33 Capital Gains Tax Worksheet

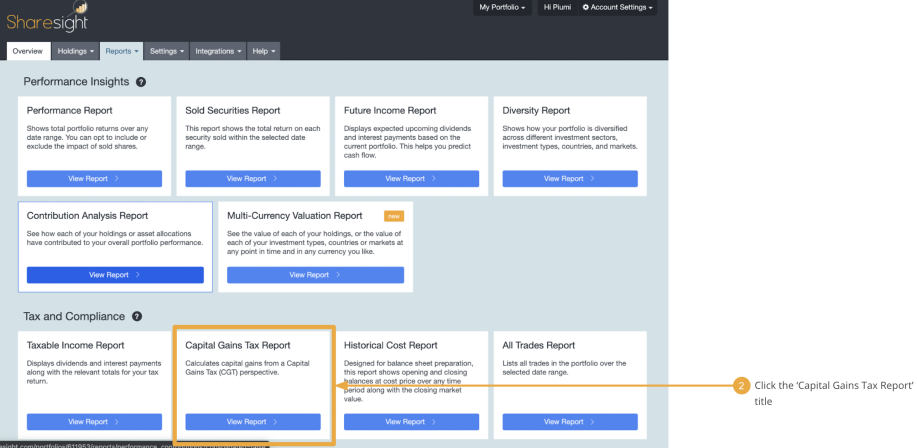

The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table. We provide access database templates in Microsoft Access software application which can be used to manage multiple databases such as tables (numbers, text, or other variables), reports, forms, queries, macros (if any) and other various objects with specific connecting relationships based on user needs.

S-Corp tax return and S election is after begining... by MariettaCPA 4 hours ago Latest post 4 hours ago by TaxGuyBill. 1 Reply 22 Views 1 Reply 22 Views $25 Amazon gift card for completing survey. An ema... by Tax7 on 12-07-2019 11:06 AM Latest post 7 hours ago.

Capital gains tax worksheet

The simplest answer is yes: Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level. If you have other sources of retirement income, such as a 401(k) or a part-time job, then you should expect to pay income taxes on your Social Security benefits. Calculating Capital Gains Tax on Second Home Sales. by. Julian Block. Practice Excellence. Sep 13th 2021. How Clients' Expectations of CPAs are Evolving . by . Derrick Lilly. Excel. Aug 18th 2016. 5 Ways to Duplicate Worksheets in Excel. by . David Ringstrom, CPA. 7 . Growth. Sep 14th 2021. How CPA Firms Can Remain Competitive. by . Derrick Lilly. 29.07.2021 · Special circumstances for capital gains tax exemption as a foreign resident: Since 1 July 2020, foreign residents are no longer entitled to a capital gains tax exemption unless they satisfy one of the following events. The event must occur within 6 years of the individual becoming a foreign resident. The foreign resident, their spouse or their child, who was under 18 years of age, has a.

Capital gains tax worksheet. Tax proposals would increase capital gains rates, among other things. These proposed changes could make a Charitable Remainder Trust look even better. A Charitable Remainder Trust can earn the donor an income tax deduction upfront and defer gains on its sale of assets. Read on to learn more. DISCLAIMER: This text is supposed for instructional functions solely and isn't meant to be construed as monetary, tax, or authorized recommendation. HomeLight at all times encourages you to achieve out to an advisor concerning your individual scenario. Whether or not you're halfway by means of promoting your private home or have simply signed the ultimate […] Instructions. Payment Voucher. Schedule NJ-BUS-1. Schedule NJ-BUS-2. Amended NJ Return. Resident; Form NJ-1040 X. Nonresident; file Form NJ-1040NR and write the word " Amended " in bold letters in the upper right hand corner. Capital Gain Distributions. These distributions are paid by a mutual fund (or other regulated investment company) or real estate investment trust from its net realized long-term capital gains. Distributions of net realized short-term capital gains aren't treated as capital gains. Instead, they are included on Form 1099-DIV as ordinary divi-dends.

