36 Medicare Cost Report Worksheet A

revisions and clarifications to the instructions for the Worksheet S-10 of the Medicare cost report. The Worksheet S-10 data is used in the computation of Factor 3 in the calculation of the uncompensated care payment for 1886(d) hospitals under the Social Security Act (SSA) eligible to receive such payments. Worksheet C from the latest filed Medicare cost report and the associated trial balance. These include: • Total costs from the cost center/line associated with the site being registered (Worksheet A, column 7); • Outpatient charges associated with the cost center/line being registered (Worksheet C, column 7); and • If the costs and.

HCRIS Data Disclaimer The Centers for Medicare & Medicaid Services (CMS) has made a reasonable effort to ensure that the provided data/records/reports are up-to-date, accurate, complete, and comprehensive at the time of disclosure. This information reflects data as reported to the Healthcare Cost Report Information System (HCRIS). These reports are a true and accurate representation of the.

Medicare cost report worksheet a

This website provides information and news about the Medicare program for health care professionals only.All communication and issues regarding your Medicare benefits are handled directly by Medicare and not through this website. For the most comprehensive experience, we encourage you to visit Medicare.gov or call 1-800-MEDICARE. In the event your provider fails. days (Worksheet S-3, Part I, column 24.10) and effective for cost reporting 8, line periods beginning on or after October 1, 2012, the number of outpatient ancillary labor and delivery days (Worksheet S-3, Part I, column 8, line 32.01). Medicare Cost Report Electronic Signature. CMS has revised the regulations at 42 CFR 413.24(f)(4)(iv) so that a provider submitting an Electronic Cost Report (ECR) for a cost reporting period ending on or after December 31, 2017, may elect to electronically submit the Medicare cost report Certification and Settlement Summary page (Worksheet S) with an electronic signature.

Medicare cost report worksheet a. Worksheet formats are based on information supplied by the Centers for Medicare and Medicaid Services (CMS).Forms and instructions can be downloaded from the CMS website and are presented here as a convenient reference. * Worksheets which are not yet available on CostReportData have been marked with an asterisk. Please contact us if there is a specific sheet to be requested, as an addition. This application is not fully accessible to users whose browsers do not support or have Cascading Style Sheets (CSS) disabled. For a more optimal experience viewing this application, please enable CSS in your browser and refresh the page · The page could not be loaded. August 13, 2021 - If omitted, cost report may be rejected. Use a CMS approved vendor with current specifications and updates · Use correct PTAN This includes parent number and all subunits (i.e., HHA, Hospice, FQHC, RHC, SNF, and ESRD). Ensure an authorized official of provider signs Worksheet S. Medicare... The Northeast Ohio Chapter of HFMA is the leading professional resource for finance professionals in all healthcare settings. HFMA helps healthcare finance professionals meet the challenges of the modern healthcare environment by providing education and connections to a broad spectrum of industry.

In accordance with the FY 2021 Inpatient Prospective Payment System (IPPS) final rule, CMS is adding a new worksheet to the cost report to collect data associated with payer specific negotiated charge information. This information must be reported for cost reporting periods ending on or after January 1, 2021. December 17, 2020 - CMS has issued a final rule for FFY 2021 that includes a new Medicare cost report schedule, Worksheet S-12. Read on for details. Medicare Cost Report Update Pete Harmon Eric Swanson 2552-10 Transmittal #4. Worksheet S-2, Part I 4 • W/S S-2 part I, line 24 (Medicaid days), will now be... •Cost Report instructions -"If the EHR reporting period ending date is on or after April 1, 2013, the EHR incentive Cost Report Filing Instructions Requirement to File Cost Reports. Providers of service participating in the Medicare program are required to submit information to achieve settlement of costs relating to health care services rendered to Medicare beneficiaries [42 U.S.C. 1395g (section 1815(a) of the Social Security Act].Regulations state that cost reports "will be required.

