32 Business Income Insurance Worksheet

There are several ways to determine how much life insurance you should purchase. One way is to consider how much of a premium you are willing to pay or how much your current income is. Another strategy is known as the "family needs approach", and involves calculating how much money your family will need if something should happen to you. The basic calculation is as follows: Amount of Life. Your Modified Adjusted Gross Income is calculated by taking the Adjusted Gross Income (AGI) from your tax return and adding back in certain deductions such as student loan interest, self-employed taxes, home interest payments and higher education expenses. You can visit the IRS website and access Worksheet 2-1 to calculate your Modified.

Life insurance prevents financial chaos from adding to your loved ones' grief of losing you. Since the goal is to replace your income, you should get coverage equal to 10-12 times your income. One final note on life insurance: Never get whole life (also known as cash value insurance). It's a complete rip-off.

Business income insurance worksheet

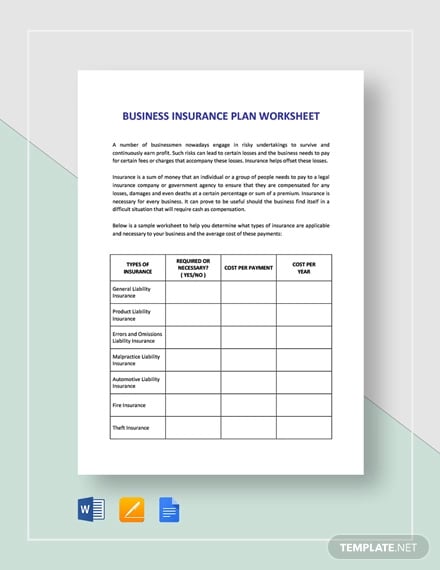

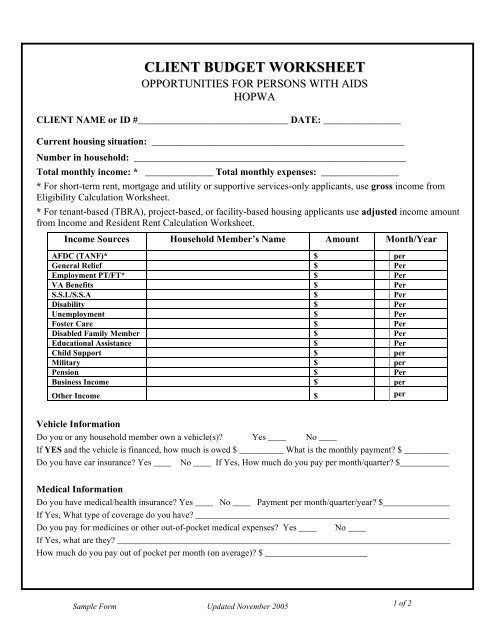

-Discuss potential cash budget benefits and pitfalls for the business, including how the budget supports the strategic goal of the business to increase revenue by 10% annually. -Outline your expected business expenses (e.g. fixed and variable costs, marketing, labor, operations, insurance) and sources of revenue (e.g. funding, sales of products. The Tax Cuts and Jobs Act lowered the maximum mortgage interest deduction amount, but increased the standard deduction amounts. Due to these changes, fewer taxpayers may choose to itemize their deductions. The 2019 standard deduction amounts are: Single/married filing separately: $12,200. Head of household: $18,350. business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month policy period.

Business income insurance worksheet. Because CPAP is covered as durable medical equipment, the Medicare Part B deductible applies; it's $203 in 2021. Then you pay 20% of the Medicare-approved amount for the CPAP machine rental and. The primary reasons balance sheets are important to analyze are for mergers, asset liquidations, a potential investment in the company, or whether a company is stable enough to expand or pay down. Assignment 2: Expenses Worksheet in Excel Before beginning this assignment, you should thoroughly review Excel Worksheets, Charts, Formulas, Functions, and Tables from your course textbook, Go! All in one: Computer concepts and application. For this assignment you will use Microsoft Excel to develop a worksheet that details your personal expenses in at least four […] The premiums for an employer-paid supplemental life insurance policy under $50,000 are tax-free to the employee. However, the premiums for policies that exceed $50,000 are subject to income tax.

