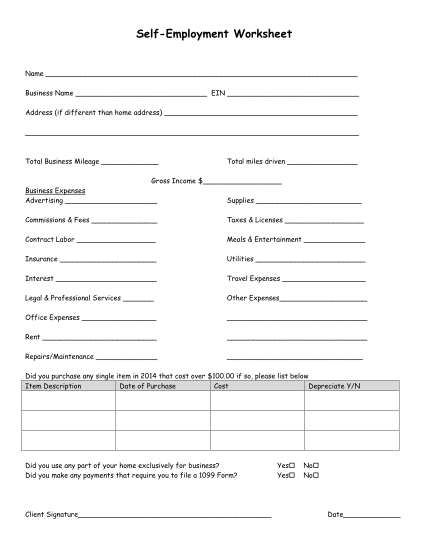

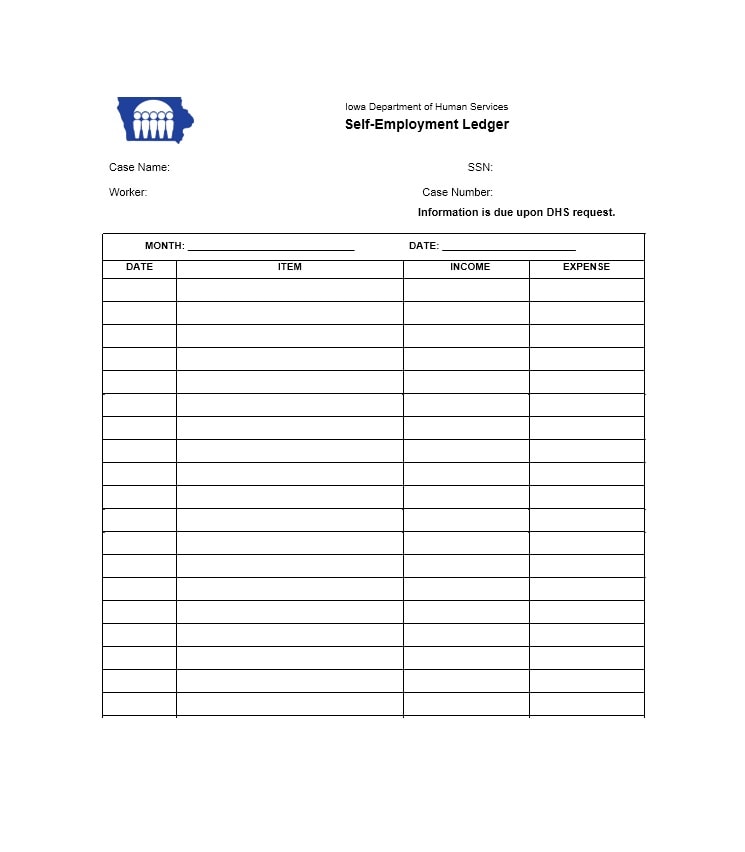

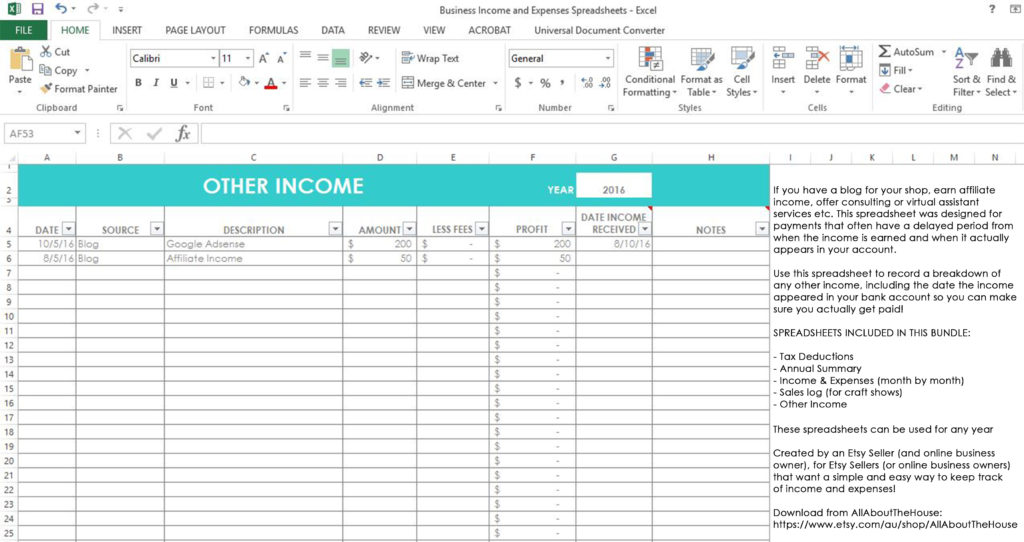

35 Self Employment Expenses Worksheet

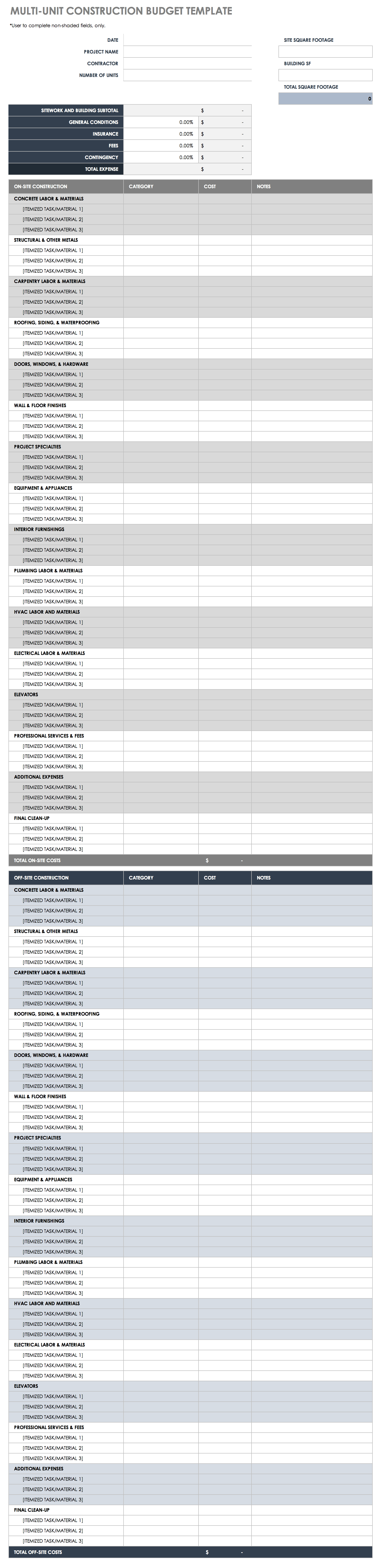

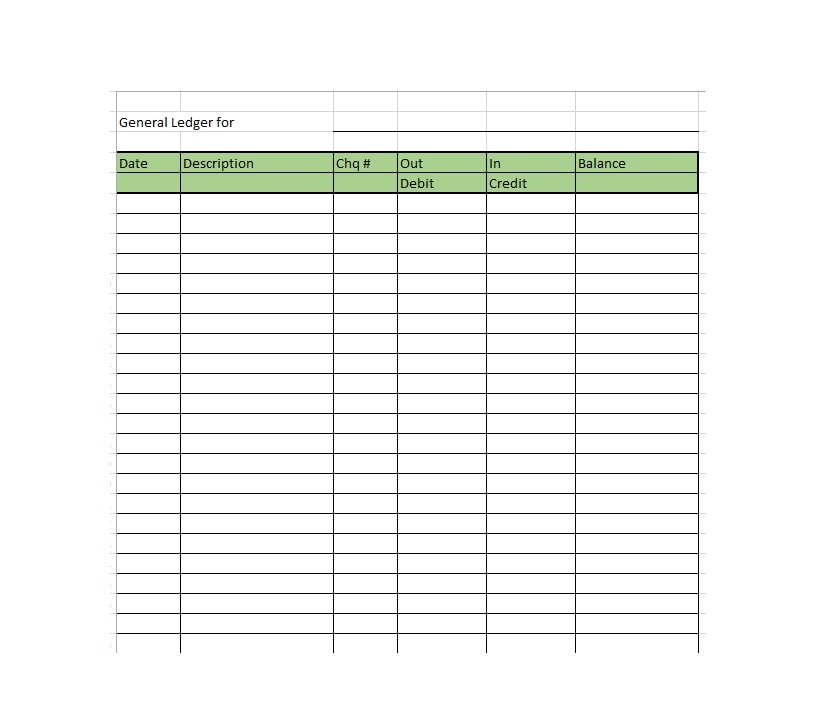

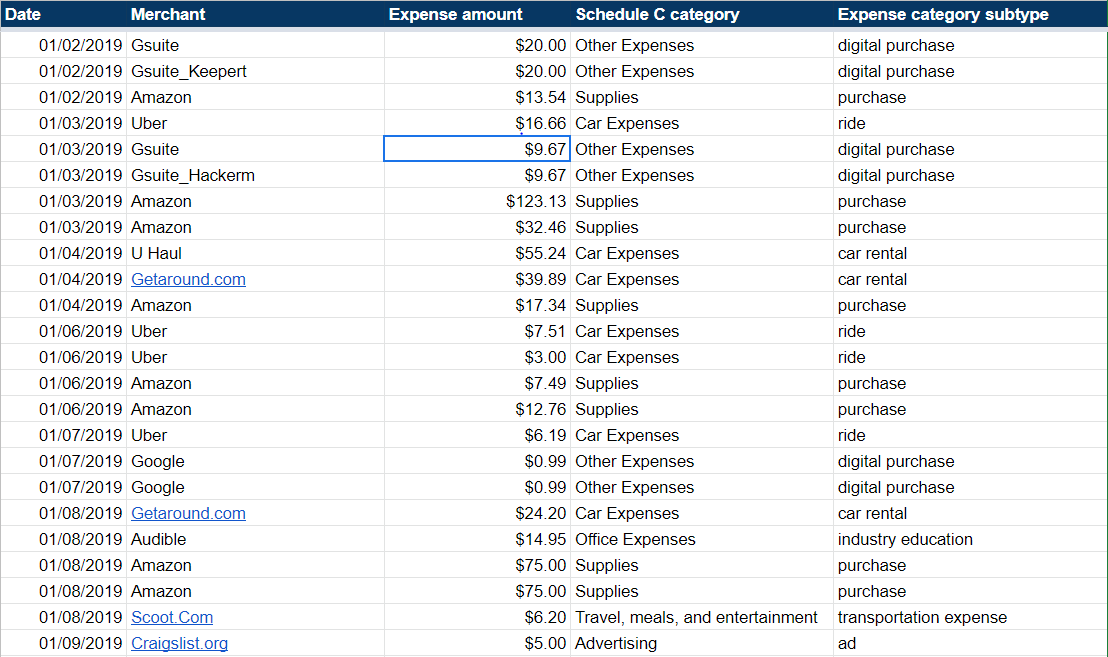

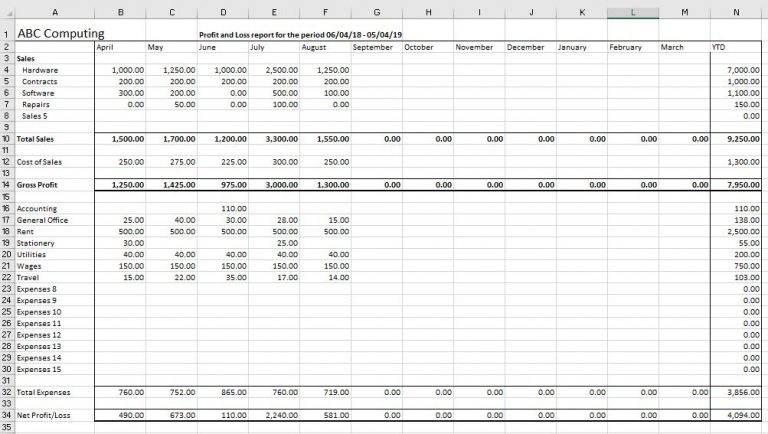

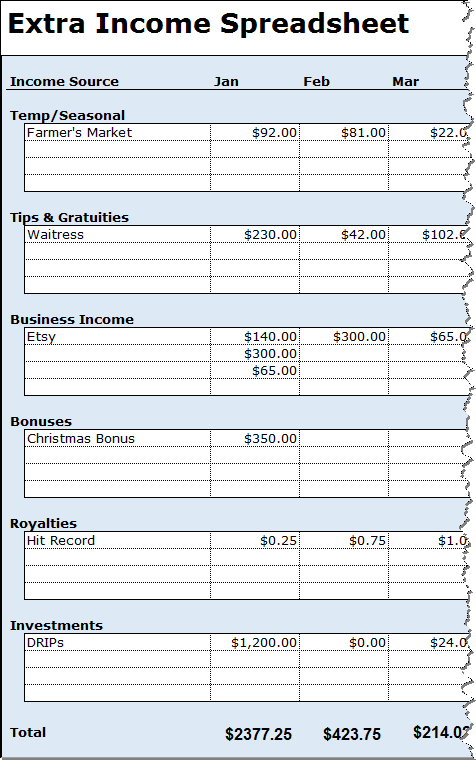

Schedule C Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors Use separate sheet for each business Use a separate worksheet for each business ownedoperated Do not duplicate expenses Name type of business OwnedOperated by Client Spouse Bookkeeping For Self Employed Spreadsheet In 2021 Budget Spreadsheet Excel Spreadsheets Templates Bookkeeping Templates Small Business Tax Spreadsheet Business Worksheet Business Tax Deductions Business Budget Template Free Small Business Income And Expenses Excel Spreadsheet Tracker To Make Your Self Employed Tax Re Spreadsheet Business All expenses should be totaled from actual receipts that can be presented to the CRA in the event of an audit Need more info Call or email us or visit our website at lorennanckecom Title Microsoft Word - Worksheet - Self employment income and expenses 2017 brand typefacedocx Schedule C Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors Use separate sheet for each business Use a separate worksheet for each business ownedoperated Do not duplicate expenses Name type of business OwnedOperated by Client Spouse Income Total Self employed business expenses worksheet Add the Income and Expenses Personal versus Business Expenses Schedule C Self-EmployedBusiness Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising The Hidden Facts About Monthly Company Report Template Uncovered Through an Old Guru What About Regular Monthly Business Report Template Dont allow it to be difficult for people to … Tax Worksheet for Self-employed Independent contractors Sole proprietors Single LLC LLCs 1099-MISC with box 7 income listed Try your best to fill this out If you’re not sure where something goes don’t worry every expense on here except for meals is deducted at the same rate 33 Self Employed Expense Worksheet Written By Jon L Ruth Friday August 27 2021 Add Comment Edit Self employed expense worksheet Bookkeeping Templates For Self Employed 5 Useful Templates Best