31 Self Employed Business Expenses Worksheet

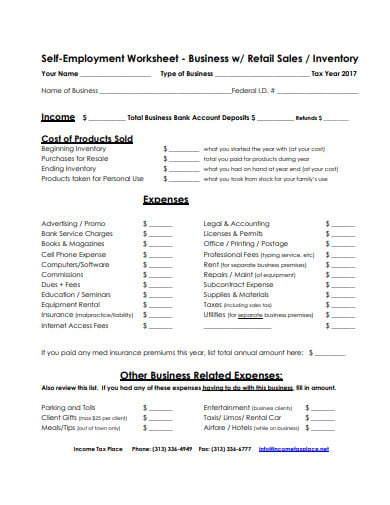

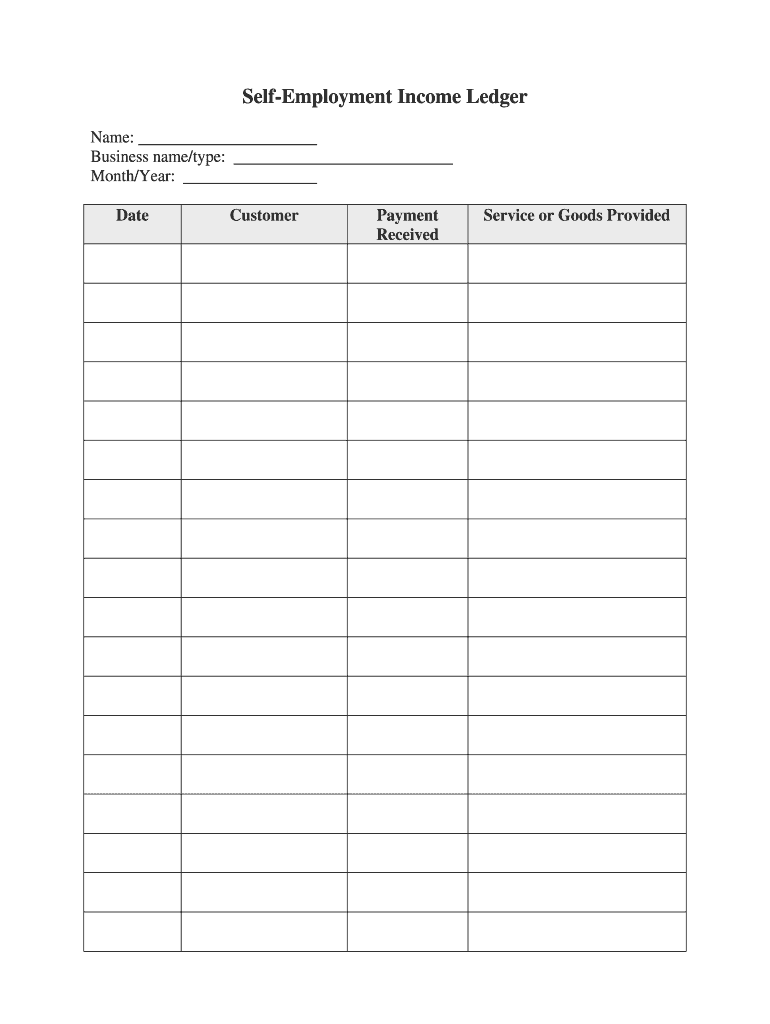

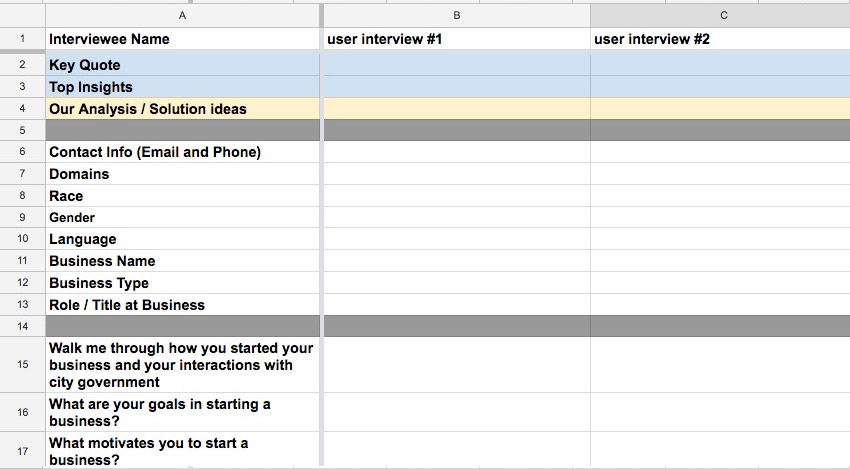

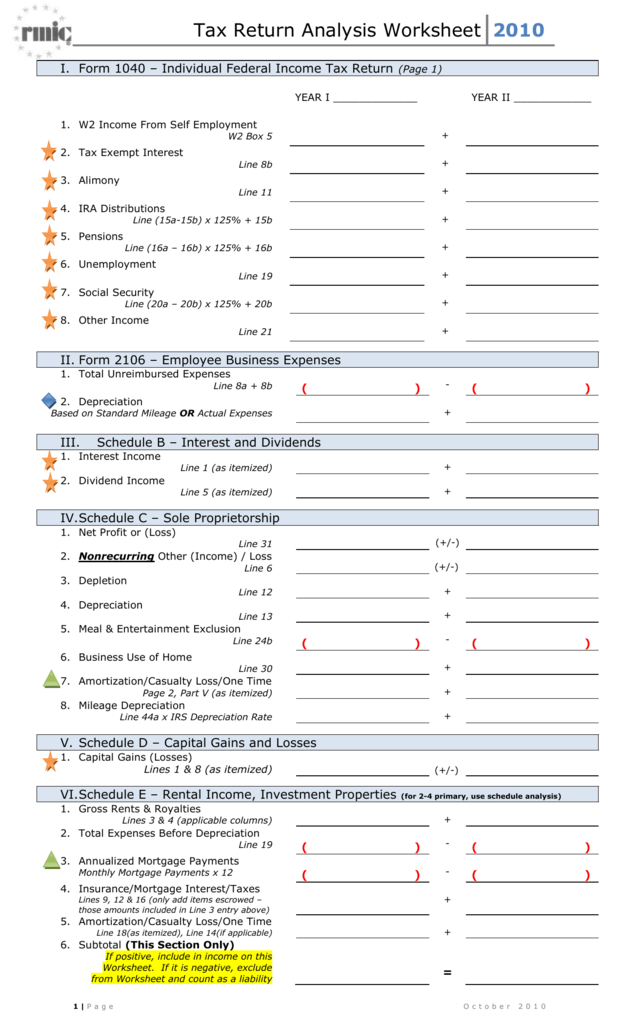

Schedule C Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors Use separate sheet for each business Use a separate worksheet for each business ownedoperated Do not duplicate expenses Name type of business OwnedOperated by Client Spouse Income Total Self employed business expenses worksheet Add the Income and Expenses Personal versus Business Expenses Schedule C -- Self Employed Business Income and Expense Worksheet Complete this form if you were self-employed during this tax year Validate or refuse with just one click You can elect to deduct or amortize certain business start-up Tax Worksheet for Self-employed Independent contractors Sole proprietors Single LLC LLCs 1099-MISC with box 7 income listed Try your best to fill this out If you’re not sure where something goes don’t worry every expense on here Bookkeeping For Self Employed Spreadsheet In 2021 Budget Spreadsheet Excel Spreadsheets Templates Bookkeeping Templates Small Business Tax Spreadsheet Business Worksheet Business Tax Deductions Business Budget Template Free Small Business Income And Expenses Excel Spreadsheet Tracker To Make Your Self Employed Tax Re Spreadsheet Business Schedule C Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors Use separate sheet for each business2 pages New Questions About Health Care Cover Letter Examples There are tons of insurance providers to address but working with a reputable business will be sure youll be taken care … For example the cost of a personal computer is a deductible business expense if you use the computer to write business reports Also since you cannot deduct personal expenses enter only the business part of expenses on Form T2125 T2042 or T2121 Small Business Tax Spreadsheet Business Tax Deductions Business Worksheet Business Budget Template Self-Employed Business Expenses Schedule C Worksheet for unincorporated businesses or farms Use separate sheet for each type of business2 pages Certain self-employed individuals in similar circumstances are entitled to similar credits Enrolling in a Small Business Health Options Program SHOP plan is generally the only way for a small business or non-profit Retain the worksheet pursuant to section 16 and submit the worksheet to GO -Biz or the FTB upon request for Self Employed Businesses andor Independent Contractors ▻IRS requires we have on file your own information to support all Schedule Cs Business Name 1 page But many self-employed professionals arent taking advantage of tax deductions That means some freelancers are paying more taxes than they have to As a freelancer you can claim deductions on expenses that according to the IRS are ordinary and necessary for the operation of your business SELF-EMPLOYMENT WORKSHEET Please provide 3 months of all self-employment gross monthly income and expenses Rent or Lease other business property1 page Factors to Consider for a Self-Employed Borrower Any individual who has a 25 or greater ownership interest in a business is considered to be self-employed The following factors must be analyzed before approving a mortgage for a self-employed borrower the stability of the borrowers income the location and nature of the borrowers business Free Business Expense Spreadsheet and Self Employed Business Tax Deduction Sheet A Success Of Your Small Lisa Marie Espinoza 327 followers the borrower has been self-employed in the same business for at least five years and the borrowers individual tax returns show an increase in self-employment income over the