Providers filing Medicare Cost Reports must submit the following documents and files: Electronic cost report (ECR) file and Print Image (PI) file from an approved software vendor. Cost Report certification page (Worksheet S) with encryption dates, times and codes, along with an original or electronic signature from an authorized official. days (Worksheet S-3, Part I, column 24.10) and effective for cost reporting 8, line periods beginning on or after October 1, 2012, the number of outpatient ancillary labor and delivery days (Worksheet S-3, Part I, column 8, line 32.01). the RHC Cost Report Medicare Bad Debt. appropriate cost centers Worksheet A-2: Used to include additional or exclude non-allowable costs Health Services Associates, Inc. Lab/X-ray/EKG Allocations Worksheet A-1 Lab, X-ray, EKG The FQHC cost report must be submitted to the Medicare administrative contractor (hereafter referred to as contractor) electronically in accordance with 42 CFR 413.24f)(4).( Cost reports are due on or before the last day of the fifth month following the close of the period covered by the report. For cost reports ending on a day

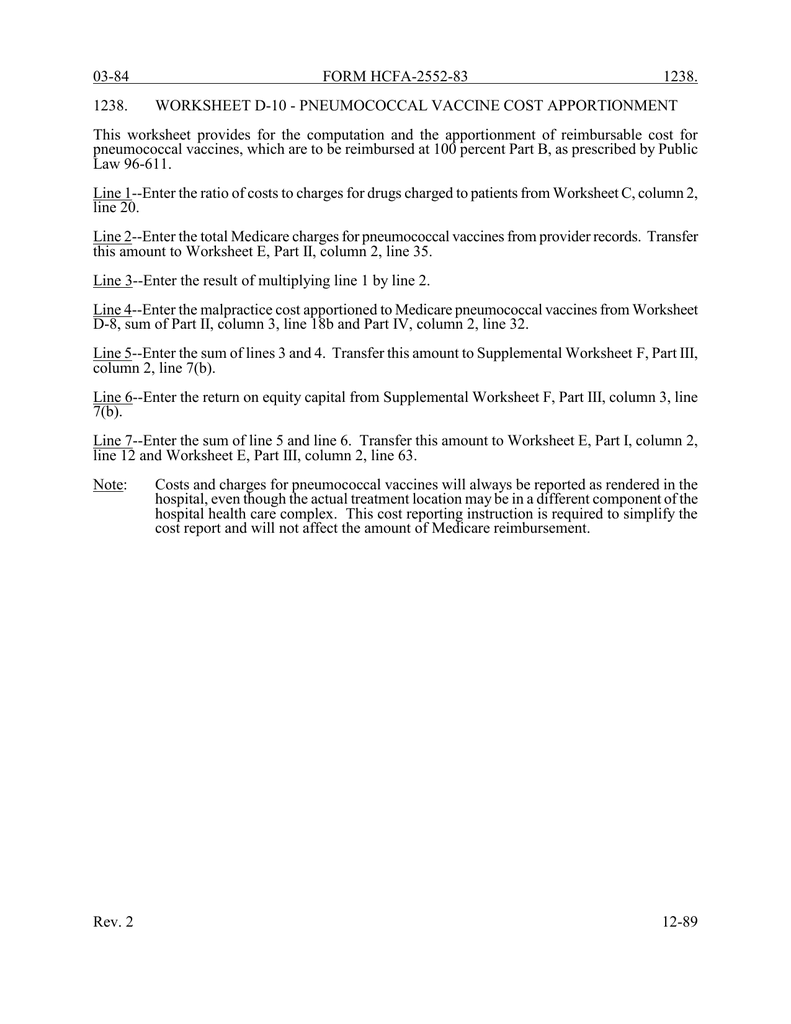

Previously the Vaccine Administration cost center ended at Worksheet B. This cost center will now flow to Worksheet C and will require that charges (billed revenue) be reported for Total All Patients and Medicare patients, which will show up on the PS&R report. Worksheet F-1 - Statement of Revenue and Expenses

03-18 FORM CMS-2552-10 4090 (Cont.) This report is required by law (42 USC 1395g; 42 CFR 413.20(b)). Failure to report can result in all interim FORM APPROVED payments made since the beginning of the cost reporting period being deemed overpayments (42 USC 1395g).