The Tax Cuts and Jobs Act lowered the maximum mortgage interest deduction amount, but increased the standard deduction amounts. Due to these changes, fewer taxpayers may choose to itemize their deductions. The 2019 standard deduction amounts are: Single/married filing separately: $12,200. Head of household: $18,350. several 1099-R's totaled 41868 20178 taxpayer 21690 spouse of which 6051 non taxable leaving35817 taxable however the software placed 22305 in line 5b with 'ROL... read more. mcantonio Level 1. ProSeries Professional. posted Sep 15, 2021. Last activity Sep 15, 2021 by Just-Lisa-Now-. While employer paid disability insurance benefits can be taxable, benefits of private disability insurance is not. Tax treatment of disability income varies depending on the circumstances. Does Disability Count As Income For Mortgage. Lenders consider all your income when you apply for a mortgage loan. That includes your Social Security income. Business income insurance can help cover these payroll costs. Utilities. For example, say you need to pay for utilities for the next two months while your business is being repaired. However, you can’t open your operation until after the repairs are finished. Your business income insurance can step in and help pay for your utility bills. Lost.

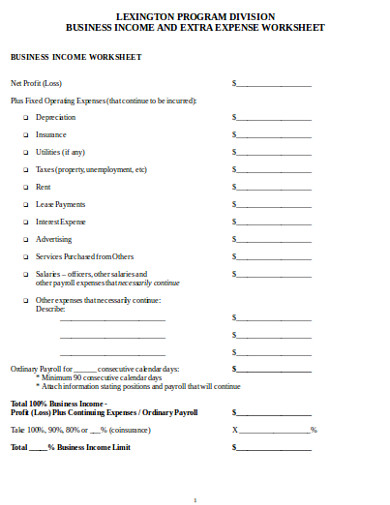

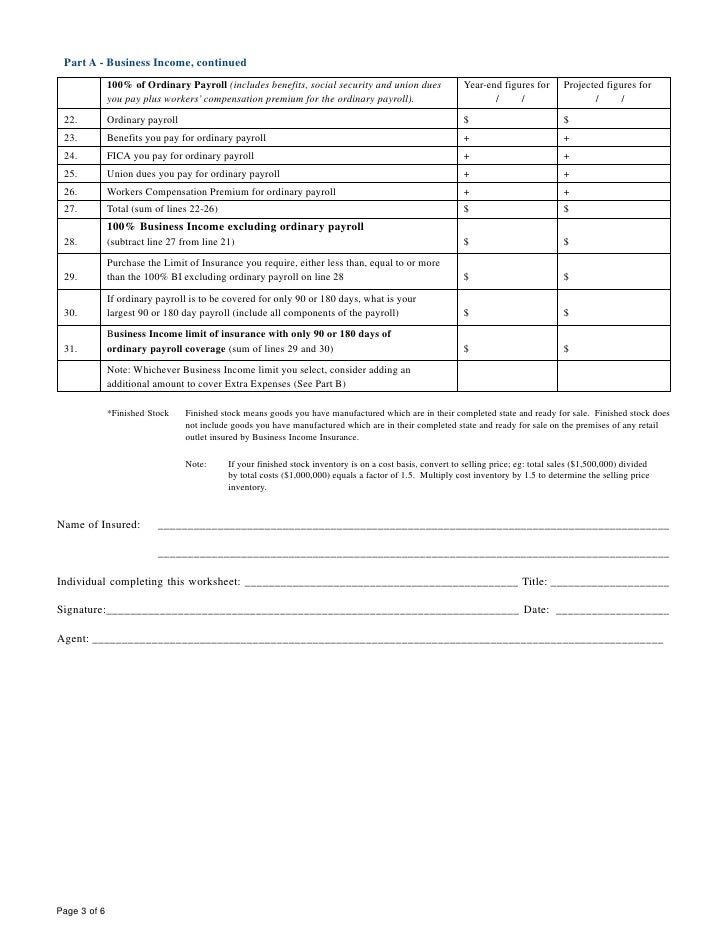

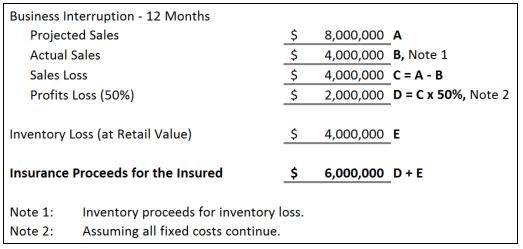

The figure in L. represents 100% of your estimated Business Income exposure for 12 months, and additional expenses. Using this figure as information, determine the approximate amount of insurance needed based on your evaluation of the number of months needed (may exceed 12 months) to replace your property, resume Online Business Income Report August 2019. Online Business Income Report