33 Mortgage Loan Comparison Worksheet

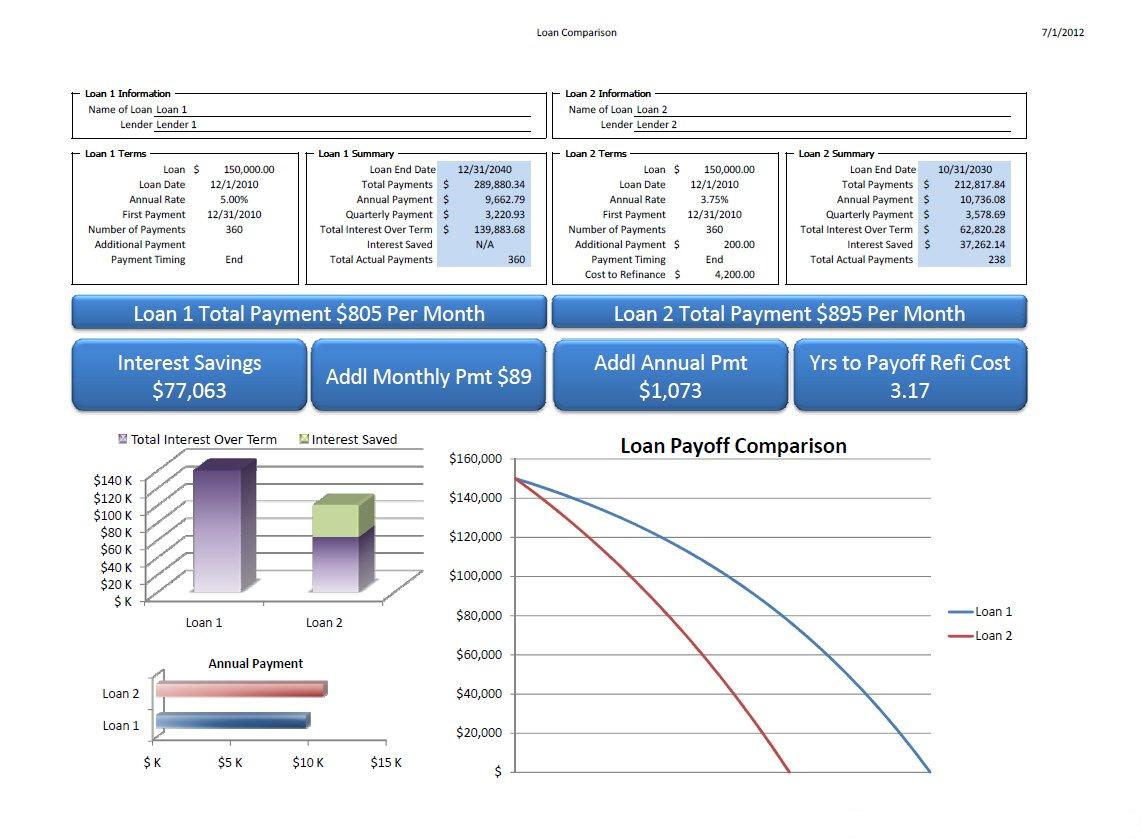

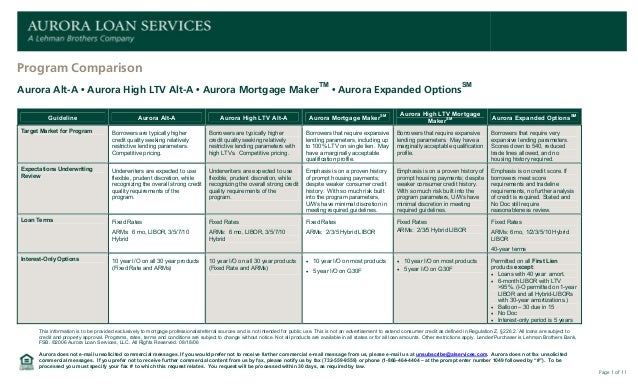

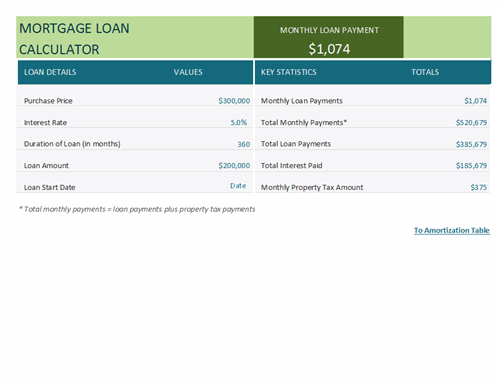

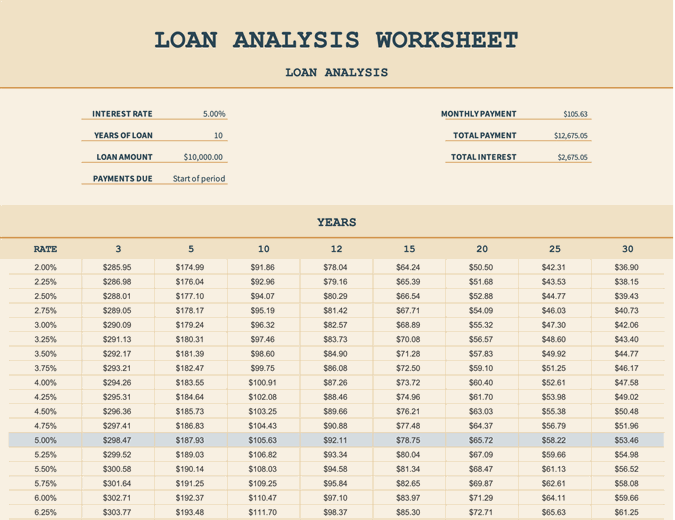

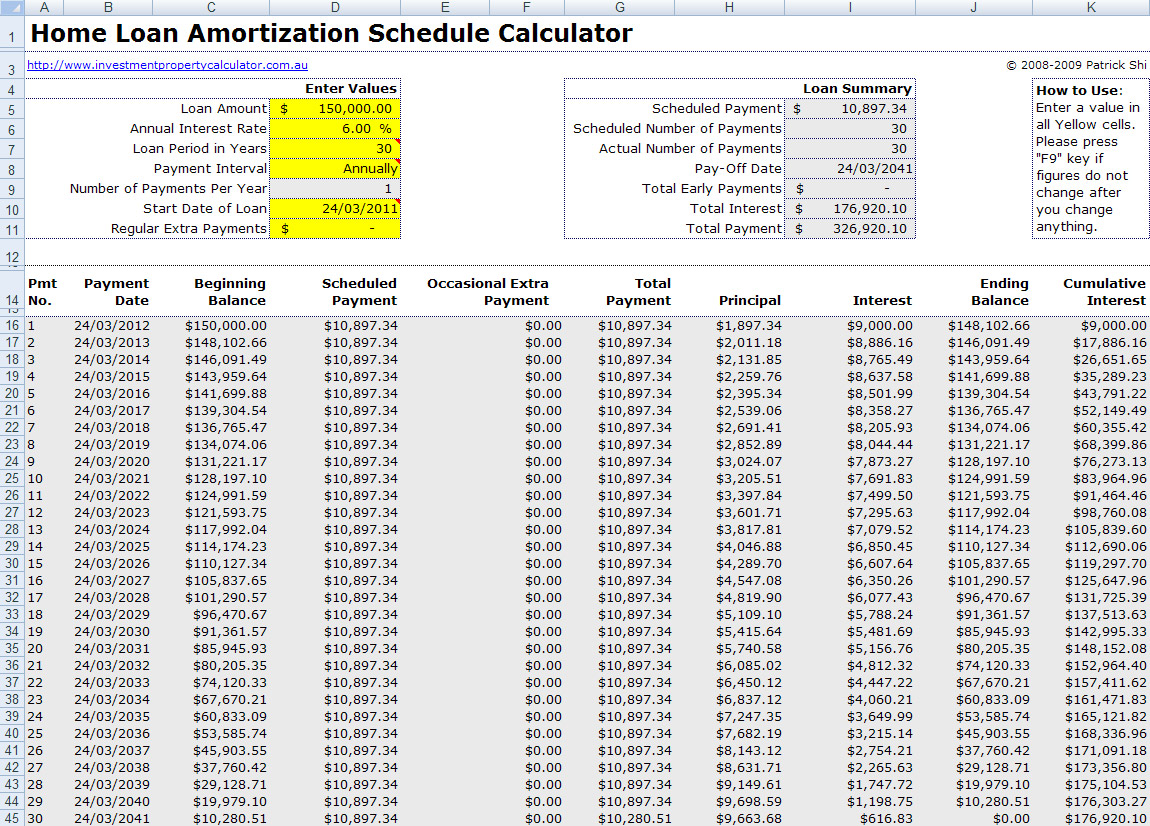

Calculator Rates Microsoft Excel Mortgage Calculator with Amortization Schedule Want to Calculate Mortgage Payments Offline? We have offered a downloadable Windows application for calculating mortgages for many years, but we have recently had a number of people request an Excel spreadsheet which shows loan amortization tables. Sample Mortgage Comparison Assuming a $250,000 mortgage loan, no points or fees and a borrower credit score of 720. This is simply a comparison of the different rates you may be offered with some of the mortgage products available today. Actual rates will vary. (continued)

