31 Non Cash Charitable Contributions Worksheet

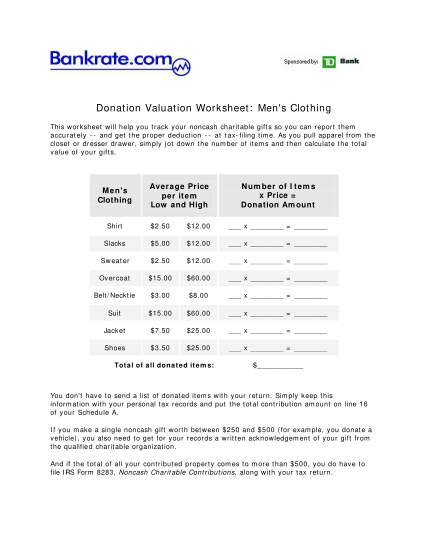

Americans love to give: They deduct over $200 billion of charitable contributions a year on their tax returns, according to IRS data. Most of those contributions are in cash, but tax pros say you. For more information about non cash donations see: toaster coffee maker microwave dinner plates - each saucers - each cups - each glasses - each flatware - place setting of 4 pieces soup bowls serving dishes misc. cooking utensils misc. serving utensils misc. cutting utensils under shirts / under shorts sport coats casual wear jackets: fabric

Related posts from non cash charitable contributions donations worksheet 2017 download 7 tax return spreadsheet sample template 2020 a income tax return may be a set of forms that a taxpayer uses to calculate and report taxes owed to intern revenue service (irs).is that the annual deadline for filing a income tax return , though some sorts of.

Non cash charitable contributions worksheet

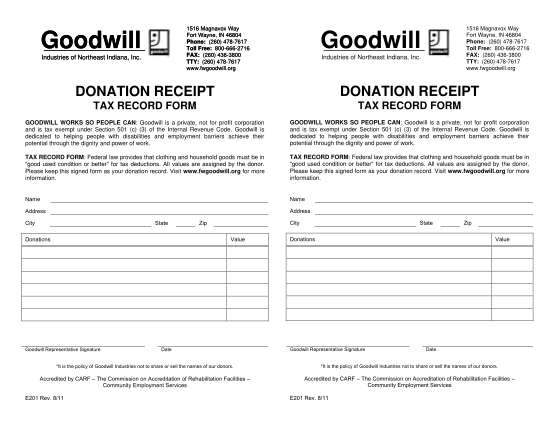

Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in 1-800-SA-TRUCK (1-800-728-7825) The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. It includes low and high estimates. Please choose a value within this range that reflects your item's relative age and quality. The Salvation Army does not set a valuation on your.

