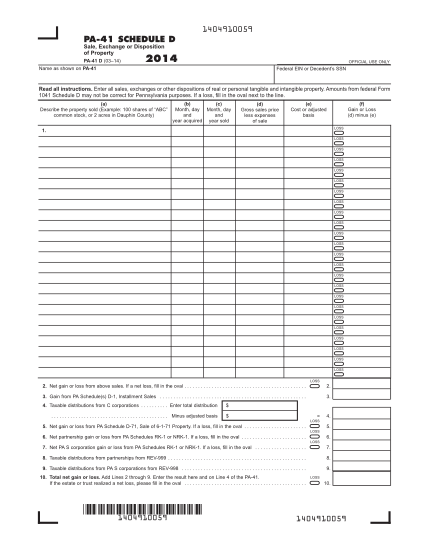

32 Schedule D Tax Worksheet 2014

Access Google Sheets with a free Google account (for personal use) or Google Workspace account (for business use). the 2014 Schedule D Tax Worksheet, or Part V of the 2014 Schedule D (Form 1041), see the instructions before completing this part.* 27 Enter the amount from Form 8801, line 10. If you filed Form 2555 or 2555-EZ for 2014, enter the

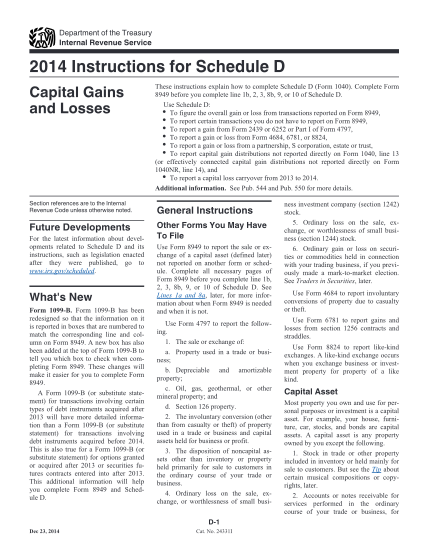

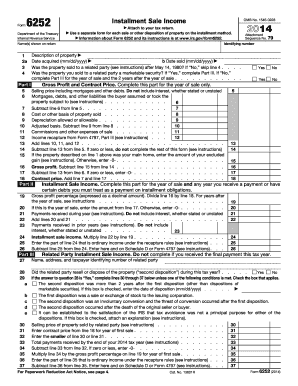

Q Report the sale or exchange on Form 8949 as if the taxpayer were not taking the exclusion and enter the amount of the exclusion as a negative number (in parentheses) in column (g). However, if the transaction is reported as an installment sale, see Gain from an installment sale of QSB stock in the Instructions for Schedule D (Form 1040).

Schedule d tax worksheet 2014

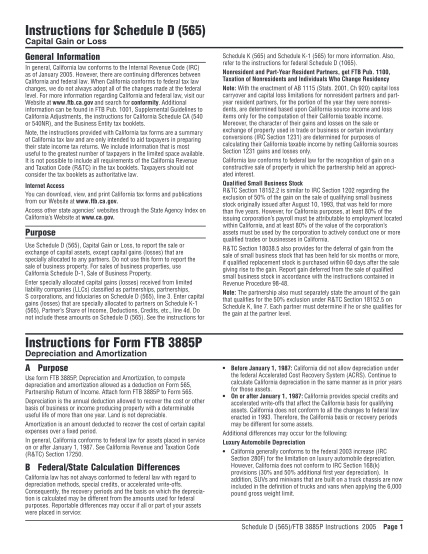

Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses 2018 Form 1040 (Schedule D) Capital Gains and Losses 2017 Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040), Capital Gains and Losses 2017 Form 1040 (Schedule D) Capital loss carryover from your 2018 California Schedule D (540). Capital gain from children under age 19 or students under age 24 included on the parent’s or child’s federal tax return and reported on the California tax return by the opposite taxpayer. For more information, get form FTB 3803. Get FTB Pub. 1001 for more information about: Form 6251 (2014) Page 2. Part III. Tax Computation Using Maximum Capital Gains Rates. Complete Part III only if you are required to do so by line 31 or by the Foreign Earned Income Tax Worksheet in the instructions. 36. Enter the amount from Form 6251, line 30. If you are filing Form 2555 or 2555-EZ, enter the amount from.