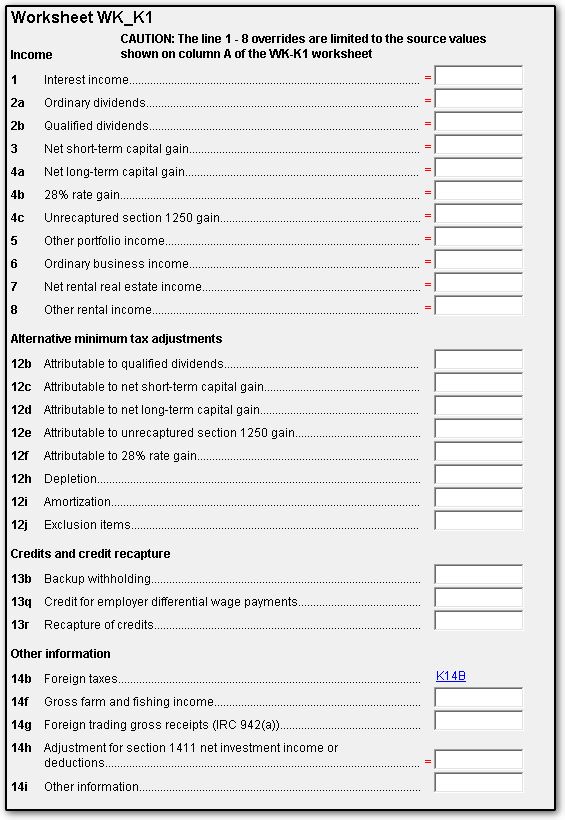

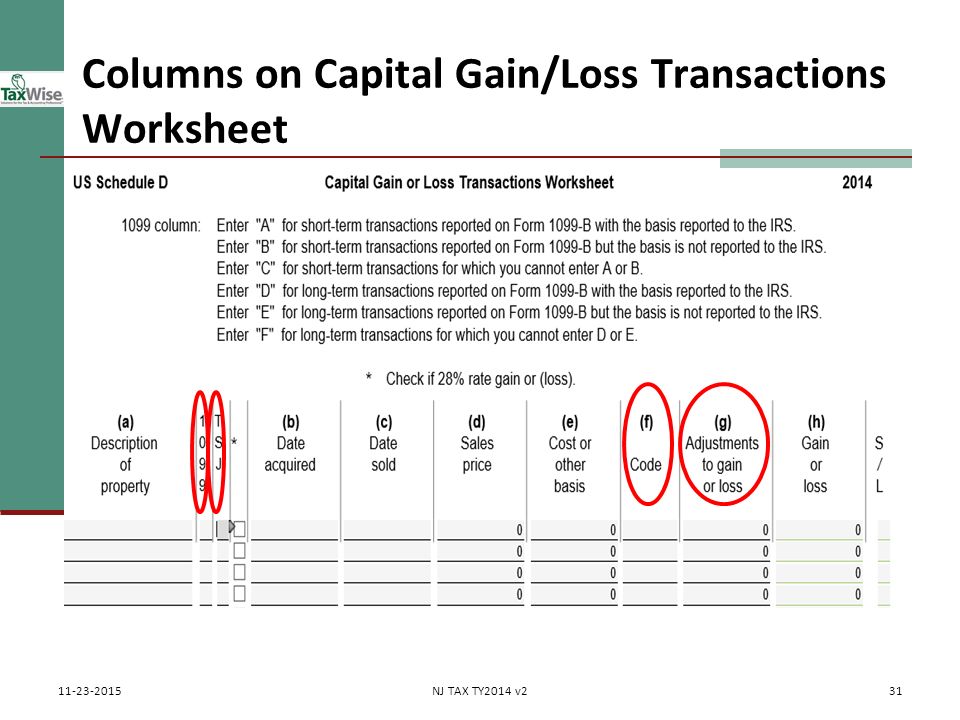

29.07.2021 · Special circumstances for capital gains tax exemption as a foreign resident: Since 1 July 2020, foreign residents are no longer entitled to a capital gains tax exemption unless they satisfy one of the following events. The event must occur within 6 years of the individual becoming a foreign resident. The foreign resident, their spouse or their child, who was under 18 years of age, has a. Alimony Paid smart worksheet.. Where can I designate capital gains on a Form K-1 as non-portfolio vs. portfolio income? adriana3 New Member.... Hello Tax experts I prepared 1040 with 1095A and 8962 for tax year 2020in March 2021 before the law UI exclusion $10200. At the time taxpayer's AGI is above thr... Federal Estate Tax and the For the 99.5% Act. The federal estate tax can significantly reduce the legacy that you will be passed along to your loved ones if you are exposed because it carries a 40 percent top rate. Most people do not have to pay the tax, because there is a credit or exclusion is quite high at the present time. Line 1. Enter all sales and exchanges of capital assets, including stocks, bonds, and real estate (if not reported on line 1a or 8a of Schedule D or on Form 4684, 4797, 6252, 6781, or 8824). Include these transactions even if you didn't receive a Form 1099-B or 1099-S (or substitute statement) for the transaction.

