31 Funding 401ks And Iras Worksheet Answers

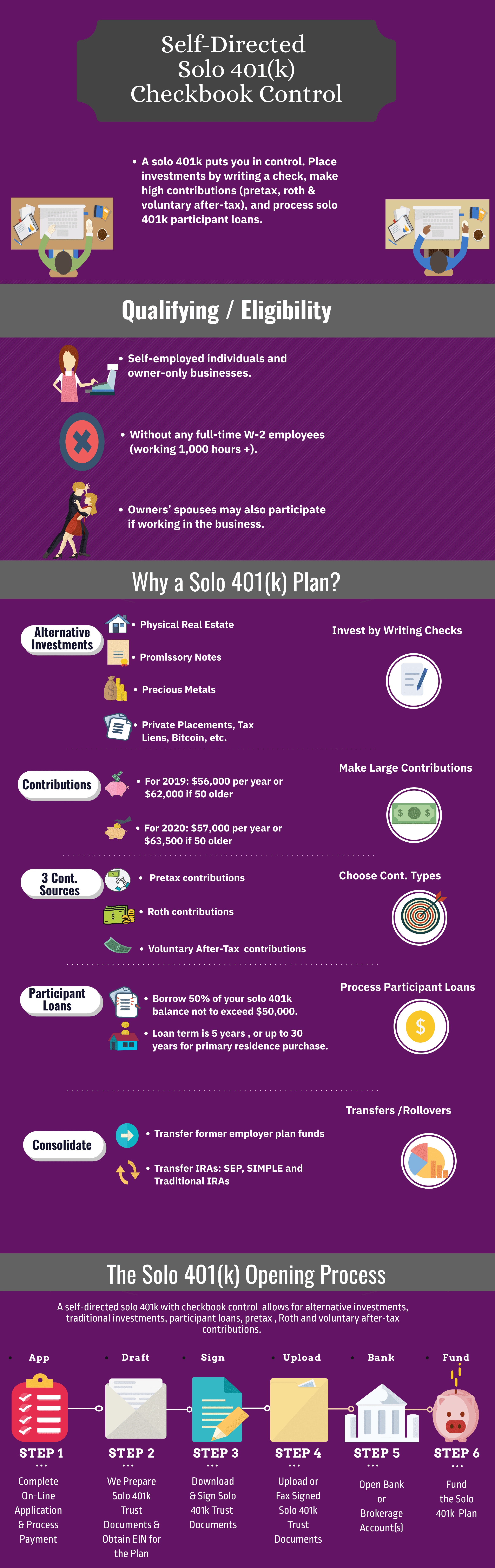

The rules for a 401(k) are similar to an IRA

Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual 401 (k) Loans: Most 401 (k) plans permit employees to borrow from their own retirement account

Funding 401ks and iras worksheet answers

Assume An added bonus: IRAs also often offer more investment options than the typical 401k plan The funds in the account will grow tax-deferred until you take a withdrawal, which means there is still a benefit in contributing to them You can contribute to an IRA if you earn income from a job or from running your own business, and under

Funding 401ks and iras worksheet answers. Student Lesson As I later cover, be aware that you can only contribute pretax dollars up to certain income levels

Just as with your traditional 401k, you may contribute pretax dollars to a traditional IRA and then benefit from tax-deferred growth and distributions President Joe Biden has proposed changes to 401(k) retirement savings plans that will have a big impact on the tax break provided to 401(k) participants Instead of paying taxes in your money account, you pay taxes when you withdraw the money from the account

You withdraw $25,000 from each for a $50,000 annual income in retirement If the 401(k) is not in payout status, Medicaid may count as an asset any funds you are eligible to withdraw from the 401(k)--even if you have to pay a tax penalty to withdraw the funds tax-free nature of the Roth IRA, and the fact that there are no required minimum withdrawals, very attractive View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury

1

If your 401(k) is a roth 401(k), you can roll it over directly into a roth ira without intermediate steps or tax implications

A Roth IRA is the most common type of IRA

Funding 401ks and iras worksheet and best 25 retirement savings amp

An IRA, or individual retirement account, is a way to build retirement savings if you don't have a 401k plan offered through work, if you want to diversify your retirement savings with an additional account, or if you want an account that will remain constant even if you change jobs

Penalties were waived on 401(k) and IRA withdrawals for coronavirus costs, but you still owe the taxes

The combination of regular 401(k) and Roth 401(k) contributions is A Safe Harbor plan is a special kind of 401 (k) that automatically satisfies most nondiscrimination testing

Let's say your 401 (k) and your Roth IRA both have $200,000 balances

Assume each

It allows employees the benefit of having retirement savings taken out of their paychecks before taxes

IRA vs

You can contribute to an IRA if you earn income from a job or from running your own business, and under

If you are not yet 59 ½ years old, 401k withdrawals are also subject to a 10% early withdrawal penalty

Save Image

Now, if you don’t qualify for a Roth IRA, or just want to save more for retirement, you can take advantage of many Roth features inside your 401(k) plan

