32 Amt Qualified Dividends And Capital Gains Worksheet

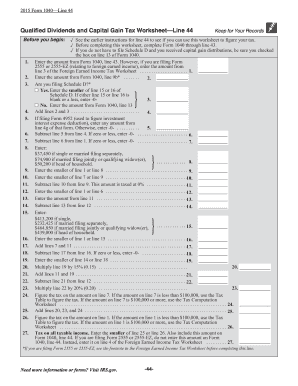

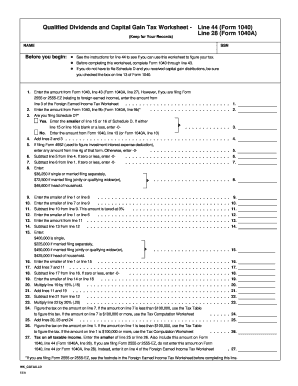

2014 Irs Tax Form 1040 Instructions Form 1040 For 2014 Choice Image Free Form Design Examples Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax amount

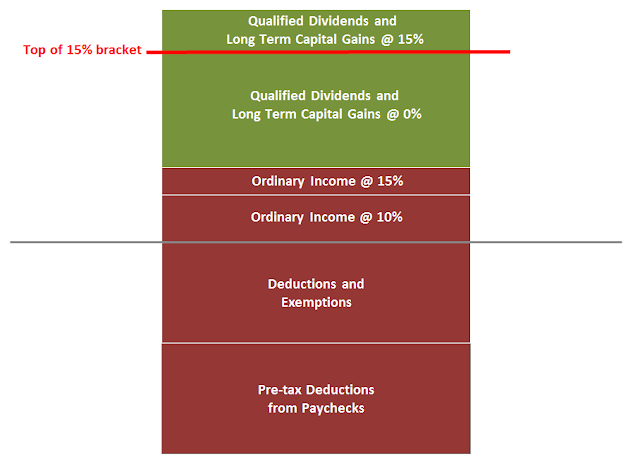

Any Ordinary Dividends that are not considered to be Qualified Dividends are taxed as ordinary income

Amt qualified dividends and capital gains worksheet

21 Posts Related to Capital Gains Worksheet Part 3 Line 1

Amt qualified dividends and capital gains worksheet. It does not get filed with your return See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax Capital Gains Worksheet Ato

Before the new tax bill, it had the most impact on households earning between $500,000 and $1 million annually Before completing this worksheet complete The tax will be calculated on the Qualified Dividends and Capital Gain Tax Worksheet In 2021, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1)

Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms Enter the amount from line 6 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 11a, or the amount from line 13 of the Schedule D Tax Worksheet in the instructions for Schedule D (Form 1040), whichever applies (as refigured for the AMT, if necessary) (see instructions) Imagine that in 2021 your top marginal married filing jointly bracket is the 22% bracket When it says 'Foreign qualified dividends and lt capital gains' , I can only introduce up to $1000

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g, even if you don’t need to file Schedule D

These tables show, by Vanguard fund, the percentages of 2020 dividend and net short-term capital gains distributions that are eligible for reduced tax rates as qualified dividend income under the Jobs and Growth Tax Relief Reconciliation Act of 2003

Keep for Your Records

If the amount on line 1 is $100,000 or more, use the Tax Computation Worksheet 26

Qualified dividend taxes are usually calculated using the capital gains tax rates

Long-term capital gains are taxed at only three rates: 0%, 15%, and 20%

See who pays

Here was the breakout for the tax year 2017, according to the Tax Policy Center: 6

The effect of this election is that qualified dividends and net capital gains included in net investment income are taxed at ordinary tax rates, not at the lower long-term capital gains tax rates

S

In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year

For the Desktop version you can switch to Forms Mode and open the worksheet to see it

Get an overview of foreign tax distributions and worksheets for funds that distributed foreign income and foreign qualified dividend income

6% of your $58k taxable income, then you're allowed a credit no more than 2

If a large part of your taxable income is qualified dividends and long-term capital gains, and you end up paying only $1,500 to the U

Add lines 20, 23, and 24 Figure the tax on the amount on line 1

These will get taxed at preferential long term capital gains rates

The AMT exemptions are phased out by 25% of the excess of alternative minimum taxable income (AMTI) over $150,000 for married persons filing a joint return and surviving spouses, $112,500 for singles

Remember, this isn't for the tax return you file in 2021, but rather, any gains you incur from January 1, 2021 to December 31, 2021

So lines 1-7 of this worksheet are figuring what is your total qualified income (line 6) and your total ordinary income (line 7), so they can be taxed at their different rates

Symbol

2020 Year-end QDI figures for short-term capital gains

Amt Capital Gains Worksheet

Qualified Dividend: A qualified dividend is a type of dividend to which capital gains tax rates are applied

Enter the amount from line 7 of the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040, line 44, or the amount from line 19 of the Schedule D Tax Worksheet, whichever applies Short-term capital gains are taxed at your ordinary income tax rate

Foreign tax information

The Qualified Dividends and Capital Gains worksheet is actually a simplified version of the Schedule D Tax worksheet

The portion of Ordinary Dividends that are considered to be Qualified Dividends are taxed at the lower capital gain rates

0 Response to "32 Amt Qualified Dividends And Capital Gains Worksheet"

Post a Comment