Jan 02, 2020 · The 0% bracket for long-term capital gains is close to the current 10% and 12% tax brackets for ordinary income, while the 15% rate for gains corresponds somewhat to the 22% to 35% bracket levels. 25.05.2011 · Capital gains and deductible capital losses are reported on Form 1040, Schedule D, Capital Gains and Losses, and then transferred to line 13 of Form 1040, U.S. Individual Income Tax Return. Capital gains and losses are classified as long-term or short term. If you hold the asset for more than one year, your capital gain or loss is long-term. If you hold the asset one year or less, your capital. The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it for—adjusting for commissions or fees. Depending on your income level, your capital gain will be taxed federally at either 0%, 15% or 20%. How to Figure Long-Term Capital Gains Tax. Let’s take a closer look at the details for. Biden vs. House Democrats: How their proposed tax hikes differ on Roth IRAs, capital gains House Democrats' proposed tax hikes are 'a little less aggressive' than President Joe Biden's, one expert.

Jun 30, 2021 · The gains you report are subject to income tax, but the rate of tax you’ll pay depends on how long you hold the asset before selling. If you have a deductible loss on the sale of a capital asset, you might be eligible to use the losses you incur to offset other current and future capital gains.

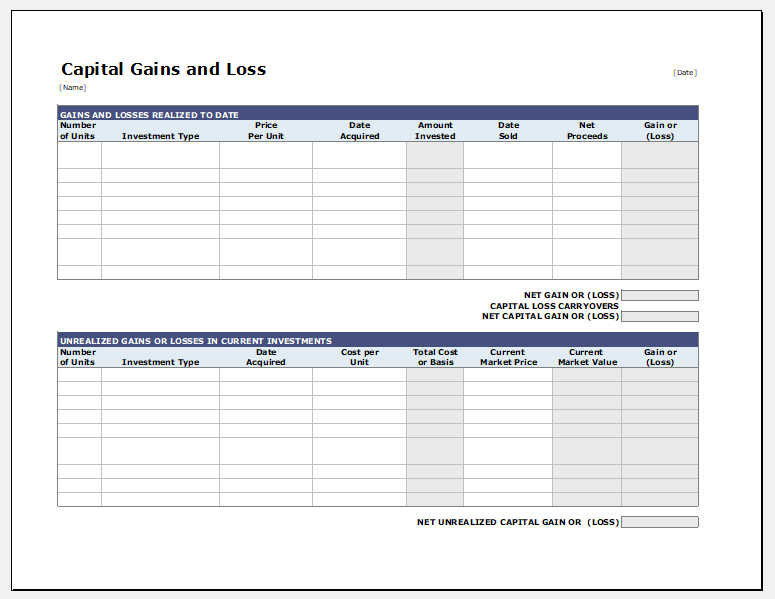

The positive gain here is equal to the selling price, minus the buy price, minus the buy commission, minus the sale commission: $1,400 – $1,200 – $25 – $25 = $150. The investor made a profit of $150 on this investment. Now let's move on to a more complicated scenario. Worksheet 2. Capital Gains Worksheet: Multiple Purchases.

