33 Income Tax Deduction Worksheet

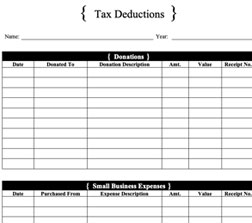

Tax day is often dreaded by many Americans, especially if they owe income taxes. Use this quiz/worksheet combo to assess your understanding of tax liability and deductions. Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return.

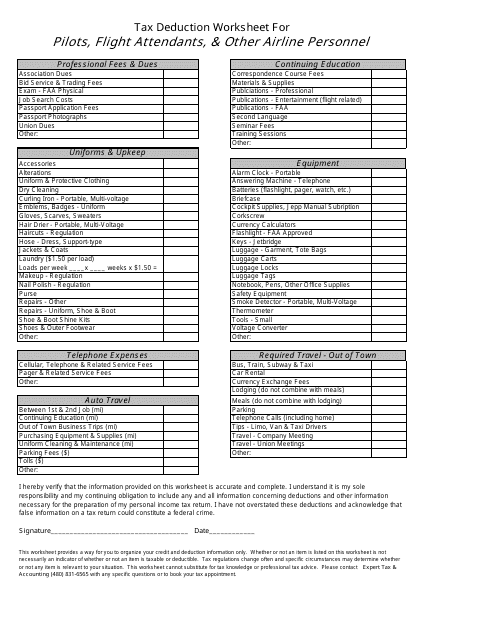

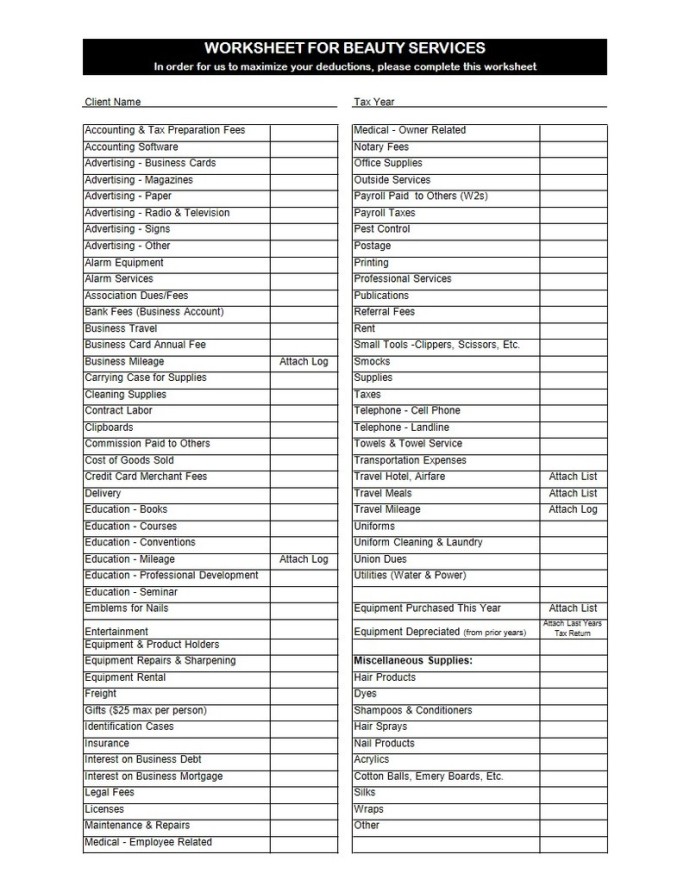

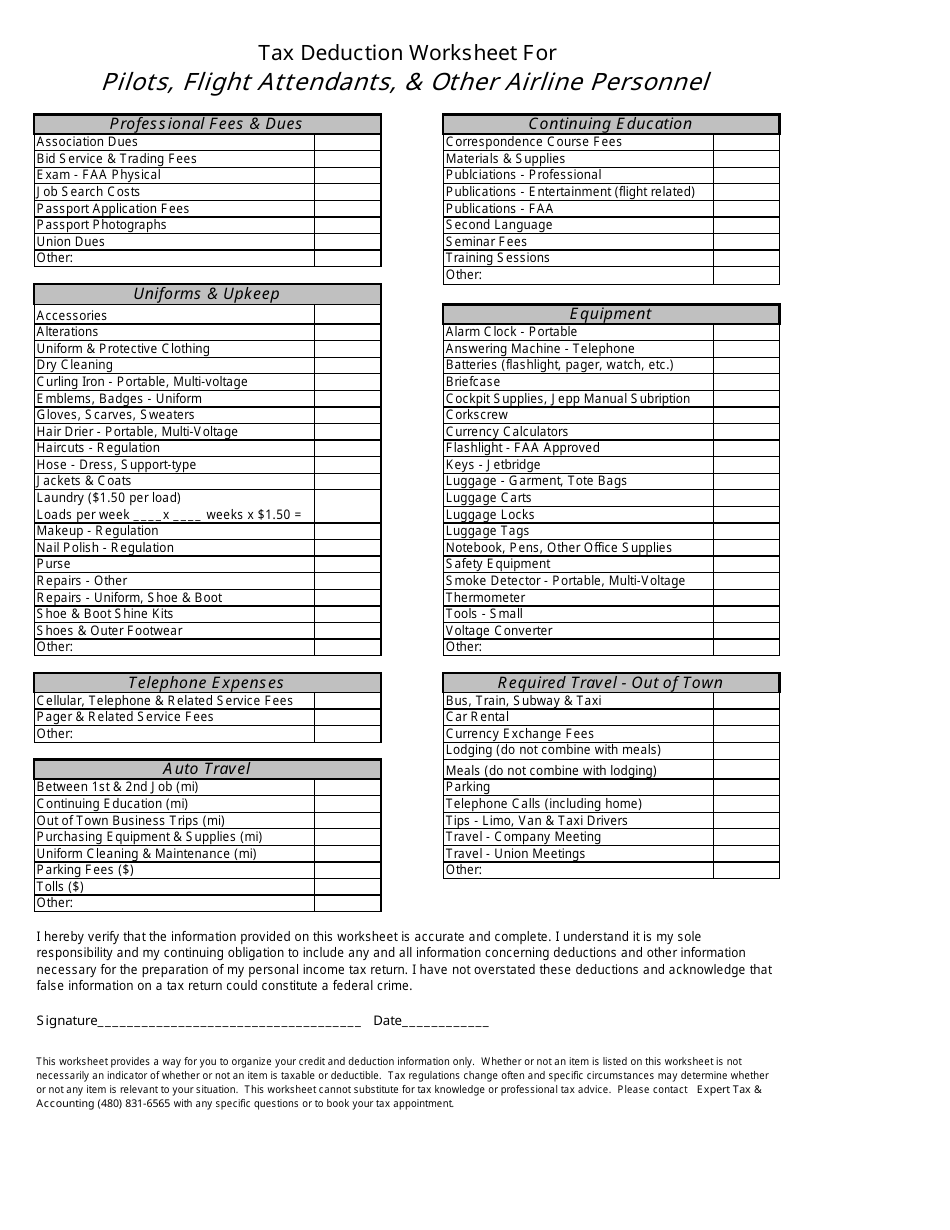

Tax Worksheets. Our Tax Organizers are designed to help you maximize your deductions and minimize any problems in preparing and filing your tax return. The organizer is revised annually to be compatible with the ever-changing tax laws. These organizers are primarily for the current tax year, although it can be used for past years.

Income tax deduction worksheet

If your modified adjusted gross income (AGI) is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you don't have to pay tax on unemployment compensation of up to $10,200. Download this income tax worksheet AKA income tax organizer to maximize your deductions and minimize errors and omissions. FileTax site offers FREE information to HELP YOU PLAN AND MANAGE YOUR STATE AND FEDERAL INCOME TAXES. , get the federal income tax booklet, or go to. irs.gov. and search for . eitc assistant. • California Earned Income Tax Credit (EITC) - EITC reduces your California tax obligation, or allows a refund if no California tax is due. You may qualify if you have wage income earned in California and/or net earnings from self-employment of less.

Income tax deduction worksheet. 1. Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction. 2. $1,100. 3. Enter the larger of line 1 or line 2 here. 3. Generally, your earned income is the total of me amount(s) you reported on Form 1040. line I and Sch 1 - line 3 business inc or (loss); line 6 farm inc or (loss); line 14 deductible part of SE tax. ** Married Filing Separately — You can check the boxes for 'Your spouse " if your filing siaÍus is separately and your spouse had no income. R-620-965 (9/18) IRC Section 965 Income & FIT Deduction Worksheet Attach Form R-620-965 to your Form CIFT-620 or IT-541 General Information On December 22, 2017, Public Law 115-97, commonly referred to as the Tax Cuts and Job Act ("TCJA"), was enacted into federal law. I'm receiving 4 different errors related to State Tax Refund Worksheet, what's the correct items to enter for: 1. Item Q. 2. Item Q line 3. 3. Item Q line 1 (This seems to be line 5b of 2018 Schedule A based on this thread) 4. Item Q line 2