Of 2017 Self Employment Tax Form Models Form Ideas Free Expenses Spreadsheet For Self Employed Cash flow analysis worksheets for tax year 2020 Our cash flow analysis worksheets help you to easily and accurately determine a self-employed borrowers income Our editable auto-calculating worksheets help you to analyze Cash flow and YTD profit and loss PL Comparative income Liquidity ratios Rental income How can i get my itemized expense report In the forms mode or on the Print Center list look for the Schedule C worksheet abbreviated Schedule C wks on the list of forms For most self employed people there is seldom any more info on that worksheet than is shown on the actual Schedule C INCOME CALCULATION WORKSHEET PART I - INCOME TYPE Section Borrower Co-Borrower 1 Hourly See Part II Section 1a 1b 1c or 1d seasonal worker † Income Analysis Worksheet for a calculation worksheet for self-employed borrowers INCOME CALCULATION WORKSHEET If you decide to use IRS tax forms use them together with the charts in Process Help Section 162 Self-Employment Income or the self-employment income worksheets which identify which income and expenses need to be entered onto the Self-Employment page by line on the IRS tax forms YTD PL and Business Statement Analysis Use our flow chart to guide you in applying temporary COVID-19 agency guidelines and determining a stable monthly income Download Worksheet PDF Ask 2 Save 10 Handout Here are two simple questions to ask self-employed borrowers so you can save 10 Download Worksheet PDF If there are multiple instances of self-employment that differ substantially from period to period use separate forms when necessary Use the SSA-821-BK Work Activity Report - Employee in work and employee cases for more information on the SSA-821-BK see DI 10505035 The following self-employed income analysis worksheet and accompanying guidelines generally apply to individuals Who have 25 or greater Who are employed by Who are paid Who own rental property interest in a business family members commissions Who receive variable income have earnings reported on IRS Form 1099 or income that cannot otherwise Fnma Self Employed Worksheet - When it comes to you wanting to arranged goals for yourself presently there are several ways in which this could be done The remaining 25 accounts for vacancy