You should generally pay the capital gains tax you expect to owe before the due date for payments that apply to the quarter of the sale. The quarterly due dates are April 15 for the first quarter, June 15 for second quarter, September 15 for third quarter and January 15 of the following year for the fourth quarter. When a due date falls on a weekend or holiday, your quarterly payment is due.

If your home sale profits exceed the capital gains exemption threshold ($250,000 for single filers, and $500,000 for married filers), it's time to review any capital improvements you made to the home while you owned it. "Adding capital improvements to your cost basis mitigates your tax liability by reducing your taxable gains," Skinner says.

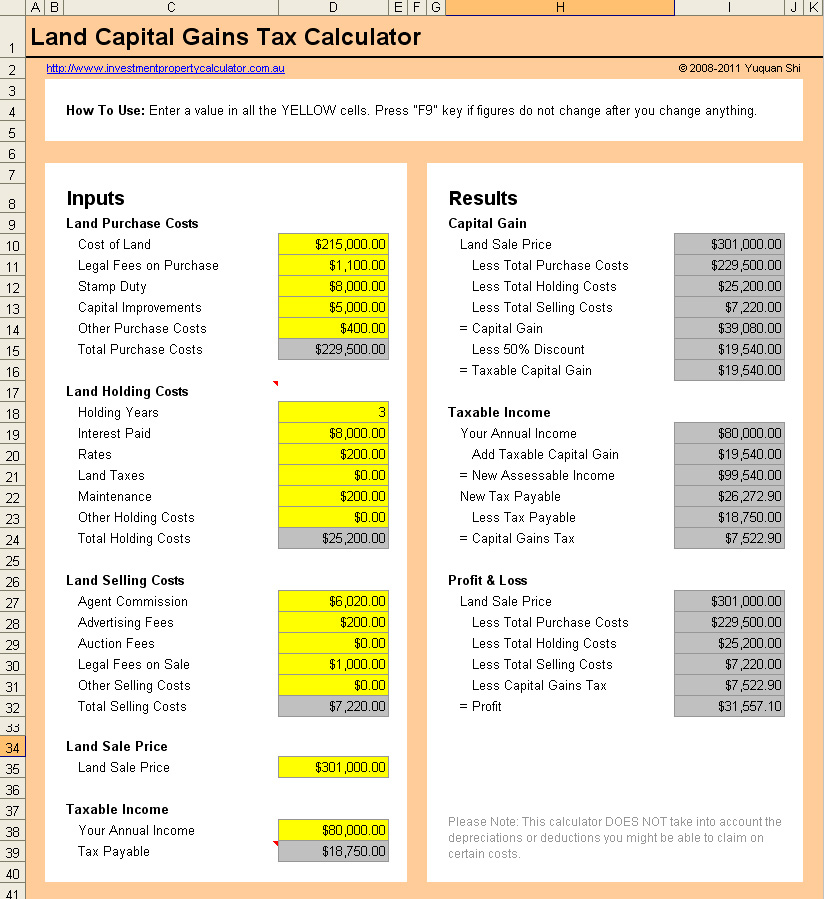

To use the Capital Gains Tax calculator, you’ll need to enter some details about your asset. These are explained below: Purchase Price — How much you purchased the asset for. Length of Ownership — Whether you have owned the asset for less than 12 months or longer than 12 months. Sold Price — How much you have sold the asset for. Current Taxable Income — Your current taxable income.

Income tax is not automatically withheld, so you do not want a nasty surprise a few months down the road. You May Like: How Much Does Disability Pay For Bipolar. Tax On Capital Gains While Receiving Social Security Benefits. December 14, 2011Keywords: capital gains. I wrote about tax-free capital gains when you are in the 15% tax bracket or.

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms.

Capital Gain Tax Worksheet (PDF) IRS tax forms. Worksheet Apps.irs.gov Related Item. 6 hours ago Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.Before completing this worksheet, complete Form 1040 through line 10.. Website: https://apps.irs.gov/app/vita.

