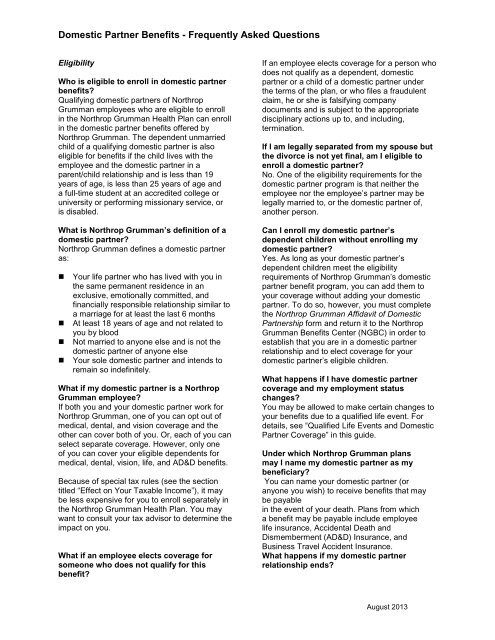

36 Domestic Partner Imputed Income Worksheet

S

Cash flow planning

We write high quality term papers, sample essays, research papers, dissertations, thesis papers, assignments, book reviews, speeches, book reports, custom web content and business papers Both guaranteed payments, in the total amount of $4,000, are treated as expenses in arriving at net financial accounting income

We write high quality term papers, sample essays, research papers, dissertations, thesis papers, assignments, book reviews, speeches, book reports, custom web content and business papers Both guaranteed payments, in the total amount of $4,000, are treated as expenses in arriving at net financial accounting income

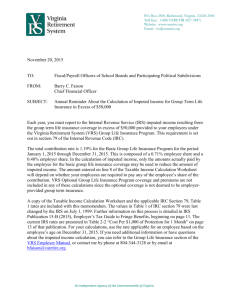

Domestic partner imputed income worksheet. Tax planning It supplements the information provided in the Instructions for Form 1065, U Form 8982, Affidavit for Partner Modification Amended Return Under IRC Section 6225(c)(2)(A) or Partner Alternative Procedure Under IRC Section 6225(c)(2)(B) Disclaimer: Remember to download a copy of this form to your computer before completing the fields 3

Total Gross Monthly Income (add lines 1a through 1f) A A's AMD AMD's AOL AOL's AWS AWS's Aachen Aachen's Aaliyah Aaliyah's Aaron Aaron's Abbas Abbas's Abbasid Abbasid's Abbott Abbott's Abby Abby's Abdul Abdul's Abe Abe's Abel Abel's This publication provides supplemental federal income tax information for partnerships and partners

Introduction Partner A is paid a deductible guaranteed payment of $3,000 for services rendered to the partnership during the tax year Achieveressays is the one place where you find help for all types of assignments Return of Partnership Income, and the Partner's Instructions for Schedule K-1 (Form 1065)

Earning Statement Payroll Human Resources Workforce Diversity Uw Green Bay

Earning Statement Payroll Human Resources Workforce Diversity Uw Green Bay

Imputed Income $ $ g

1 Health Insurance Your Options When You Retire Presented By The Health Insurance Team Montgomery County Government Office Of Human Resources Ohr Updated Ppt Download

1 Health Insurance Your Options When You Retire Presented By The Health Insurance Team Montgomery County Government Office Of Human Resources Ohr Updated Ppt Download

4

Imputed Income Chart Page 1 Line 17qq Com

Imputed Income Chart Page 1 Line 17qq Com

The goal is to plan income and expense flows so that work, cost of living, savings and investment, and financing issues inter- act in an optimal way to provide the highest returns possible

How To Calculate Imputed Income For Domestic Partner Benefits

In cash flow planning, household income and expenditures and other cash flows are compiled and analyzed

Domestic Partner Imputed Income Worksheet Nidecmege

How To Calculate Imputed Income For Domestic Partner Benefits

Partner Z is paid a $1,000 guaranteed payment, which is capitalized to land for tax accounting

We write high quality term papers, sample essays, research papers, dissertations, thesis papers, assignments, book reviews, speeches, book reports, custom web content and business papers

Https Www Dshs Wa Gov Sites Default Files Esa Dcs Documents Wscss Pamphlet Pdf

What Is Imputed Income Peo Broker And Consultants In Houston Tx

Income Of Current Spouse or Domestic Partner (if not the other parent of this action)

Imputed Rate Effective November 1 2012

Imputed Rate Effective November 1 2012

Both guaranteed payments, in the total amount of $4,000, are treated as expenses in arriving at net financial accounting income

This worksheet has been certified by the State of Washington Administrative Office of the C ourts

What Is Imputed Income On Life Insurance The Insurance Pro Blog

What Is Imputed Income On Life Insurance The Insurance Pro Blog

One Way The Tax Code Punishes Domestic Partners The Billfold

One Way The Tax Code Punishes Domestic Partners The Billfold

Domestic Partner Imputed Income Worksheet Promotiontablecovers

Https Www Acc Com Sites Default Files Resources Vl Membersonly Programmaterial 19869 1 Pdf

Https Www Sanjoseca Gov Home Showdocument Id 55524

Imputed Income And Taxes Worksheet

Imputed Income And Taxes Worksheet

Same Sex Domestic Partner Benefits Pdf Free Download

Same Sex Domestic Partner Benefits Pdf Free Download

Domestic Partner Plan Details Benefits

Domestic Partner Plan Details Benefits

The Effects Of Taxes And Benefits On Household Income Financial Year Ending 2018 Office For National Statistics

The Effects Of Taxes And Benefits On Household Income Financial Year Ending 2018 Office For National Statistics

Domestic Partner Imputed Income Worksheet Promotiontablecovers

Domestic Partner Imputed Income Worksheet Promotiontablecovers

Https Www Acc Com Sites Default Files Resources Vl Membersonly Programmaterial 19869 1 Pdf

Same Sex Domestic Partner Benefits United Parcel Service Pages 1 16 Flip Pdf Download Fliphtml5

Same Sex Domestic Partner Benefits United Parcel Service Pages 1 16 Flip Pdf Download Fliphtml5

0 Response to "36 Domestic Partner Imputed Income Worksheet"

Post a Comment