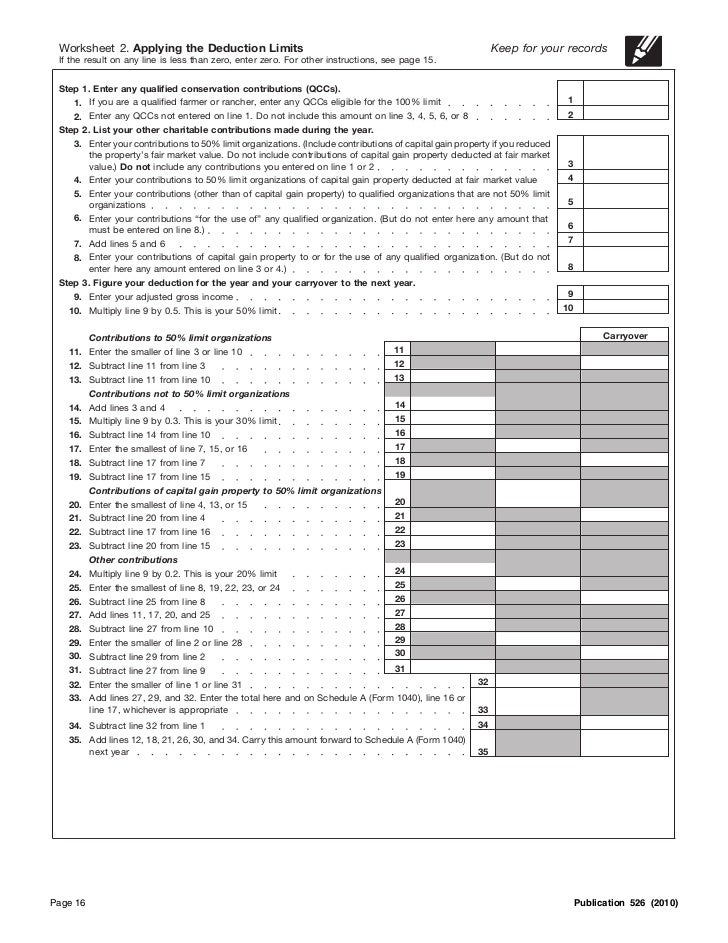

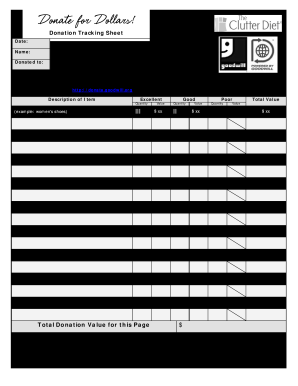

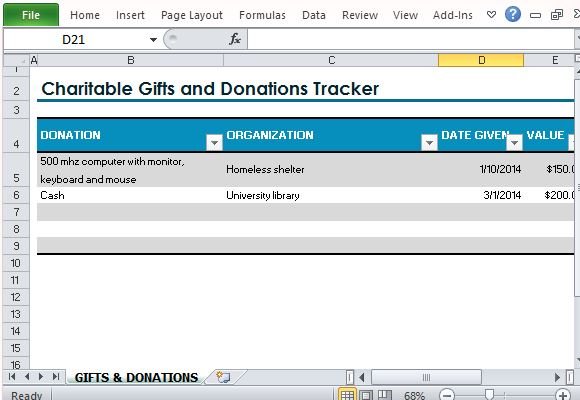

Non cash charitable contributions worksheet. Use this donation calculator to find, calculate, as well as document the value of non-cash donations. You can look up clothing, household goods furniture and appliances. Using The Spreadsheet. If you are using a tablet or mobile device, you cannot enter any data. However, you can browse the sheet to find values. Non cash charitable contributions worksheet author: July 1st to arc, and another donation to arc on sept. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property the claimed value of which exceeds 500. The $11,000 amount is the sum of your current and carryover contributions to 50% limit organizations, $6,000 + $5,000.) The deduction for your $5,000 carryover is subject to the special 30% limit for contributions of capital gain property. This means it is limited to the smaller of: $7,200 (your 30% limit), or. Charitable Contribution Worksheet. Karen. December 20, 2017. Reporting Non Cash Charitable Donations can be extremely beneficial to your bottom line tax liability. Although, pulling it all together can also be painfully arduous. I am providing access to a worksheet built in excel. Download it and open in your 'sheets' app (excel, numbers.