August 2019 Welcome to the August 2019 edition of our online business/blog income report. As you'll see by reading the report, the income does not only come from our blog but also our course sales. Business Income Insurance is often extended to 18 or 24 months. Consult your VANTREO insurance professional before placing this coverage. VANTREO Insurance Brokerage License #0F69776 ___ SIMPLIFIED BUSINESS INCOME AND EXTRA EXPENSE WORKSHEET This worksheet is designed to help determine a 12-month business income and extra expense exposure. Business This article will help you enter the Employee Retention Credit on your client's income tax return. Although the credit is claimed on payroll filings (Form 944,. read more. Intuit Help Intuit. posted Sep 9, 2021. Last activity Sep 9, 2021. 0 0.

Business Income Worksheet Non Manufacturing or Mercantile Operations Actual values for Estimated values year ending 200_ for year ending 200_ A. Net Income Before Taxes B. Add Total Operating Expenses Sub - Total If Ordinary Payroll is to be excluded or limited: C. Deduct any or all Ordinary Payroll Expense D. Business Income Basis (A+B) - C

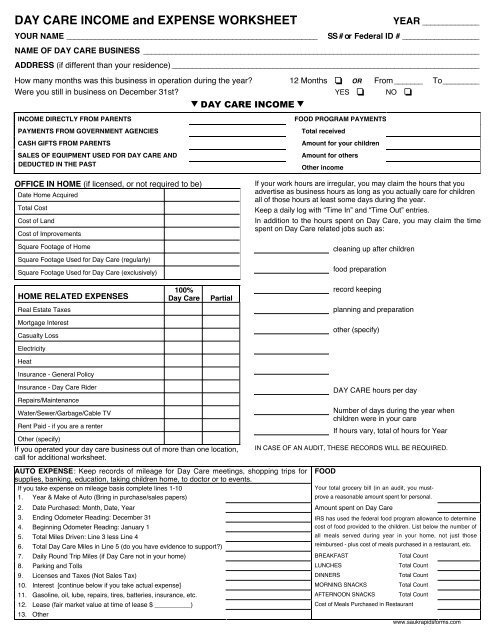

Free Business Income And Expense Tracker Worksheet Business Expense Tracker Expense Tracker Small Business Expenses. Pride Tax Preparation has the knowledge and experience preparing taxes for home day care child care providers. Home daycare tax worksheet. Tom Copelands Taking Care of Business The Nations Leading Expert on the Business of.

Sec 481 Different Amount for State. Client did a Cost Seg and I want to enter the amount under other deductions on the 8825.The state amount is different. I can di different depreciation amounts e... read more. hollywood Level 1. Lacerte Tax. posted Sep 12, 2021. Last activity Sep 12, 2021.

