33 Non Cash Charitable Contributions Donations Worksheet

The taxpayer makes a $35,000 cash charitable contribution to a qualified charity and makes the election to apply Section 2205 of the CARES Act to the $35,000 contribution. Since the 2020 charitable contribution limit is 50% of $150,000 = $75,000 for the contribution carryover from 2017 and the qualified charitable donation in 2020 is not. There are some rules, though, dictating just how much tax benefit you can claim from a donation of stock. The first important consideration is the cap on charitable deductions. Generally, you're allowed to reduce your taxable income up to a maximum of 50% of your adjusted gross income with charitable non-cash contributions.

3. Nonprofit cash flow projection template. This template breaks down your annual or monthly budget incrementally, giving a fair picture of your cash flow. You can enter your estimated receivables and expenditure as well as the date you expect to receive both. If you're not sure about a receivable, don't add it to the budget worksheet.

Non cash charitable contributions donations worksheet

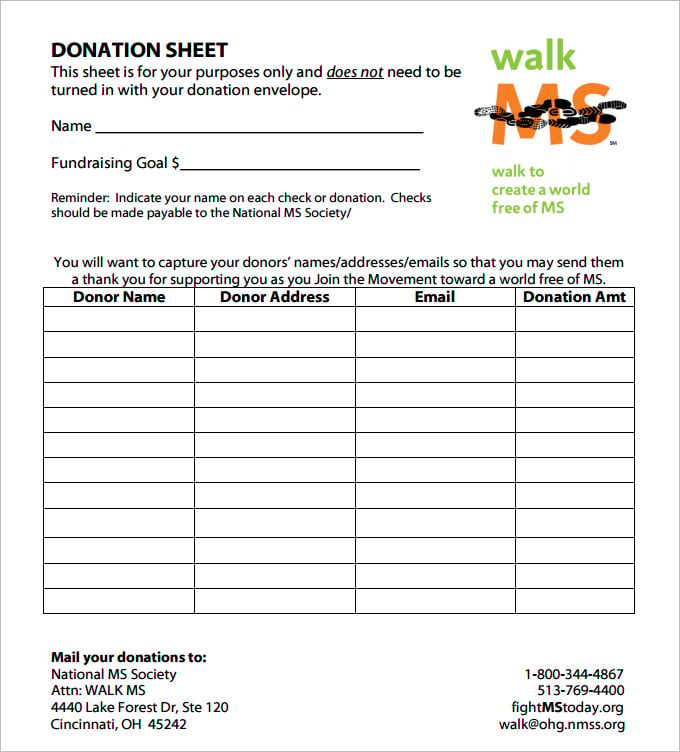

The original CARES Act introduced a new $300 charity deduction for non-itemizers. It's only for 2020 and only for those who take the standard deduction. The donation has to be in cash, not in household items, cars, or appreciated securities. It has to be made directly to a charity, not to a donor-advised fund. Printable donation form mail completed form to st. place , tn donation amount q monthly q have provided a free printable donation receipt that can be used for these tax and business tracking purposes. our form allows space for the donor information, affiliation, twenty plus lines to list donations, donation values, and total amounts of donations. Rules for 2020 up limits on itemized deductions for cash gifts and let non-itemizers deduct up to $300 of cash gifts while using a standard deduction.. to $300 in charitable cash donations...

Non cash charitable contributions donations worksheet. Cash donations include those made by check, credit card or debit card. They don't include securities, household items or other property. Though cash contributions to most charitable organizations qualify, some don't. People should review Publication 526, Charitable Contributions for details. Cash contributions made to supporting organizations. To write off any cash contributions, no matter how small, you need a canceled check, bank record or a receipt with the charity's name and donation amount. That means that putting cash in the church collection plate or the Salvation Army bucket is a no-no if you want to be able to take a deduction for it. A QCD allows you to receive a tax benefit from your charitable contribution even if you do not itemize your deductions, because the QCD is excluded from your taxable income. As an example of the potential tax savings of a QCD, consider a hypothetical donor, Bob, who is a single tax-filer with anticipated ordinary income of $80,000 in 2021. Jun 3, 2015 - Fill Donations Worksheet, download blank or editable online. Sign, fax and printable from PC, iPad, tablet or mobile with PDFfiller Instantly No software. Try Now!

Cash Charitable Contributions Worksheet and Charitable Donation Itemization Worksheet. Gifts for multiple events: If you have many different charities or other non-profit organizations that you are affiliated with, and each one is associated with an activity or cause, you could make lists of all of them. What Proof do you Need to Claim a Charitable Donation? By default, always at least get written confirmation. I won't get in to the full details here, since I have previously gone in to depth about cash and non-cash scenarios where you need a charitable donation receipt, appraisal, or no written acknowledgement at all in order to deduct a. Related posts from non cash charitable contributions donations worksheet 2017 download 7 tax return spreadsheet sample template 2020 a income tax return may be a set of forms that a taxpayer uses to calculate and report taxes owed to intern revenue service (irs).is that the annual deadline for filing a income tax return , though some sorts of. Salvation Army Donation Guide. Fill out, securely sign, print or email your donation value guide 2007-2020 spreadsheet form instantly with SignNow. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android. Start a free trial now to save yourself time and money!

