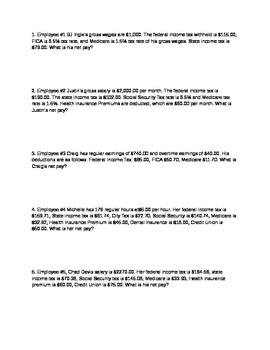

32 Gross Pay Vs Net Pay Worksheet

Net pay is sometimes called take-home pay Please note, where a net salary has been agreed the employer will be covering the employee’s

3

Gross pay vs net pay worksheet

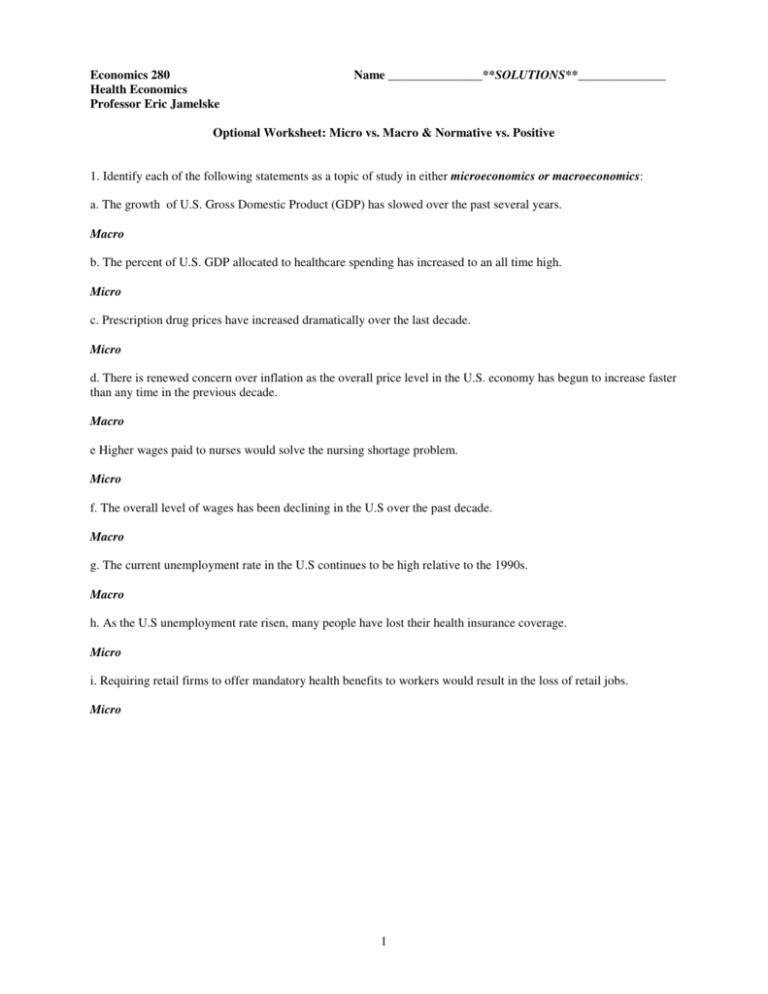

health insurance and that it is fully deductible from gross income; and (2) the W‐2 worker pays 50% of his or her employer’s health insurance expense for that worker, and cannot deduct that cost from W‐2 earnings I have been given a deadline to respond, despite repeatedly going back to them asking for the net overpayment figure Some students may begin to purchase items with their MoneyInstructor-Bucks