Annual program donates a day's worth of trading commissions generated by BMO Capital Markets globally; Has raised over C$28 million and supported more than 5000 students since its inception in 2005; TORONTO, NEW YORK, and LONDON, Sept. 23, 2021 /CNW/ - BMO Capital Markets today announced that its 2021 Equity Through Education (ETE) trading day, held on September 22, 2021, raised C$1.6 million.

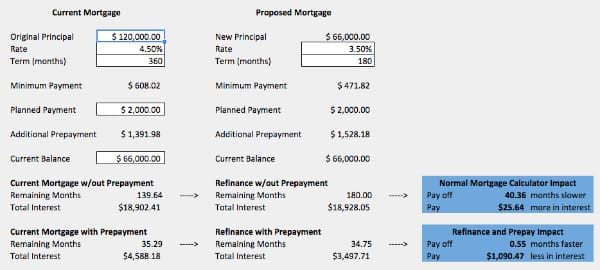

Mortgage loan comparison worksheet

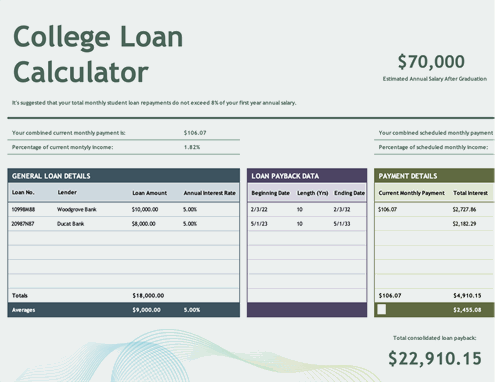

Weigh the pros and cons of various mortgages with this accessible loan comparison template. Mortgage Comparison Worksheet As you are working with lenders to select a mortgage, there are several factors to consider that may make a big difference in your monthly payments and the overall cost of your loan. 1. Save it in your emergency fund. Around 1 in 8 federal student loan borrowers (13%) say they put loan payment money into a savings account, according to the survey. The COVID-19 pandemic has.

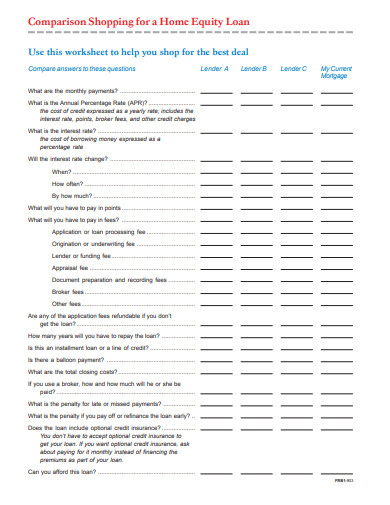

Mortgage loan comparison worksheet. Mar 3, 2021 - Free download templates mortgage loan comparison, mortgage comparison sheet, mortgage comparison spreadsheet, mortgage refinance comparison. A home equity loan is a financial product that lets you borrow against your home's value. Getting it right means understanding the mortgage process, from start to finish. From what you need to do before bu. Knowing your home's value helps you determine a list price if you're selling it. Here's a look at how to modify your home loan. Loan comparison calculator Compare loans, calculate costs, and more When it comes time to compare loans, it’s always important to have a clear picture of all relevant costs.