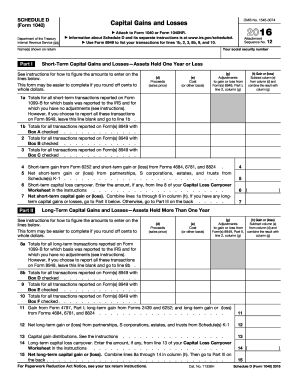

Schedule d tax worksheet 2014. SCHEDULE D (Form 1065) 2014 Department of the Treasury Internal Revenue Service. Capital Gains and Losses . . Attach to Form 1065 or Form 8865. The Trust tax returns instructions 2014 will help you complete the Trust tax return 2014 (NAT 0660). It is not available in print. These instructions cover: how to complete schedules that trusts might need to attach to their tax return; record keeping requirements. Schedule D - Viewing Tax Worksheet. If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D (Form 1040), according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. Fill out this section of the IRS Schedule D tax worksheet in a similar manner as you calculated your short-term capital gains and losses, transferring the corresponding Form 8949 amounts to Lines.

Individual Income Tax Return and Form D-400TC, Individual Tax Credits D-400 without TC: 2011: Individual Income Tax Return (no tax credits) D-401: 2011: North Carolina Individual Income Tax Instructions D-400X-WS: 2011: North Carolina Amended Schedule D-400V: 2011: Payment Voucher: Pay Online: D-422: 2011: Underpayment of Estimated Tax D-422A: 2011 The IRS Schedule D form and instructions booklet are generally published in December of each year. If published, the 2020 tax year PDF file will display, the prior tax year 2019 if not. Last year, many of the federal income tax forms were published late in December, with instructions booklet following in early January due to last minute. Fill out Form 1040. Put your totals from Schedule D on line 13 of form 1040. Attach Schedule D and Form 8949 to your Form 1040 so the IRS can verify your figures. Your long-term gains or losses qualify you for a 15 percent tax rate. 2014 Tax Table — Continued If line 43 (taxable income) is— And you are— At least But less than Single Married filing jointly * Married filing sepa- rately Head of a house- hold Your tax is— 3,000 3,000 3,050 303 303 303 303 3,050 3,100 308 308 308 308 3,100 3,150 313 313 313 313 3,150 3,200 318 318 318 318 3,200 3,250 323 323 323 323

Enter the amount from line 28 of Form 1120 on line 17 of Schedule D. Attach to Schedule D the Form 1120 computation or other worksheet used to figure taxable income. For corporations figuring the built-in gains tax for separate groups of assets, taxable income must be apportioned to each group of assets in proportion to the net recognized built. SCHEDULE D - 2014 DONATION SCHEDULE Individuals who fi le an individual income tax return and have overpaid their tax may choose to donate all or part of their overpayment shown on Line 31 of Form IT-540 to the organizations or funds listed below. Enter on Lines 2 through 25, the portion of the overpayment you wish to donate. Schedule D Tax Worksheet: in the instructions if either line 18b, col. (2) or line 18c, col. (2) is more than zero. 21:. Use the 2014 Tax Rate Schedule for Estates and Trusts (see the Schedule G instructions in the instructions for Form 1041). . 44: 45 Tax on all taxable income. WORKSHEETS D, E, K and EXTENSION 2014 NET PROFITS TAX RETURN These are worksheets only. Do not file these worksheets with your return. WORKSHEET D: ALLOCATION OF BUSINESS INCOME & RECEIPTS TAX CREDIT FOR PARTNERSHIPS, ETC., WITH CORPORATE MEMBERS (THIS SCHEDULE IS TO BE USED ONLY BY PARTNERSHIPS, JOINT VENTURES AND ASSOCIATIONS

To view the tax calculation on the Schedule D Tax Worksheet, which will show the calculation of the tax which flows to Form 1040 U.S. Individual Income Tax Return , Line 6 or Form 1040-NR U.S. Nonresident Alien Income Tax Return, Line 14: From within your TaxAct Online return, click Print Center down the left to expand, then click Custom Print.

The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions. Schedule B: Interest and Ordinary Dividends. Schedule C: Profit or Loss from Business. Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss.

Instructions for filing the 2014 Business Income and Receipts Tax and Net Profits Tax. Use this form to file 2014 Business Income & Receipts Tax (BIRT). This form includes Schedules B, C-1, D, A, and E. Use this form to file 2014 Business Income & Receipts Tax (BIRT) if 100% of your business was conducted in Philadelphia.