2020 Tax Return Checklist in 2021. Step 1: Before you start efiling, download or print this page as you collect the forms, receipts, documents, etc. necessary to prepare and efile your taxes. If you miss an important form on your tax return, such as income or deduction, you will have to prepare a Tax Amendment. In order to avoid the hassles of a tax amendment, we at eFile strongly. FARMERS TAX INFORMATION WORKSHEET - 2019. 2 FARM EXPENSES - 2019. the enclosed information is correct and includes all income, deductions and other information for the preparation of this year's Income Tax Return, for which I have adequate contemporaneous records. ... † The Historic Preservation Income Tax Credit is a new nonrefundable credit for taxable years 2020 to 2024 for substantial rehabilitation of a certifi ed historic structure. (Act 267, SLH 2019) † The Ship Repair Industry Tax Credit is a new nonrefundable credit for taxable years 2022 to 2026 for the construction of a new drydock at Pearl Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return.

Unemployment Tax (FUTA), State Unemployment (SUI) and State Training Tax (ETT). DO NOT INCLUDE - any amount deducted from the employee's wages, such as federal or state withholding, employee share of FICA and Medicare, or California SDI. This information is available from your payroll service. Be very careful here if you are not clear on. income.pdf This downloadable file contains worksheets for, wages and pensions, IRA distributions, interest and dividends, Miscellaneous income (tax refunds, social security, unemployment, other income). Don't forget to attach W-2's and 1099 forms to you worksheets. , get the federal income tax booklet, or go to. irs.gov. and search for . eitc assistant. • California Earned Income Tax Credit (EITC) - EITC reduces your California tax obligation, or allows a refund if no California tax is due. You may qualify if you have wage income earned in California and/or net earnings from self-employment of less. Federal Income Tax Deduction Worksheet 1 Enter the tax as shown on line 13 on Form 1040 or line 53 on Form 1040NR... 1 2 Net Investment Income Tax. Enter amount from line 17, Form 8960..... 2 3 Federal Tax.

gross income. Employers withhold (or deduct) some of their employees’ pay in order to cover. payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits. The amount of money you actually take home (after tax withholding and other deductions are taken out of