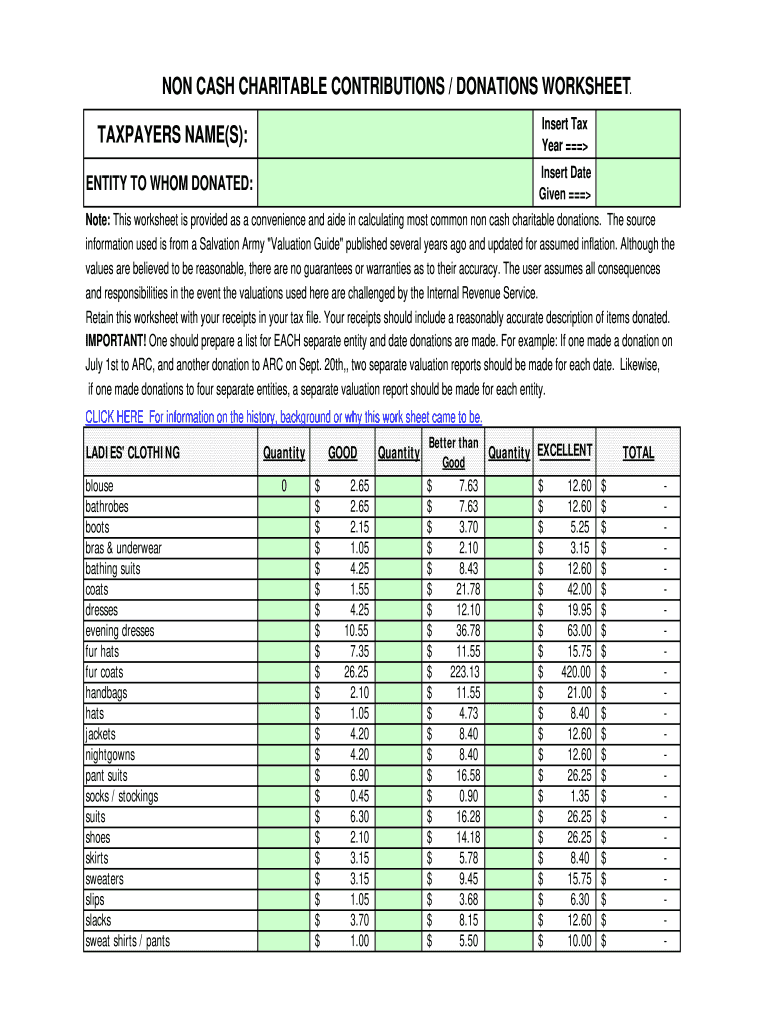

deduct your charitable contributions if you don't itemize deductions and not every non-profit organization is a tax-qualified. NON-CASH CONTRIBUTION WORKSHEET... Non-Cash Rev: 061223. Sheets $2.00 $8.00 Throw Rugs $1.50 $12.00 Towels $0.50 $4.00 Total Furniture Low High Qty Total Bed Complete ... Non-cash donations, on the other hand, can get a little squirrely. Donations of items like clothing, cars, or household goods are assessed at the "fair market value," or FMV. Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Non Cash Charitable Contributions Worksheet - Excel Version Author: Heather Murphy-Walker Last modified by: Aaron Kimball Created Date: 7/16/2014 8:56:26 PM Other titles: Sheet1 Sheet2 Sheet3 Sheet1!Print_Area

Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations. The source information used is from a Salvation Army "Valuation Guide" published several years ago and updated for assumed inflation. Although the Retain this worksheet with your receipts in your tax file. Thanks Pat but I made no entries at all, these were cash donations carryovers from 2017 and it appears that the carryover amount was put on the wrong "Non-cash" line by the software and carried as such to the worksheet. Has never been an issue as the proper amount of carry over was being used. GUIDELINES FOR DEDUCTING NON-CASH CHARITABLE CONTRIBUTIONS If you donated a single item or a group of similar items, other than publicly traded securities, that you value at over $5,000, you cannot use this worksheet -- a signed Declaration of Appraiser must be obtained for donations valued at over $5,000. deduct your charitable contributions if you don't itemize deductions and not every non-profit organization is a tax-qualified charitable organization. If in doubt, ask the group whether your contribution is "tax-deductible.". NON-CASH CONTRIBUTION 2018 WORKSHEET Below suggested prices from www.salvationarmyusa

Charitable contributions of property in excess of $5,000. Planning Tip: Most cell phones today can take pictures. Take a picture of all items donated. Keep the electronic pictures for proof the items were in good or better con-dition at the time they were donated. Recordkeeping Rules for Charitable Contributions

Stick to these simple actions to get non cash charitable contributions/donations worksheet ready for sending: Get the document you require in the collection of legal forms. Open the template in the online editing tool. Read through the recommendations to discover which details you must give. Click the fillable fields and put the requested data.