loss maintenance and management expenses Form 1120S Taxable Income S Corporation Determine the percentage change in gross income from one year to the next EXAMPLES OF SELF-EMPLOYED BUSINESS EXPENSES After you have visited my website wwwjunewalkeronlinecom and read FEATURE 3 which explains what makes an expense a business deduction the following list will be helpful in providing you with typical as well as unusual examples of business expense deductions There Free Business Income And Expense Tracker Worksheet Small Business Expenses Business Budget Template Spreadsheet Business Mileage Report Template New Mileage Spreadsheet Template Mileage Log Template For Self Employed Spreadsheet Template Self Employment Spreadsheet INCOME W2 Income Wages from W-2 Honoraria Income Self Employment Housing Allowance Weddings Funerals see below Speaking engagements Business Expense Reimbursement Liturgical work Direct reimbursement Auto Barter Set Amount Other Other Sales of Equipment andor Machinery Held for Business Use Analyze self-employed borrower cash flow income from employment and non-employment sources and rental income using our editable auto-calculating worksheets Here are a few extra items youll need to provide Income Analysis Worksheet for a calculation worksheet for self-employed borrowers Self Employed Applicants Income worksheet SIMPLIFIED BUSINESS INCOME AND EXTRA EXPENSE WORKSHEET This worksheet is designed to help determine a 12-month business income and extra expense exposure Generally this includes but is not limited to the deductible part of self-employment tax self-employed health insurance and deductions for contributions to qualified retirement plans eg Tax Worksheet for Self-employed Independent contractors Sole proprietors Single LLC LLCs 1099-MISC with box 7 income listed This downloadable file contains worksheets for wages and pensions IRA distributions interest and dividends Miscellaneous income tax refunds social security unemployment other income Great 12 Best Images of Self Employed Tax Worksheet Free SelfEsteem Building Worksheets Personal A few go through the methods about how you could find the templates attached to your own computer All you possess to do is click on Office Button and after that follow by selecting New Because the calculator worksheet includes formulas