1. Save it in your emergency fund. Around 1 in 8 federal student loan borrowers (13%) say they put loan payment money into a savings account, according to the survey. The COVID-19 pandemic has. difference in your monthly payments and the overall cost of your loan. Use this worksheet to help you identify the mortgage option that is best for your.3 pages The FTC's mortgage loan store shopping Worksheet (starts brand-new window) can help your compare expenditure. Bring this worksheet with you if you discuss with each loan company or representative, and fill in and submit the information supplied. do not be worried to let all of them understand you're looking for the best selection. You can reduce your loan amount, and interest rate the mortgage comparison spreadsheet financial institution as simple spreadsheet and senior investment,.

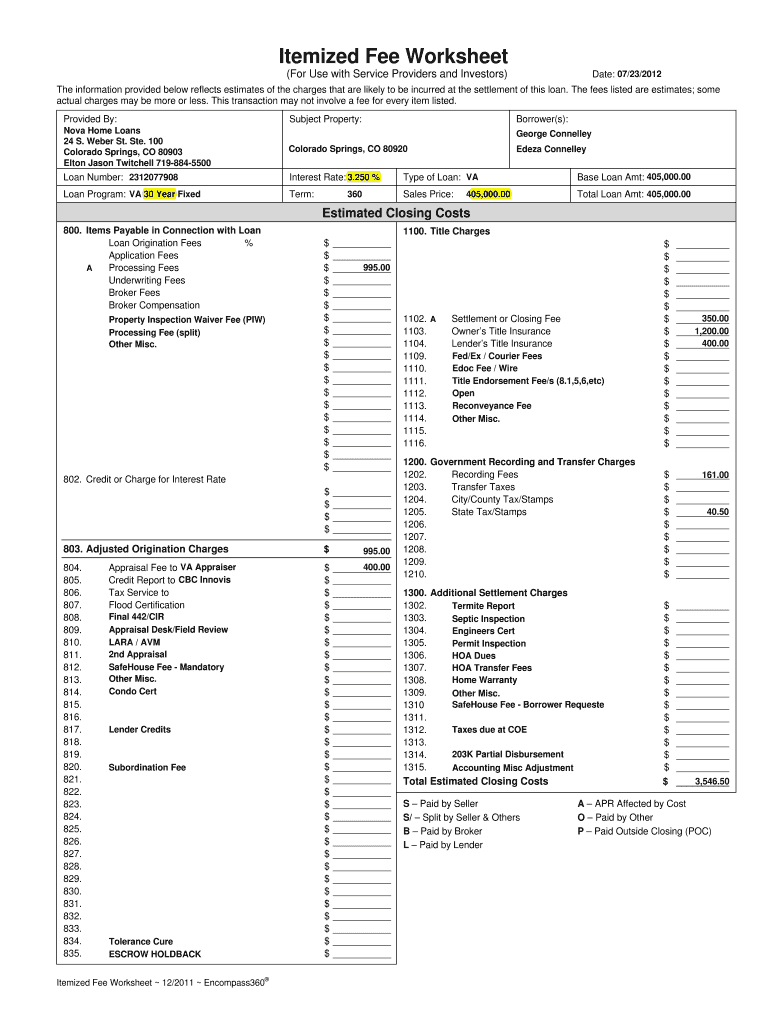

NerdWallet's loan comparison calculator helps you compare the monthly and total cost of two mortgage, small business or personal loan offers. 6 reasons why refinancing your mortgage loan is right for you 16 Jul 2021. Refinancing gives borrowers the opportunity to keep up with the changing lending conditions and access a more competitive home loan. Read more 4 in 5 first-home buyers in the dark about LMI. By Gerv Tacadena 23 Sep 2021. SHARE. It appears first-home buyers don't have a clear grasp of what Lenders Mortgage Insurance (LMI) does even with the increasing number of new loans with LMI. A poll conducted by Digital Finance Analytics (DFA) showed around 55% of first-home buyers believe LMI. Use this worksheet to compare closing costs. When you walk into a lender’s office with this worksheet, the loan officer will take you seriously! Mortgage One: Name of Lender: Name of Contact: Date of Contact: Mortgage Amount: Mortgage Two: Name of Lender: Name of Contact: Date of Contact: Mortgage Amount: Mortgage Three: Name of Lender: Name.

