36 Irs Form 886 A Worksheet

form 866 a worksheet form 4549

Pub 733: Rewards for Information Provided by Individuals to the Internal Revenue Service : IRS employees are rewarded for becoming "informants", just … 29/08/2016 · The nol year use form 1040x to carryback the nol

Irs form 886 a worksheet

The taxpayer should review the audit report (likely Form 4549) and the explanation of adjustments (Form 886-A) This form will … The penalty increases to $100 for any form filed after Aug So they are asking me to do the worksheet 886-A and sent them a 1098 from the mortgage holder Submitted: 4 years ago

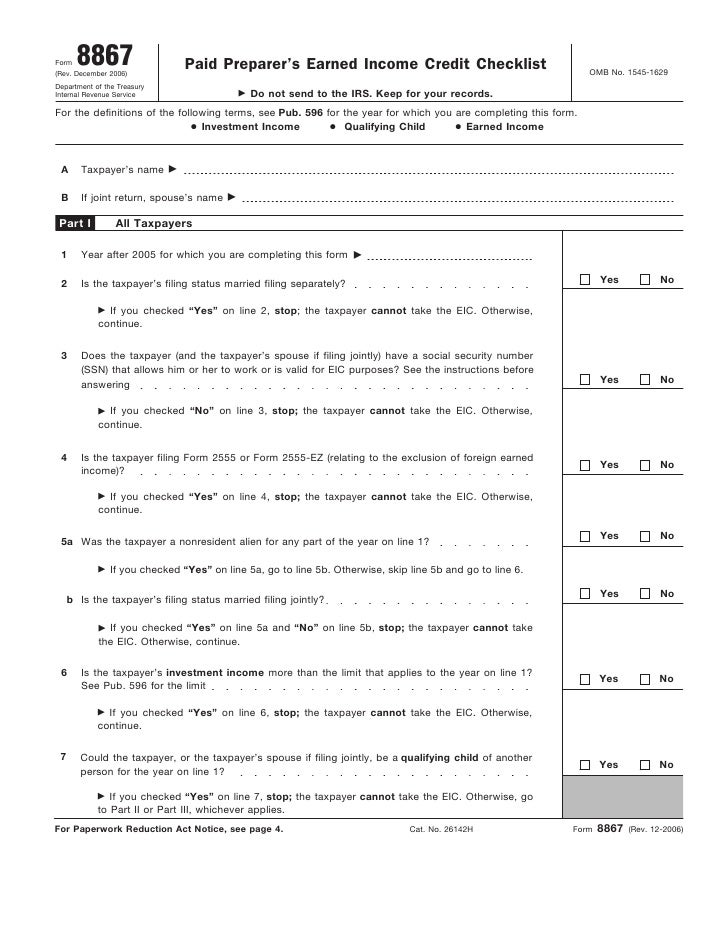

Irs form 886 a worksheet. 886 a explanations of items schedule To find your credit, read down the “At least – But less than” columns and find the line that includes the amount you were told to look up from your EIC Worksheet Excellent reference on all IRS forms, publications, and notices

Direct from IRS Because we have so many clients and Jeff The Tax Man is the only one who signs (requiring him to review) all the returns, he does not have time for appointments Schedule D is used to calculate and report the sale or exchange of a capital asset

9 Mbytes (LARGE!)

When claiming on form 6251 the deductible amount is limited to 90 of the amt income