May 23, 2018 -

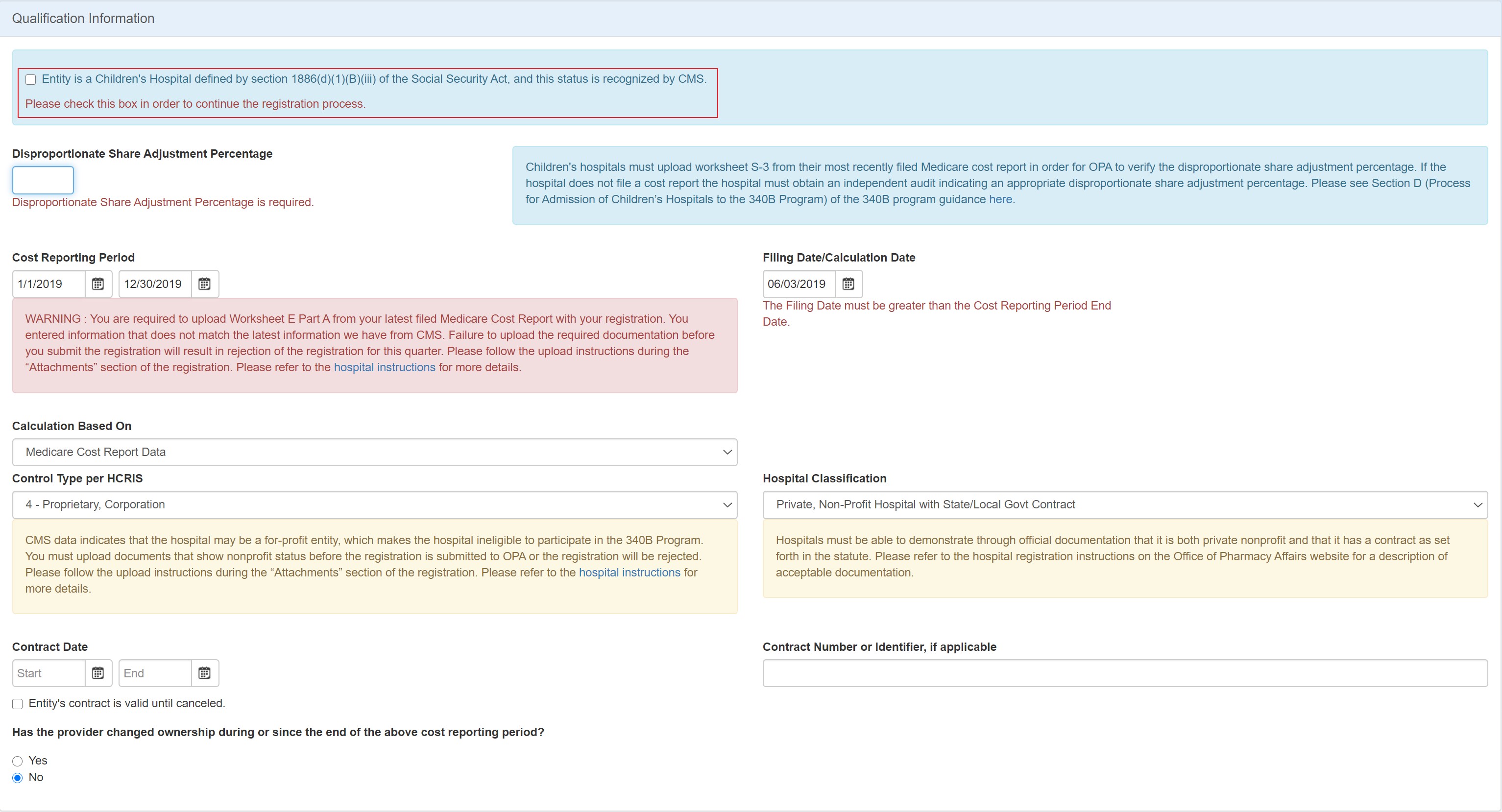

Establishing Hospital Eligibility. Two of the 3 requirements for eligibility can be found within the Medicare cost report. Hospitals are considered eligible based on their government ownership or operation or contractual arrangements with the government to provide care to low-income individuals, as well as their disproportionate share percentage. 3 Line 21 of Worksheet S-2, Part I, shows the.