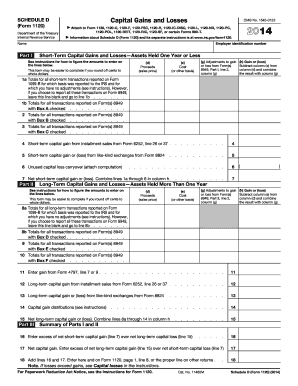

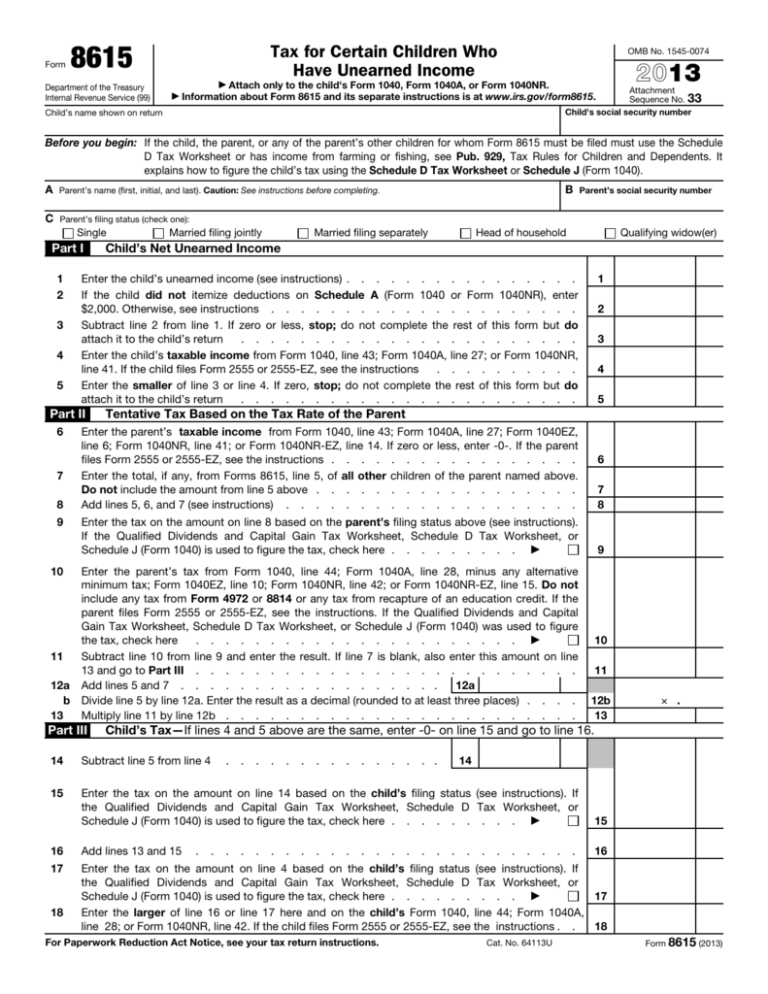

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). No. Complete the rest of Form 1040 or Form 1040NR. Schedule D (Form 1040) 2014

2014 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949,

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.. Schedule D. If either line 15 or 16 is blank or a loss, enter -0-. 3. No. Enter the amount from Schedule 1, line 13. 4. Add lines 2 and 3.....

2014 SCHEDULE H WORKSHEET P3 Homeowner and Renter Property Tax Credit Revised 11/2014 *149980130000* z z z 2014 SCHEDULE H PAGE 3 Last name and SSN Federal Adjusted Gross Income of the tax fi ling unit (see instructions) - Report the AGI of every member of your tax fi ling unit, including income subject to federal but not DC income tax.

2014 Publication 17 - IRS tax forms. 17.

Schedule d tax worksheet 2015. Complete form 8949 before you complete line 1b 2 3 8b 9 or 10 of schedule d. Before completing this worksheet complete form 1040 through line 43. 2015 tax computation worksheet. Tax computation worksheet form 1040 instructions html. This form may be easier to complete if you round off cents to whole dollars.

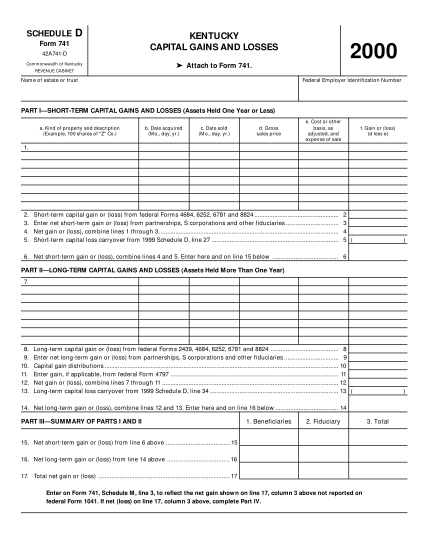

Capital loss carryover from your 2018 California Schedule D (540). Capital gain from children under age 19 or students under age 24 included on the parent’s or child’s federal tax return and reported on the California tax return by the opposite taxpayer. For more information, get form FTB 3803. Get FTB Pub. 1001 for more information about:

NOTE: Tax return forms and supporting documents must be filed electronically (see Electronic Services) or submitted on paper. Do NOT submit disks, USB flash drives, or any other form of electronic media. Electronic media cannot be processed and will be destroyed.

If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D, according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. To view the tax calculation on the Schedule D Tax Worksheet which will show the calculation of the tax which.

