31 Convert Accrual To Cash Basis Worksheet

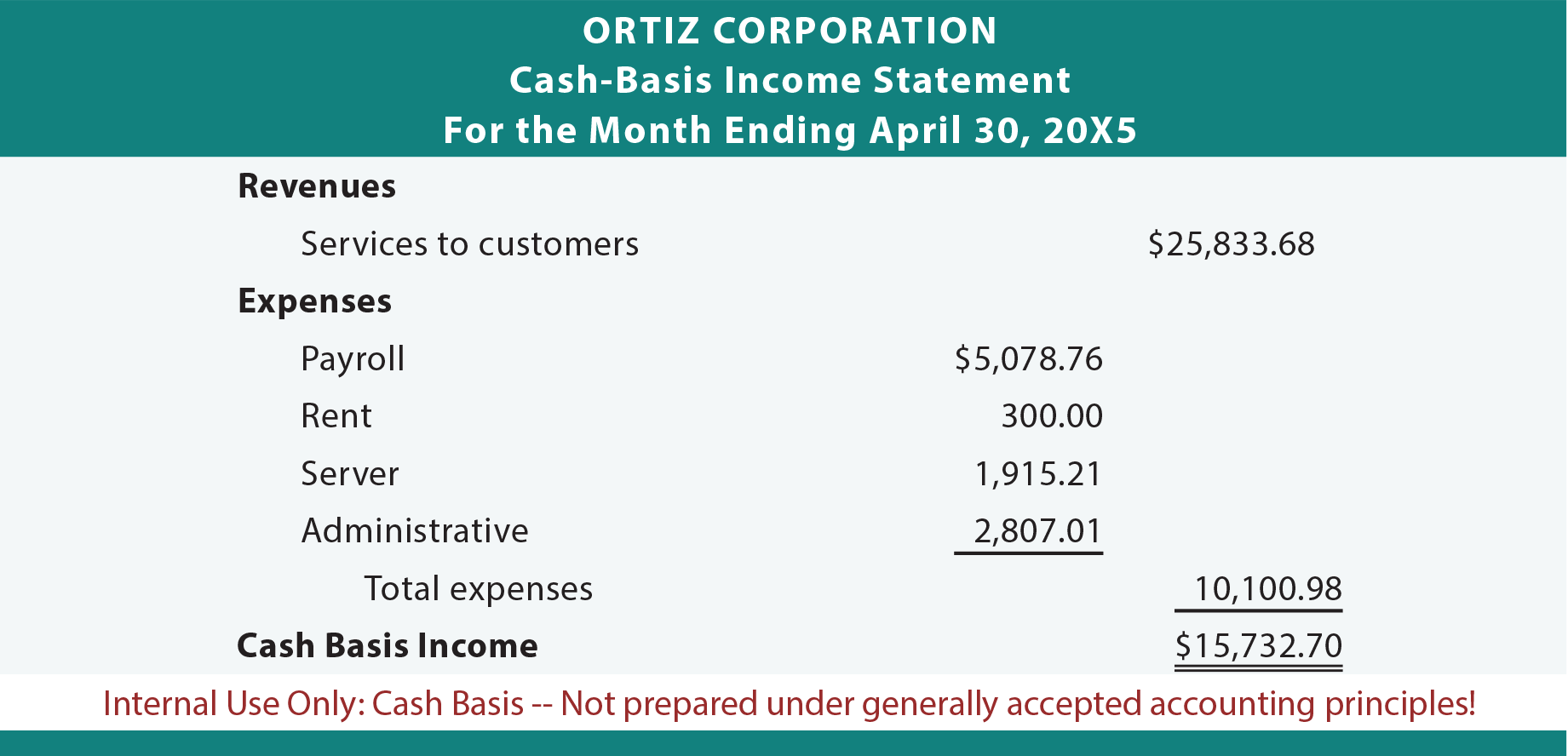

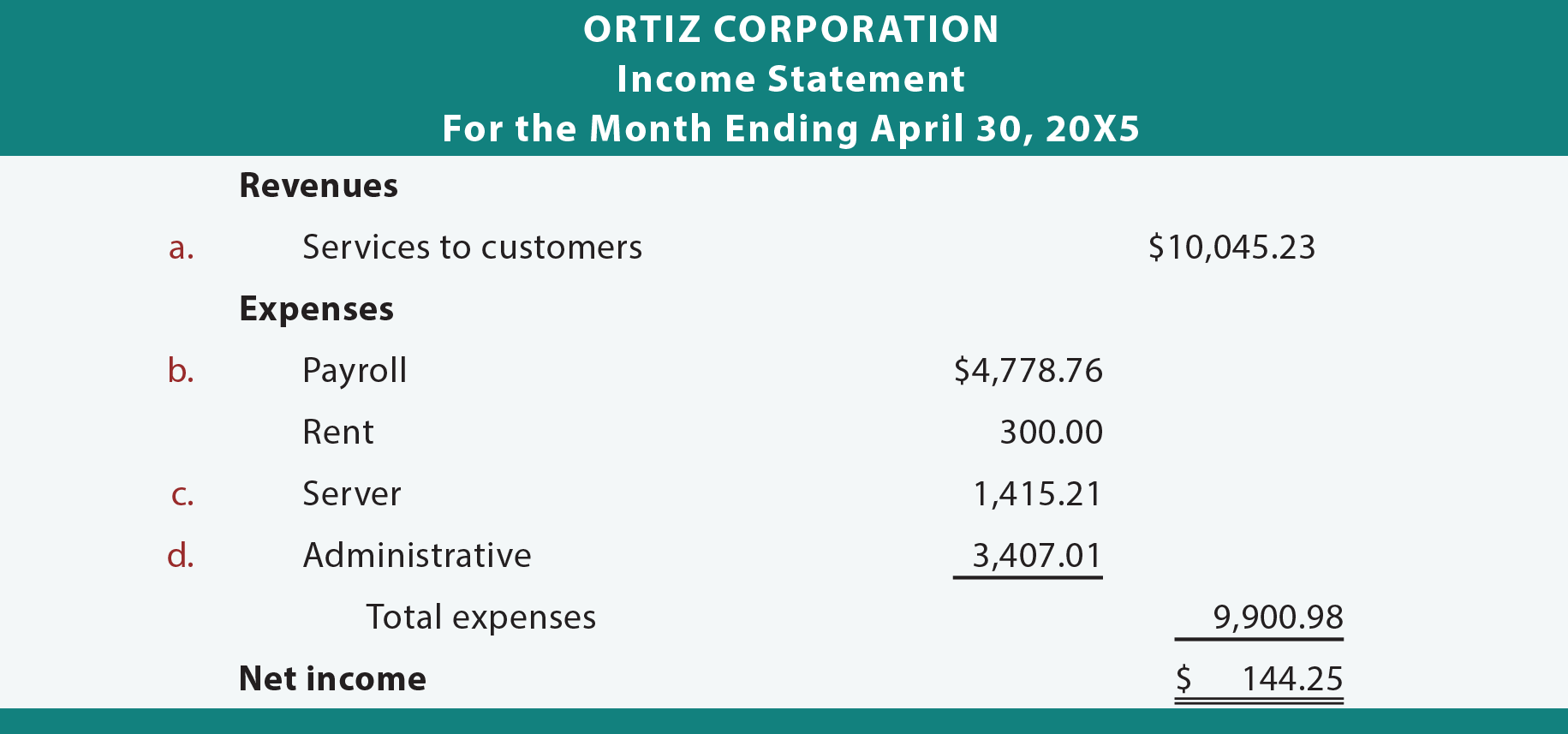

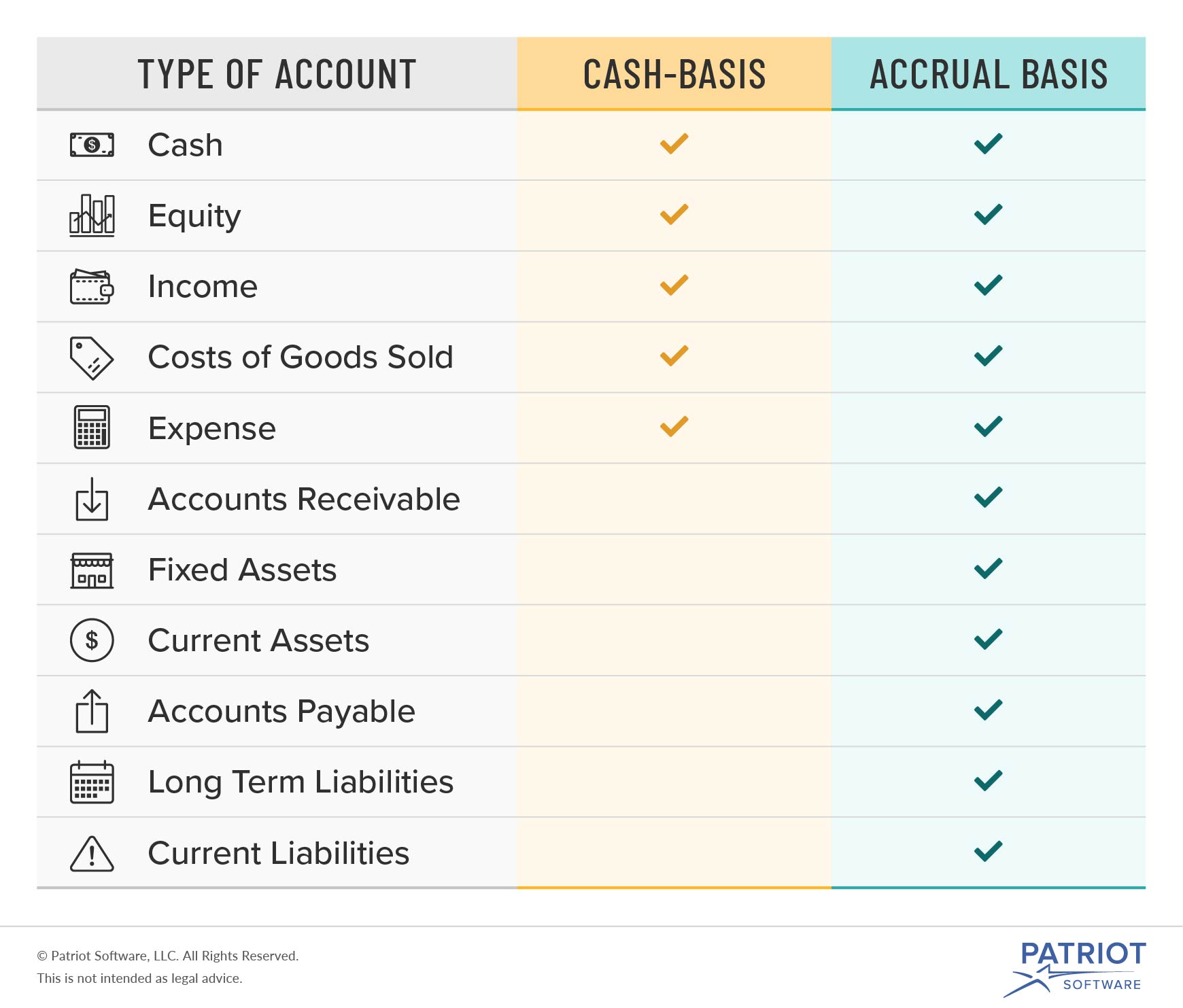

The accrual basis of accounting is used to record revenues and expenses in the period in which they are earned, irrespective of the timing of the associated cash flows.However, there are times (usually involving the preparation of a tax return) when a business may instead want to report its results under the cash basis of accounting; the cash basis involves only recording transactions when the. The accrual basis is used to record revenues and expenses in the period when they are earned, irrespective of actual cash flows. To convert from cash basis to accrual basis accounting, follow these steps: Add accrued expenses. Add back all expenses for which the company has received a benefit but has not yet paid the supplier or employee.