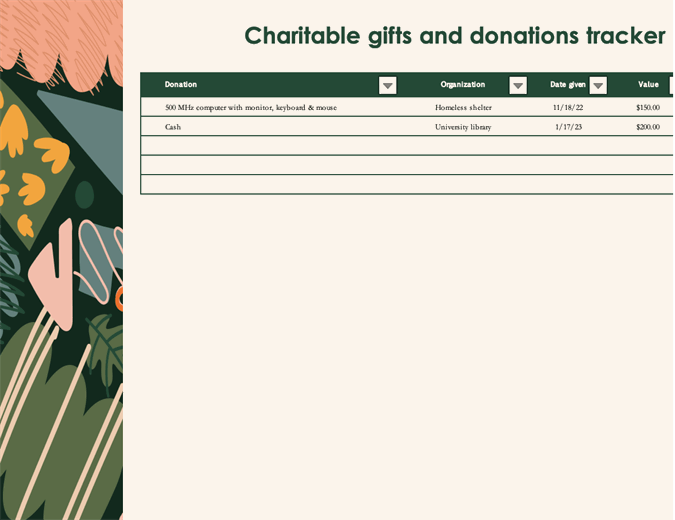

Charitable Contributions for Non-Itemizers - The Taxpayer Certainty and Disaster Tax Relief Act allows those who don't itemize their deductions a deduction of up to $300 for cash contributions made during 2021. Married couples filing jointly are allowed a deduction of up to $600 for the cash contributions they make during 2021. Non cash charitable donations worksheet. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. The donation value guide below helps you determine the approximate tax deductible value of some of the more commonly donated items. Insert tax year insert date given enter items not provided for in. Non-cash donations, on the other hand, can get a little squirrely. Donations of items like clothing, cars, or household goods are assessed at the "fair market value," or FMV. The amount of your charitable contribution to charity X is reduced by $700 (70% of $1,000). The result is your charitable contribution deduction to charity X can’t exceed $300 ($1,000 donation - $700 state tax credit). The reduction applies even if you can’t claim the state tax credit for that year.

Thanks Pat but I made no entries at all, these were cash donations carryovers from 2017 and it appears that the carryover amount was put on the wrong "Non-cash" line by the software and carried as such to the worksheet. Has never been an issue as the proper amount of carry over was being used.

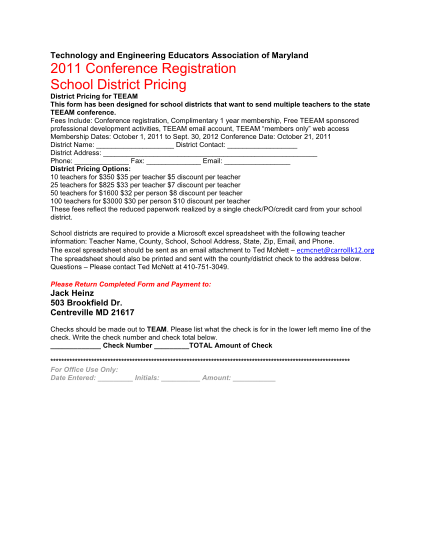

Charitable Contributions Worksheet Deductible charitable contributions an s corporation qualifies depending on the contribution s value use worksheet 2 of publication 526 to apply the deduction limits For special rules provide more generous tax treatment for qualifying cash contributions these temporary provisions will not apply after unless congress amends the law the charitable Money paid.

For 2020, you are allowed to deduct up to $300 ($150 if Married filing Separately) of cash donations to 501(c)3 organizations even if you do not itemize your deductions. In order to take this above-the-line deduction, enter your donation(s) under Deductions & Credits > Charitable Donations > Donations to Charities in 2020.

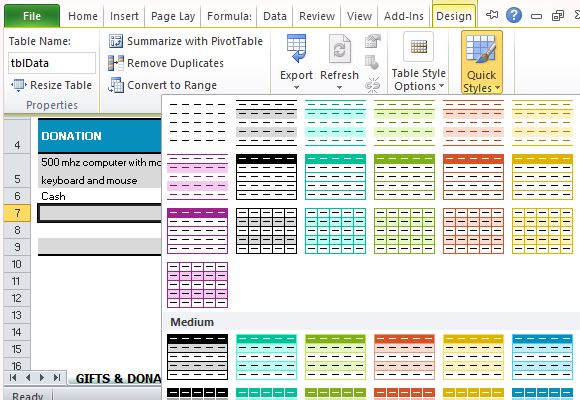

You can print five types of donation reports in TurboTax ItsDeductible: item donations, money donations, mileage donations, stock donations, and summary. If you have an ItsDeductible account and one of TurboTax's software programs, you can import your deductions and generate IRS Form 8283, Non-cash Charitable Contributions.