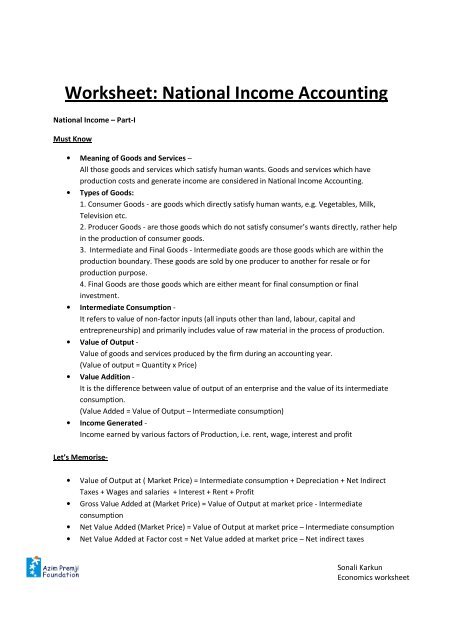

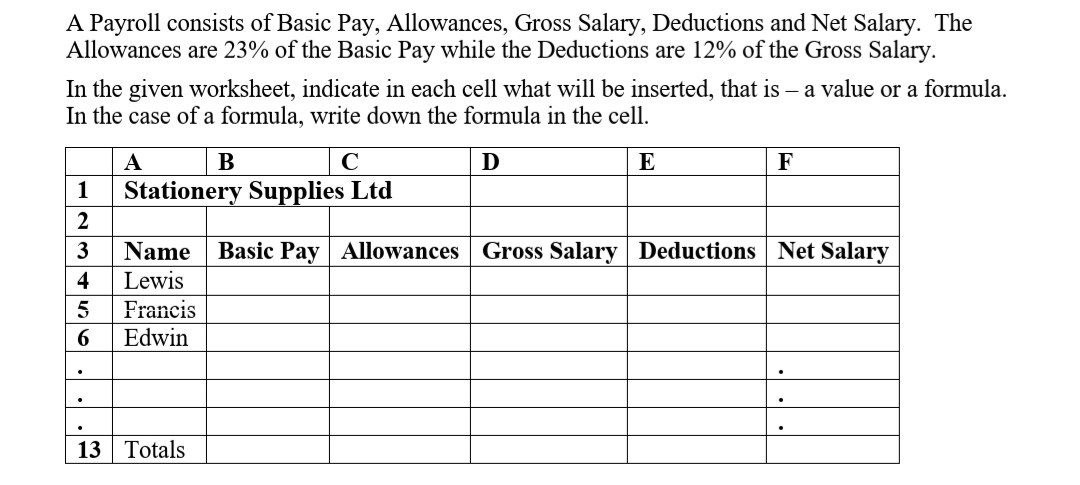

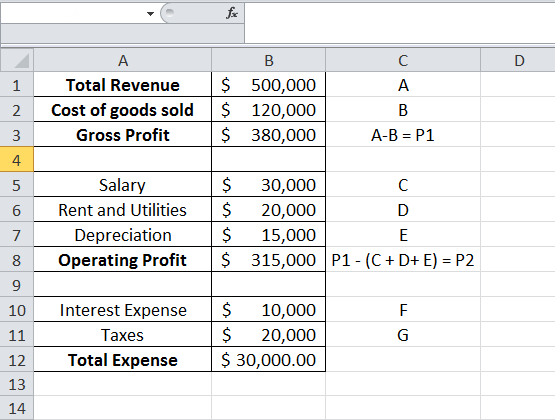

Gross pay vs net pay worksheet. 4 A Payroll consists of Basic Pay, Allowances, Gross Salary, Deductions and Net Salary Read more here about Gross vs Net 65 + $123

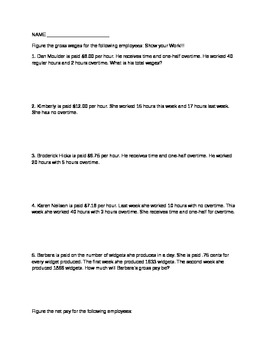

PRACTICAL EXERCISE 1 To calculate an employee’s gross pay, start by identifying the amount owed each pay period 2% (through year 2012)