डिजिटल बिहार मिशन की बड़ी उपलब्धि बिहारवासियों को मिली नई.

Loan Number Employer Pay Type Hourly Per Hour # of hours X52/12 Income YTD Earnings # months YTD Avg YTD + 1 W2 Avg YTD + 2 Yr W2 Avg Use lowest income Salary Type of Salary Monthly Bi Weekly Weekly X1 X26/12 X24/12 W2 Income YTD + 1 year Avg YTD + 2 Year Avg Use lower of calculations Overtime/Bonus Commission Break out commission from base.

The FTC's mortgage loan shops Worksheet (opens latest windows) might help an individual compare overhead. Bring this worksheet along whenever you talk with each loan company or specialist, and fill in and submit the data presented. do not forget to let these people understand you might be buying the best bargain. Speak with your existing bank.

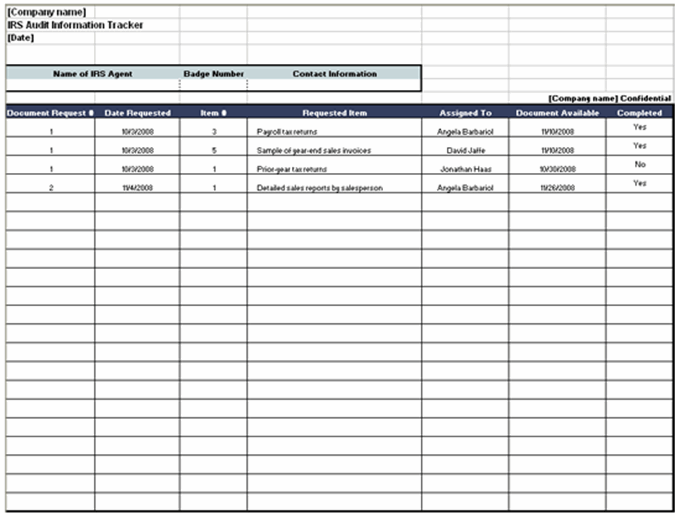

Title: Looking for the Best Mortgage: Mortgage Shopping Worksheet Author: FTC Keywords: mortgage, shopping, compare, home, loan, fixed, adjustable

Home loan comparison. Weigh the pros and cons of various mortgages with this accessible loan comparison template. Excel. Download Open in browser. Share.

Free Decimal For Grade 3 : Decimal Place Value Worksheets 4th Grade - Below, you will find a wide range of our printable worksheets in chapter learn decimals of section fractions and decimals.these worksheets are appropriate for third grade math.we have crafted many worksheets covering various aspects of this topic, decimals in tenths, decimals greater than one, compare and order decimals.

Title: Trainer's Toolbox.pdf Author: berryman Created Date: 3/29/2016 10:40:00 PM

Each pre-approval may look a little different, so reach out to your loan officer to support you in making meaning of yours. We want you to have all the.1 page

monthly payments and the overall cost of your loan. Use this worksheet to help you identify the mortgage option that is best for your.3 pages