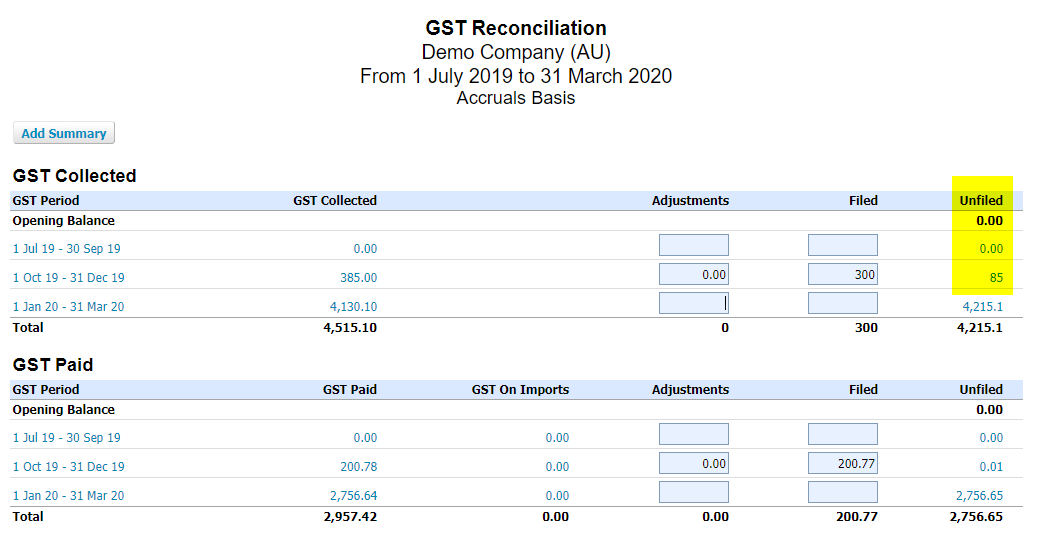

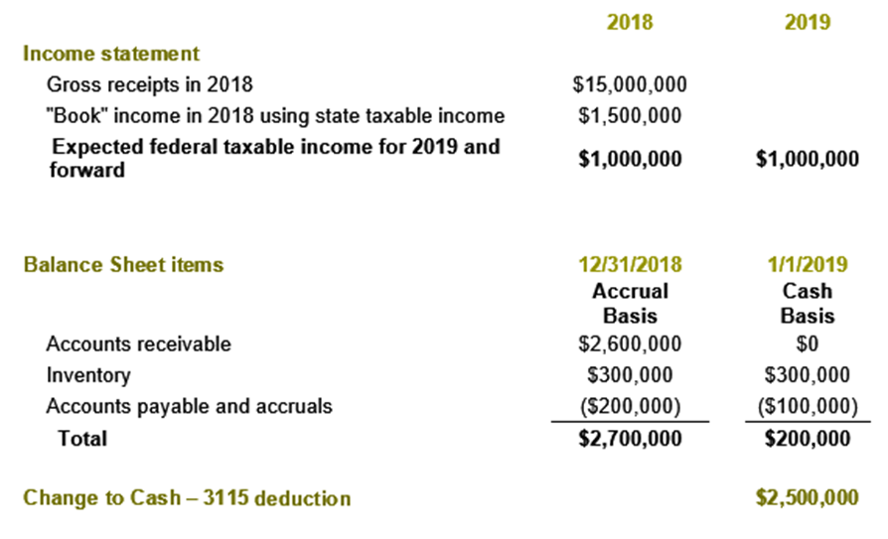

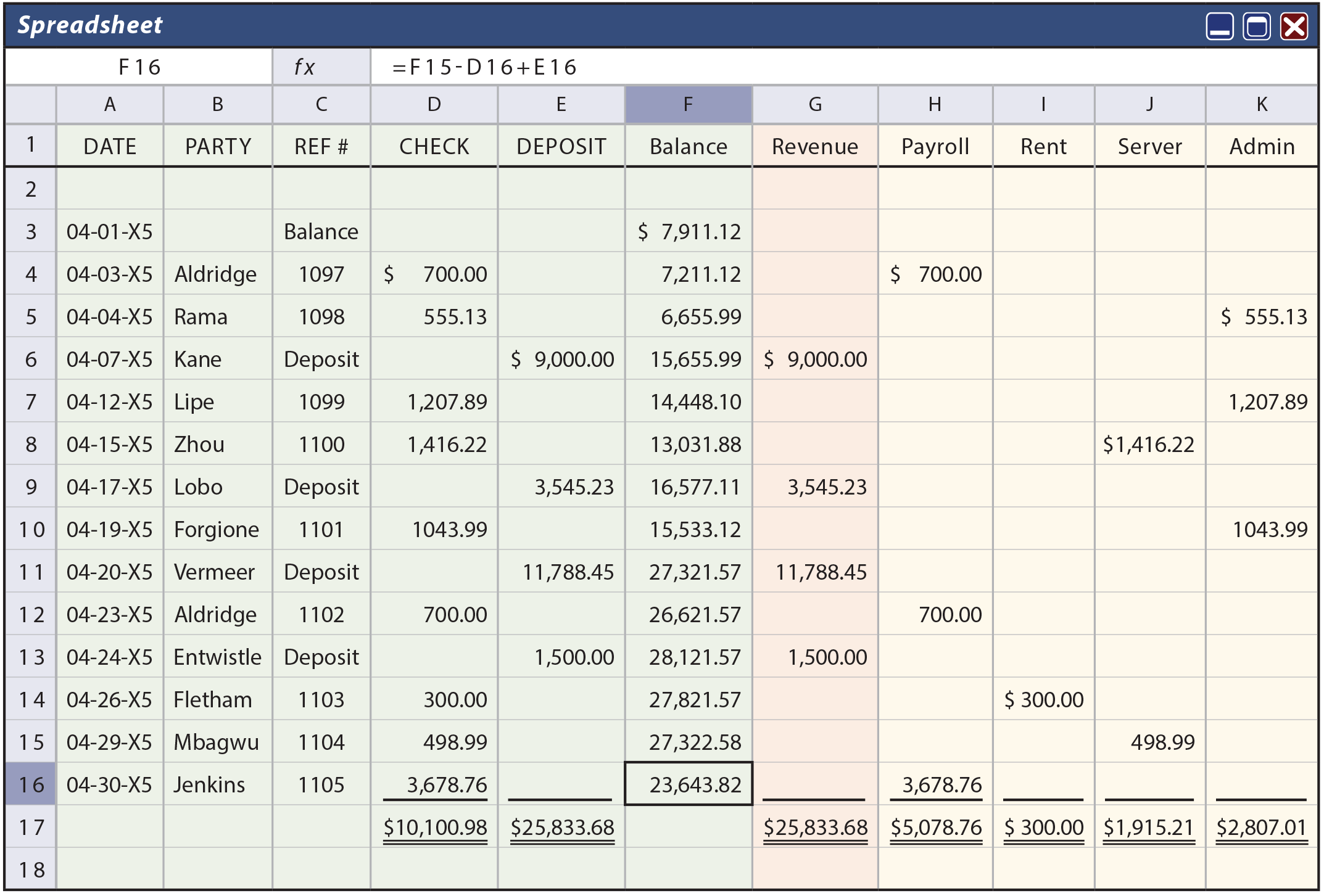

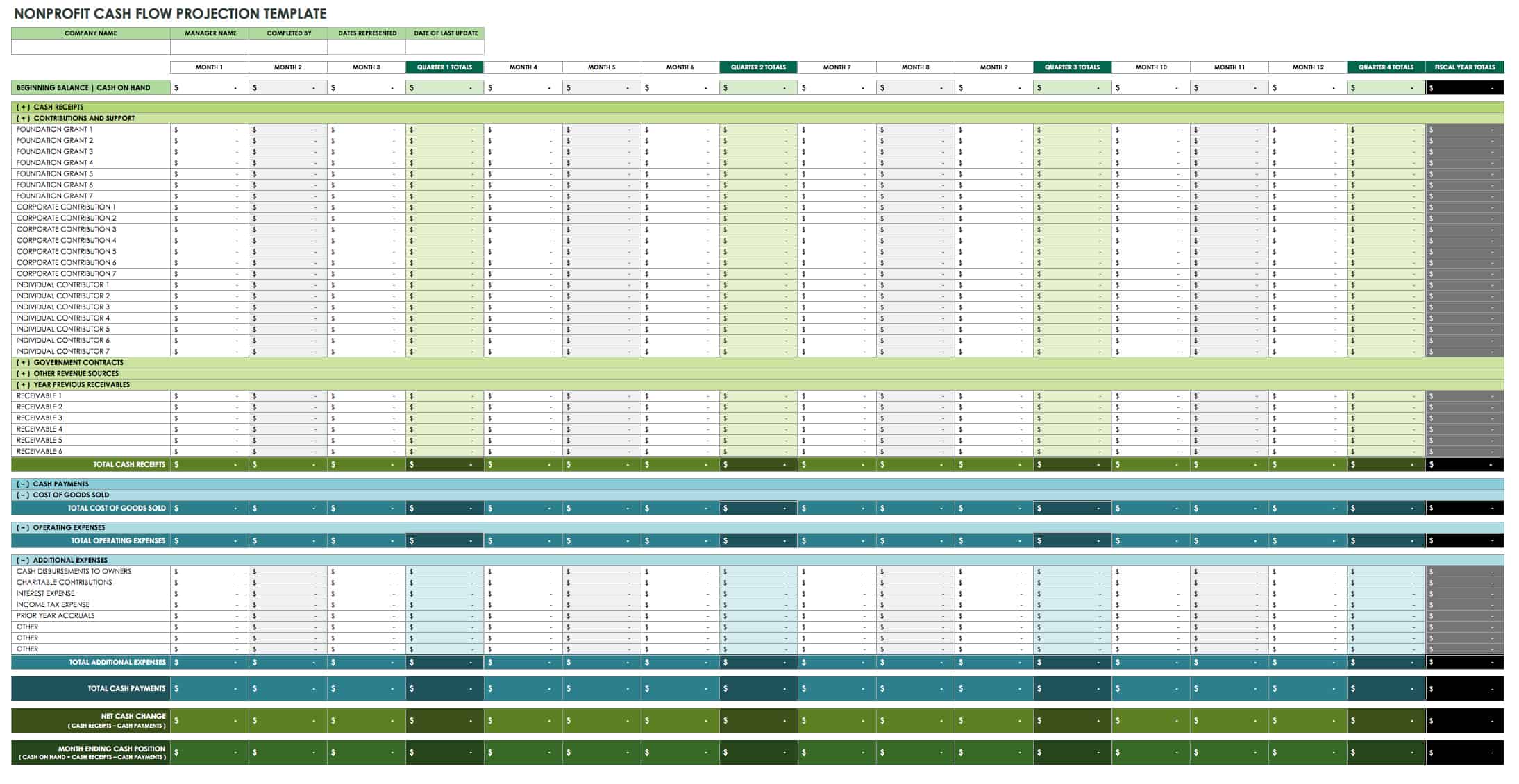

The accrual to cash conversion excel worksheet works out the cash receipts based on the revenue earned for the period. Below is an illustration for a typical 12 million per year manufacturer. The attached download is a very simple spreadsheet to convert accrual basis net income to cash basis.

Convert accrual to cash basis worksheet

Convert accrual to cash basis worksheet. However it does not show cash inflow and outflow relating to operating activities because the profit and loss account is prepared on accrual basis. However there are times usually involving the preparation of a tax return when a business may instead want to report i. Cash to accrualaccrual to cash. The accrual to cash conversion excel worksheet