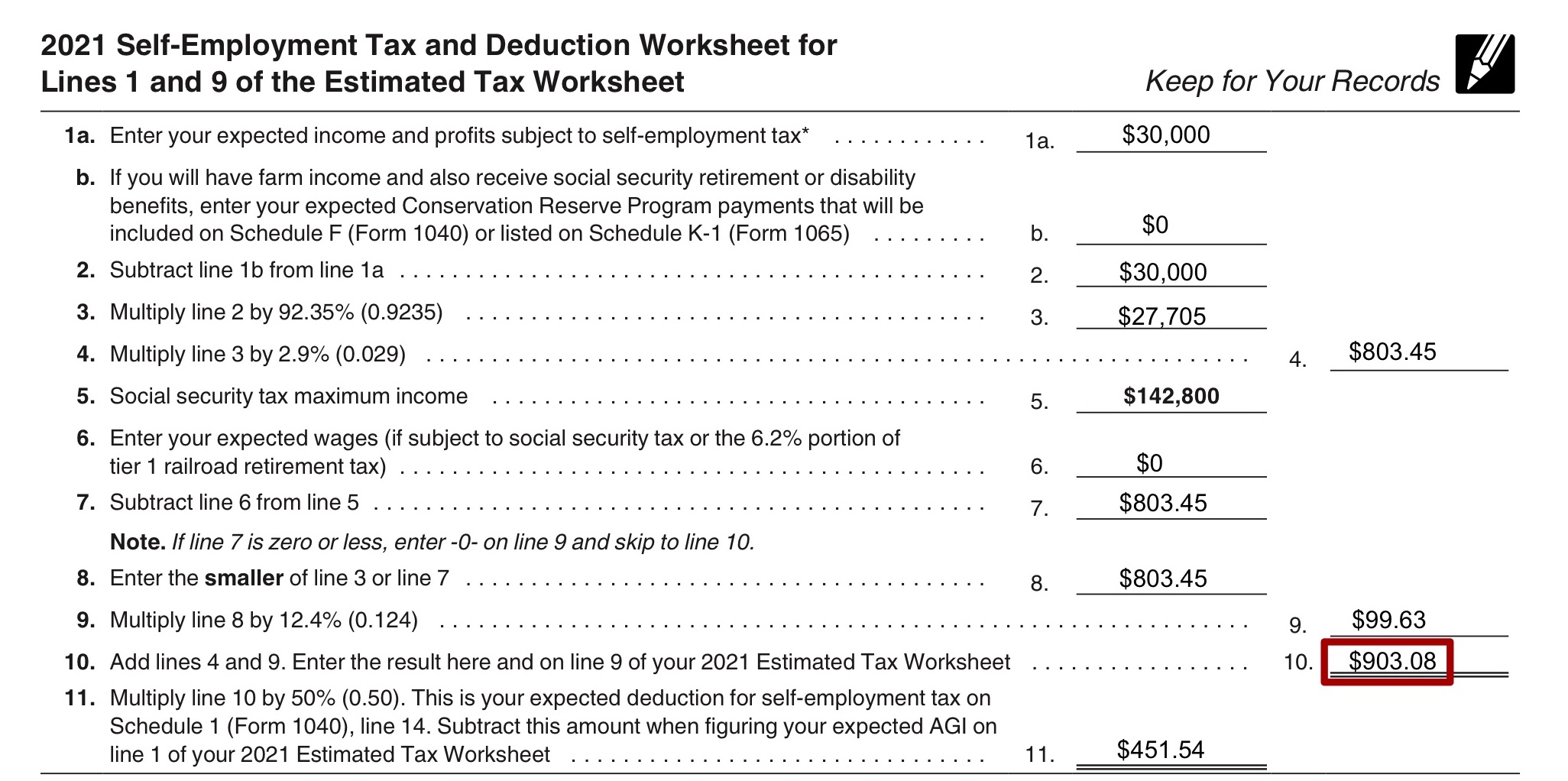

Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you’re not sure where something goes don’t worry, every expense on here, except for meals, is deducted at the same rate.

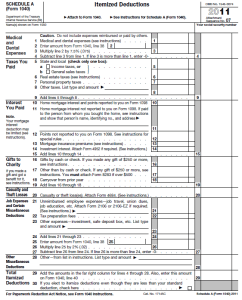

Add all of the itemized deductions you plan to claim for the year. For example, if you anticipate a $12,000 mortgage interest deduction, $4,000 state income tax deduction and a $5,000 charitable donations deduction, your total deductions are $21,000.

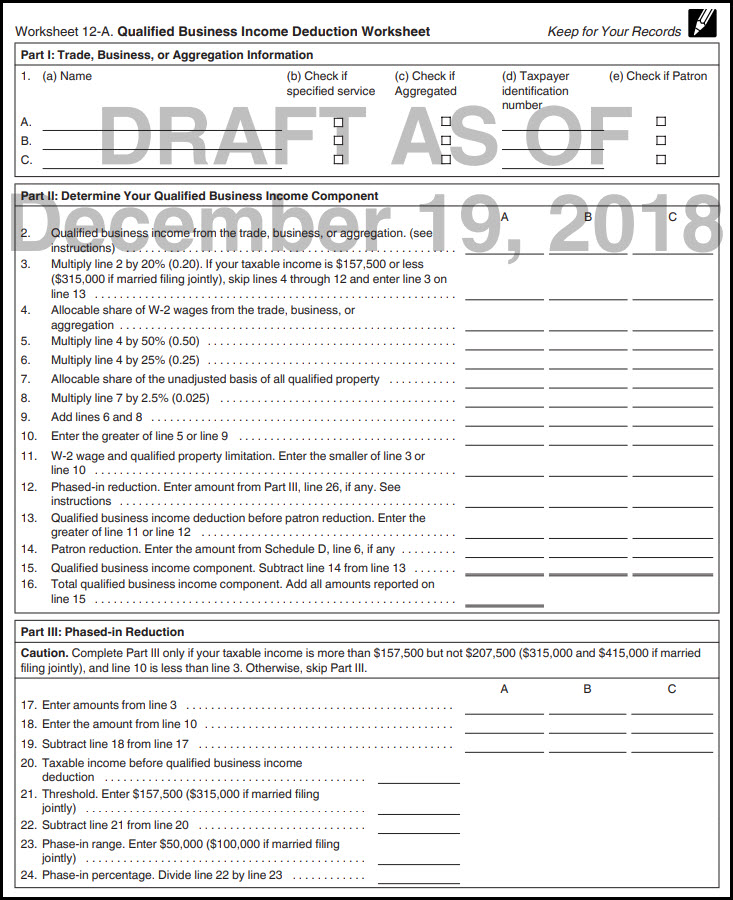

Qualified business income de-duction. The simplified worksheet for figuring your qualified business income deduction is now Form 8995, Qualified Business Income Deduction Simplified Computation. If you don't meet the requirements to file Form 8995, use Form 8995-A, Qualified Business In-come Deduction. For more infor-

The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge.