Worksheet or line 6 of your Schedule D Tax Worksheet by any of your capital gain excess not used in (1) above. 3. Reduce (but not below zero) the amount on your Schedule D (Form 1040), line 18, by your capital gain excess. 4. Include your capital gain excess as a loss on line 16 of your Unrecaptured Section 1250 Gain Worksheet on page D-9 of the

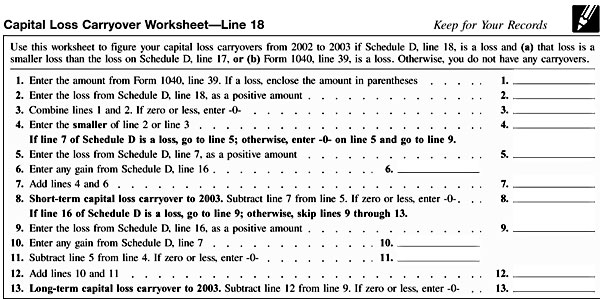

Fill out this section of the IRS Schedule D tax worksheet in a similar manner as. including the Capital Loss Carryover Worksheet, 28% Rate Gain Workshee… 2014 28% Rate Gain Worksheet - Form 1040 Schedule D Instructions - Page D-12. 2013 28% Rate Gain Worksheet - Form 1040 Schedule D Instructions - Page D-11. 2012 28% Rate Gain.

Schedule D Tax Worksheet. by Emily Hall. Schedule D Tax Worksheet. 2014 Form 1040 Schedule D K 1 Instructions Forms Resume Examples from Schedule D Tax Worksheet. , source: spartandriveby . 1040 Form 2015 Schedule D If You Do Meet The Criteria For Long Be from Schedule D Tax Worksheet. , source: spartandriveby .

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). No. Complete the rest of Form 1040 or Form 1040NR. Schedule D (Form 1040) 2014

Schedule D Tax Worksheet: in the instructions. Do not: complete lines 21 and 22 below. 21 : If line 16 is a loss, enter here and on Form 1040, line 13, or Form 1040NR, line 14, the : smaller : of:. 2014 Form 1040 (Schedule D) Author: SE:W:CAR:MP Subject: Capital Gains and Losses

When California conforms to federal tax law changes, we do not always. and the Schedule D (540NR) Worksheet for Nonresident and Part-Year Residents, in order to complete column E on Schedule CA (540NR), California Adjustments - Nonresidents or... Line 6 - 2014 California Capital Loss Carryover. If you had California .

Use this worksheet to figure your capital loss carryovers from 2019 to 2020 if your 2019 Schedule D, line 21, is a loss and (a) that loss is a smaller loss than the loss on your 2019 Schedule D, line 16, or (b) if the amount on your 2019 Form 1040 or 1040-SR, line 11b (or your 2019 Form 1040-NR, line 41, if applicable) would be less than zero.

Complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44 (or in the instructions for Form 1040NR, line 42). No. Complete the rest of Form 1040 or Form 1040NR. Schedule D (Form 1040) 2014

Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040 or Form 1040-SR), Capital Gains and Losses 2018 Form 1040 (Schedule D) Capital Gains and Losses 2017 Inst 1040 (Schedule D) Instructions for Schedule D (Form 1040), Capital Gains and Losses 2017 Form 1040 (Schedule D)

For the 2014 filing season, direct reporting on Schedule D is allowed. Taxpayers will be able to combine qualifying transactions and report the totals directly on Schedule D. If they choose to report in this manner, they do not need to include these transactions on Form 8949.

If you have to file Schedule D, and line 18 or 19 of Schedule D is more than zero, use the Schedule D Tax Worksheet in the Instructions for Schedule D to figure the amount to enter on Form 1040, line 44. But if you are filing Form 2555 or 2555-EZ, you must use the Foreign Earned Income Tax.

Form 6251 (2014) Page 2. Part III. Tax Computation Using Maximum Capital Gains Rates. Complete Part III only if you are required to do so by line 31 or by the Foreign Earned Income Tax Worksheet in the instructions. 36. Enter the amount from Form 6251, line 30. If you are filing Form 2555 or 2555-EZ, enter the amount from.

2014 Form 1040—Line 44 Qualified Dividends and Capital Gain Tax Worksheet—Line 44 Keep for Your Records See the earlier instructions for line 44 to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 43. If you do not have to file Schedule D and you received capital gain distributions, be sure you checked the box on line.

An overall capitalization rate between 7.25% and 9.0% will be used to appraise these properties; although adjustments may be made on the individual characteristics of each property and the information provided to the chief appraiser as required under Section 11.182(d) and (g), Texas Property Tax Code.

Line 34 – Tax from Schedule G-1 and Form FTB 5870A. If you received a qualified lump-sum distribution in 2019 and you were born before January 2, 1936, get California Schedule G-1, Tax on Lump-Sum Distributions, to figure your tax by special methods that may result in less tax. Attach Schedule G-1 to your tax return.

0 Response to "32 Schedule D Tax Worksheet 2014"

Post a Comment