Medicare Cost Report Electronic Signature. CMS has revised the regulations at 42 CFR 413.24(f)(4)(iv) so that a provider submitting an Electronic Cost Report (ECR) for a cost reporting period ending on or after December 31, 2017, may elect to electronically submit the Medicare cost report Certification and Settlement Summary page (Worksheet S) with an electronic signature.

OverviewIn the Fiscal Year (FY) 2018 Inpatient Prospective Payment System (IPPS) Final Rule, CMS finalized that uncompensated care data from the Medicare Cost Report Worksheet S-10 would be incorporated into Factor 3 of the Disproportionate Share Hospital Uncompensated Care Payment (DSH UCP). This payment methodology continued with the FY 2019 IPPS Final Rule, and was also proposed in the FY.

Basic CAH Medicare Medicare Cost Mechanics 17 Worksheet number is at top right-hand corner of each worksheet. Worksheet Series S Settlement, Organization, and Patient Statistical Information A Expense Assignment B Allocation of Overhead Costs C Patient Care Revenue and Cost-to-Charge Ratio D Determination of Medicare's Costs

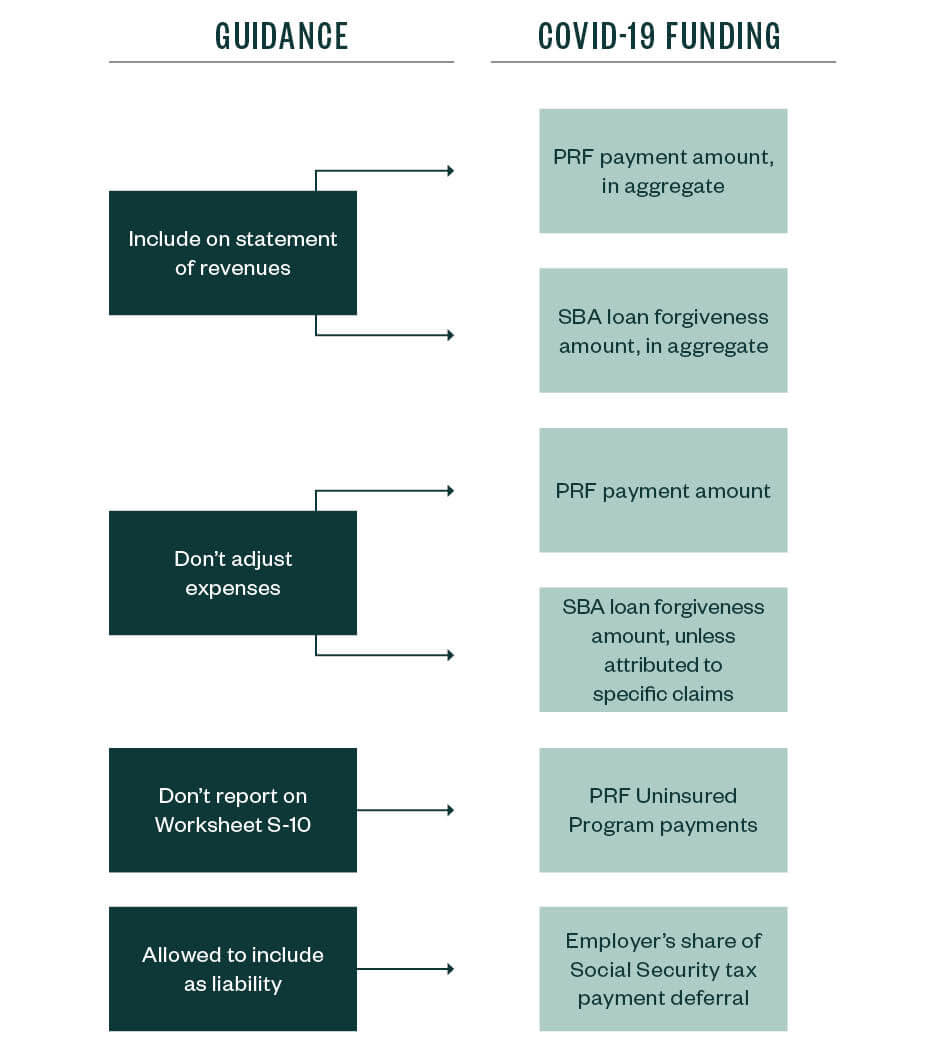

Worksheet O: HHA Based Hospice Costs; While CMS extended the 2019 Medicare Cost Report due date multiple times because of the COVID-19 public health emergency (PHE), the 2020 Medicare Cost Report that includes all of these changes is expected to be due May 31, 2021 (unless CMS extends the deadline) for most HCA CHHA members who operate on a.

Walkthrough of Worksheet S-1 Part I includes the following information: Line 9 -indicate if FQHC is part of a chain organization as defined by CMS If yes, complete lines 10 -12 Line 13 -indicate if FQHC is filing a consolidated cost report ("yes" or "no")

January 15, 2021 - To access the cost report file used by CMS to calculate the Inpatient PPS MS-DRG relative weights for the IPPS Final and/or Proposed Rules, visit: https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/index · Note: The Hospital Cost Reporting worksheet forms can be.

Skip to main content · Search · Medicare.gov: the official U.S. government site for Medicare · Open Enrollment starts Oct 15 · Preview 2022 Health & Drug Plans Log in/Create Account · See how Medicare is responding to Coronavirus · Learn More · Get started · Learn about Medicare ·.

The Centers for Medicare & Medicaid Services uses transmittals to communicate new or changed policies or procedures that we will incorporate into the CMS Online Manual System. The cover or transmittal page summarizes and specifies the changes. The transmittals for 2000 through 2012 have been.