If you use that dedicated checking account for your business income deposits, a running tally will take a couple of minutes to check in your online bank records. 5. Use the IRS 1040-ES Worksheet

Net worth calculator Budget calculator Budget worksheet Savings goal calculator Total car cost. may require proof of business insurance to allow you to sell... Lost income and operating ...

Access regular yearly pay or hourly salary inside protected years. 1b.. Access ordinary yearly salary or per hour pay through the latest complete coin vendor sealed years. 1c. separate the worth registered in 1.a. by 1.b. If 1.c. was. Readmore

Great american insurance Group | Specialty Human ServiceS DiviSion F.36220 (01/14) business income worksheet – pg 2 Business Income and Extra Expense Example $1,000,000 12-month expected BI exposure (item E, page 1) 8 month max expected period of recovery (item 2, page 1) 3 peak months generate an average of 33% greater business income.

* Growth factor indicates the expected change in earnings from the base year to the period covered under the insurance policy, allowing for both growth and inflation. NOTE: A key question in selecting a Limit of Business Income at the Golf/Country Club is the Club’s attitude towards membership dues.

business income worksheet must be submitted to and accepted by us prior to a loss. A new worksheet must be submitted if you (1) change the limit of insurance mid-term, or (2) at the end of each 12 month policy period.

An envelope. It indicates the ability to send an email. You may not be eligible to open or contribute to a Roth IRA if you make too much money. If you are eligible, you can open a Roth IRA by.

Completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections below:

Summer of Tax Deductions. As the country emerges from the pandemic this summer, more people are going places, engaging in recreational activities and enjoying the great outdoors. This can lead to tax-saving opportunities for both individual taxpayers and small business owners. Accordingly, we have developed a six-part series devoted to tax.

"Sales Compensation Plan Components," Online Business Advisor. For example, if a 15 percent commission is paid on sales of $1 million, the income for the salesperson is $150,000 ($1,000,000 × 0.15 = $150,000).