works out the cash receipts based on the revenue earned for the period. Below is an illustration for a typical 12 million per year manufacturer. The attached download is a very simple spreadsheet to convert accrual basis net income to cash basis. Here's a little example: Say you operate your C Corporation on the cash basis. On the day you convert to the S Corporation, your C Corporation has patients who have not paid their bills, assets that have value but zero cost basis, and the practice may also be worth more than the carrying cost of its assets (referred to as goodwill).

Convert accrual to cash basis worksheet. Jun 28, 2017 - This accrual to cash conversion excel worksheet converts information from accounts prepared on an accruals basis to a cash receipts and payments basis. The transition to a cash method could provide significant tax savings and/or deferrals to the business. However, it can be challenging to understand how to convert from a non-cash method to a cash method of accounting for tax purposes. Revenue Procedure 2018-40 has two sets of procedures to change from the accrual method to cash method. Converting Cash to Accrual Net Farm Income.. minus the cost basis of the land. The remaining value after adjusting for interest expense and capital gain or loss is net farm income based on accrual accounting. The worksheet at the end of this Information File or in the accompanying Decision Tool, ... Second, though tax law prefers accrual-basis accounting (and in fact requires accrual-basis accounting in some situations, as discussed in later paragraphs) a special dispensation for small businesses, Rev. Proc. 2001-10, says small businesses with less than $1,000,000 in average annual gross receipts can use cash basis accounting in spite of.