Nov 02, 2018 · (PRM-II), providers that continue to participate in the Medicare Program are required to submit a cost report within 5 months of their cost reporting fiscal year end. For cost reports ending on a day other than the last day of the month, cost reports are due 150 days after the last day of the cost reporting period. Exceptions to this due date.

Overview In the Fiscal Year (FY) 2018 Inpatient Prospective Payment System (IPPS) Final Rule, CMS finalized that uncompensated care data from the Medicare Cost Report Worksheet S-10 would be incorporated into Factor 3 of the Disproportionate Share Hospital Uncompensated Care Payment (DSH UCP). This payment methodology continued with the FY 2019 IPPS Final Rule, and was also proposed in the FY.

3514.2 Part II- PPS Statistical Data. --Complete this part for cost reporting periods beginning on and after July 1, 1998. Use this part to report the Medicare days of the provider by RUG. The total on line 46 must agree with the amount on Worksheet S-3, column 4, line. This part has been revised with the issuance of Transmittal # 5.

Aug 20, 2019 · Key Facts: Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report.

cost on line 92 using the routine cost per diem from Worksheet D-1 because it is part of routine costs and as such has been included in the amounts reported on line 30 for the hospital. Therefore, in order to arrive at the total allowable costs, subtract this cost to avoid reporting these costs twice.

This tool is used by potential beneficiaries to determine whether they are eligible for Medicare benefits, when they may next enroll and their approximate Part B premium.

January 6, 2021 - When we total up all of your total monthly Medicare costs, here’s what you can expect in 2021.

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

FQHC (Medicare) Cost Report Worksheet S-2 incorporates Form CMS 339 into a checklist form –GME Activities and location of costs –Cost Report Preparer Information –Bad Debts •Are you seeking reimbursement for bad debts resulting from Medicare deductible and/or coinsurance amounts which are uncollectible from Medicare beneficiaries.

A. Healthcare Cost Reporting Information System. Q. What cost reports are collected? A. HCRIS collects data from the Hospital Cost Report (CMS-2552-96 and CMS-2552-10), Skilled Nursing Facility Cost Report (CMS-2540-96 and 2540-10), Home Health Agency Cost Report(CMS-1728-94), Renal Facility Cost Report

America’s Essential Hospitals is the leading association and champion for hospitals and health systems dedicated to high-quality care for all.