past two years For certain loan casefiles DU will issue a message permitting only one year of personal and business tax returns provided lenders document the income by Schedule C Worksheet for Self-Employed Filers and Contractors – tax year 2020 This document will list and explain the information and documentation that we 6 pages And lets go ahead and say after business expenses deductions and employment taxes well get to those next youre left with 50000 in taxable income Now if this is your only income and youre not filing jointly with your spouse then based on your tax bracket 9700 taxed at 10 29775 taxed at 12 and 10525 taxed at 22 Use a separate worksheet for each business ownedoperated Do not duplicate expenses Name type of business OwnedOperated by Client Spouse Income 2 pages When you sign onto your online account and land on the Tax Home web page scroll down and click on Add a state This will take you back to the 2020 online tax return Click on Tax Tools on the left side of the online program screen Then click on Print Center Then click on Print save or preview this years return In addition to providing tax relief through removal of penalties interest tax levies and liens the 2017 IRS Fresh Start Tax Program also makes it easy for you to pay off your tax debts Under the program you can pay off your tax debts in two ways Installment agreements Offers in compromise Under the Fresh Start initiative the IRS can file a lien notice only if you owe 10000 or more in tax debt That means you can avoid a tax lien if you owe the IRS 9999 or less The Fresh Start program also introduced a way to avoid a federal tax lien even if you owe 10000 or more Pays for itself TurboTax Self-Employed Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020 Actual results will vary based on your tax situation Pays for itself TurboTax Self-Employed Estimates based on deductible business expenses calculated at the self-employment tax income rate 153 for tax year 2020 Actual results will vary based on your tax situation There are dedicated services for the self-employed and small business owners amongst others You can also opt to receive advice from a CPA or Enrolled Agent Turbotax is a pricier option than others the complete self-employed package is 11999 But it is comprehensive including industry-specific tax deductions to make Welcome back Ask questions get answers and join our large community of tax professionals A small business lets you take advantage of many tax-saving strategies and anyone can start a business with no money The general idea is to find business tax deductions for expenditures you normally make anyhow For example the tax code allows a health insurance deduction for the self-employed without itemizing So if youre already E-filed 1040X Returns requiring a take action call to Confirm Iden Efiled 2019 and 2020 1040X Amended returns have been getting a message on the Wheres My Amended Return Tool on the IRS WebsiteTake ActionYour Amended Return read more TaxingUpNorth Level 2 posted Aug 26 2021 Separating your business and personal finances is a key step on the way to formalizing your business says Keith Hall president and CEO of the National Association for the Self-Employed In 2006 the pharmaceutical business accounted for nearly 92 of GSKs business 2 Table 157 exhibits income in million rupees and expenses in million rupees of Glaxosmithkline Pharmaceuticals Ltd from 1989-1990 to 2006-2007 except 1993-1994 Step one Writing down all streams of income and all expenses Step two Seeing if they balance each other out If they come out balanced then its good to go Spreadsheet - Theres quite a lot of software that can be used for budgeting However the most