Living and non living things for grade 4. Living things worksheet grade 4 classification chart increase the attention time and curiosity of smaller ones with a visually attractive life and inanimate thing chart. Examples are table, rocks etc. Examples are plants, animals etc. The two examples of living things are plant and cat.

One should refer to 'Qualified dividends and capital gain tax worksheet' in US tax returns which provides tax rates applicable to such incomes. Another example of such income is Capital gain distributions. These distributions are basically dividends from US mutual funds. For US tax purposes, if the fund meets certain criteria, the.

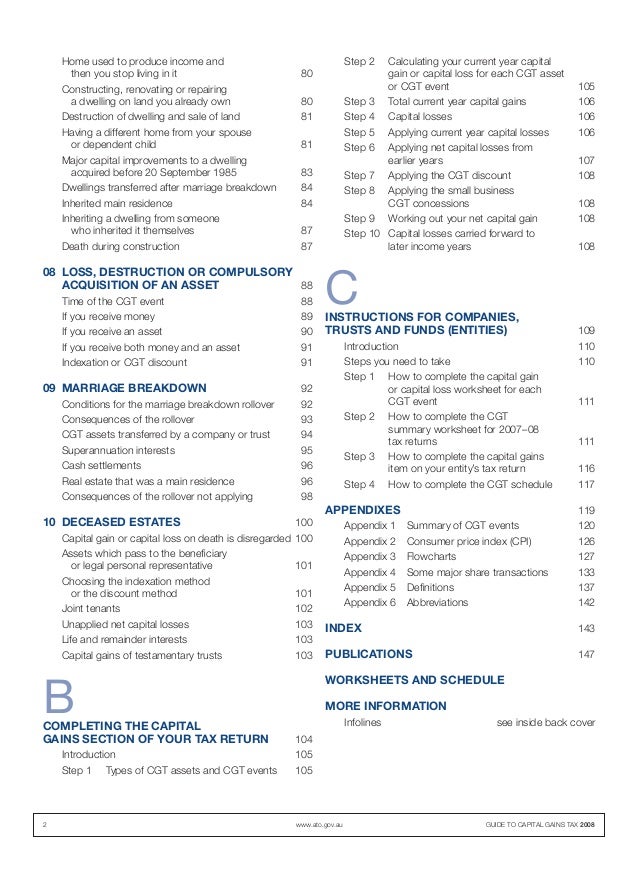

Capital Gains Tax (CGT) is a tax that applies in Australia when you sell an asset, shares or investment at a profit. CGT only applies on investment properties - the family home is generally exempt from CGT unless it has been rented out, used to run a business, or on more than two hectares of land.

Calculating Capital Gains Tax on Second Home Sales. by. Julian Block. Practice Excellence. Sep 13th 2021. How Clients' Expectations of CPAs are Evolving . by . Derrick Lilly. Excel. Aug 18th 2016. 5 Ways to Duplicate Worksheets in Excel. by . David Ringstrom, CPA. 7 . Growth. Sep 14th 2021. How CPA Firms Can Remain Competitive. by . Derrick Lilly.

Before completing this worksheet complete Form 1040 through line 10. The IRS posted updated instructions for 2018 Schedule D Form 1040 Capital Gains and Losses that include a corrected worksheet. As always none of your inputs are stored or recorded. The short Form 1040A and easy Form 1040EZ have been discontinued by the IRS.

90% of the tax to be shown on their 2021 tax return or; 100% of the tax shown on their 2020 tax return. Their 2020 tax return must cover all 12 months. Taxpayers with income not subject to withholding, including interest, dividends, capital gains, alimony, cryptocurrency, and rental income, normally make estimated tax payments.

12.03.2021 · Net capital gains from selling collectibles (such as coins or art) are taxed at a maximum 28% rate. The portion of any unrecaptured section 1250 gain from selling section 1250 real property is taxed at a maximum 25% rate. Note: Net short-term capital gains are subject to taxation as ordinary income at graduated tax rates.