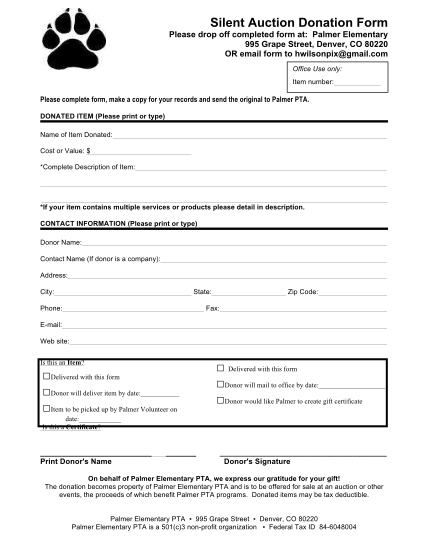

IMPORTANT! One should prepare a list for EACH separate entity and date donations are made. For example: If one made a donation Boitnott & Schaben LLC www.botetourtcpas Phone 540-966-0114 For more information about Charitable Contributions & Non-Cash Donations see IRS Publication 526: $2.00 $7.00 2.00 $12.00 $0.00 $5.00 $10.00 2.00 $15.00 $0.

Use the slider to estimate the fair market value of an item. Donation Value. $1 $200. $50. Price. $10.00 - $20.00. Fair Market Value. Below is a donation value guide of what items generally sell for at Goodwill locations. To determine the fair market value of an item not on this list, use 30% of the item's original price.

NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET. TAXPAYERS NAME(S): Insert Tax Year ===> ENTITY TO WHOM DONATED: Insert Date Given ===> Note: This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations.