widely used one is Microsoft Excel Self-EmployedBusiness Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising 2018 Capital Loss Carryover Worksheet by Jane on September 02 2021 in capital carryover loss wallpaper Report short-term gains or losses in Part I Publication 550 Investment In e and Expenses Reporting Capital from Capital Loss Carryover P Worksheet 6-A Self-Employed Health Insurance Deduction Worksheet Chronically ill individual Benefits received Other coverage This publication discusses common business expenses and explains what is and is not deductible The general rules for deducting business expenses are discussed in the opening chapter If you are self-employed Weve discussed young claimants and the barriers they might face to get SSDI and SSI benefits but what about an older claimant If you are less than your self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money There is the worksheet that will involve in it the expenses done on the business and its related affair The related expenditure can be Excel Labels To Word Recruitment Tracker Format In You possibly can create a price range for the entire 12 months with the nice assist of this software program 1 and 2 must be submitted to Lender You need to fill out a PPP loan forgiveness application form and submit that to your lender Schedule A worksheet p 9 1 How to Apply for PPP Loan Forgiveness as a Self-Employed Worker Youll work with your lender on your PPP loan forgiveness application SELF EMPLOYED INCOMEEXPENSE SHEET NAME OF PROPRIETOR BUSINESS ADDRESS BUSINESS NAME FEDERAL ID NUMBER Automobile Mileage Adequate records required COST OF GOODS SOLD If Applicable Beginning of the Year Inventory End of Year Inventory Purchases Other Title Self Employed Income Expense Sheetxlsx Author Assistant Roommates arent just for college students As rents soar more adults are combining households to share the burden By the end of 2019 nearly a third of US adults over 18 lived in a shared household according to the Census Bureau Thats up from roughly 1 in 5 adults in 2005 But living with a … EXAMPLES OF SELF-EMPLOYED BUSINESS EXPENSES After you have visited my website wwwjunewalkeronlinecom and read FEATURE 3 which explains what makes an expense a business deduction the following list will be helpful in providing you with typical as well as unusual examples of business expense deductions There For the total of 50000 capital loss in 2020 All numbers are hypothetical From my understanding capital loss carryover to 2021 should be 97000 but turbotax shows something like 90000 less than 97000 97000 calculation from my understanding is 50000 carried over from 2019 - 3000 capital loss used in 2020 50000 capital TRUCKER’S INCOME EXPENSE WORKSHEET business require information returns to be filed by payer Due date of return is January 31 Nonfiling penalty can be 150 per recipient If recipient does not furnish you with hisher Social Security Number you are required to withhold 31 of the payments How to create expense and income spreadsheets A budget spreadsheet is one of the best tools that you can use to manage your finances plansOnce you have all of the information within the example spreadsheet you can use it to analyze how you go about your spending and how you can prevent yourself from spending more than you need toSo here are the steps that will help you create your own Deductible expenses are those that are seen as “ordinary and necessary” for conducting business These expenses can range from advertising to utilities and everything in between Remember however that you can only deduct the business use of the expense you’re deducting This list is relevant for many self-employed professionals