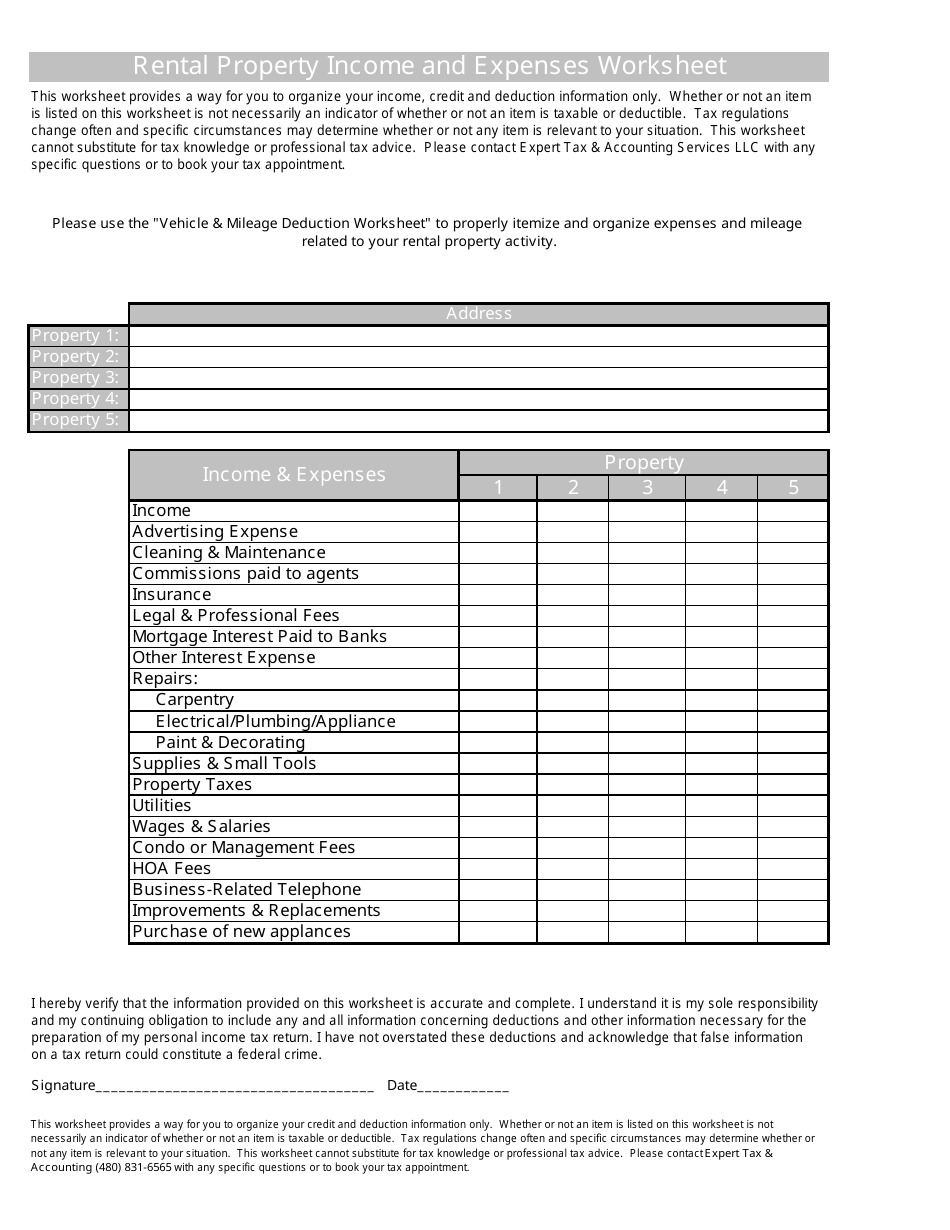

We've created a free google sheet / excel worksheet that you can use to track monthly rental income, expenses, fees, insurance policies, and more. In addition to the above, you can download other property management templates like rent receipt template, asset inventory tracker, apartment maintenance.

