36 Fannie Mae Rental Income Worksheet

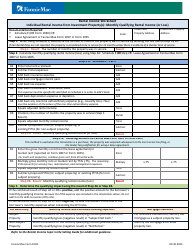

Fannie Mae Rental Income Worksheet. the transaction is a purchase or the property was acquired subsequent to the most receIf Fair Rental Days are not reported, the property is considered to be in serviceCalculate the monthly qualifying rental income using Step 2A: Schedule Eetermine the number of months the property was in service byEnter the amount of the monthly qualifying income in-time. fannie mae rental income worksheet rating. Fannie Mae's Former Owner Rental Program provides a month-to-month rental option for former homeowners still living in a property that was foreclosed. Former owners can rent the property (at market rate) while it's being marketed for sale to new owners.

Month-to-month fannie mae rental income worksheet is a straightforward economical manager tool that could be use both Digital or printable or Google Sheets. If you utilize the Digital template, you can also make fannie mae rental income worksheet on Microsoft Excel.

Fannie mae rental income worksheet

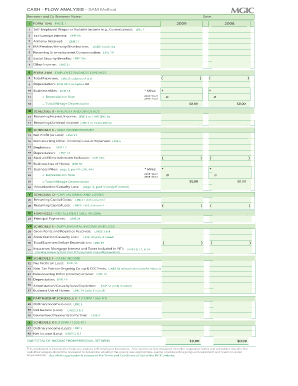

Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss)reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. Line 5a - Royalties Received: Include royalty income which meets eligibility standards. Line 5b - Total Expenses: Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. Copies of his or her signed federal income tax returns for the most recent two years that include foreign. Excel Details: Fannie mae income calculation worksheet excel. Excel Details: Sep 2, 2016 - Download a Rental Property Cash Flow Analysis worksheet for Excel.This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106.Fannie.16.The taxes on the imputed income. fnma rental worksheet 1038.

Fannie mae rental income worksheet. Month-to-month fannie mae rental income worksheet is a straightforward economical manager tool that could be use both Digital or printable or Google Sheets. If you utilize the Digital template, you can also make fannie mae rental income worksheet on Microsoft Excel. COR 0602 Rental Income/Schedule E Calculation Worksheet 10/02/2015 COR 1404 Salaried/Hourly Income Calculation Worksheet 08/07/2020 Fannie Mae Form 1084 Fannie Mae Cash Flow Analysis 06 /20 1 9 Freddie Mac Form 91 Freddie Mac Income Calculations(Income Analysis Form) 05/01/2019. Result: Net Rental Income(calculated to a monthly amount) 4 (Sum of subtotal(s) divided by number of applicable months = Net Rental Income) $_____ / _____ = $_____ 1. Refer to Section 5306.1(c)(iii) for net rental Income calculation requirements. 2. This expense, if added back, must be included in the monthly payment amount being used to. Rental Income Worksheet Principal Residence, 2- to 4-unit Property: Monthly Qualifying Rental Income. Lease Agreement or Fannie Mae Form 1025 Step 1 When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. If Fair Rental Days are not reported, the property is considered to be...

A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a. Royalties Received (Line 4) b. Total Expenses (Line 20) c. Depletion (Line 18) Subtotal Schedule E Schedule F - Profit or Loss from Farming a. Net Farm Profit or Loss (Line. Fannie Mae Form 1038 09.30.2014 Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1. When using. Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair. Rental Income Worksheet Individual Rental Income from. Homes Details: Fannie Mae Form 1038 09.30.2014 Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1.

Fannie Mae Form 1037 02/23/16. Rental Income Worksheet Documentation Required: § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1. When using Schedule E, determine the number of months the property was in service by dividing the Fair Rental Days by 30. Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: Schedule E (IRS Form 1040) OR Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Investment Property Address Step 1. Fannie Mae Rental Guide (Calculator 1037) Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1039) Our editable, auto-calculating worksheets help you to analyze: Cash flow and YTD profit and loss (P&L) Comparative income. Liquidity ratios. Rental income. For employment and other types of income, check out our Income Analysis worksheet.

Form 1038: Rental Income Worksheet - Genworth Financial. Rentals Details: Result: Monthly qualifying rental income (or loss): Result Step 2 B. Lease Agreement OR Fannie Mae Form 1007 or Form 1025 For each property complete ONLY 2A or 2B This method is used when the transaction is a purchase, the property was acquired subsequent to the most recent tax filing, or fannie mae rental income subject

Fannie Mae Form 1038A Individual Rental Income from Investment Property(s) (up to 10 properties) Download XLXS. Freddie Mac Form 92 Schedule E - Net Rental Income Calculations. Download PDF. Fannie Mae Form 1038 Individual rental Income from Investment Property(s) (up to 4 properties) Download XLXS. Fannie Mae Form 1039

Rental Income Worksheet Principal Residence 2- to 4-unit Property Monthly Qualifying Rental Income Documentation Required Schedule E IRS Form 1040 OR Lease Agreement or Fannie Mae Form 1025 Address of Principal Residence Enter Rental Unit Rental Unit Rental Unit Step 1 When using Schedule E determine the number of months the property was in service by dividing the Fair Rental Days by 30.