Get Non Cash Charitable Contributions Worksheet Pictures. If the value of the donated items is $250 or more to one charity in one day, you are required to obtain a written receipt from the. When valuing items, take into consideration the condition of the items.

This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. Charitable contributions of property in excess of 5000. From the Item Donation Summary associated with each donation date you can select Add More Items or Done With This Donation. TurboTax 2020 CARES Act 300 Charity Donation Deduction.

Non cash charitable contributions / donations worksheet 2020 For individuals over the age of 55, the idea of spending money for life insurance may be overshadowed because so many are dealing with the increase of...

A: For any non-cash charitable contribution of $250 or more, you must maintain a receipt from the qualified organization. 2 In addition to providing a description of the donation, this receipt must also state whether any goods or services were provided in exchange for the donation as well as the value of such goods/services.

In general, you can deduct up to 60% of your adjusted gross income via charitable donations (100% if the gifts are in cash), but you may be limited to 20%, 30% or 50% depending on the type of.

Printable donation form mail completed form to st. place , tn donation amount q monthly q have provided a free printable donation receipt that can be used for these tax and business tracking purposes. our form allows space for the donor information, affiliation, twenty plus lines to list donations, donation values, and total amounts of donations.

Deducting Charitable Donations Of Clothing And Household Items The Official Taxslayer. 1040 Form Contributions Non Cash Donations Fill Printable Fillable Blank Filler. Clothing donation tax deduction worksheet forms and templates fillable printable sles for word filler small business to charitable giving businessnewsdaily donation values and...

Likewise, sweat shirts / pants MY / OUR BEST GUESS OF VALUE L NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET.K Insert Tax Year ===> Insert Date Given ===>JENTER ITEMS NOT PROVIDED FOR IN THE ABOVE CATEGORIES. SET YOUR OWN VALUE.

For non-cash donations, you deduct in the year that the property was given. The exception is you can carry over deductions from any year in which you surpass the deduction limits (discussed next), up to a maximum of 5 years. Deduction Limits. Most of us will never have to worry about this, but there is an IRS maximum charitable donation limit.

Related posts from non cash charitable contributions donations worksheet 2017 download 7 tax return spreadsheet sample template 2020 a income tax return may be a set of forms that a taxpayer uses to calculate and report taxes owed to intern revenue service (irs).is that the annual deadline for filing a income tax return , though some sorts of.

Non cash charitable contributions / donations worksheet. These spreadsheets will help you calculate and track your charitable donations for tax deduction purposes. 20th two separate valuation reports should be made for each date. This worksheet is provided as a convenience and aid in calculating most common non cash charitable donationsthe source.

Rules for 2020 up limits on itemized deductions for cash gifts and let non-itemizers deduct up to $300 of cash gifts while using a standard deduction.. to $300 in charitable cash donations...

Technically, Form 8283 must be submitted for all donations valued at over $500, but really pricey gifts over $5,000 require that you fill out Section B of the form as well. As for aircraft, cars, and boats, the rules here are particularly tricky and you might have a choice of valuation methods depending on what the charity does with the gift.

Net worth worksheet excel, night elie wiesel worksheets, ninth grade math worksheets, nm child support worksheet, nol worksheet, nomenclature chemistry worksheet, non cash charitable contributions donations worksheet, non cash charitable contributions worksheet, non profit budget worksheet, nonfiction text features worksheets, noun and pronoun.

Deducting Charitable Donations of Clothing and Household Items. The tax laws say that you can deduct charitable contributions worth up to 60% of your AGI. But special rules do apply, depending on what you donate. The items that are subject to these rules include clothing, household items, cars, boats, airplanes, business inventory, patents, and.

Here's how the CARES Act changes deducting charitable contributions made in 2020: Previously, charitable contributions could only be deducted if taxpayers itemized their deductions. However, taxpayers who don't itemize deductions may take a charitable deduction of up to $300 for cash contributions made in 2020 to qualifying organizations. For.

The original CARES Act introduced a new $300 charity deduction for non-itemizers. It's only for 2020 and only for those who take the standard deduction. The donation has to be in cash, not in household items, cars, or appreciated securities. It has to be made directly to a charity, not to a donor-advised fund.

Broadly put, the worksheet form is a table which requires indicating the taxpayer, the donee, the year reported on, and the date. Related posts from Donation Spreadsheet Goodwill. A Non Cash Charitable Contributions/Donations Worksheet is necessary for individuals who make non cash charitable donations to the Salvation Army that do not exceed.

0 Response to "33 Non Cash Charitable Contributions Donations Worksheet"

Post a Comment