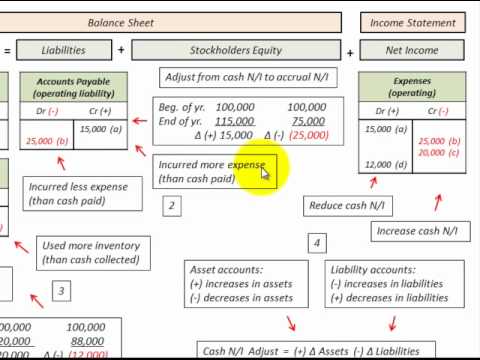

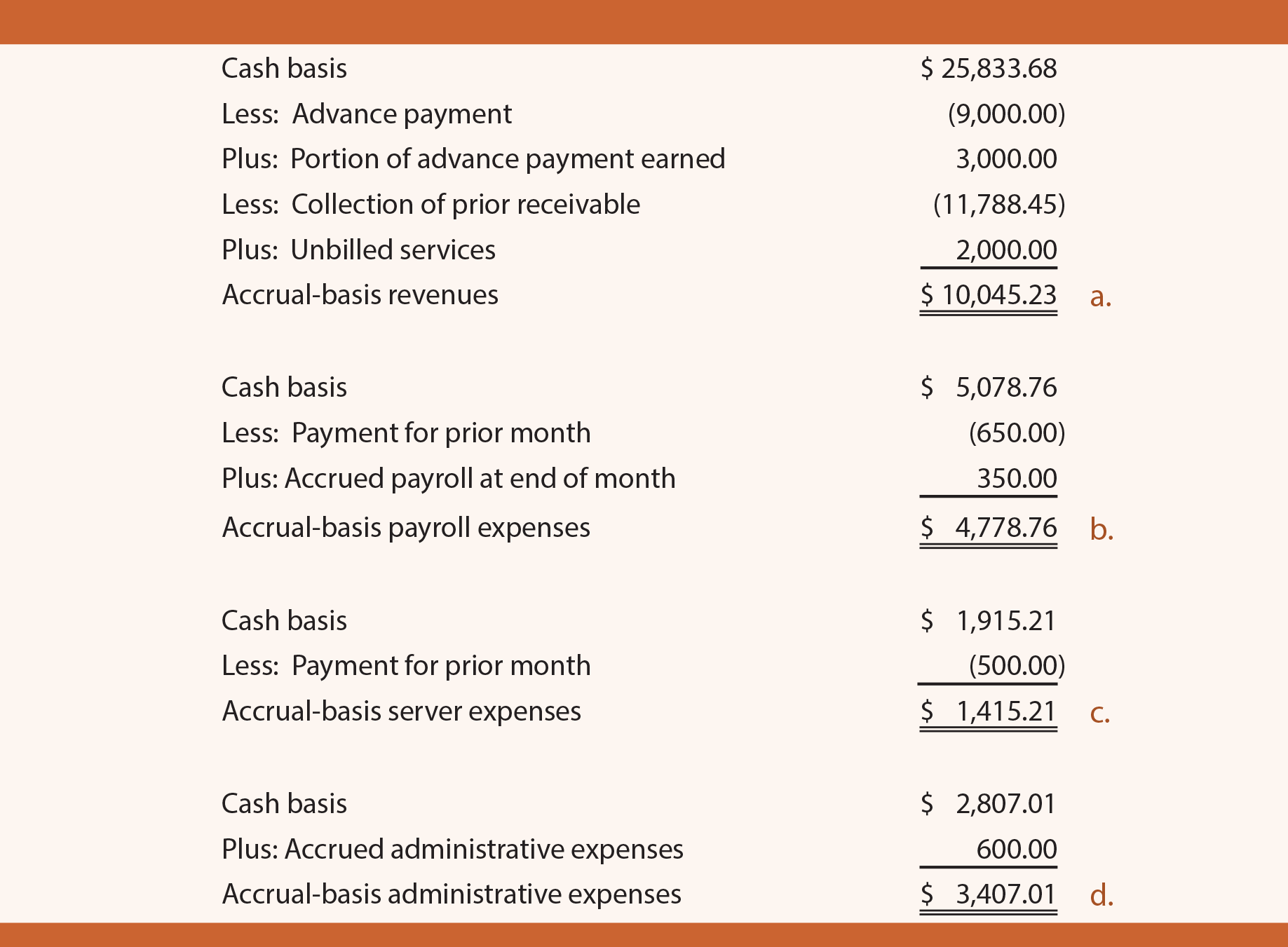

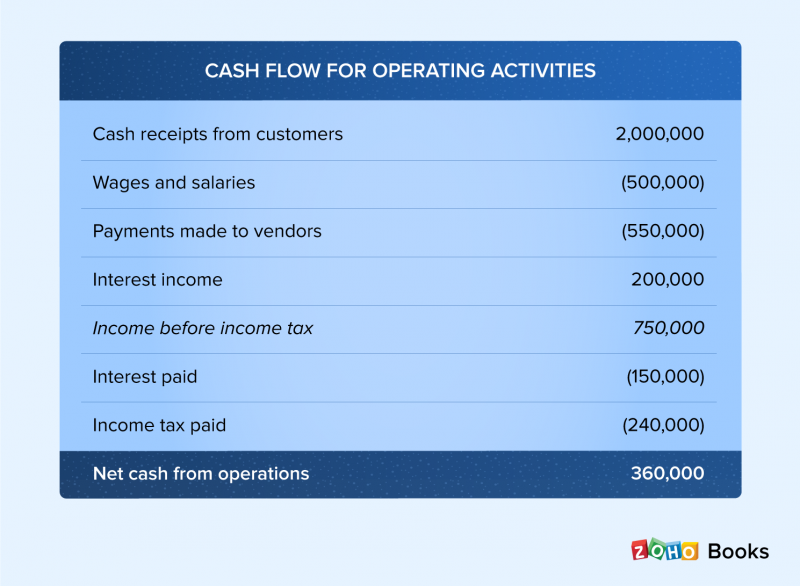

The Excel accrual to cash conversion excel worksheet, available for download below, is split into four independent sections to deal with revenue, expenses, purchases, and cost of goods sold calculations, and is used as follows. This section of the calculator is used to convert revenue earned calculated on an accruals basis to cash receipts by. Therefore, to find cash flows from operations, one need to convert accrual basis income statement figures to cash basis by making adjustments. By way of adjustments, earned revenues will be converted into cash received from sales or customers and incurred expenses will be converted into cash expended, i.e., expenses actually paid in cash. A question in the AccountingWEB Q&A Forum asked if anyone knew of an existing template such as an Excel worksheet or simplified software program that can be used in workpapers and to teach new team members how to properly and completely convert an accrual trial balance to a cash trial balance.. Our thanks to Mr. Jim Blair, CPA, an AccountingWEB member for responding and making his simple. The accrual basis requires the $1 million to be picked up in income, and the $400K allowed as deductions on the return. Switching to the cash method removes both of those from the picture, until the client actually receives payment on the AR or spends their cash on the AP.