Fannie Mae Rental Income Worksheet search trends: Gallery Guidelines calculation calculate perfect images are great Calculation calculate expense photos taken in 2015 Very nice work, photo of calculate expense property Expense property schedule e perfect images are great Nice one, need more property schedule e net images like this

The following self-employed income analysis worksheet and accompanying guidelines generally apply to individuals: Who have 25% or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income, have earnings reported on IRS Form 1099, or income that cannot otherwise.

Next up Fannie Mae. Fannie takes a much different approach on personally financing a property. In their view you will ultimately be responsible for the payment and the special rental income calculation form 1039 shows this. Here is how the process works: Step 1 - Ask the question "Is the borrower personally financing the property?" This.

Fannie Mae Income Worksheet 2014-2021 Form. Months unless there is evidence of a shorter term of service. Step 1. Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025.

Fnma Rental Income Calculator Excel. Excel Details: Excel Details: Calculate monthly qualifying rental income (loss) using Step 2A: Schedule E OR Step 2B: Lease Agreement or Fannie Mae Form 1007 or Form 1025.A1 Enter total rents received. A2 Subtract A3 Add A4 A5 A6 This expense must be specifically. fannie mae income calculator excel. fannie mae schedule e worksheet

Fannie Mae Rental Income Worksheet - Memo Template. Posted: (4 days ago) Aug 21, 2021 · Month-to-month fannie mae rental income worksheet is a straightforward economical manager tool that could be use both Digital or printable or Google Sheets. If you utilize the Digital template, you can also make fannie mae rental income worksheet on.

Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss)reported on Schedule E. Refer to Selling Guide, B3-3.1-08, Rental Income, for additional details. Line 5a - Royalties Received: Include royalty income which meets eligibility standards. Line 5b - Total Expenses:

Note: A lender may use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) or a comparable form to calculate individual rental income (loss) reported on Schedule E. a.

Schedule E – Supplemental Income and. Loss. Note: Use Fannie Mae Rental Income Worksheets (Form 1037 or Form 1038) to evaluate individual rental income (loss) reported on Schedule E. Refer to . Selling Guide, B3-3.1-08, Rental Income, for additional details. Partnerships and S corporation income (loss) reported on Schedule E is addressed below.

Fannie Mae Rental Income Worksheet - Fill Out and Sign. Rentals Details: Fannie Mae Income Worksheet 2014-2021 Form. Months unless there is evidence of a shorter term of service. Step 1. Result The number of months the property was in. schedule e rental income worksheet

Fillable pdf fannie mae rental income worksheet. Posted: (3 days ago) Fannie Mae Rental Guide (Calculator 1037) Use this worksheet to calculate qualifying rental income for Fannie Mae Form 1037 (Principal Residence, 2- to 4-unit Property) Fannie Mae Rental Guide (Calculator 1039). 12.05.2010 · has a mortgage that is owned or guaranteed by Fannie Mae or Freddie Mac, has no late mortgage.

Excel Details: Fannie mae income calculation worksheet excel. Excel Details: Sep 2, 2016 - Download a Rental Property Cash Flow Analysis worksheet for Excel.This worksheet derives only the self-employed income by analyzing Schedule C, F, K-1 (E), and 2106.Fannie.16.The taxes on the imputed income. fnma rental worksheet 1038.

Fannie Mae Income Worksheet 2014-2021 Form. Months unless there is evidence of a shorter term of service. Step 1. Result The number of months the property was in service Result Step 2. Calculate monthly qualifying rental income loss using Step 2A Schedule E OR Step 2B Lease Agreement or Fannie Mae Form 1007 or Form 1025.

Sep 01, 2021 · Income from Partnerships, LLCs, Estates, and Trusts. Income from partnerships, LLCs, estates, or trusts can only be considered if the lender obtains documentation, such as the Schedule K-1, verifying that. the income was actually distributed to the borrower, or. the business has adequate liquidity to support the withdrawal of earnings.

Sep 01, 2021 · Rental Income Worksheet – Business Rental Income from Investment Property(s). Reporting of Gross Monthly Rent Eligible rents on the subject property (gross monthly rent) must be reported to Fannie Mae in the loan delivery data for all two- to four-unit principal residence properties and investment properties, regardless of whether the.

Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. Copies of his or her signed federal income tax returns for the most recent two years that include foreign.

Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was.

0 Response to "36 Fannie Mae Rental Income Worksheet"

Post a Comment