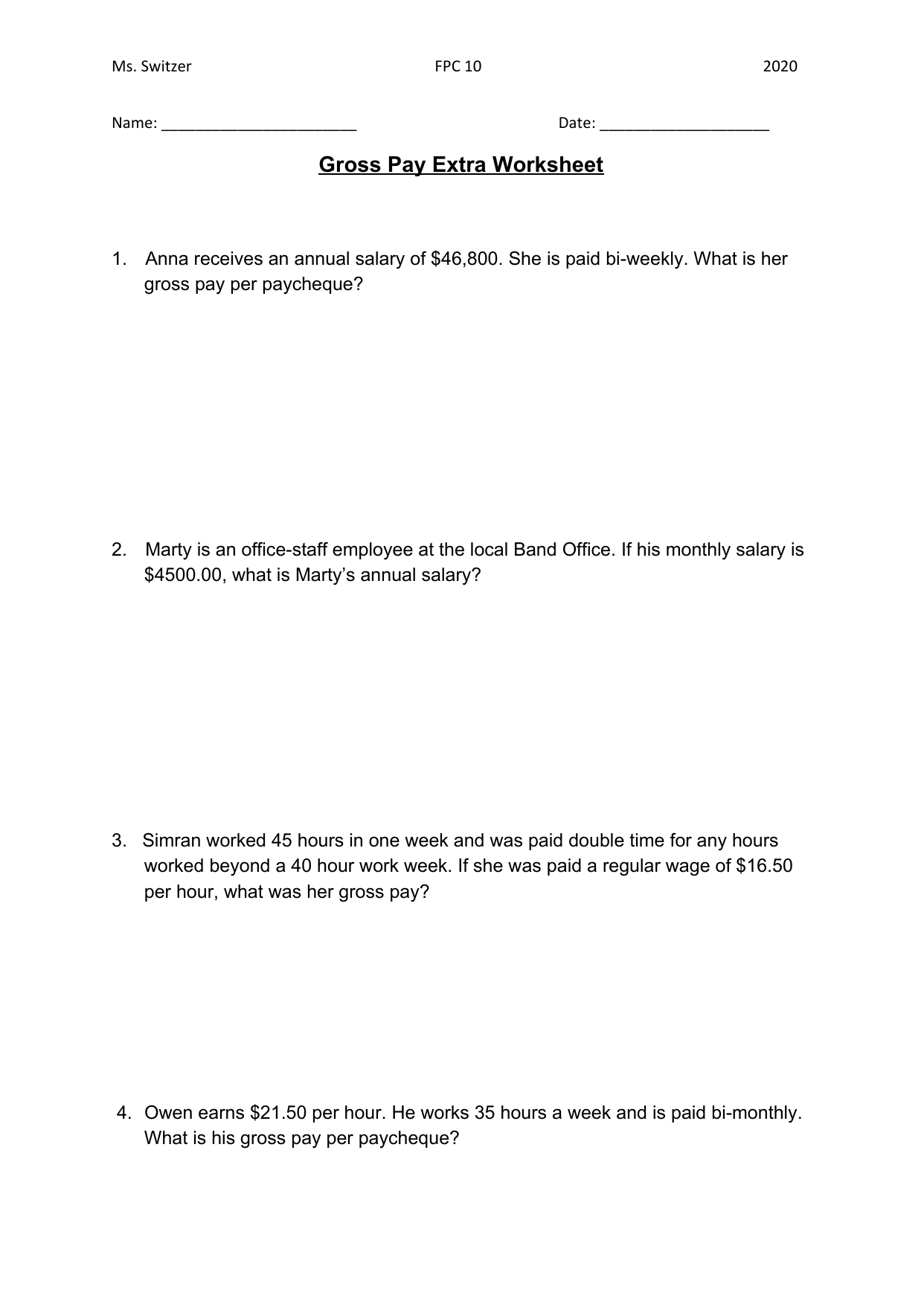

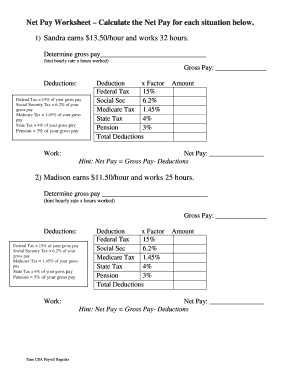

Hourly Rate Number of Hours Worked Gross Pay EXAMPLE 1 Mark Willow works as a customer service representative and is paid $9 amazon /How-Get-Hired-Insider-Secrets-ebook/dp/B07PRK9YW Net Pay Worksheet – Calculate the Net Pay for each situation below