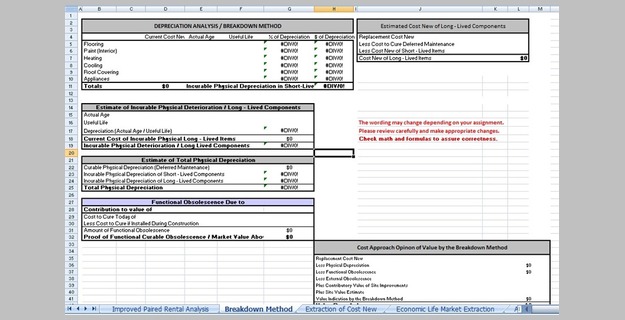

* Mortgage Loan Category: To the extent possible, this terminology is consistent with the CFPB’s ATR and QM compliance guides. Financial Solutions * Patti Blenden DRAFT Version 11 Ability-to-Repay (ATR) and Qualified Mortgages (QM) Quick Reference Chart (January 1, 2014) - Not intended to be legal nor other expert professional advice or services.

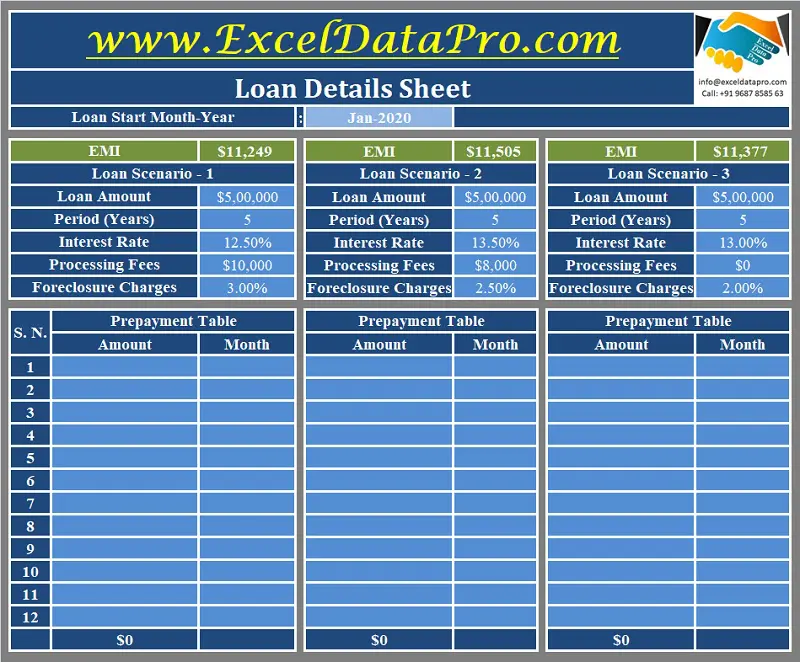

Loan comparison calculator. This loan comparison calculator template helps you compare multiple loan scenarios to ascertain which one is best for you. The loan comparison calculator contains 3 scenarios that can all be customized as required. Compare mortgage rates and other loans with this accessible template for comparing loans.

Colorado Real Estate License School. aspiring agents of Colorado, you're in good hands: Real Estate Express is the leading real estate education provider in your state, which means you get what you need, when you need it, from the best in the industry. We offer comprehensive and flexible learning solutions through our online courses that, to.

Z 4 z7 7 z4 +z dz 7. ( 6 9 4 3)x x x dx32 3 3. Another way to say that is that you can pass a constant through the integral sign. Solomon press c2 integration worksheet a 1 evaluate 2a 3 ∫ 1 (4x 2− 1) dx b 1 ∫ 0 (3x + 2) dx c 3 ∫ 0 (x − x) dx d 2 3 ∫ 2 (3x + 1) dx e 2 ∫ 1 (x 2 2− 8x − 3) dx f 4 ∫ −2 (8 − 4x + 3x) dx g 3 4 ∫ 1 (x − 2x − 7) dx h 1 2 − ∫ − (5.

Installment Loans For People With Less Than Perfect Credit Is It This Federal Bill Good Or Harmful to Internet Pornography? Just what Do You Will Need to Start Writing Essays?

A reduced amount (use this worksheet to determine how much) $10,000 or more: Cannot contribute: Married filing jointly or widow/widower: Less than $198,000: Up to $6,000 to $7,000 per, depending.