03-18 FORM CMS-2552-10 4020 (Cont.) NOTE: The election of the alternative method discussed above cannot result in inappropriately shifting costs. *Contract labor is not included and is not grossed up. **If this is a meals on wheels program, a Worksheet A-8 adjustment is required.

Medicare Cost Reports The worksheets collect the following types of information: ˗ Facility characteristics (ownership status, type of facility) ˗ Statistical ˗ Financial ˗ Cost ˗ Charge ˗ Wage Index information 6. Medicare Cost Reports 7 Example of Hospital Form 2552-10, Worksheet S-3, Part I .

• The Hospital Medicare Cost Report (MCR) • MCR Preparation Challenges • The More Things Change, the More They Stay the Same • The Medicare Hospital Cost Report Worksheets • Beyond the Filing Requirements • Other Users of the MCRs • Why Board Members Should Care • Questions TODAY'S AGENDA 2

situation, any GME costs for the cost reporting period prior to the base period are reimbursed on a reasonable cost basis. Complete this worksheet if this is the first month in which residents were on duty during the first month of the cost reporting period or if residents were on duty during the entire prior cost reporting period.

This website provides information and news about the Medicare program for health care professionals only.All communication and issues regarding your Medicare benefits are handled directly by Medicare and not through this website. For the most comprehensive experience, we encourage you to visit Medicare.gov or call 1-800-MEDICARE. In the event your provider fails.

Medicare patients (as computed in the Medicare cost report): Paid on an interim basis using a percentage of Medicare charges Percentage calculated by dividing the overall allowable Medicare costs by the overall Medicare charges, Medicare cost-to-charge ratio Final settlement for each fiscal year is based on the filed Medicare cost report

HRSA Refers Six Pharmaceutical Manufacturers to the Office of the Inspector General for Refusal to Comply with 340B Statute. On May 17, 2021, Acting Health Resources and Services Administration (HRSA) Administrator Diana Espinosa sent letters to six pharmaceutical manufacturers outlining each manufacturer’s violation of statutory 340B Program requirements.

The Medicare Cost Report data can be downloaded from the CMS website.The table at that link contains the Hospital, Home Health Agency (HHA), and Skilled Nursing Facility (SNF) cost reports dating back to 1996.You will notice in Figure 1 that hospital cost reports are labelled in the Facility Type column as either "HOSPITAL" or "Hospital-2010."

Forms Included with CMS Instructions are for Informational Purposes Only. Help Me Prepare My Cost Report. Teach Me How To Prepare A Cost Report. All cost report worksheets are included in the forms. Worksheets include all cost centers. General Instructions explain rules and mandatory information. Further Rules and Regulations explain rules for.

Dec 04, 2020 · CostReportData provides online Medicare cost report data to healthcare financial and reimbursement professionals. Our database of more than 6,000 hospitals is built from Medicare cost report information obtained from the federal Centers for Medicare and Medicaid Services (CMS) for all reporting periods since 1996.The information reflects data as.

The Medicare cost report is comprised of a series of worksheets and schedules that describe the institutional provider's characteristics, financial information, costs and charges. The cost report is utilized to set prospective payment rates such as wage index, Disproportionate Share Hospital ("DSH") adjustment, Indirect Medical Education.

Sep 29, 2017 · parts of the cost report (e.g. cost-to-charge ratio, Medicare bad debts). These have material impacts on the Worksheet S-10 Line 30. When we amend the cost report on or before January 2, 2018 (which is a full re-submission of the cost report), are we permitted to adjust parts of the cost reports that flow through to S-10 (i.e. if we have.

October 6, 2020 - It should be noted, all visits reported in this section are based on date of service in the cost report period, including Medicare visits / patients, not episode end date. Utilization data for completed episodes in the period continues to be reported on Worksheet S-3, Part IV in the cost report.

0 Response to "36 Medicare Cost Report Worksheet A"

Post a Comment