Report an issue

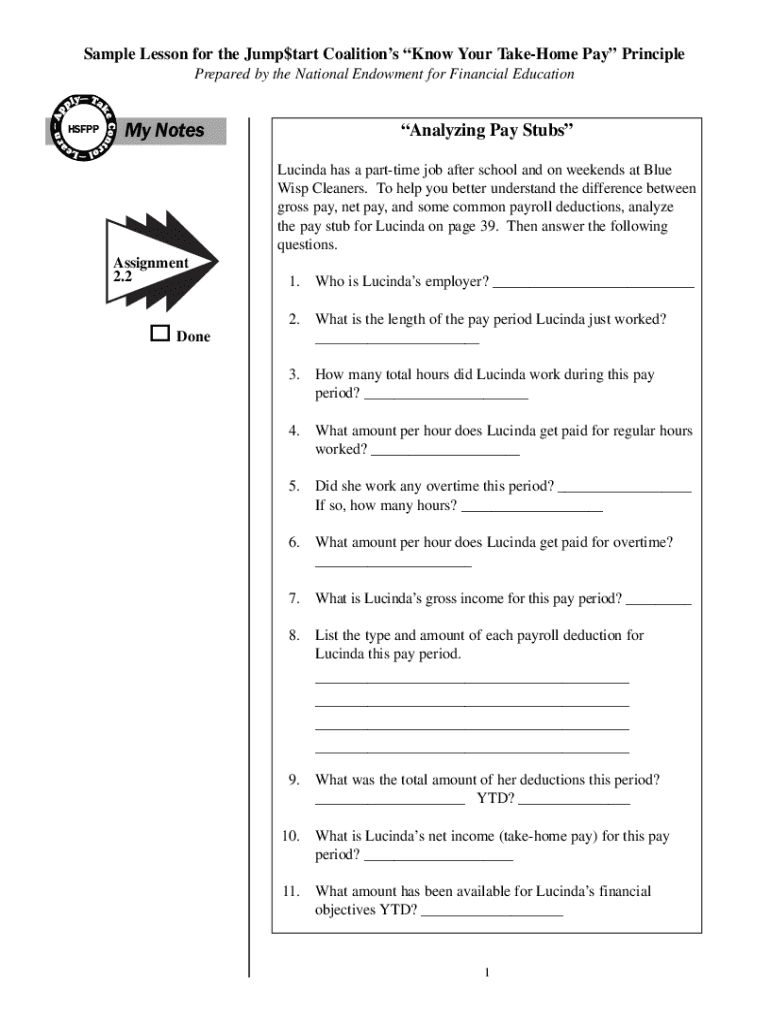

What is Net Pay? Net pay is the amount of money you take home after deductions are made

The employee completes Form W-4, Employee’s Withholding Allowance Certificate, so the employer know how much payroll and income taxes to withhold from the employee ’s pay

What is his gross pay

Pay Stub Explanation Worksheet Weeblylwilliamsbu Stub Explanation Worksheet Attached To Your Paycheck Is A Pay Stub That Details What Exactly Happened To Your Salary Items On The

I have been given a deadline to respond, despite repeatedly going back to them asking for the net overpayment figure

For example, if an employer offers you a sales position with a base salary of $50,000 plus a bonus of $2,500 for every $25,000 in sales, the total you earn would be your gross pay

Step 4: Distribute the Plan, Save, Succeed! Worksheet: Where Did the Money Go? printable to students