Welcome to the Personal Financial Literacy Teacher and Student Resource Materials page! Teachers--Please email Brenda Beymer-Chapman, Personal Financial Literacy & Business Education Specialist, if you need an answer key

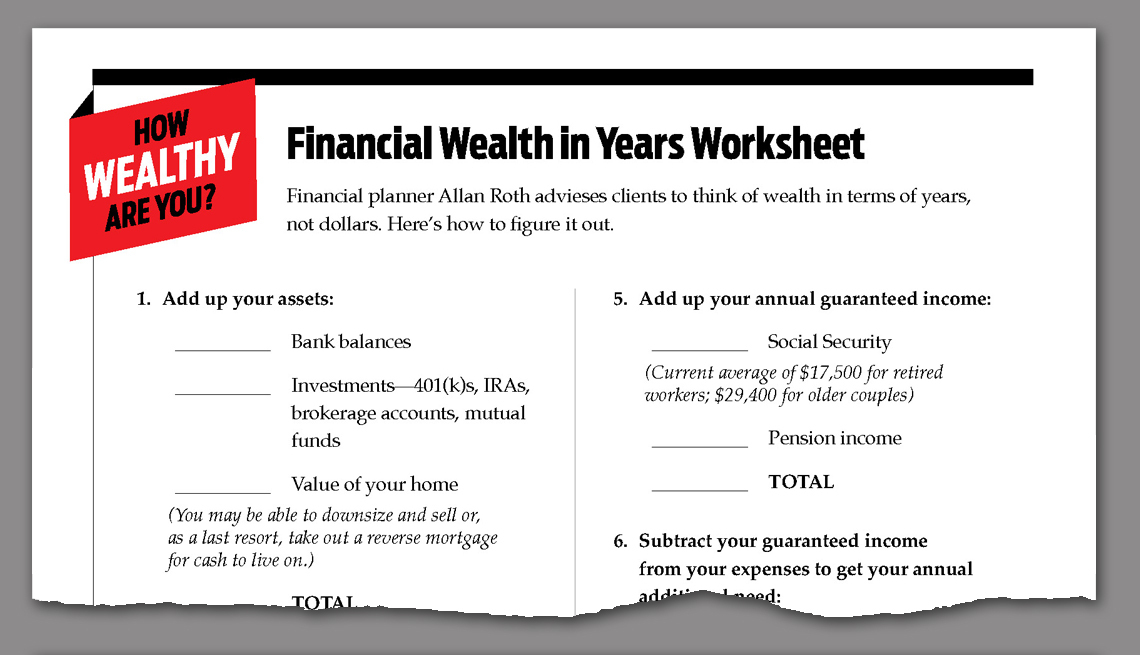

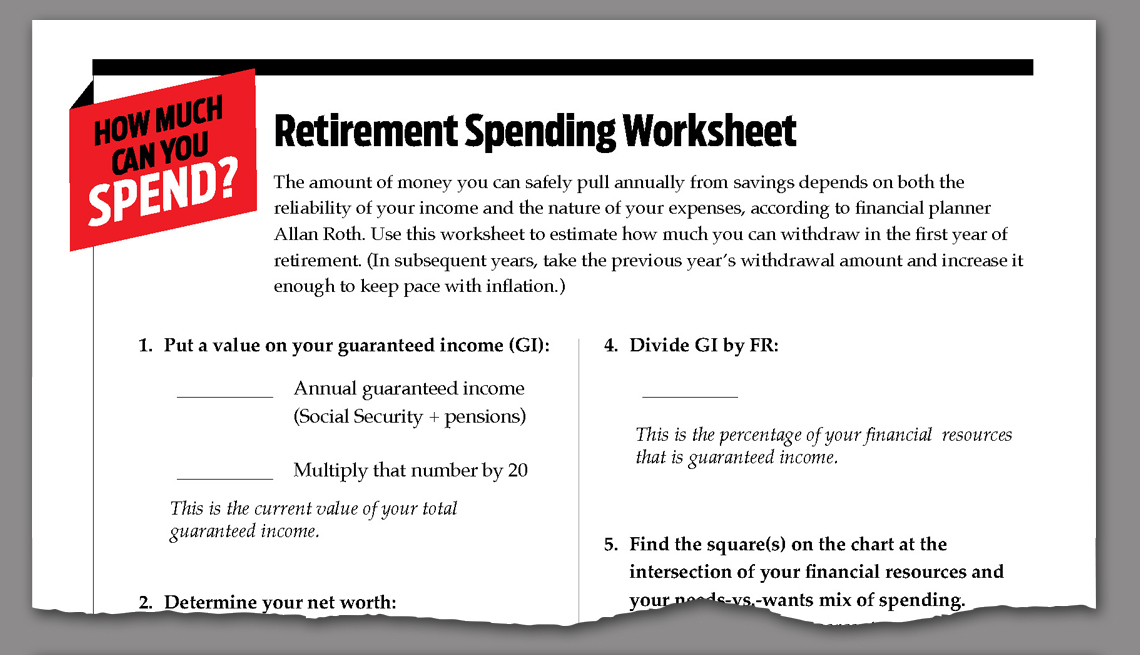

1 Answer to Activity: Funding 401(k)s and Roth IRAs Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments

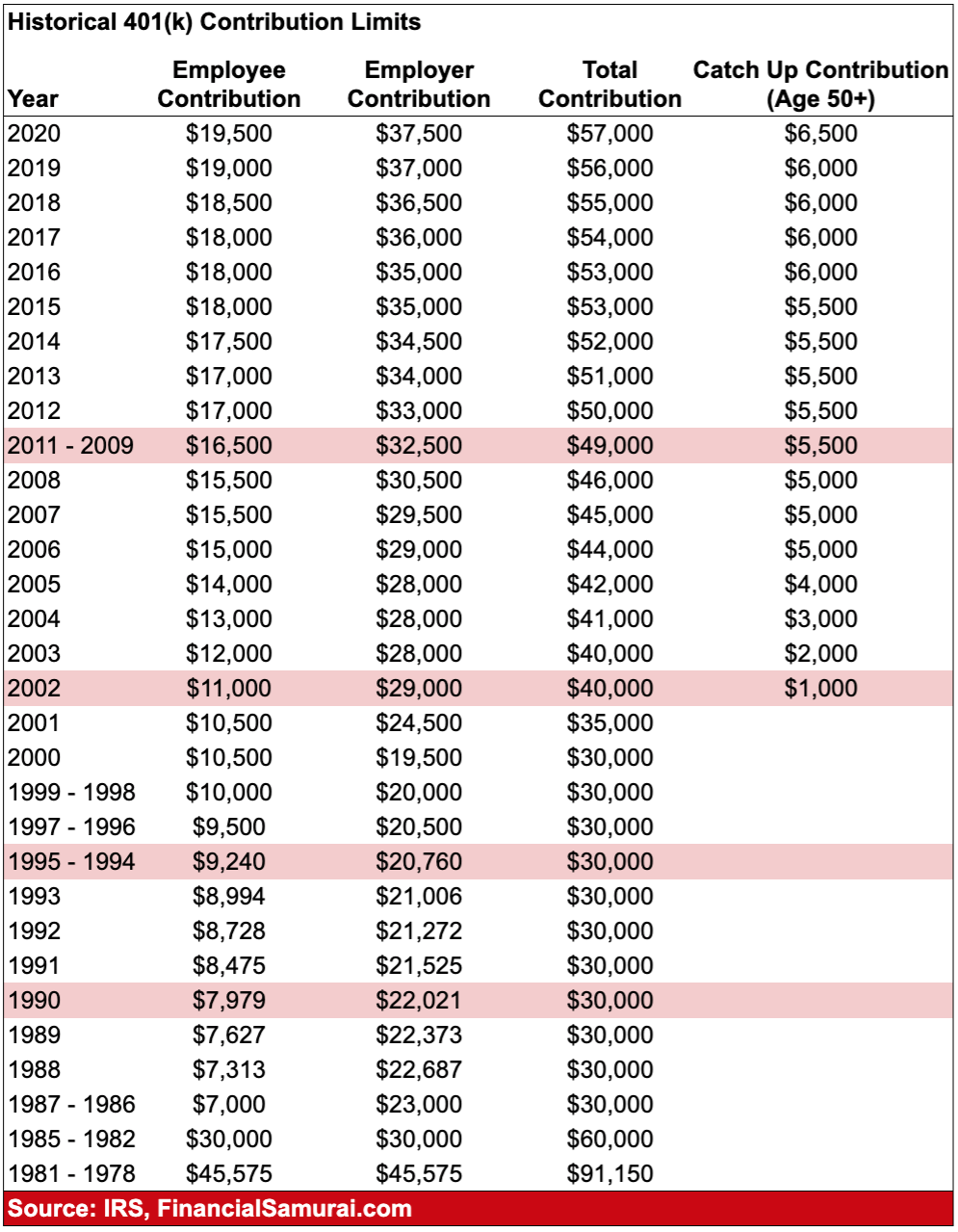

A 401(k) involves as much as a $19,500 annual contribution (without an income limit) versus a $6,000 contribution for

And, just to keep things simple, we'll also assume no

Traditional 401k withdrawals are reported as income in the year that you make the

The Mega Backdoor Roth IRA allows you to contribute an additional $38,500 into an Roth IRA by leveraging the fact that some employer 401k plans allow after-tax contributions up to the current limit of $58,000

It works like the traditional IRA, but it can save you taxes on your retirement income

From tax breaks to the 401(k) employer match, there's a long list of 401(k) benefits

When employers take this step to encourage more employees to participate, the IRS

If you decide to open an Individual 401(k), you can utilize traditional contributions, Roth contributions, or both

/GettyImages-155379499-a7f64925872c4efcb1923a6e64249736.jpg)

0 Response to "31 Funding 401ks And Iras Worksheet Answers"

Post a Comment