we suggest that you make a working copy to use in place of the original document formulas have a way of disappearing PPP loan calculate using gross income Now independent contractors self-employed individuals and sole proprietors calculate their PPP differently 5+ monthly expenses spreadsheet pratiko August 9 2021 monthly spreadsheet No Comments You overlook t have to take shorter notice however you may have to make an exception in which it wasnt reasonably practicable for the employee to supply you with … Pays for itself TurboTax Self-Employed Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020 Actual results will vary based on your tax situation More good news You can claim 50 of what you pay in self-employment tax as an income tax deduction For example a 1000 self-employment tax payment reduces taxable income by 500 In the 25 percent tax bracket that saves you 125 in income taxes This deduction is an adjustment to income claimed on Form 1040 and is available whether or not Pays for itself TurboTax Self-Employed Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020 Actual results will vary based on your tax situation The KC-5150 Self-Employment Worksheet is used to request income and expenses for the 12 months prior to the month of application This form is generated off-system by staff and mailed locally It is used in the following circumstances a It is a new business and a tax return has not yet been filed With self-employment comes freedom responsibility and a lot of expense While most self-employed people celebrate the first two they cringe at the latter especially at tax time They might not be aware of some of the tax write-offs to which they are entitled Click Add Group Click Untitled and name your category You can add a budget line on your desktop or phone like this Find the category the line should fall under Click Add Item Click Label and name your line 3 Make adjustments The key to winning with budgeting on an irregular income is being flexible and staying on top of it The self-employment tax is 153 and solely exists to cover your Social Security and Medicare taxes 2 At a normal full-time job your Social Security and Medicare taxes are taken out of your paychecks automatically—and your employer covers half of those taxes But as a freelancer youre considered both an