Medicare constitute the Total Direct Compensation that will be paid to the rostered minister. Housing Allowance (Ministers of Word and Sacrament) (Pastor only)

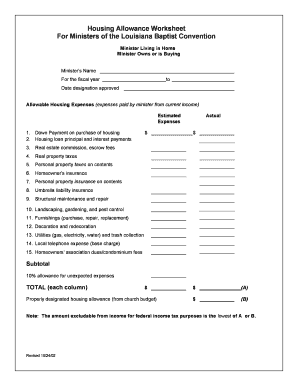

Pastor's housing allowance worksheet

District Superintendent, Pastor, Church Treasurer, Recording Secretary Housing Allowance Worksheet To provide an estimate of actual costs which should be used to assist the pastor and local congregation to determine an appropriate Housing Allowance, one of the following figures should be used: A "worksheet" is provided for the minister's use upon request. (Here's a link to the form we've used for this purpose: Minister's Housing Allowance Worksheet.) Approval - The housing allowance amount is "approved" by the executive pastor's signature via an annual compensation document. This document is the minister's. In order for the housing allowance to be tax-deductible for the pastor, the governing body must approve the amount of the housing allowance and record the action prior to the time the income is received. The designation of the housing allowance does not affect other calculations of salary, benefits or expenses. See Interpretive Comments. 22 23.

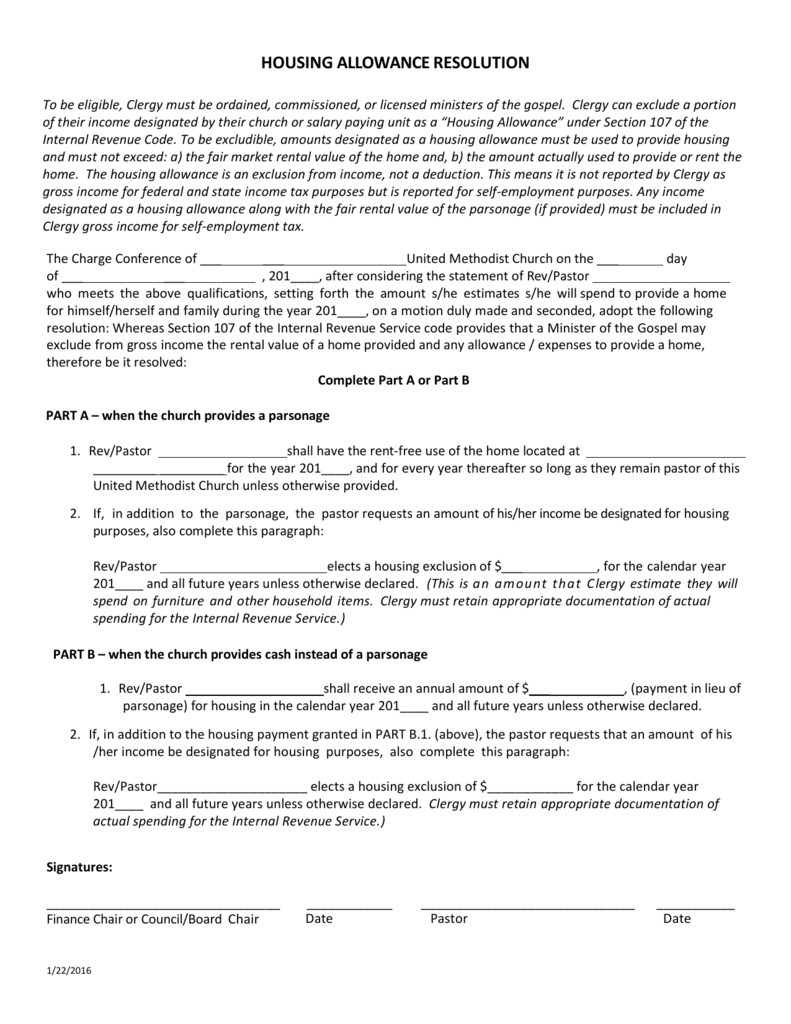

Pastor's housing allowance worksheet. (Ministers must prepay their taxes by using the quarterly estimated tax procedure, unless they elect voluntary withholding.) • They are eligible for a church-designated housing allowance. • They must pay SECA taxes for Social Security coverage (non-ministerial employees pay half of the FICA tax and their employer pays the other half). How a member of the clergy or religious worker figures net earnings from self-em-ployment. This publication also covers certain income tax rules of interest to ministers and members of a religious order. In the back of Pub. 517 is a set of work-sheets that you can use to figure the PARSONAGE or HOUSING ALLOWANCE NOTIFICATION BY THE CHURCH. Applied to Principal Residence Only! Date: Dear : This is to notify you of the action taken establishing your housing allowance at a meeting held on . A copy of the Resolution is attached. Under section 107 of the Internal Revenue Code, a minister of the gospel is allowed to What is a housing allowance? A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The amount spent on housing reduces a qualifying minister's federal and state income tax burden. Section 107 of the Internal Revenue Code (IRC) states that:

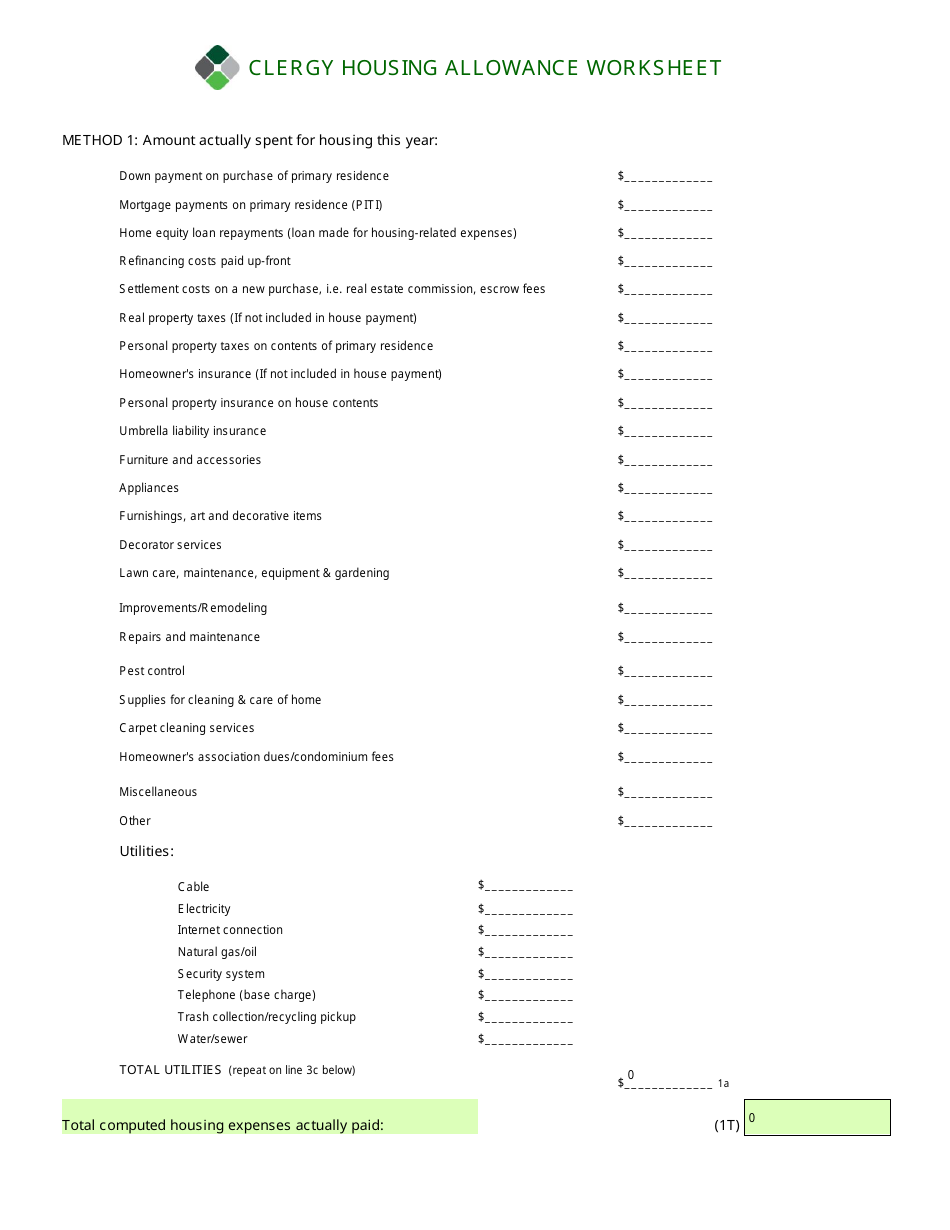

Housing Allowance Worksheet. Fill Out, Securely Sign, Print or Email Your Clergy Worksheet Instantly with SignNow. the Most Secure Digital Platform to Get Legally Binding, Electronically Signed Documents in Just a Few Seconds. Available for PC, iOS and Android. Start a Free Trial Now to Save Yourself Time and Money! Housing Allowance Questions and Answers; Pastor Housing Allowance Worksheet; Pastor Housing Allowance Sample Letter; Minister's Manual by Paul Powell; Church Contribution Letter Template; 2015 Tri-Rivers Area Demographic Report; Consumer Credit Authorization Form; Federal Trade Commission Guidelines Concerning Background and Credit Checks. Downloadable.PDF Document. 2019 Minister Housing Allowance Worksheet Download. If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses. • A minister's housing allowance is an exclusion for federal income taxes only. Ministers must add the nontaxable amount of their self-employment taxes on Schedule SE (unless exempt from self-employment taxes).