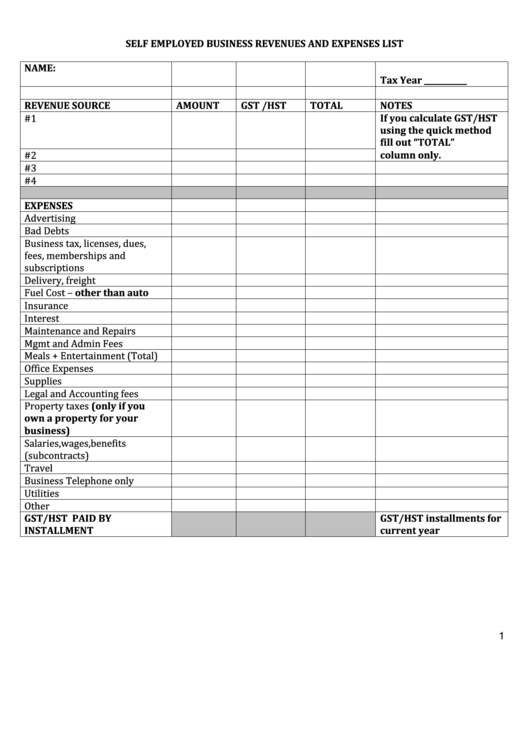

Self employed business expenses worksheet

0 Response to "31 Self Employed Business Expenses Worksheet"

Post a Comment