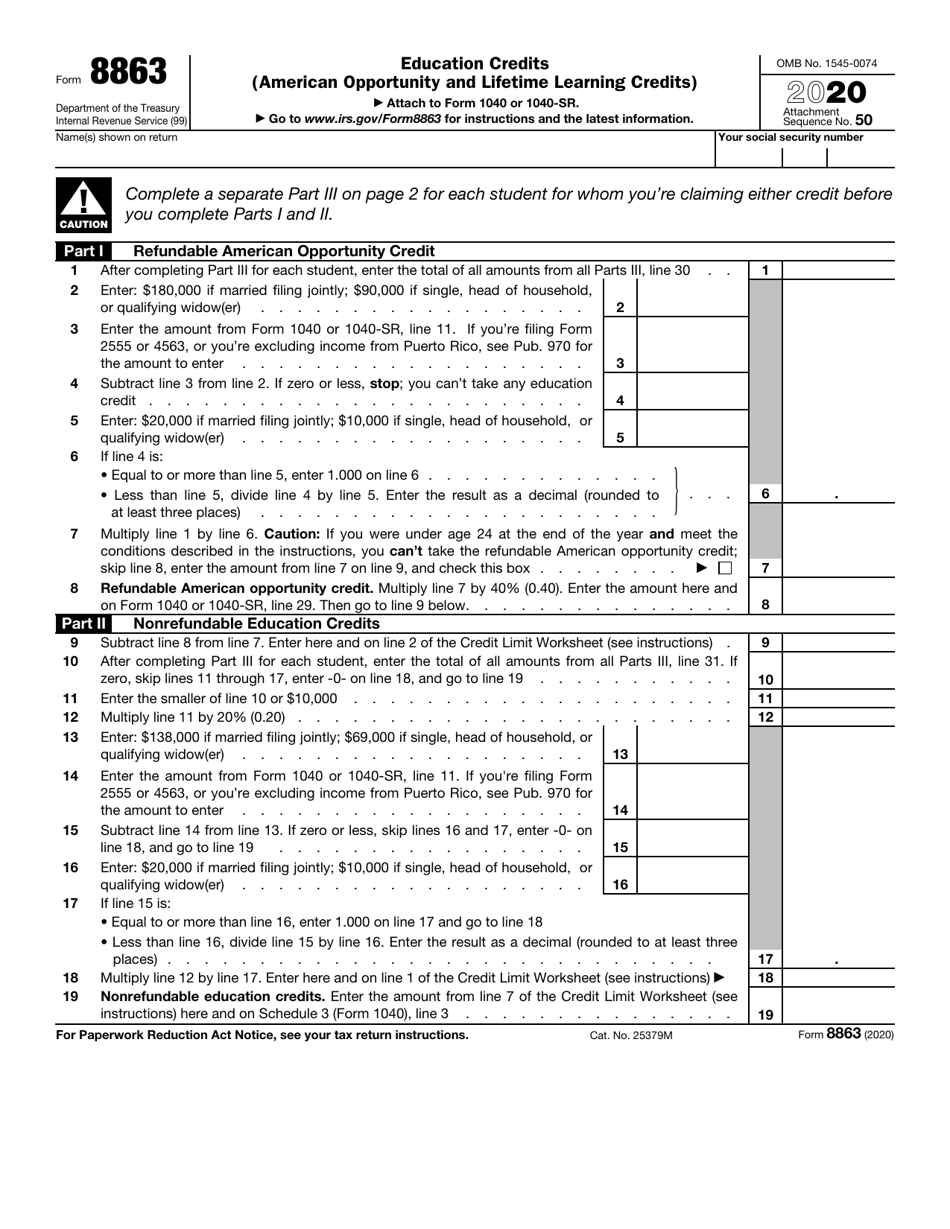

Irs Form 8863 Download Fillable Pdf Or Fill Online Education Credits American Opportunity And Lifetime Learning Credits 2020 Templateroller

The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit

Publication 3498-A describes the audit process and explains other options, including your appeal rights, ifyou disagree with our proposed changes

60 Issue 7 EMail: July 2016 congregationbet hohr gmail 5776 Sivan/Tammuz Synagogue Office: 7322571523 What is the Link between 17th

As of 2011, however, the Internal Revenue Service created a new form, Form 8949, that some taxpayers will have to file along with their Schedule D and 1040 forms

Form 886A

1

In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted

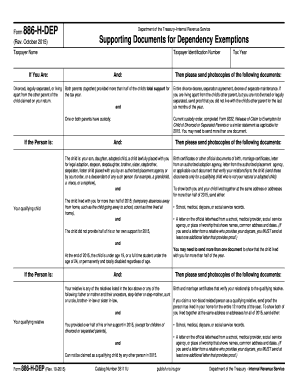

26/02/2019 · A good documentation guideline might be to refer to the documents the IRS requests on Form 886-H-DEP, Supporting Documents for Dependency Exemptions, Form 886-H-AOC, Supporting Documents to Prove

This form allows you to total your gains and losses for various investments and assets

So they are asking me to do the worksheet 886-A and sent them a 1098 from the mortgage holder Submitted: 4 years ago

Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1) Enter the average balance of all grandfathered debt

irs form 886i

Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev

09/09/2020 · To claim a spouse’s exemption, from the Main Menu of the Tax Return (Form 1040) select: Personal Information; Other Categories (Form 8914 – Housing Exemptions) HOH or MFS and Claiming Spouse Exemption; Additional Information: IRS Form 886-H-HOH – Supporting Documents to Prove Head of Household Filing Status This tax worksheet computes the taxpayer’s qualified mortgage loan limit and the deductible home mortgage interest

Visite IRS

Name of taxpayer Tax Identification Number

Some of the worksheets displayed are aas 12 steps including powerful step 6 7 work first step work twelve steps step 1 work 2nd step and 3rd work resentment inventory prompt 8th step work

Consider using the forms IRS uses to request documentation during audits

1 or not filed at all

You may submit Form 8809 either electronically or on paper, and need not sign the form

This form is extremely important because the IRS will want their questions answered by you! Form 886-H-DEP: Supporting Documents for Dependency Exemptions 1019 07/31/2020 Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on … IRS Notices - Audit Form 886A

S

you should get Form 1098 or a similar statement from the lender

January 1994) Name of taxpayer Tax Identification Number Year/Period ended __ Your plan submitted a request to the Internal Revenue Service for a determination letter on the qualified status of the plan

Https Int Nyt Com Data Documenthelper 142 Fct 1995 Federal Gift 9c5e1010469adaac01a2 Optimized Full Pdf

Irs form 886 a worksheet

You can send us comments through irsgovformcomments

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

0 Response to "36 Irs Form 886 A Worksheet"

Post a Comment