8b. Cash Housing Allowance (if answered YES above, leave blank) Other Benefits Paid To/For the Pastor in addition to cash: Box 1 of Clergy W-2 Form = Line 2 + Line 8b - Lines 10b, 11a, 11b, 11c, 12; Box 14 on W-2 should = Line 13 with notation "Housing" One time Moving Expense (not included in appointment or benefits calculations) FL3/PL3. Therefore, any "unused" portion of the designated housing allowance must be included in the pastor's gross income when filing his annual tax return. 9. Q. Can the housing allowance resolution be adopted or amended mid-year? A. Yes. The housing allowance resolution can be adopted or amended at any time. However, it can only be applied prospectively. 06 - Minister's Housing Allowance Resolution. Charge Conference. If there is an amount reported on Line #8b or #13 of the Pastor Support Worksheet (form 4), this form is required. 8. HOUSING: Pastor housing benefit via parsonage or cash housing allowance. Select YES in 8a if pastor lives in a parsonage. If pastor is provided a cash housing allowance select NO in 8a and enter annual amount in 8b. (This is not to be confused with the housing allowance resolution in Line 13.) 9.

A "worksheet" is provided for the minister's use upon request. (Here's a link to the form we've used for this purpose: Minister's Housing Allowance Worksheet.) Approval - The housing allowance amount is "approved" by the executive pastor's signature via an annual compensation document. This document is the minister's.

CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return.

Minister's Housing Expenses Worksheet. Share. Get the most out of your Minister's Housing Allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax return.

MMBB's Housing Allowance Worksheet Example Subject: Download MMBB's Housing Allowance Worksheet, which serves as an example only. This form in not intend to provide advice in any way and should be treated as such. Created Date: 3/5/2015 3:42:32 PM

District Superintendent, Pastor, Church Treasurer, Recording Secretary Housing Allowance Worksheet To provide an estimate of actual costs which should be used to assist the pastor and local congregation to determine an appropriate Housing Allowance, one of the following figures should be used:

13 on Pastor’s Support Worksheet) Minister Provided Housing. THEREFORE, BE IT RESOLVED. that the Administrative Board/Council or Church/Charge Conference of the Charge hereby designates the amount of *$ , whose . for the year 2022 as a housing allowance for The Reverend residence is at (*Use total from Line 1. 3 on Pastor’s Support.

Pastoral Housing Allowance for 2021. Pastors: It is time again to make sure you update your housing allowance resolution. According to tax law, if you are planning to claim a housing allowance deduction (actually an 'exclusion') for the upcoming calendar year, your Session is required to designate the specific amount to be paid to you as housing allowance prior to the beginning of that.

In order for the housing allowance to be tax-deductible for the pastor, the governing body must approve the amount of the housing allowance and record the action prior to the time the income is received. The designation of the housing allowance does not affect other calculations of salary, benefits or expenses. See Interpretive Comments. 22 23.

1. Using a worksheet, which shows the amount budgeted for the past two years and the actual amount received and disbursed, study the trends and accuracy of your past projections. The past actual disbursements become a part of the factor in future projections. 2. The second factor comes from your plans and goals for the future.

With a housing allowance in place, a minister's board of directors can approve up to 100% of his or her salary under a non-taxable status on the pastor's income taxes. Having a housing allowance also can cover home expenses that range from rent and property taxes to appliances and furniture, home improvements, and much more.

EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources www.clergytaxnet

The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1.

The ministers' housing allowance is a very important tax benefit available to ministers. Section 107 of the Internal Revenue Code allows "ministers of the gospel" to exclude some or all of their ministerial income designated by their church or church-related employer as a housing allowance from income for federal income tax purposes.

$10,000. In that case, at most $5,000 of the $10,000 housing allowance can be excluded from the pastor’s gross income in that calendar year. Q. Is the housing allowance also excluded from earnings subject to self-employment taxes? A. No. The housing allowance exclusion only applies for federalincome tax purposes. By law, clergy

A minister who receives a housing allowance may exclude the allowance from gross income to the extent it is used to pay expenses in providing a home. A housing allowance is also available to a minister living in a parsonage to the extent he uses the allowance for his personally paid out-of-pocket costs not paid by the church.

Dec 16, 2019 · The housing allowance for pastors is not and can never be a retroactive benefit. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Therefore, it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020.

MINISTER'S HOUSING EXPENSES WORKSHEET ANNUAL HOUSING EXPENSES Rent (if a primary residence was ented for all or part of the year) $. MINISTER'S HOUSING ALLOWANCE In order to claim Minister's Housing Allowance exemptions for federal income tax purposes on your retirement distributions, you

This worksheet is designed to help a retired clergyperson determine the amount that he or she may exclude from gross income pursuant to the provisions of Section 107 of the Internal Revenue Code (Code). Those provisions provide that "a minister of the gospel" may exclude a "housing allowance" from his or her gross income.

Jul 30, 2021 · THE UNITED METHODIST CHURCH CHARGE CONFERENCE. 7/30/2021 . Charge Conference 2021 Checklist . CHURCH _____ Pastor in Charge _____

0 Response to "31 Pastor's Housing Allowance Worksheet"

Post a Comment