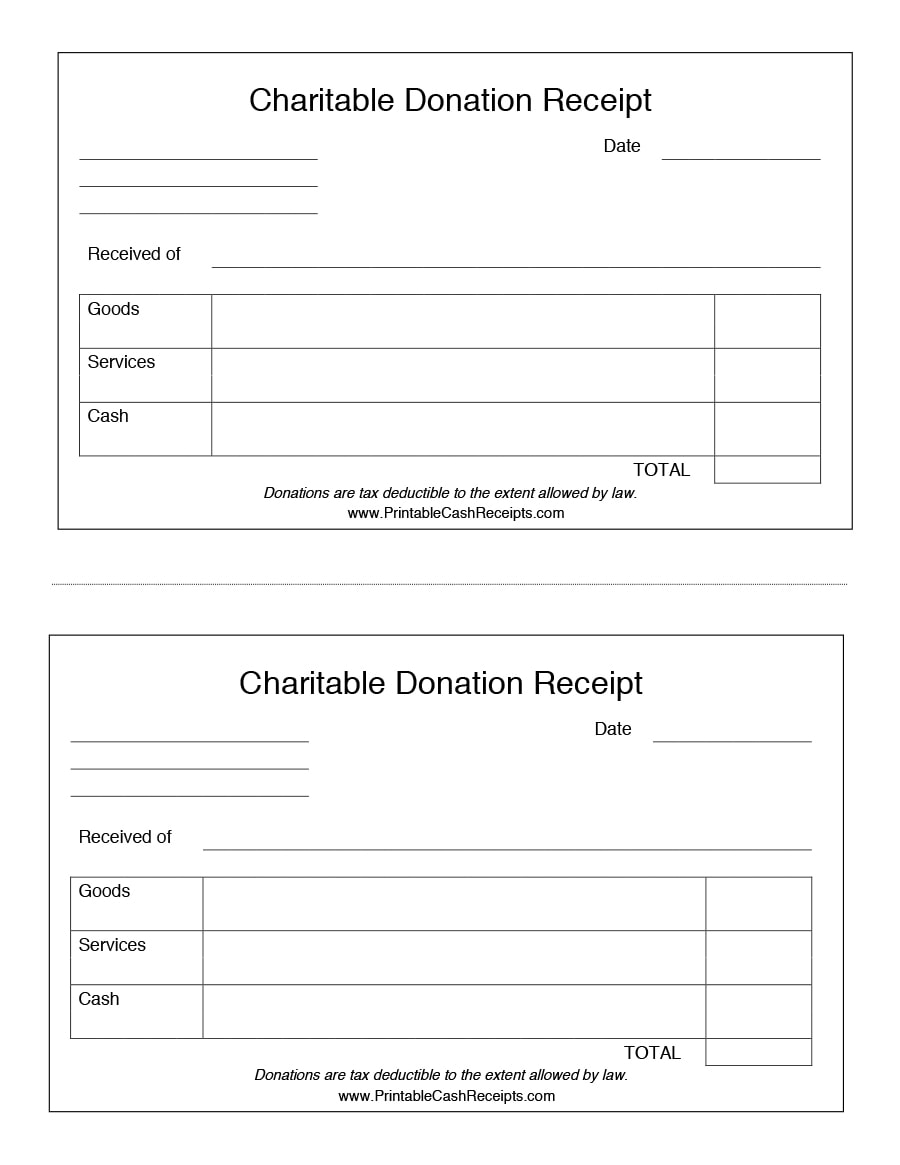

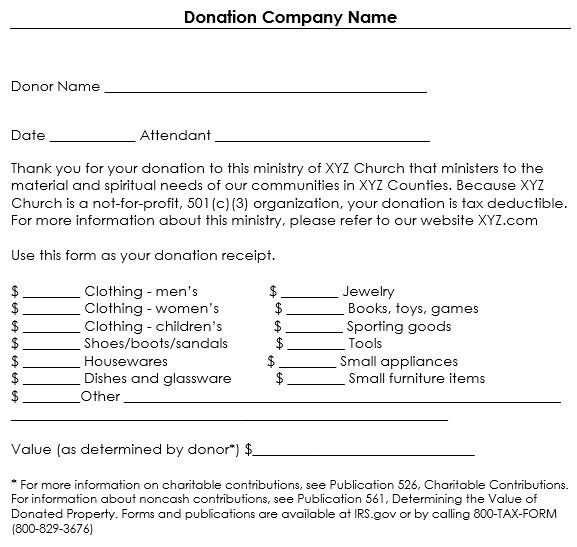

PDF. Size: 83 KB Download. The Donation Form Templates can help you procure the details about the amount and property you've donated in charity hospitals and foundations. Generating charity and donation for the needy is a human and godly act, but keeping a track of it can be somewhat difficult. All of these documents and templates contain the.

Non cash charitable contributions / donations worksheet 2021. if one made donations to four separate entities, a separate valuation report should be made for each entity. July 1st to ARC, and another donation to ARC on Sept. 20th two separate valuation reports should be made for each date. Likewise, sweat shirts / pants MY / OUR BEST GUESS OF VALUE NON CASH CHARITABLE CONTRIBUTIONS / DONATIONS.

Get Non Cash Charitable Contributions Worksheet Pictures. If the value of the donated items is $250 or more to one charity in one day, you are required to obtain a written receipt from the. When valuing items, take into consideration the condition of the items.

Information about Form 8283, Noncash Charitable Contributions, including recent updates, related forms and instructions on how to file. Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500.

non-cash charitable contribution worksheet date _____ organization _____ address_____ the following tables are estimates only. actual fmv may vary significantly. women’s clothing qty amount qty amount subtotal bathrobe 12.00 x = 9.00 x =

Missing Information: Non-Cash Charitable Contributions Worksheet Name. Home Telephone: Work Telephone: Tax Year: 2016 Cell: The following is a guideline for valuation of non-cash charitable contributions. When valuing items, take into consideration the condition of the items. If the value of the donated items is $250 or more to one charity in

8283, "Non-cash Charitable Contributions." Where the non-cash charitable contribution, other than publicly traded securities, exceeds $5,000 (including "similar property" contributed to one or more charitable organizations), the donee charitable organizations are required to file Internal Revenue Service Federal Form

NON-CASH DONATION WORKSHEET (Based on Salvation Army average prices for items in Good Condition) DONATED TO: DONATION DATE: CHILDREN'S CLOTHING LOW HIGH AVG QTY AMOUNT VALUE Blouses 2.40 9.60 6.00 Boots 3.60 24.00 13.80 Coats 5.40 24.00 14.70 Dresses 4.20 14.40 9.30 Jackets 3.60 30.00 16.80 Jeans 4.20 14.40 9.30 Pants 3.00 14.40 8.70 Snowsuits.

1-800-SA-TRUCK (1-800-728-7825) The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. It includes low and high estimates. Please choose a value within this range that reflects your item's relative age and quality. The Salvation Army does not set a valuation on your.

/GettyImages-583903612-5b588612c9e77c00785d6d7e.jpg)

0 Response to "31 Non Cash Charitable Contributions Worksheet"

Post a Comment