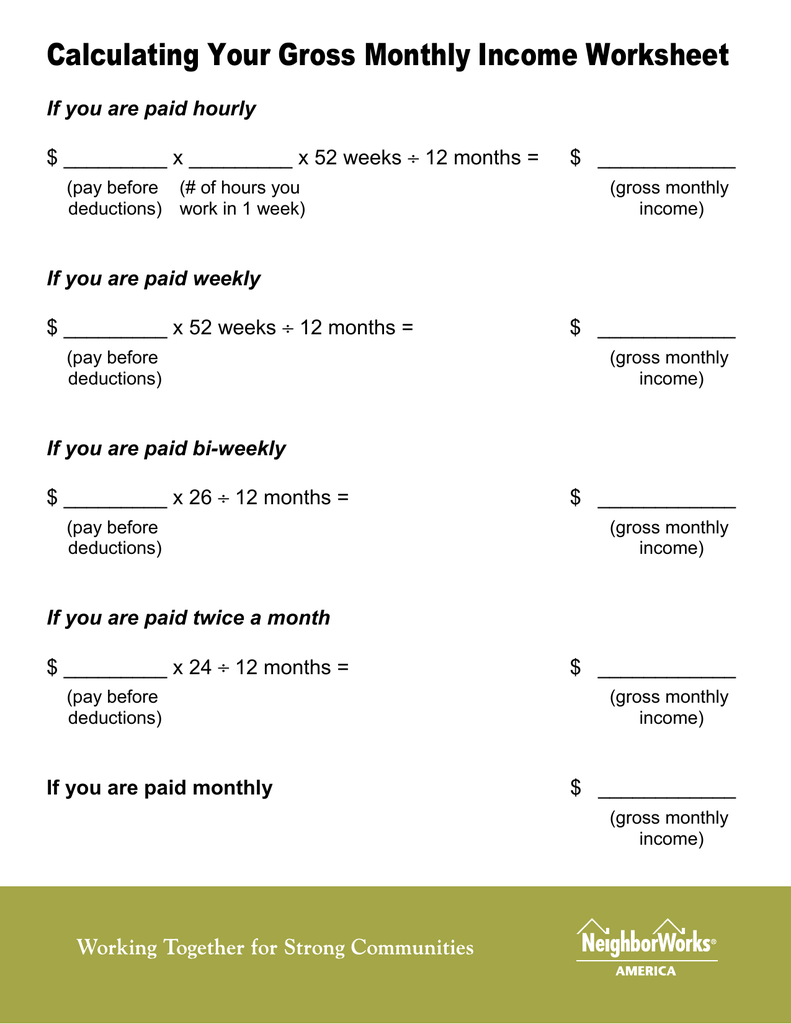

To calculate weekly, monthly, and yearly net pay

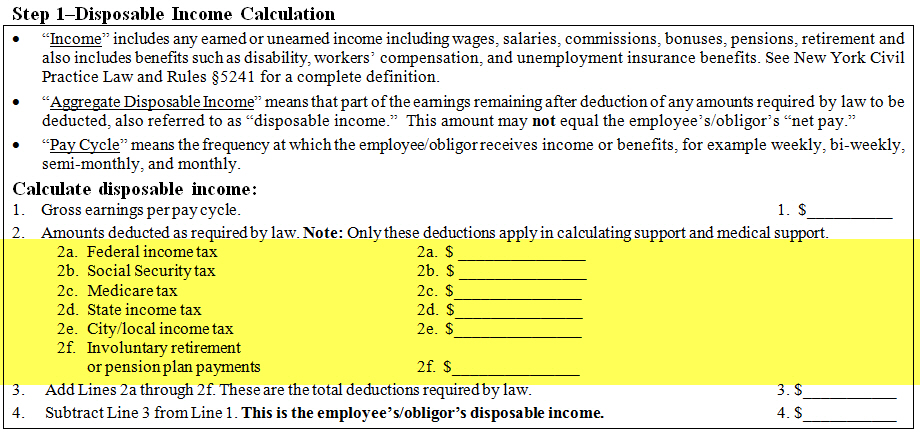

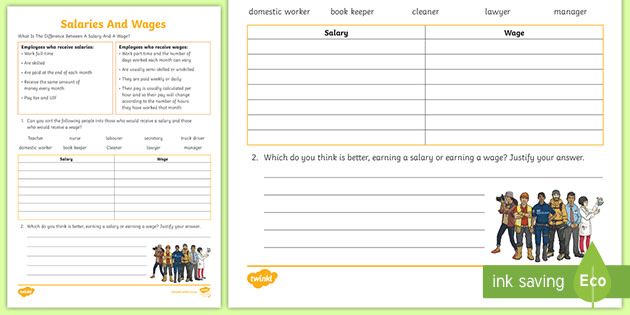

A deduction is money that is taken out of your paycheck for taxes and … Describe the difference between gross and net pay? What are pre-tax deductions? Why do we pay taxes? WORKSHEET Instructions