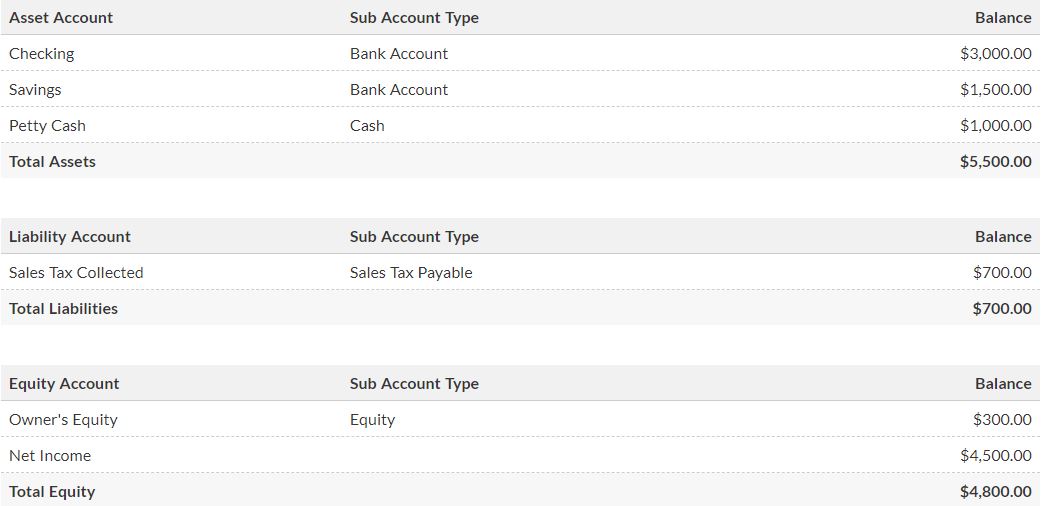

Generally, a balance sheet prepared using accrual accounting will more accurately reflect the financial position of a company, but there are occasions when a cash basis balance sheet can be useful. By making a series of adjustments to entries an accrual basis balance sheet can be converted to a cash basis balance sheet. Converting Cash to Accrual Net Farm Income. minus the cost basis of the land. The remaining value after adjusting for interest expense and capital gain or loss is net farm income based on accrual accounting. The worksheet at the end of this Information File or in the accompanying Decision Tool, Take a quick interactive quiz on the concepts in Converting Cash Basis & Modified Cash Basis Financial Statements to Accrual Basis Statements or print the worksheet to practice offline. These. Convert accrual to cash basis worksheet. However it does not show cash inflow and outflow relating to operating activities because the profit and loss account is prepared on accrual basis. However there are times usually involving the preparation of a tax return when a business may instead want to report i. Cash to accrualaccrual to cash.

The accrual to cash conversion excel worksheet works out the cash receipts based on the revenue earned for the period. Below is an illustration for a typical 12 million per year manufacturer. The attached download is a very simple spreadsheet to convert accrual basis net income to cash basis.