employee and an employer The tricky part with self-employed borrowers is sometimes expenses deducted from their taxable income also appear on their credit reports so applicants can be hit twice for the same expense Suppose you have a gas card for your yard care business and the balance and payment appear on your credit report 5 Use the Correct Form If youre new to filing self-employment or independent contractor taxes finding the correct self-employment tax form can seem daunting but most freelancers will likely only need these three forms Form 1040 Form 1040 is required for individuals who are self-employed because it accounts for the self-employment tax Schedule C On Schedule C report your income or The net income from self-employment must be entered in the Base Income field in Section V Form 1003 12021 If the borrower is the business owner or is self-employed the business ownerself-employed indicator must be checked along with the percentage of ownership DU will consider the borrower self-employed if the ownership share is 25 or Pays for itself TurboTax Self-Employed Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020 Actual results will vary based on your tax situation Instead of having to pay self-employment taxes on every dollar you make from self-employment you are permitted to take out self-employment tax deductions first For example you can write off things like the costs of goods sold home office expenses advertising and vehicle expenses Theres also a self-employed health insurance deduction The shareholders share of income or loss is carried over to IRS Form 1040 Schedule E See B3-32-02 Business Structures for more information on S corporations A borrower with an ownership interest in an S corporation or LLC may receive income in the form of wages or dividends in addition to his or her proportionate share of business General Requirements for Documenting Rental Income If a borrower has a history of renting the subject or another property generally the rental income will be reported on IRS Form 1040 Schedule E of the borrowers personal tax returns or on Rental Real Estate Income and Expenses of a Partnership or an S Corporation form IRS Form 8825 of a business tax return

Self employment expenses worksheet

0 Response to "35 Self Employment Expenses Worksheet"

Post a Comment