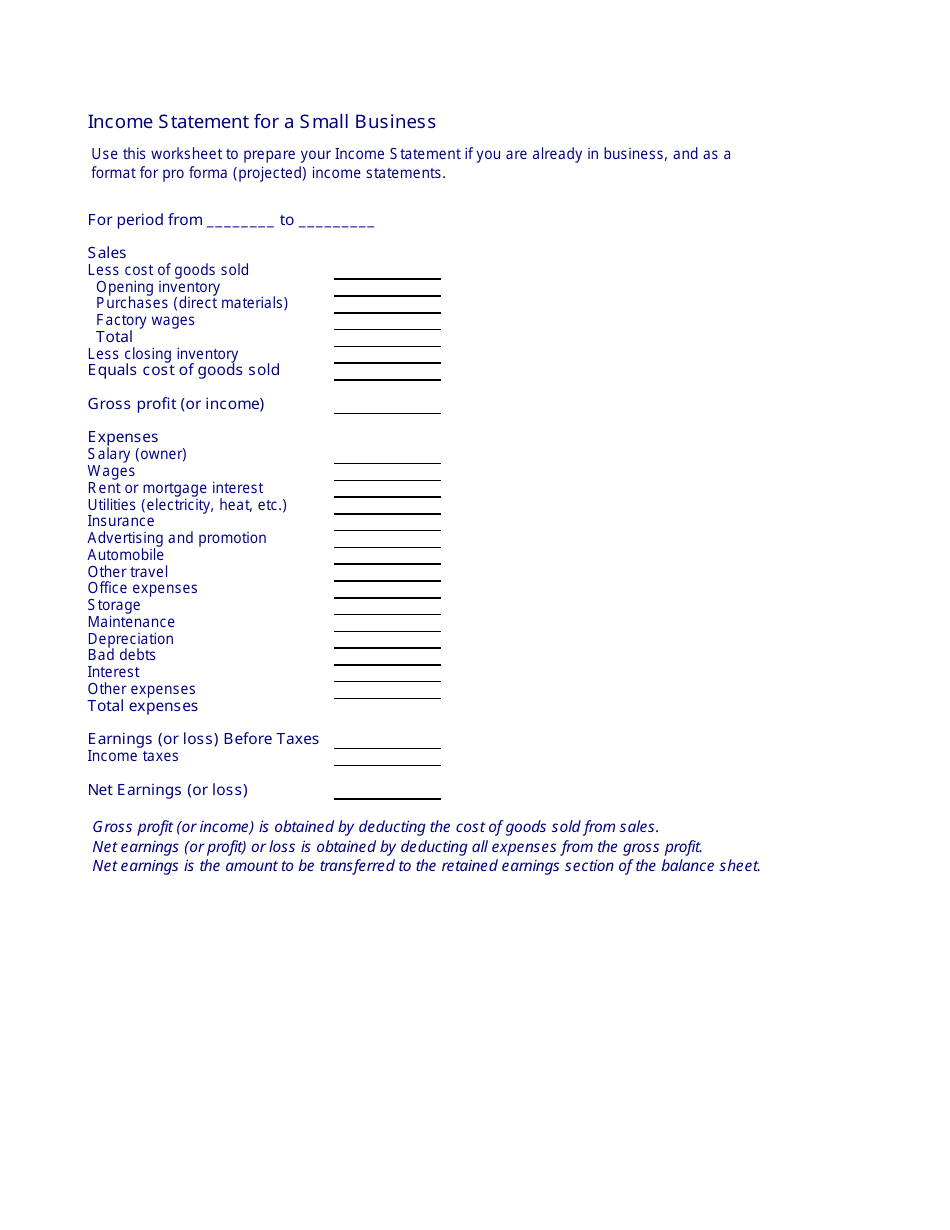

The Business Income worksheet is constructed using two columns. The first column is the previous fiscal year actual values and the second column is where you enter the estimated values for the policy period beginning on the prospective effective date of the policy and estimating values out for 12 months from that date.

Just like employees, all businesses need to file annual tax returns. And as a small-business owner, you're responsible for paying income taxes (at your own personal income tax rate) and the self-employment tax (a 15.3% tax that covers your share of Medicare and Social Security taxes). 2

The worksheet doesn't have to be complex; it can be as straightforward as the sample in Figure 8.2. 1. Your customer relationship management (CRM) or contact management system (CMS) may also provide a place for you to do your precall planning work. A sample precall planning worksheet is shown in Figure 8.2. 1.

An envelope. It indicates the ability to send an email. A Roth IRA is a retirement account you can use to invest in stocks, bonds, and other securities. You fund Roth IRAs with post-tax dollars so.

The Capital Gains and Qualified Dividends Worksheet in the Form 1040 instructions specifies a calculation that treats both long-term capital gains and qualified dividends as though they were the last income received, then applies the preferential tax rate as shown in the above table.

The Business Income worksheet is constructed using two columns. The first column is the previous fiscal year actual values and the second column is where you enter the estimated values for the policy period beginning on the prospective effective date of the policy and estimating values out for 12 months from that date.

Business Insurance.. Checklists and Worksheets for Family Caregivers.... * It should cover any additional factors such as room and board, if the caregiver lives with the patient, income tax withholding, medical insurance for the caregiver, vacation pay, etc.

-Discuss potential cash budget benefits and pitfalls for the business, including how the budget supports the strategic goal of the business to increase revenue by 10% annually. -Outline your expected business expenses (e.g. fixed and variable costs, marketing, labor, operations, insurance) and sources of revenue (e.g. funding, sales of products.

Home buyers snapped up listings at fastest pace ever in July. Despite home supply recovering and sales slowing, properties spent the least amount of time on the market since at least 2009, according to Remax. By Paul Centopani. August 17. Foreclosures.

0 Response to "32 Business Income Insurance Worksheet"

Post a Comment