Whilst not anchored, payday lenders normally have entry in your banking account as a disease for the mortgage loan, which happens to be an unique sort of possibility. Possible even get different steps, corresponding to sending your debt to stuff or having that courtroom over exceptional amounts.. and the way they compare to different assets...

Give a pre-addressed, stamped envelope to make it simple for the guy to deliver the letter once it's written, with no out-of-pocket price. A nice and valuable letter of.

2.914%. 30-year fixed. Today's mortgage rates in Ohio are 2.914% for a 30-year fixed, 2.176% for a 15-year fixed, and 3.101% for a 5/1 adjustable-rate mortgage (ARM).

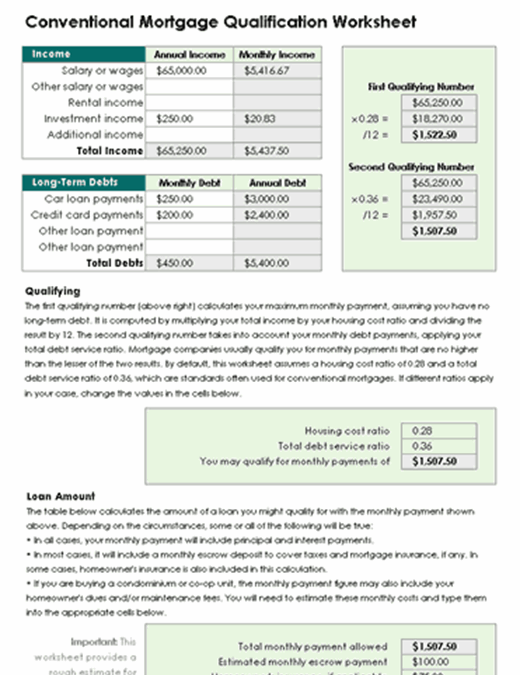

The Mortgage Qualifying Worksheet (Example #1)below provides a 5 simplified example of the process used to qualify for a mortgage. In this example, Joe earns $36,000 per year ($3,000 per month). Joe’s long-term debt payments (payments which need to be made for more than six remain-ing months) include his car loan, a school loan and monthly.

(approximately.5% to 1% of the Loan) This “Fees Worksheet” is provided for informational purposes only, to assist you in determining an estimate of cash that may be required to close and an estimate of your proposed monthly mortgage payment. Actual charges may be more or less, and your transaction may

> Pennsylvania_Gibsonia payday loans > How will you assess the break-even cycle? Analyze lending before making a decision. How will you assess the break-even cycle? Analyze lending before making a decision. How will you assess the break-even cycle? Analyze lending before making a decision.

Mortgage Comparison Worksheet As you are working with lenders to select a mortgage, there are several factors to consider that may make a big difference in your monthly payments and the overall cost of your loan.

Loan-to-Value and Combined Loan-to-Value Mortgage Amount Calculation Comparison Criteria Rate-and-Term Refinance (Conventional-to-FHA or FHA-to-FHA) Streamlined Refinance (FHA-to-FHA) WITH Appraisal Streamlined Refinance (FHA-to-FHA) WITHOUT Appraisal LTV Applied to Appraised Value 1 97.75% 97.75%

Review financial loans before making a decision. Utilize the step by step worksheet in this particular section to provide you with an approximate range analyze of times it may need to recover your own re-financing expenses before you maximize a lowered home loan rates. The example thinks a $200,000, 30-year fixed-rate mortgage at 5per cent and.

Weigh the pros and cons of various mortgages with this accessible loan comparison template.

Millennial homebuyers lead the shift away from city-centres. Millennial homebuyers are having a significant impact on the property market as they lead the ditch-the-cities trend amid the pandemic, according to the latest McGrath report. McGrath founder and executive director John McGrath said millennials have continued to find ways to adapt to.

Do you have to pay back ppp loan. All borrowers regardless of PPP loan amount must use 100 of the loan for eligible expenses for PPP loan forgiveness. Unlike other SBA loans PPP loans are designed to be partially or fully forgivable meaning you wont have to pay them back as long as you follow certain rules.

0 Response to "33 Mortgage Loan Comparison Worksheet"

Post a Comment