31 Fannie Mae Rental Income Calculation Worksheet

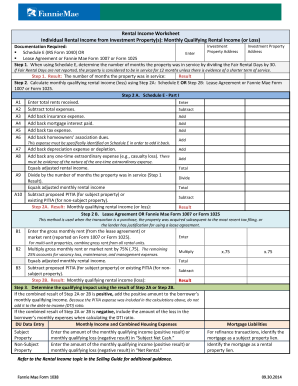

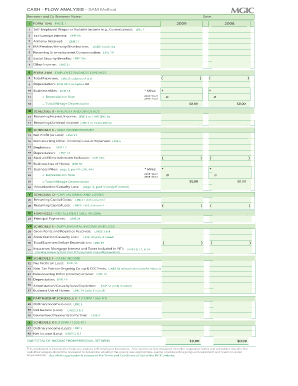

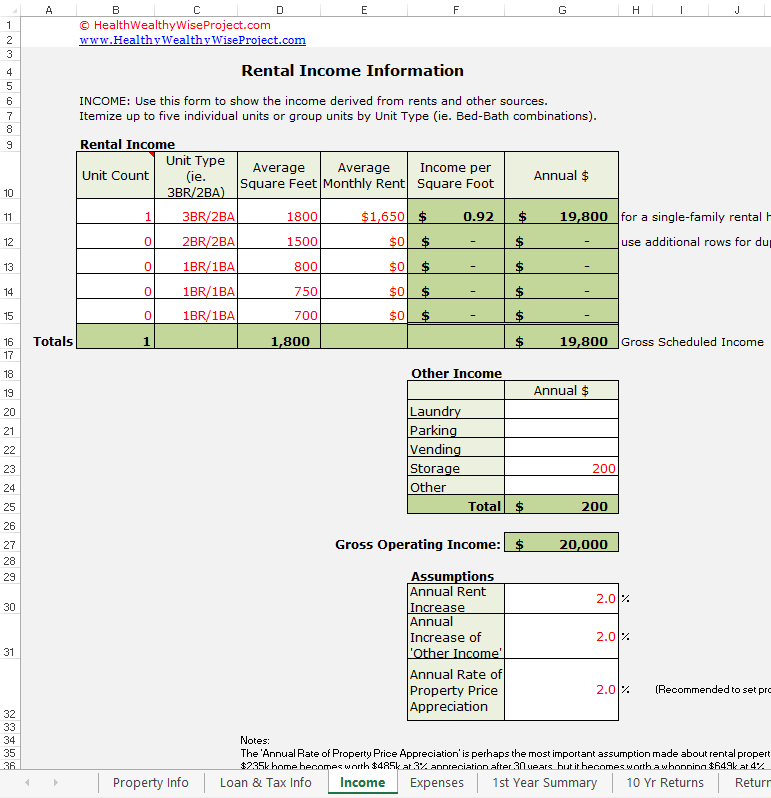

Fannie Mae publishes four worksheets that lenders may use to calculate rental income Use of these worksheets is optional The worksheets are Rental Income Worksheet – Principal Residence 2– to 4–unit Property Rental Income Worksheet – Individual Rental Income from Investment Propertys up to 4 properties Rental Income Worksheet Individual Rental Income from Investment Propertys Monthly Qualifying Rental Income or Loss Documentation Required Schedule E IRS Form 1040 OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1 Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025 A1 Enter total rents received A2 Subtract A3 Add A4 A5 A6 This expense must be specifically identified on Schedule E in order to add it back A7 A8 Equals adjusted rental income Total A9 Divide Equals Fannie Mae Form 1038 09302014 Rental Income Worksheet Individual Rental Income from Investment Propertys Monthly Qualifying Rental Income or Loss Documentation Required Schedule E IRS Form 1040 OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1 When using Fannie Mae Income Worksheet 2014-2021 Form Months unless there is evidence of a shorter term of service Step 1 Result The number of months the property was in service Result Step 2 Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025 Schedule E – Supplemental Income and Loss Note Use Fannie Mae Rental Income Worksheets Form 1037 or Form 1038 to evaluate individual rental income loss reported on Schedule E Refer to Selling Guide B3-31-08 Rental Income for additional details Partnerships and S corporation income loss reported on Schedule E is addressed below Please use the following calculator and quick reference guide to assist in calculating rental income from IRS Form 1040 Schedule E It provides suggested guidance only and does not replace Fannie Mae or Freddie Mac instructions or applicable guidelines Income calculation worksheet = ytd salary paytsub past year ot breakout use lowest income average date w2 for tax year Fannie mae publishes four worksheets that lenders may use to calculate rental income Annual gross rental income loss The remaining 25 accounts for vacancy loss maintenance and management expenses Entering Rental Income for the Subject Property in DU The following rental income policies apply to properties that are the subject property Refer to B3-31-08 Rental Income to determine the maximum amount of rental income that can be used for qualifying purposes for the subject property Form 1003 705 rev 609 Refer to Section 53061ciii for net rental Income calculation requirements 2 Refer to Chapter 5304 and Form 91 for the treatment of all rental real estate income or loss reported on IRS Form 8825 regardless of Borrowers percentage of ownership interest in the buisiness or whether the Borrower is personally obligated on

Fannie mae rental income calculation worksheet

0 Response to "31 Fannie Mae Rental Income Calculation Worksheet"

Post a Comment