If your modified adjusted gross income (AGI) is less than $150,000, the American Rescue Plan enacted on March 11, 2021, excludes from income up to $10,200 of unemployment compensation paid in 2020, which means you don't have to pay tax on unemployment compensation of up to $10,200.

The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A (Forms 1040 or 1040-SR).. Your total deduction for state and local income, sales and property taxes is limited to a combined, total deduction of $10,000 ($5,000 if married filing separately).

Enter in this step the amount from the Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2021 tax return and want to reduce your withholding to account for these deductions. This includes both itemized deductions and other deductions such as for student loan interest and IRAs. Step 4(c).

2021 Form 1040-ES - IRS tax forms › On roundup of the best Online Courses on www.irs.gov Courses. Posted: (1 week ago) The 2021 Estimated Tax Worksheet, • The Instructions for the 2021 Estimated Tax Worksheet, • The 2021 Tax Rate Schedules, and • Your 2020 tax return and instructions to use as a guide to figuring your income, deductions, and credits (but be sure to consider the items.

The IRS taxes income, so many of the expenses that are "ordinary and necessary" to create more taxable income are deductible. (Investment expenses related to non-taxable income are not deductible.) These deductions are subject to what is often called the "2 percent limit," meaning that the expenses are not deductible if they

2020/2021 Tax Estimate Spreadsheet. If you are looking to find out if you will get a tax refund or if you owe money this year, here is a simple Excel spreadsheet that can help you estimate federal and state income taxes before you file your return in 2021. The formulas and spreadsheets shown and linked below take the new tax reform and tax cuts.

Download this income tax worksheet AKA income tax organizer to maximize your deductions and minimize errors and omissions. FileTax site offers FREE information to HELP YOU PLAN AND MANAGE YOUR STATE AND FEDERAL INCOME TAXES.

This schedule is used by filers to report itemized deductions. Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction.

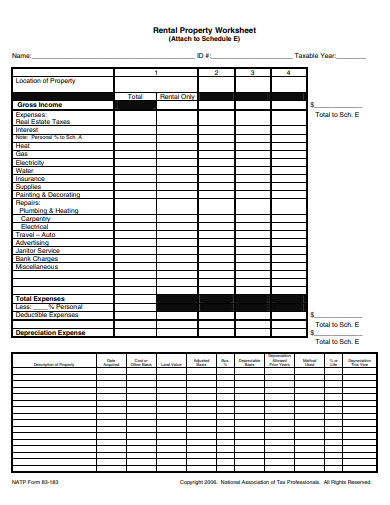

Rental Property Tax Deductions Worksheet. Also, maintain the all necessary quality factors of local and district quality. Rental property tax deductions worksheet excel. By subtracting the $91,385 in expenses from the $68,400 in rental income we get a loss of $22,985. Deductions for decline in value. Tax worksheet for rental property.

To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Alabama Use Tax Worksheet Report 2020 purchases for use in Alabama from out-of-state sellers on which tax was not collected by the seller. Standard Deduction. Federal Income Tax Deduction Worksheet. Title: 40 Booklet TY 2020.qxp Created Date: 1/25/2021 4:02:53 PM...

Rental Property Tax Deductions Worksheet. The tax will be deducted from the income from the rent and there are the deductions such as the utilities and the other expenses. Rental property tax deductions worksheet. You had to repair the floor in the rental unit. These expenses are also calculated and made the list of.

Federal Income Tax Deduction Worksheet 1 Enter the tax as shown on line 56, Form 1040, line 37 on Form 1040A, line 10 on Form 1040EZ or line 53 on Form 1040NR... 1 2 Net Investment Income Tax. Enter amount from line 17, Form 8960..... 2 3 Federal Tax.

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

0 Response to "33 Income Tax Deduction Worksheet"

Post a Comment