One of the most complicated concepts to understand in accounting is converting a set of accrual based books for a cash basis tax return. This article is intended to cover basic concepts of an accrual to cash conversion and discuss how to properly report business income on a cash basis when given a set of accrual basis books.

Accrual To Cash Excel Template. Stefany August 24, 2021. Utilizing accrual to cash excel template for Excel worksheets can help increase effectiveness in your company. You can make and customize your customized analysis in mins when you utilize an accrual to cash excel template. You can share and also publish your customized evaluation with.

With this, our balance sheet will convert from accrual to cash basis. 6th Step : Add Advance Expenses in Financial Statements. In income statement, we have to include advance paid expenses in expenses. If you have paid advance for purchasing goods, it will also include in total purchase in income statement. In balance sheet, we deduct advance.

The Differences Between Accrual & Cash-Basis Accounting. Worksheet. 1. The method of accounting that recognizes revenue when it is earned and expenses when they are incurred is called: Income.

Sometimes, it might be necessary to perform accrual to cash conversion for the following reasons: a) The company has to file tax returns on a cash basis. b) Reconciliation of accrual accounts with cash accounts is needed. Accrual to Cash Example. Let’s assume, and Alan runs a business that supplies his clients with gadgets.

The accrual to cash conversion excel worksheet works out the cash receipts based on the revenue earned for the period. Section 2 – Expenses. This section of the accrual to cash conversion excel worksheet is used to convert expenses incurred to cash payments by adjusting for movements on accrued expenses payable, and prepayments. Step 1

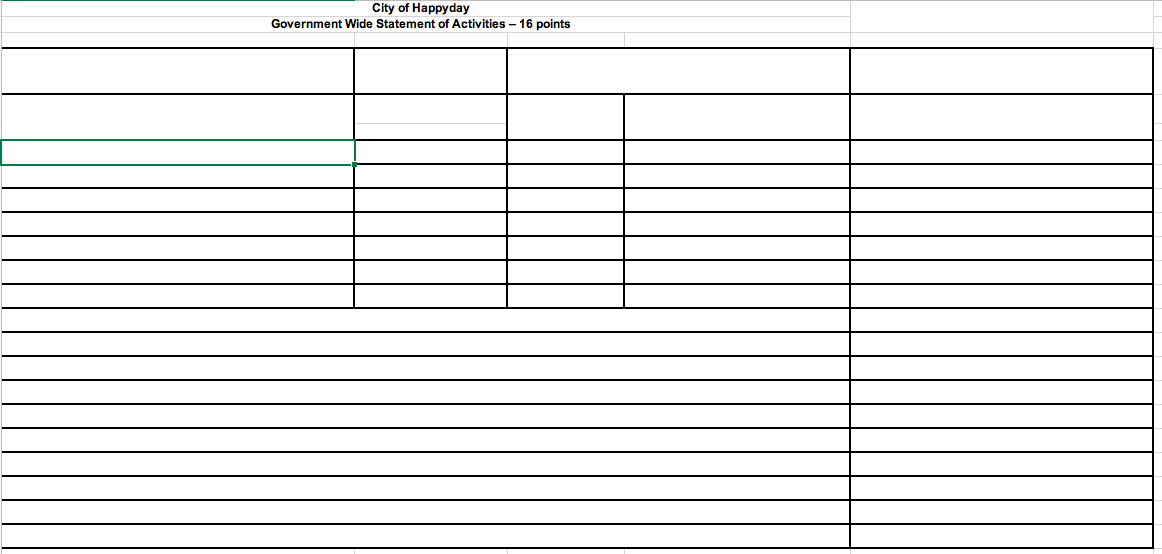

maintained on a day-to-day basis using the modified accrual basis of accounting. Adjustments are necessary to convert governmental fund financial statement totals prepared using the modified accrual basis of accounting to the government-wide financial statement amounts which, must be presented on the accrual basis of accounting.

The accrual to cash basis conversion formulas below allow for additional complications where the business has for example to deal with unearned revenue, prepaid expenses, and inventory. In each case the formula shows how to calculate cash receipts and payments using information from an accruals based accounting system.

Accrual to cash basis conversion 1. Accrual to Cash Basis Conversion Simplified in mere six steps! 2. The Accrual to Cash Basis Conversion has been a tricky one for accounting students of all ages. The accrual basis of accounting is records revenue and expenses in the period in which they are earned or incurred irrespective of the cash flow. Cash basis recognizes revenue only when cash is.

Here's a little example: Say you operate your C Corporation on the cash basis. On the day you convert to the S Corporation, your C Corporation has patients who have not paid their bills, assets that have value but zero cost basis, and the practice may also be worth more than the carrying cost of its assets (referred to as goodwill).

In this video, I walk through the basics of cash to accrual and a template for solving cash to accrual problems.

Convert accrual to cash basis worksheet. The accrual basis of accounting is records revenue and expenses in the period in which they are earned or incurred irrespective of the cash flow. The accrual to cash basis conversion has been a tricky one for accounting students of all ages. Accrual to cash conversion excel worksheet download.

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

0 Response to "31 Convert Accrual To Cash Basis Worksheet"

Post a Comment