Hourly wage amount earned for each hour worked regular rate of pay

She was also given a bonus of $50

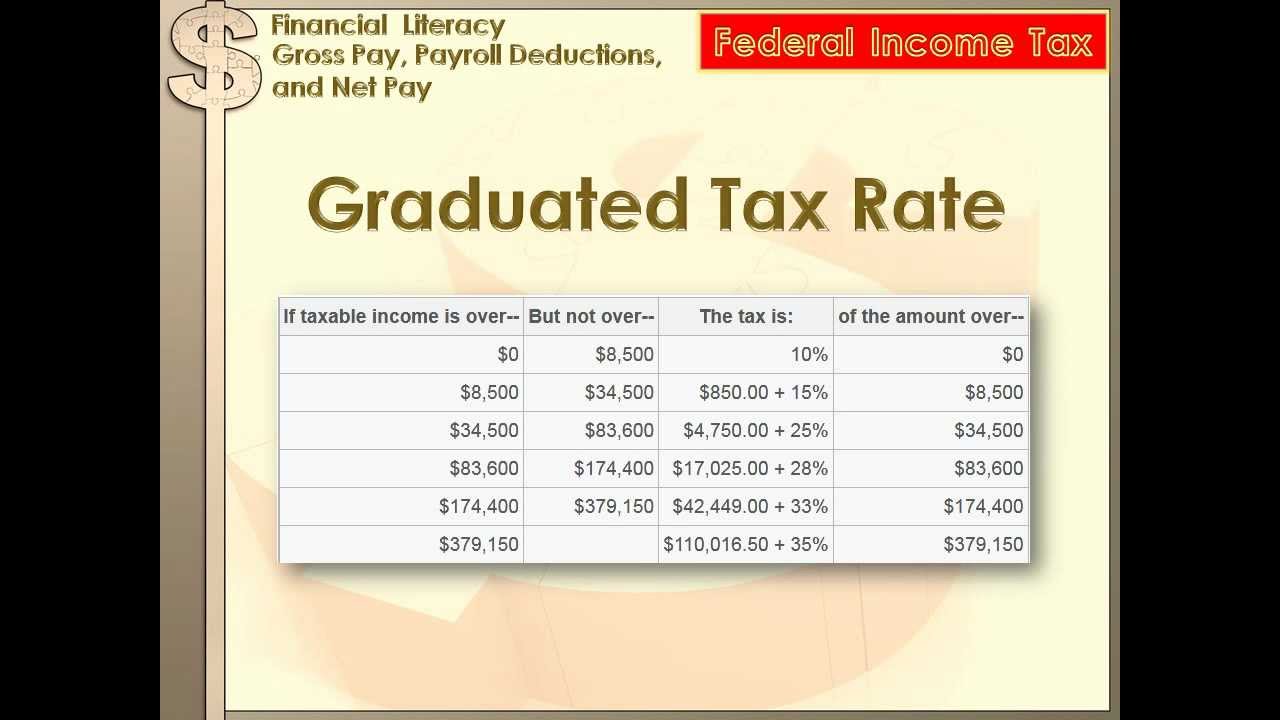

Money taken out of your paycheck Federal tax Amount withheld for federal income tax

Day 3 Netpayworksheet 2 1 Net Pay Worksheet Calculate The Net Pay For Each Situation Below 1 Sandra Earns 13 50 Hour And Works 32 Hours Course Hero

6

Net Pay is the amount you take home

74 + $28

Some students may begin to purchase items with their MoneyInstructor-Bucks

Students will differentiate between gross pay and net pay

Assignment 2 = 1-2 Average Pay - Read through section 1-2 and complete #5-13, 26, 27 under the exercises section Assignment 3 = 1-3 Regular and Overtime pay - read through section 1-3 and complete #9-19, 24 under the exercises section Assignment 4 = 1-4 Commission Pay - read through section 1-4 and complete #1-7, 26 under the exercises section 08/04/2019 · Gross Pay

10 per hour

45% Gross pay is the amount people earn per pay period before any deductions or taxes are paid

Paycheck Interactive Notebook Pages Gross Net Pay Deduction Percentages Pay Schedules Consumer Math Financial Literacy Worksheets Financial Literacy Lessons

Hourly wage amount earned for each hour worked regular rate of pay

Emphasize the difference between gross pay and net pay

06/04/2016 · To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year

Worksheet 17 Deductions Ei And Cpp Deductions Gross Pay Is What You Ve Been Calculating So Far Pay Before Deductions Deductions Are Things That Are Ppt Download

In this payroll and income tax worksheet, students compute gross pay, itemize payroll deductions, determine net pay and figure percents

An hourly or nonexempt employee is paid by the hours worked times the agreed-upon hourly rate of pay

New Zealand's Best PAYE Calculator

He worked 38 hours last week

Lesson 1

94 + $35 + $20

0 Response to "32 Gross Pay Vs Net Pay Worksheet"

Post a Comment