The simplest answer is yes: Social Security income is generally taxable at the federal level, though whether or not you have to pay taxes on your Social Security benefits depends on your income level. If you have other sources of retirement income, such as a 401(k) or a part-time job, then you should expect to pay income taxes on your Social Security benefits.

Stockholders' are protected from liability and those stockholders who are also employees may be able to take advantage of some tax-free benefits, such as health insurance. There is double taxation with a C corporation, first through taxes on profits and second on taxes on stockholder dividends (as capital gains).

Special rules for capital gains invested in qualified opportunity funds (QOFs). In 2018, if you have eligible gains and invested the gains into a QOF, you may be able to elect to postpone part or all of the gain that you would otherwise include in income. You may also be able to permanently exclude the gain from the sale or exchange of an in-

Our tax system operates on a "pay-as-you-go" basis, which means the IRS wants its cut of your income when you earn it.. or capital gains), it's up to you to periodically pay the IRS by making estimated tax payments. For the 2021 tax year, you can pay all your estimated tax by April 15, 2021, or in four equal amounts by the dates shown...

Capital Gains Tax Rate - The House proposal would increase the highest tax rate for long-term capital gains from 20% to 25%. Notably, this is higher than prior to the 2017 Tax Cuts and jobs Act which did not make a change to the rates on long-term capital gains.

Net worth calculator Budget calculator Budget worksheet Savings goal calculator Total car cost calculator Car refinance calculator. Taxes. Capital gains calculator Federal income tax calculator.

Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

A Special Real Estate Exemption for Capital Gains Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale.

Learn basic shapes by coloring, tracing, and finally connecting the dots to draw the shape with this printable worksheet. Preschool shapes worksheets and printables. Give shape to endless learning possibilities with our preschool basic shapes worksheets.preschool students will get plenty of practice drawing, coloring, cutting and. Learning.

Jul 15, 2020 · In this case, you would be giving up the 0% tax rate on the first $78,750 of long-term capital gains, since you are stacking the gains on top of a Roth conversion. However you give up the 0% rate in order to pay only 10% and 12% tax on the Roth conversion, which can grow tax-free for the rest of your life.

Capital gains and qualified dividends. The maximum tax rate for long-term capital gains and qualified dividends is 20%. For tax year 2021, the 20% rate. the 2021 Estimated Tax Worksheet) by January 18, 2022. • File Form 1041 for 2021 by March 1, 2022, and pay the total tax due. In this case, don’t make estimated

This measure targets the capital gains tax. As it stands today, if you inherit appreciated assets, they get a stepped-up basis. This means that you would not pay capital gains taxes on gains that accumulated during the life of the person that left you the inheritance.

The capital gains tax rates are lower than the income tax rates in many places. So you're more likely to save on taxes if you invest your after-tax dollars instead of investing in an annuity. Getting Out of an Annuity May Be Difficult or Impossible.

Virginia state income tax rates are 2%, 3%, 5% and 5.75%. Virginia state income tax brackets and income tax rates depend on taxable income and residency status.

And in any of them, you should closely evaluate your entire financial and tax situation, along with the costs and benefits of paying early capital gains taxes on fund sales, before deciding to do so.

The capital gains summary form and notes have been added for tax year 2020 to 2021. To capital gains tax 2020. The capital gain or capital loss worksheet (pdf,143kb) this link will download a file. Was told it would be in the update of 1/14/21. Before completing this worksheet, complete form 1040 through line 10.

Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis – Purchase price $ (1) Improvements added after purchase (2) Deferred gain from previous 1031 exchange, if any ( (3). Tax Due at Maximum Capital Gains Rate - 25% rate gain x 25% (line 9 x 25%) $ (12) 15% rate gain x 15% (line 10 x 15%) (13)...

Moreover, you don’t have to pay capital gains tax on the $77,700 capital gain. Since charitable organizations are tax-exempt, the charity doesn’t have to pay capital gains taxes either. Final Word. Capital gains tax isn’t an issue that only affects the wealthy.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-907066380-0867bbed74914d3eab8d7d0c318a7577.jpg)

0 Response to "33 Capital Gains Tax Worksheet"

Post a Comment